Maryland Proposal - Conclusion of the Liquidation with exhibit

Description

How to fill out Proposal - Conclusion Of The Liquidation With Exhibit?

You may invest hours on the web searching for the authorized record format that suits the state and federal demands you require. US Legal Forms gives thousands of authorized varieties which are reviewed by pros. You can actually acquire or print out the Maryland Proposal - Conclusion of the Liquidation with exhibit from our assistance.

If you already have a US Legal Forms bank account, you are able to log in and then click the Down load switch. Next, you are able to comprehensive, revise, print out, or indication the Maryland Proposal - Conclusion of the Liquidation with exhibit. Every single authorized record format you get is the one you have permanently. To get an additional backup associated with a purchased develop, go to the My Forms tab and then click the related switch.

If you use the US Legal Forms site the first time, adhere to the basic instructions beneath:

- Initially, make certain you have selected the correct record format for that area/city of your choice. See the develop description to ensure you have chosen the proper develop. If readily available, make use of the Review switch to check through the record format too.

- If you would like locate an additional version of your develop, make use of the Look for area to find the format that fits your needs and demands.

- After you have identified the format you need, just click Buy now to carry on.

- Select the prices strategy you need, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Complete the deal. You may use your charge card or PayPal bank account to fund the authorized develop.

- Select the formatting of your record and acquire it to the product.

- Make alterations to the record if needed. You may comprehensive, revise and indication and print out Maryland Proposal - Conclusion of the Liquidation with exhibit.

Down load and print out thousands of record templates making use of the US Legal Forms Internet site, which offers the most important selection of authorized varieties. Use skilled and express-certain templates to handle your organization or specific requires.

