A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are legal process.

Maryland Notice to Debt Collector - Falsely Representing a Document is Legal Process

Description

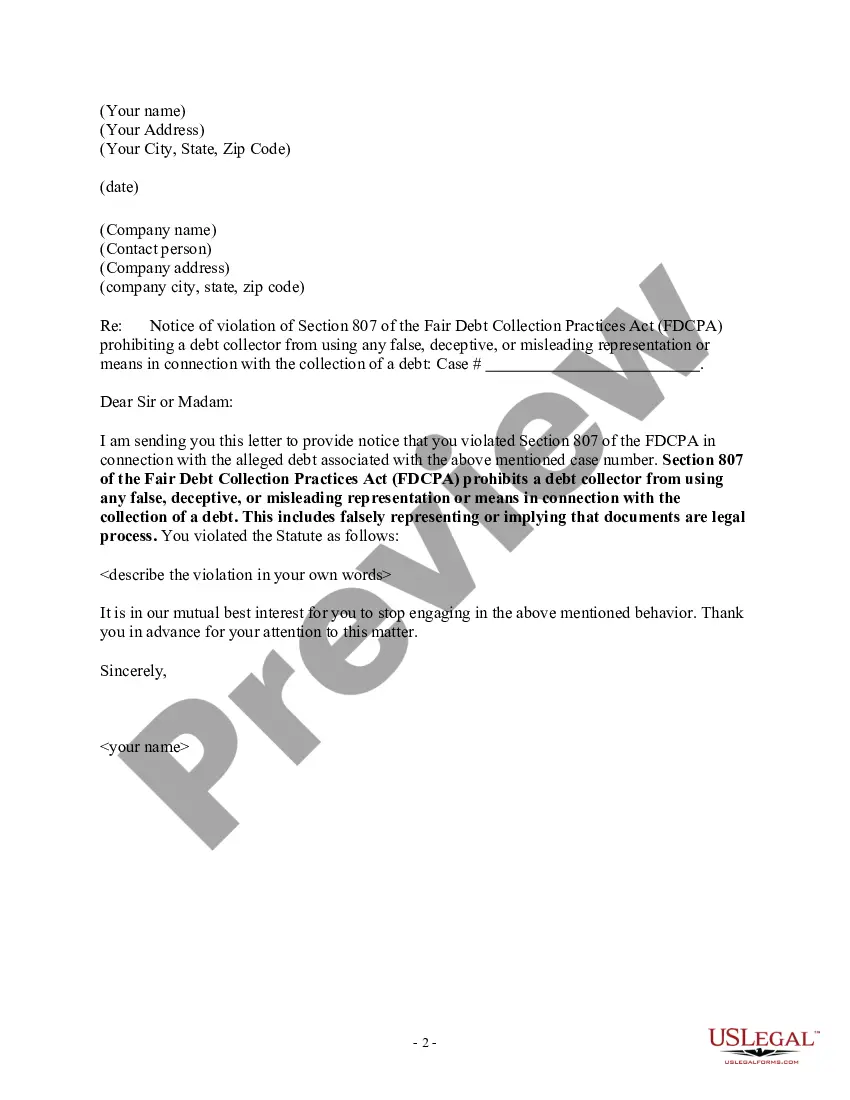

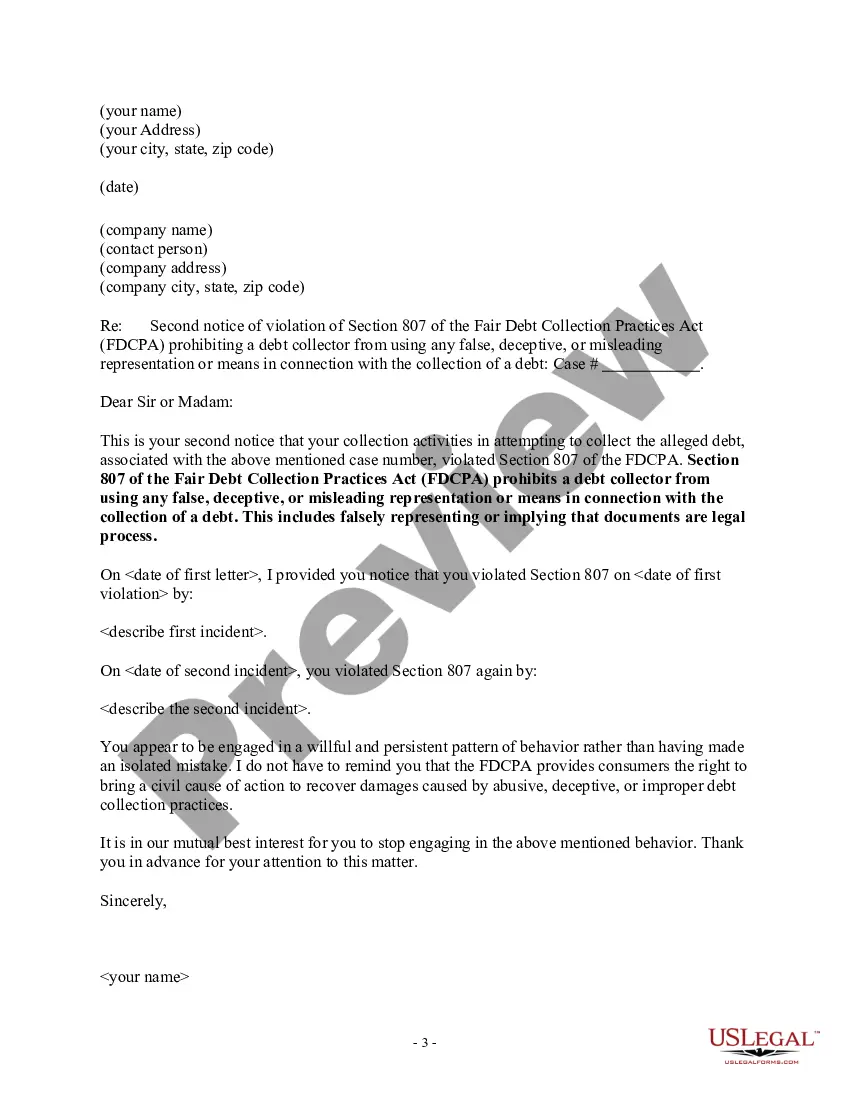

How to fill out Notice To Debt Collector - Falsely Representing A Document Is Legal Process?

Have you found yourself in the situation where you need documents for either business or personal purposes almost every single day? There is a multitude of legitimate document templates available on the internet, yet finding ones you can trust is not straightforward.

US Legal Forms offers a vast array of form templates, such as the Maryland Notice to Debt Collector - Falsely Representing a Document as Legal Process, which are designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and hold an account, just Log In. After that, you can download the Maryland Notice to Debt Collector - Falsely Representing a Document as Legal Process template.

- Obtain the document you need and ensure it is for the correct city/region.

- Utilize the Review button to examine the document.

- Read the details to confirm that you have selected the appropriate form.

- If the document isn’t what you require, use the Search field to find the form that suits your needs and preferences.

- Once you have secured the correct document, click on Purchase now.

- Choose the pricing plan you desire, provide the necessary information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- Select a convenient document format and download your copy.

Form popularity

FAQ

The most common violation of the Fair Debt Collection Practices Act is the use of harassment tactics, which includes excessive phone calls or threatening behavior. Collectors are not allowed to use abusive language or make threats of legal action that they cannot substantiate. Recognizing these violations is important for protecting your rights as a consumer. A Maryland Notice to Debt Collector - Falsely Representing a Document is Legal Process can guide you in dealing with such violations.

