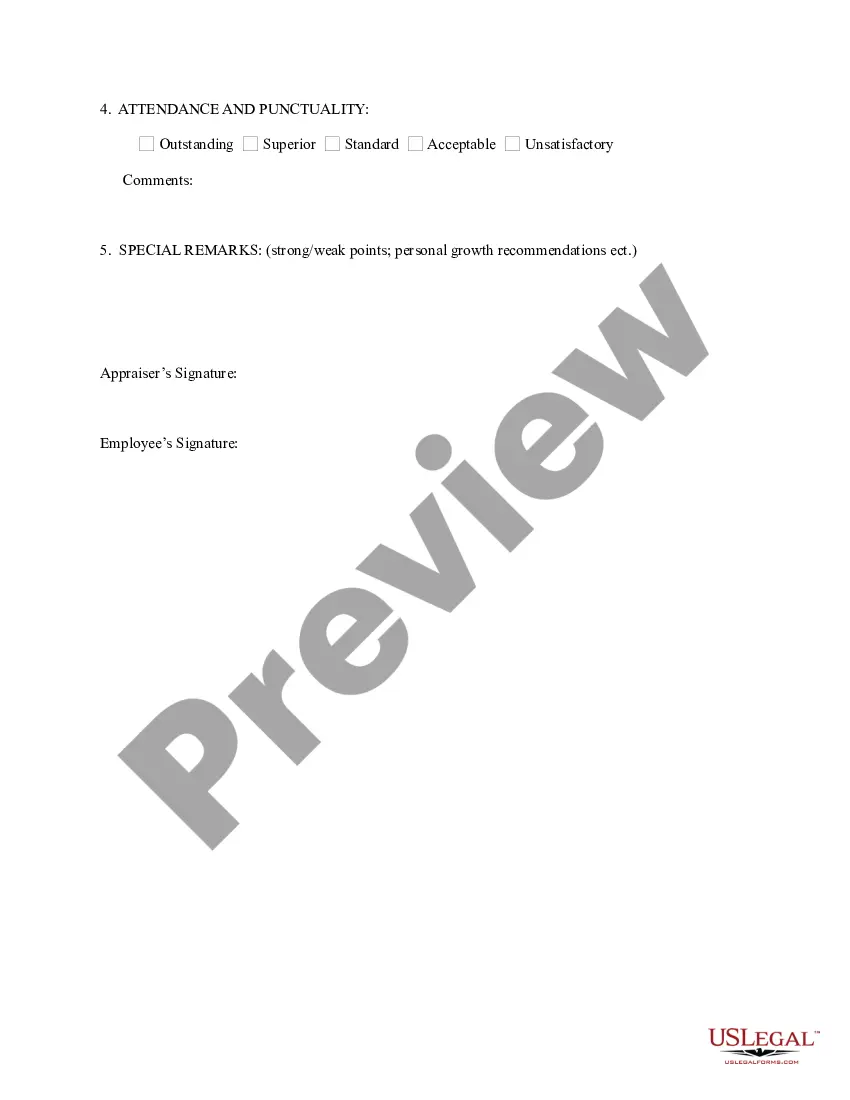

Maryland Salaried Employee Appraisal Guidelines - Employee Specific

Description

How to fill out Salaried Employee Appraisal Guidelines - Employee Specific?

Choosing the best legitimate record format can be a struggle. Naturally, there are a variety of themes available on the net, but how will you discover the legitimate form you will need? Make use of the US Legal Forms internet site. The services gives a large number of themes, such as the Maryland Salaried Employee Appraisal Guidelines - Employee Specific, that you can use for organization and personal demands. All of the varieties are examined by specialists and satisfy state and federal requirements.

When you are presently signed up, log in to the bank account and click on the Down load option to find the Maryland Salaried Employee Appraisal Guidelines - Employee Specific. Make use of your bank account to appear throughout the legitimate varieties you may have acquired previously. Go to the My Forms tab of your respective bank account and acquire one more backup in the record you will need.

When you are a whole new customer of US Legal Forms, here are straightforward recommendations for you to comply with:

- Very first, be sure you have chosen the correct form to your metropolis/county. It is possible to look over the shape utilizing the Preview option and study the shape information to make sure it is the best for you.

- In case the form is not going to satisfy your expectations, use the Seach industry to discover the appropriate form.

- When you are certain that the shape is proper, select the Acquire now option to find the form.

- Choose the pricing strategy you would like and enter in the needed info. Build your bank account and pay money for the order making use of your PayPal bank account or credit card.

- Select the file structure and obtain the legitimate record format to the device.

- Total, edit and print out and signal the received Maryland Salaried Employee Appraisal Guidelines - Employee Specific.

US Legal Forms may be the largest library of legitimate varieties where you will find different record themes. Make use of the company to obtain skillfully-produced papers that comply with express requirements.

Form popularity

FAQ

The biggest factor is if the position is exempt or nonexempt. If they are defined as nonexempt under FLSA, they must be hourly, which takes care of the decision for you. However, you may still want to consider making an exempt employee hourly if there is not enough consistent work for them to be salaried.

Salaried employees have a fixed rate of pay, regardless of the number of hours they work, and do not get paid extra for overtime. Hourly employees are given a fixed hourly salary that must be at least the federal minimum wage, paid based on the number of hours worked, and eligible for overtime pay.

In fact, employees' right to discuss their salary is protected by law. While employers may restrict workers from discussing their salary in front of customers or during work, they cannot prohibit employees from talking about pay on their own time.

A salaried employee is paid based on an annual amount, called a salary. A salary is a regular predetermined amount of pay an employee receives each payday, not determined by the quality or quantity of the employee's work.

Under federal overtime law and Texas overtime law, salaried employees must receive overtime pay for hours worked over 40 in any workweek unless two specific requirements are met: (1) the salary exceeds $455 per workweek; and (2) the employee performs duties satisfying one of the narrowly-defined FLSA overtime

Maximum hours an exempt employee can be required to work The law does not provide a maximum number of hours that an exempt worker can be required to work during a week. This means that an employer could require an exempt employee to work well beyond 40 hours a week without overtime compensation.

These exemptions also apply in Texas. So if you're paid an annual salary and earning more than a certain amount set by law, you are considered "exempt" and not covered by the FLSA. This means exempt employees are not entitled to overtime pay for working more than 40 hours in a week.

Salaried employees cannot have their pay deducted by their employer if they work less than 40 hours per week or the employee may be seen as nonexempt and entitled to overtime compensation when working more than 40 hours a week.

Maryland is not one of them, however. Under IRS rules, any portion of a mandatory service charge that the employer pays out to employees must be treated as wages, not tips.

Hourly workers are paid an hourly rate for each hour they work and are entitled to overtime pay if they work over 40 hours per week. Salary employees are typically not given overtime pay, but company-provided benefits are often more substantial than those provided to hourly workers.