Maryland Consulting Contract Questionnaire - Self-Employed

Description

How to fill out Consulting Contract Questionnaire - Self-Employed?

You can spend hours online trying to locate the official document template that fulfills the state and federal criteria you require.

US Legal Forms offers numerous legal forms that have been reviewed by professionals.

You can easily download or print the Maryland Consulting Contract Questionnaire - Self-Employed from the platform.

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Maryland Consulting Contract Questionnaire - Self-Employed.

- Every legal document template you obtain is yours forever.

- To get another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Check the form description to verify that you have chosen the right form.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

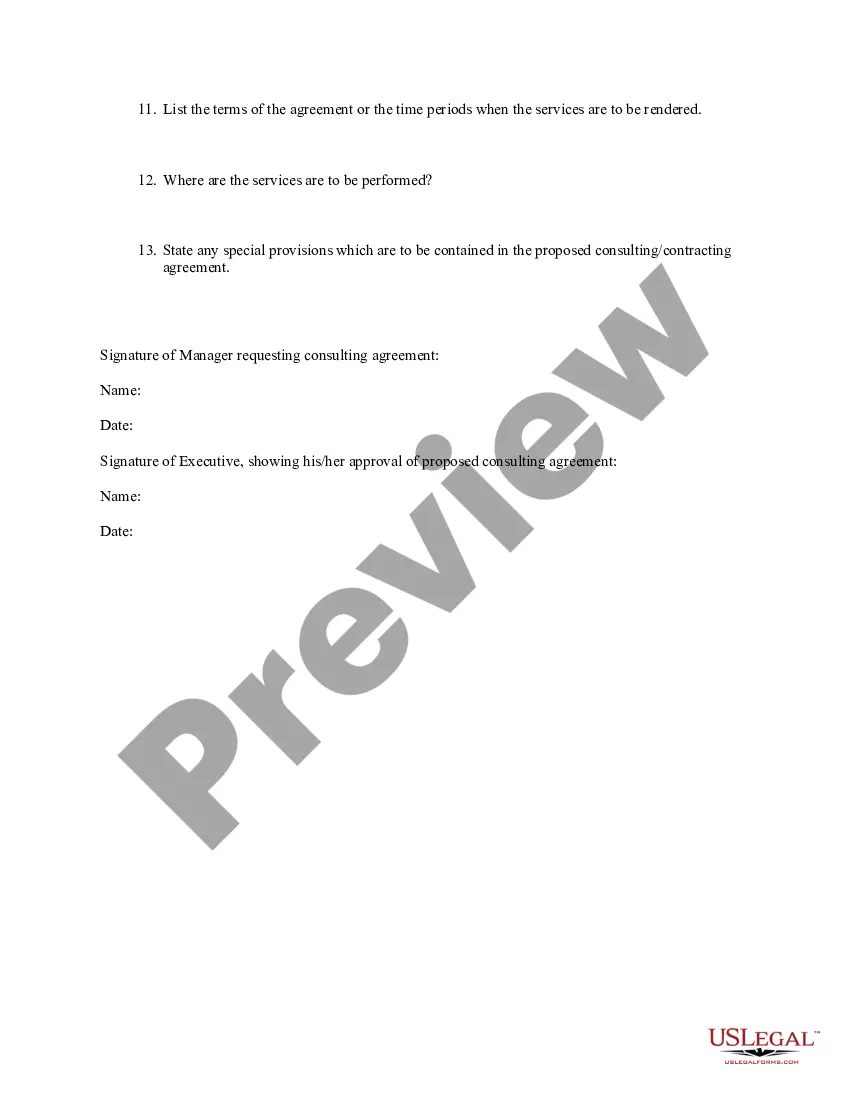

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

A consulting contract should offer a detailed description of the duties you will perform and the deliverables you promise the client. The agreement may also explain how much work you will perform at the client's office and how often you will work remotely.

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

The consulting agreement is an agreement between a consultant and a client who wishes to retain certain specified services of the consultant for a specified time at a specified rate of compensation.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.