Writing a dispute letter to a debt collector is a straightforward process. Start by clearly stating your intent to dispute the debt and include specific details such as your account number and any inaccuracies you notice. It is crucial to mention your understanding of the Maryland Notice to Debt Collector - Falsely Representing a Document is Legal Process, which strengthens your position. You may also consider utilizing USLegalForms to find effective templates to guide you through crafting a professional letter.

15 U.S. Code 1692e addresses the practices of debt collectors in the United States, specifically prohibiting them from using false, deceptive, or misleading representations to collect debts. This includes falsely representing the legal status of a document, which relates to the Maryland Notice to Debt Collector - Falsely Representing a Document is Legal Process. Understanding this code can help you recognize unfair practices and protect your rights against misleading debt collection efforts.

Under the Fair Credit Reporting Act (FCRA) (15 U.S.C. § 1681 and following), you may sue a credit reporting agency for negligent or willful noncompliance with the law within two years after you discover the harmful behavior or within five years after the harmful behavior occurs, whichever is sooner.

A debt collector may not communicate with a consumer at any unusual time (generally before a.m. or after p.m. in the consumer's time zone) or at any place that is inconvenient to the consumer, unless the consumer or a court of competent jurisdiction has given permission for such contacts.

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

5 things debt collectors can doSeek payment on an expired debt. All unsecured debts, like credit cards and medical bills, have a statute of limitations.Pressure you.Sue you for payment on a debt.Sell your debt.Negotiate what you owe.5 Ways the Fair Debt Collection Practices Act Protects You.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

You can sue a company for sending you to collections for a debt that you don't owe. If a debt collector starts calling you out of the blue, but you know perfectly well that you made the payment in question, the law gives you the right to file an action in court against the company.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.