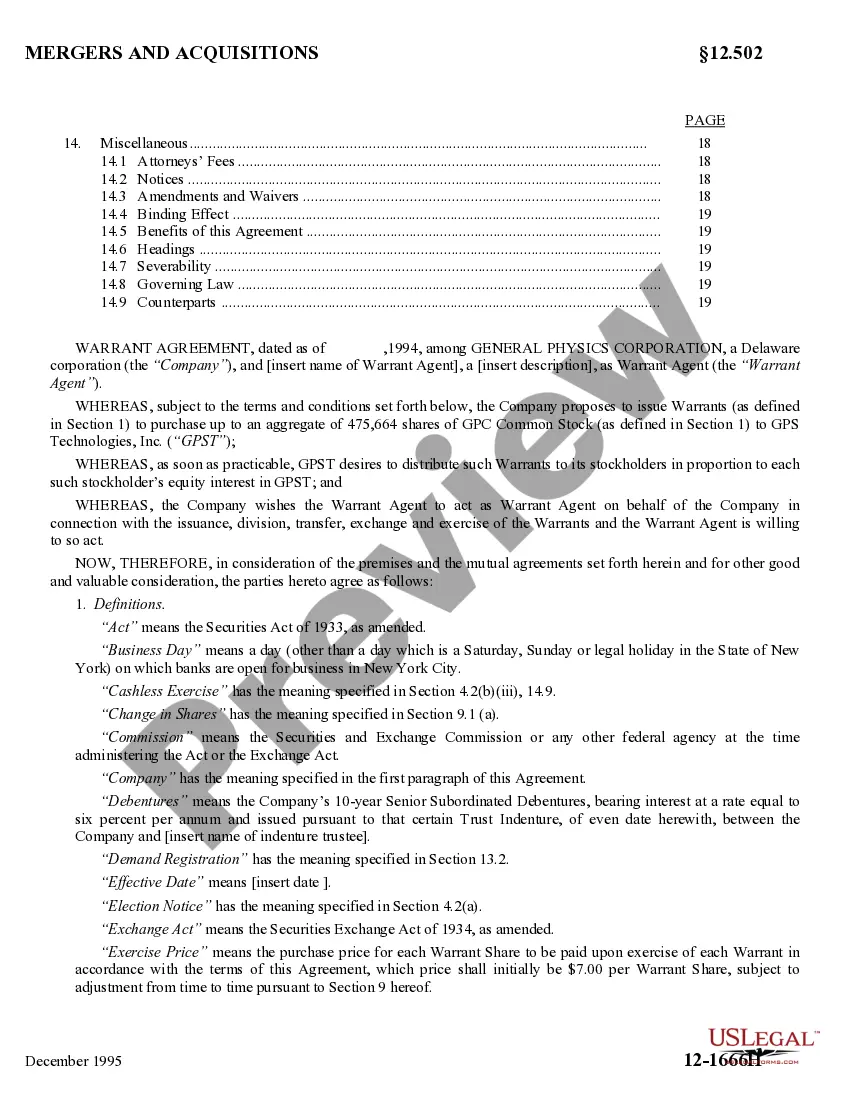

Maryland Second Warrant Agreement by General Physics Corp.

Description

How to fill out Second Warrant Agreement By General Physics Corp.?

If you have to complete, down load, or printing legal papers themes, use US Legal Forms, the greatest collection of legal kinds, which can be found online. Utilize the site`s easy and handy lookup to find the papers you will need. Numerous themes for company and specific purposes are sorted by categories and states, or search phrases. Use US Legal Forms to find the Maryland Second Warrant Agreement by General Physics Corp. within a handful of clicks.

When you are previously a US Legal Forms client, log in in your accounts and click the Acquire option to have the Maryland Second Warrant Agreement by General Physics Corp.. You can even entry kinds you formerly saved within the My Forms tab of your own accounts.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for that proper area/nation.

- Step 2. Take advantage of the Preview method to examine the form`s content. Do not forget about to read the outline.

