Maryland Order Discharging Debtor After Completion of Chapter 12 Plan - updated 2005 Act form

Description

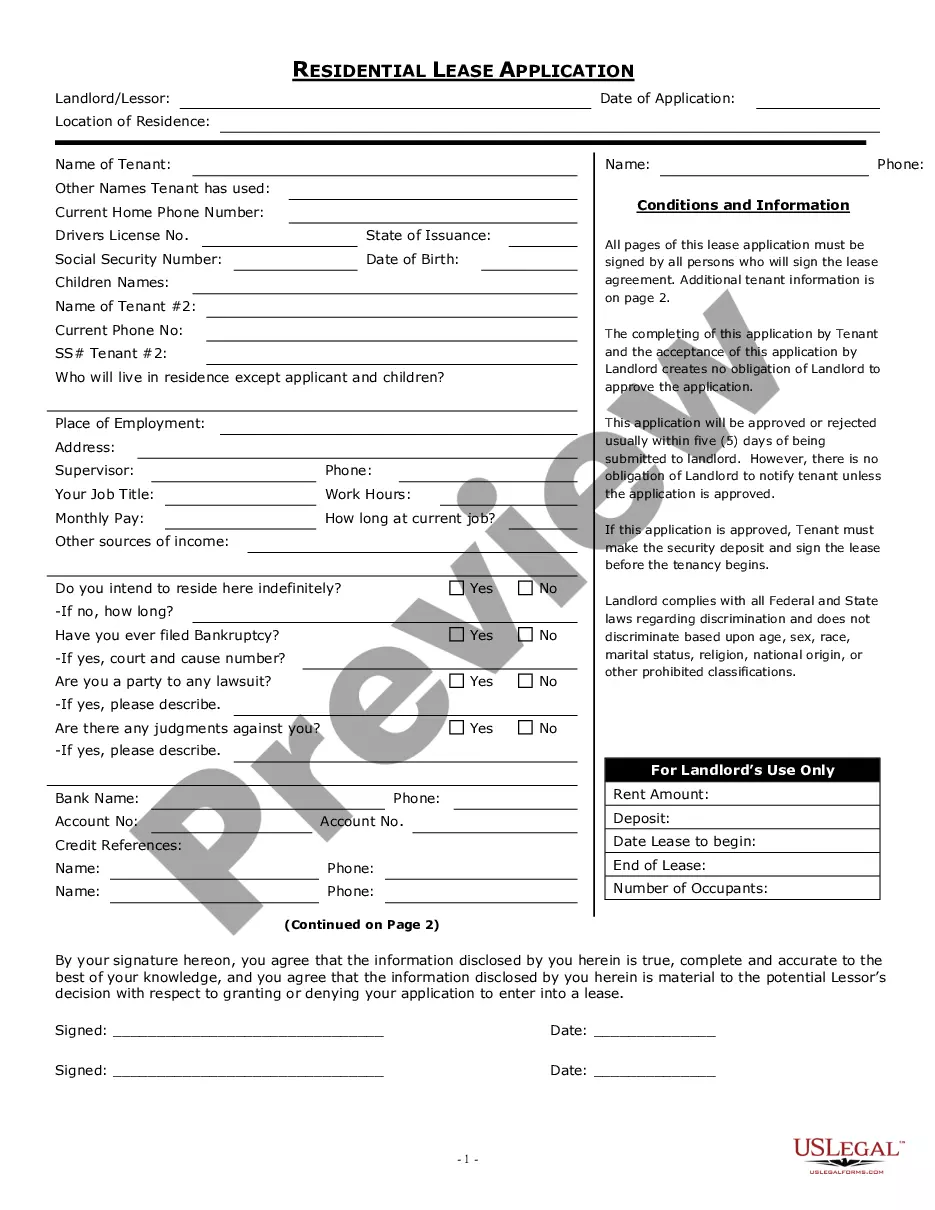

How to fill out Order Discharging Debtor After Completion Of Chapter 12 Plan - Updated 2005 Act Form?

