Maryland Statement for Vietnam Era Veterans and / or the Disabled

Description

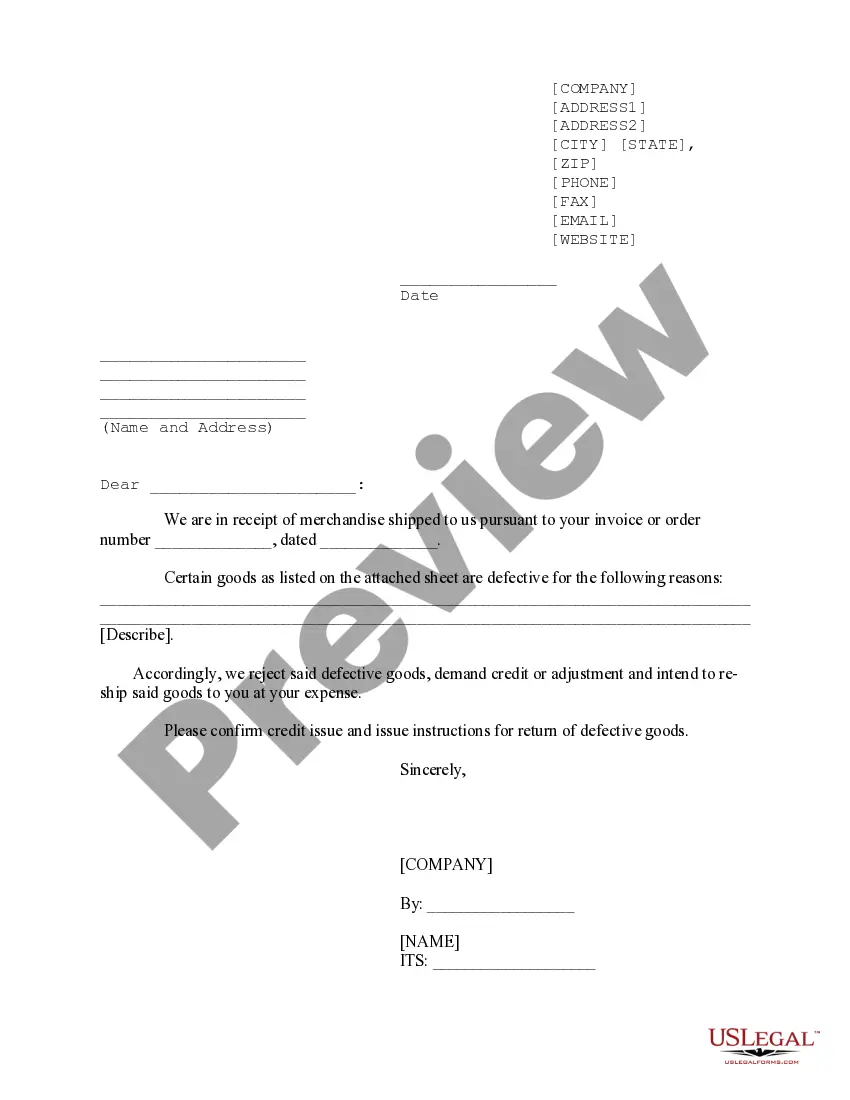

How to fill out Statement For Vietnam Era Veterans And / Or The Disabled?

If you need to comprehensive, acquire, or print legal document layouts, use US Legal Forms, the biggest variety of legal varieties, which can be found online. Utilize the site`s simple and easy practical search to discover the documents you require. A variety of layouts for business and individual reasons are sorted by groups and claims, or keywords. Use US Legal Forms to discover the Maryland Statement for Vietnam Era Veterans and / or the Disabled in just a few click throughs.

If you are currently a US Legal Forms client, log in in your profile and then click the Download switch to have the Maryland Statement for Vietnam Era Veterans and / or the Disabled. You may also access varieties you previously saved from the My Forms tab of your respective profile.

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have selected the form for the appropriate city/region.

- Step 2. Utilize the Preview choice to look over the form`s content. Never neglect to see the information.

- Step 3. If you are not satisfied with all the type, use the Look for discipline on top of the monitor to discover other versions from the legal type web template.

- Step 4. When you have located the form you require, go through the Purchase now switch. Opt for the rates prepare you like and add your accreditations to sign up for an profile.

- Step 5. Process the purchase. You can use your credit card or PayPal profile to accomplish the purchase.

- Step 6. Choose the format from the legal type and acquire it on your gadget.

- Step 7. Total, revise and print or indicator the Maryland Statement for Vietnam Era Veterans and / or the Disabled.

Every legal document web template you get is yours forever. You have acces to every single type you saved with your acccount. Go through the My Forms portion and select a type to print or acquire again.

Remain competitive and acquire, and print the Maryland Statement for Vietnam Era Veterans and / or the Disabled with US Legal Forms. There are many professional and state-distinct varieties you may use for your personal business or individual requirements.

Form popularity

FAQ

(b) PostVietnamera veteran means an eligible veteran who first became a member of the Armed Forces or first entered on active duty as a member of the Armed Forces after . (c) Vietnam era means the period be ginning August 5, 1964 and ending .

Yes, 100 percent P&T disabled veterans receive a full property tax exemption in Maryland and do not pay property tax on a primary residence. Some counties also offer a 15 to 20 percent discount for veterans who meet age and income limits.

200b200b NEW 100% Disabled Veterans Receive Free Registration for all license plate types.

Vietnam era veterans are those who served during the time of the Vietnam war but didn't set foot in the country of Vietnam. The Vietnam vet is one who was assigned within the combat zone of the country and it's surrounding waters.

Maryland Veteran Financial BenefitsProperty Tax Exemption.Income Tax.Pension Tax Exclusion.Vessel Excise Tax.State Employment Veterans Preference.CDL License.Free Hunting & Fishing Licenses for Disabled Veterans.Active Duty Hunting & Fishing Licenses.More items...?

Property Tax Exemption- Disabled Veterans and Surviving Spouses. Armed Services veterans with a permanent and total service connected disability rated 100% by the Veterans Administration may receive a complete exemption from real property taxes on the dwelling house and surrounding yard.

The State Of Maryland offers veteran hiring preferences to qualifying service members. Ten hiring points are available to eligible veterans with or without a VA-rated service-connected disability, former POWs, spouses of eligible veterans with VA-rated disabilities, and surviving spouses of eligible military members.

Maryland Veteran Financial BenefitsProperty Tax Exemption.Income Tax.Pension Tax Exclusion.Vessel Excise Tax.State Employment Veterans Preference.CDL License.Free Hunting & Fishing Licenses for Disabled Veterans.Active Duty Hunting & Fishing Licenses.More items...?

A member of the armed services serving on active duty in the State is exempt from the 5% vessel excise tax for one year. The exemption applies only to vessels currently registered elsewhere and brought into Maryland because of the duty transfer. New purchases are not exempt.

Vietnam Veterans may be eligible for a wide-variety of benefits available to all U.S. military Veterans. VA benefits include disability compensation, pension, education and training, health care, home loans, insurance, vocational rehabilitation and employment, and burial.