- Step 3. When you are unsatisfied using the kind, take advantage of the Lookup area towards the top of the display to locate other variations of your legal kind template.

- Step 4. Upon having located the shape you will need, click on the Buy now option. Choose the costs plan you prefer and add your qualifications to sign up for an accounts.

- Step 5. Method the financial transaction. You should use your charge card or PayPal accounts to finish the financial transaction.

- Step 6. Pick the file format of your legal kind and down load it on your system.

- Step 7. Total, change and printing or indicator the Maryland Second Warrant Agreement by General Physics Corp..

Every single legal papers template you buy is the one you have forever. You might have acces to each and every kind you saved within your acccount. Select the My Forms portion and pick a kind to printing or down load yet again.

Contend and down load, and printing the Maryland Second Warrant Agreement by General Physics Corp. with US Legal Forms. There are millions of expert and state-certain kinds you can use for your personal company or specific requirements.

Form popularity

FAQ

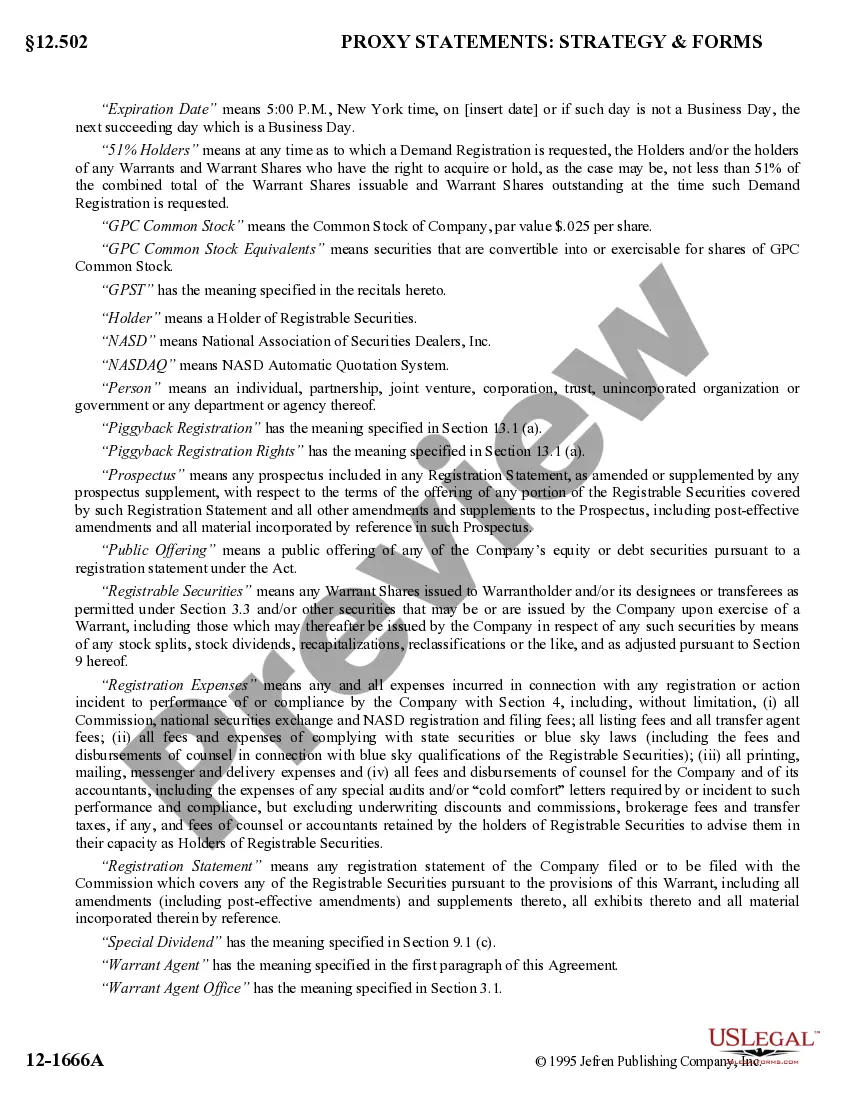

A warrant is an agreement between two parties ? the ?issuer? (i.e., a company) and the ?holder? of the warrant ? that entitles the holder to purchase the issuer's stock at a specified price within a certain time frame.