US Legal Forms - among the greatest libraries of legitimate varieties in the States - provides a wide range of legitimate file web templates you are able to acquire or print out. Using the site, you will get thousands of varieties for company and person purposes, sorted by types, states, or keywords.You will find the most recent variations of varieties just like the Maryland Order Discharging Debtor After Completion of Chapter 12 Plan - updated 2005 Act form in seconds.

If you have a membership, log in and acquire Maryland Order Discharging Debtor After Completion of Chapter 12 Plan - updated 2005 Act form from your US Legal Forms library. The Download switch will show up on every single kind you perspective. You gain access to all formerly downloaded varieties in the My Forms tab of the profile.

If you would like use US Legal Forms the very first time, listed here are simple instructions to get you started off:

- Be sure you have picked the correct kind for your personal town/state. Go through the Review switch to review the form`s content. Look at the kind explanation to ensure that you have selected the right kind.

- If the kind does not suit your requirements, make use of the Look for area near the top of the display screen to discover the one that does.

- Should you be satisfied with the shape, verify your option by clicking on the Get now switch. Then, select the prices strategy you favor and give your references to sign up on an profile.

- Method the deal. Use your charge card or PayPal profile to finish the deal.

- Select the formatting and acquire the shape on the gadget.

- Make modifications. Load, modify and print out and sign the downloaded Maryland Order Discharging Debtor After Completion of Chapter 12 Plan - updated 2005 Act form.

Every template you included with your bank account does not have an expiry date which is your own for a long time. So, if you wish to acquire or print out yet another backup, just visit the My Forms segment and then click about the kind you want.

Gain access to the Maryland Order Discharging Debtor After Completion of Chapter 12 Plan - updated 2005 Act form with US Legal Forms, by far the most comprehensive library of legitimate file web templates. Use thousands of professional and status-distinct web templates that satisfy your business or person requirements and requirements.

Form popularity

FAQ

An Objection to Discharge is a motion by a creditor to a bankruptcy court asking the court not to discharge a person's specific debt owed to that creditor. If the court grants the motion, the debt is not discharged in bankruptcy and remains due. Why a Creditor Might File an Objection to Discharge in ... Rosenblum Law ? bankruptcy-nj ? chapter-7 Rosenblum Law ? bankruptcy-nj ? chapter-7

Once you're discharged, you're no longer legally responsible for any of the debts that were included in your bankruptcy. Some debts, such as criminal fines, child maintenance arrears or TV Licence non-payment, are not discharged in bankruptcy and won't be written off. You'll need to keep paying these. Bankruptcy Discharge. Free Debt Advice From StepChange stepchange.org ? debt-info ? bankruptcy-dis... stepchange.org ? debt-info ? bankruptcy-dis...

Creditors cannot collect discharged debts This order means that no one may make any attempt to collect a discharged debt from the debtors personally. For example, creditors cannot sue, garnish wages, assert a deficiency, or otherwise try to collect from the debtors personally on discharged debts. Order of Discharge - Supreme Court supremecourt.gov ? opinions ? URLs_Cited supremecourt.gov ? opinions ? URLs_Cited

Courts can issue a discharge ruling when the debtor meets the discharge requirements under Chapter 7 or Chapter 11 of federal bankruptcy law, or the ruling is based on a debt canceling. A canceling of debt happens when the lender agrees that the rest of the debt is forgiven.

Except as otherwise provided in subdivision (d), a complaint to determine the dischargeability of a debt under §523(c) shall be filed no later than 60 days after the first date set for the meeting of creditors under §341(a).

What is a discharge in bankruptcy? A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.

The discharge is a permanent order prohibiting the creditors of the debtor from taking any form of collection action on discharged debts, including legal action and communications with the debtor, such as telephone calls, letters, and personal contacts. Discharge in Bankruptcy - Bankruptcy Basics - U.S. Courts US Courts (.gov) ? services-forms ? discharge... US Courts (.gov) ? services-forms ? discharge...

What happens when a creditor files an objection? A creditor's objection does not automatically prevent a discharge of debt. The debtor gets a chance to file an answer to the objection, and the court may hold a hearing to decide the issue. This is called an adversary proceeding, and it works much like any other lawsuit.