Form popularity

FAQ

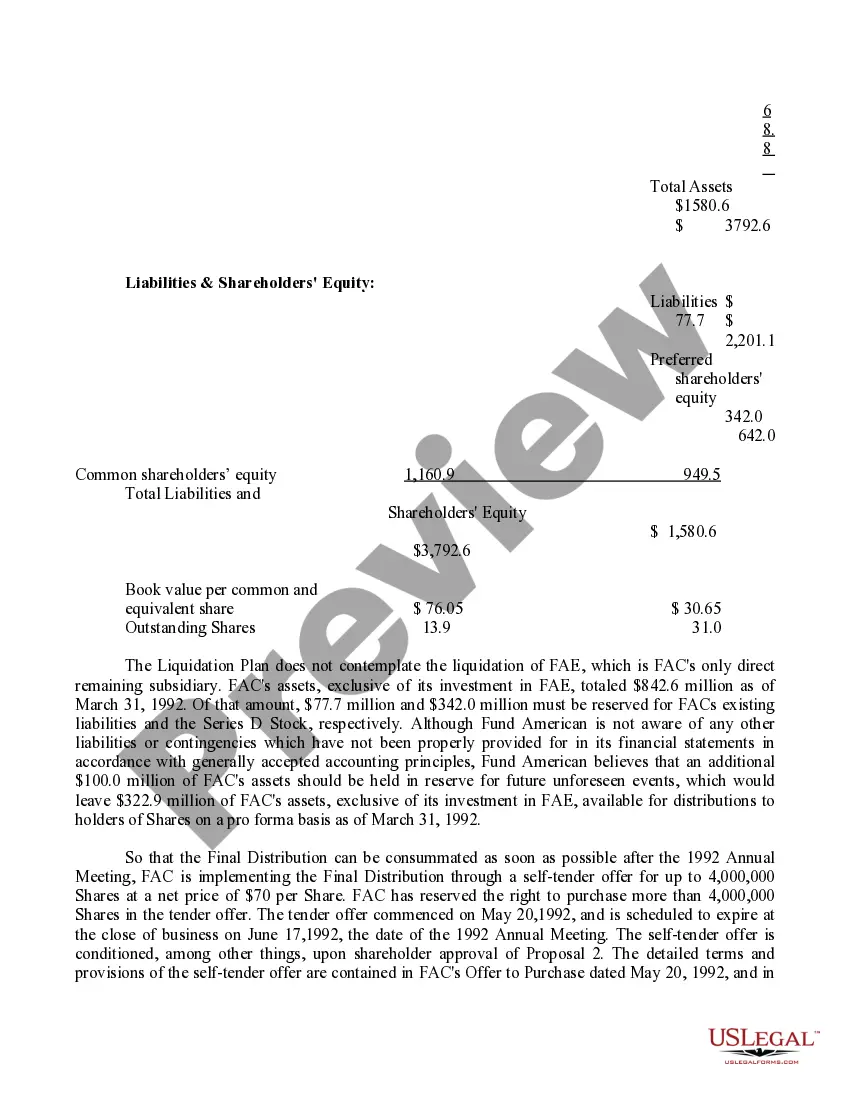

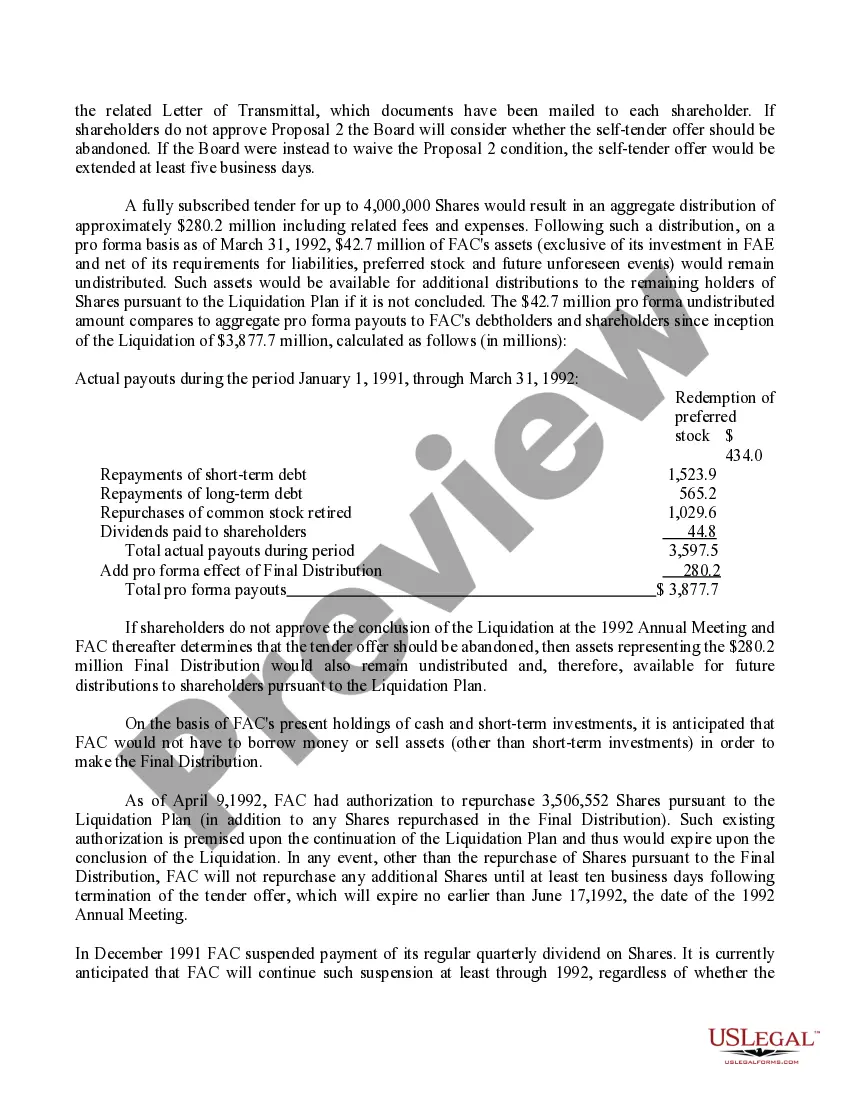

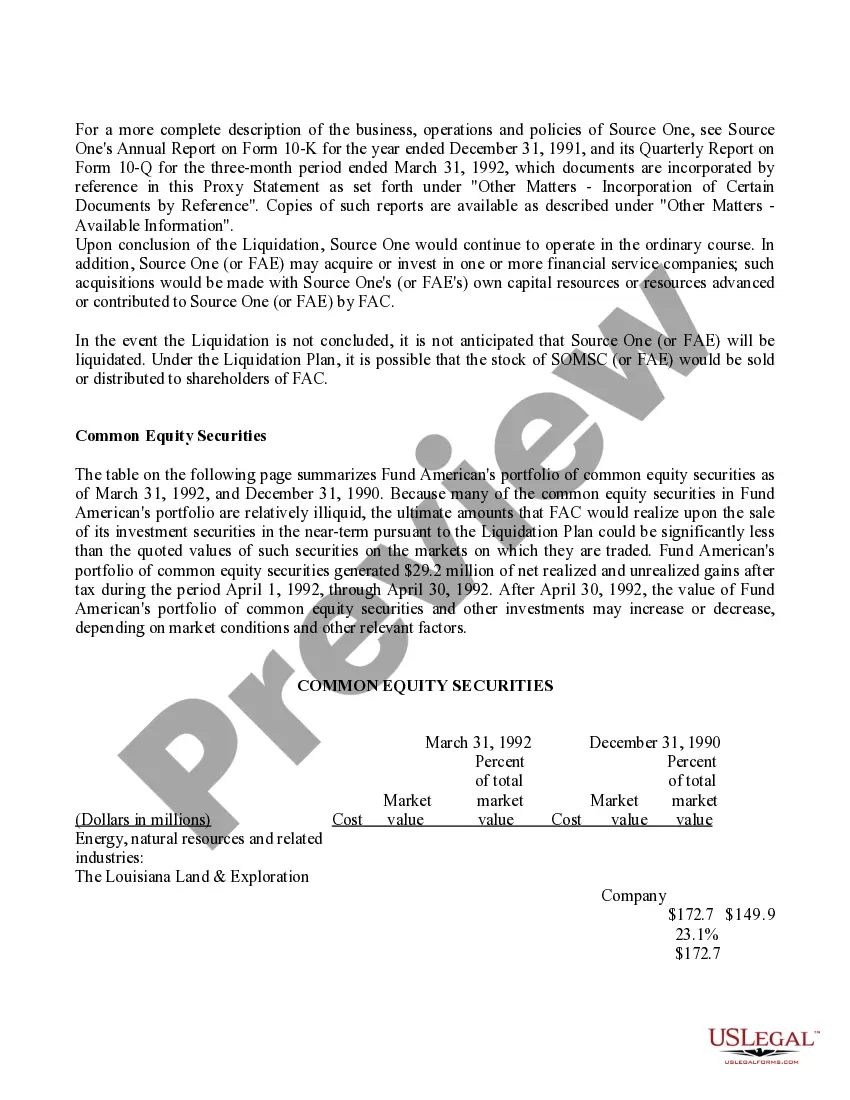

Liquidation is the process of converting a company's assets into cash, and using those funds to repay, as much as possible, the company's debts. Liquidation results in the company being shut down.

What happens to assets after liquidation? When a company is liquidated, the assets are sold and the profits are used to repay any creditors and shareholders. The reason why the assets are sold is because when a company enters liquidation, it typically does not have enough capital to pay off its debts.

The liquidation of a company is when the company's assets are sold and the company ceases operations and is deregistered. The assets are sold to pay back various claimants, such as creditors and shareholders.

The purpose of liquidation is to ensure that all the company's affairs have been dealt with and all its assets realised. When this has been done, the liquidator will apply to have the company removed from the register at the Companies House and dissolved, which means it ceases to exist.

Conclusion. In conclusion, liquidation is a legal process that is initiated when a company is unable to pay its debts. The assets of the company are sold off to pay off its creditors. The process of liquidation is usually carried out by a liquidator who is appointed by the court.