What Is Warrant Coverage? Warrant coverage is an agreement between a company and one or more shareholders where the company issues a warrant equal to some percentage of the dollar amount of an investment. Warrants, similar to options, allow investors to acquire shares at a designated price.

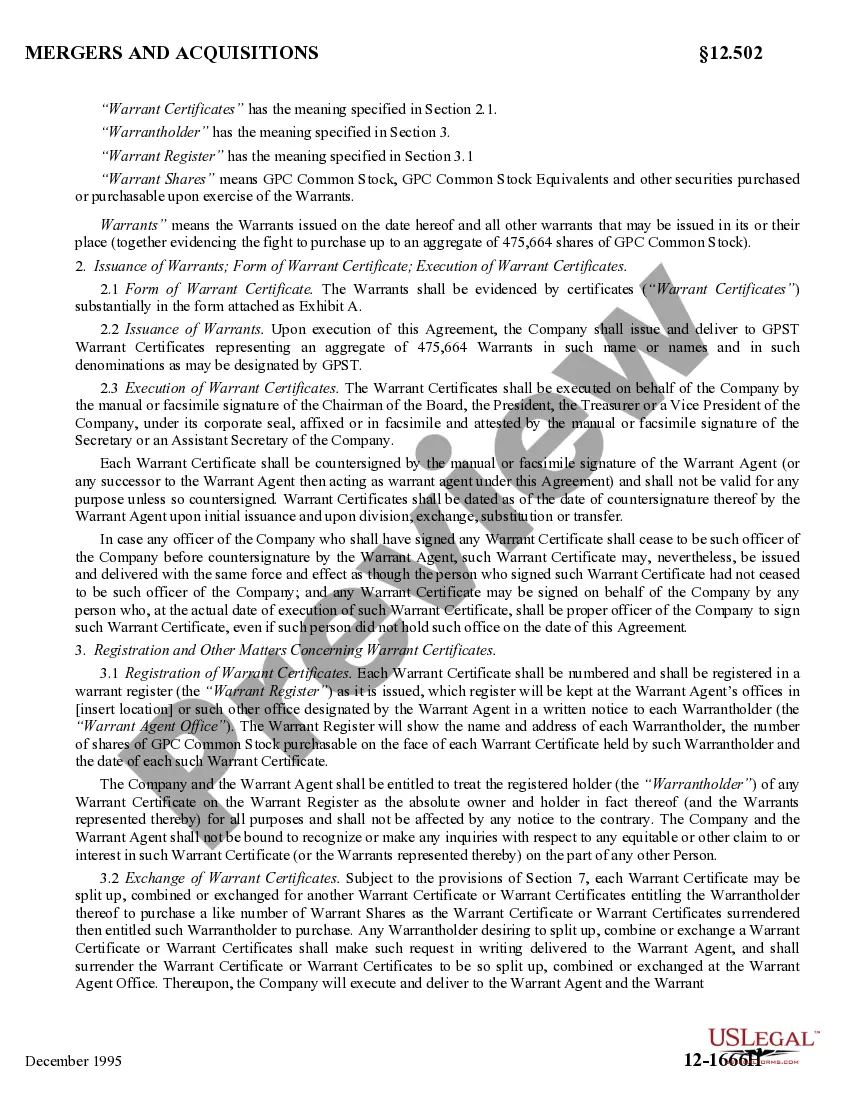

A warrant agreement is an agreement to purchase stock, also called a stock warrant. The agreement provides one party the right to purchase a company's stock at a specific price and at a specific date.

Companies often issue stock warrants by attaching the warrant to a bond or other security that they use to raise capital. The warrant helps attract investors and also represents potential future capital for the issuing company.

Warrants and call options are both types of securities contracts. A warrant gives the holder the right, but not the obligation, to buy common shares of stock directly from the company at a fixed price for a pre-defined time period.