Maryland Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

Selecting the correct legitimate document format can be rather a challenge.

Of course, there are numerous templates accessible online, but how do you find the legitimate form you need.

Make use of the US Legal Forms website. The platform offers thousands of templates, including the Maryland Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, suitable for both business and personal needs.

If the form does not meet your requirements, use the Search area to find the suitable form. Once you are sure the form is appropriate, click the Purchase now option to acquire the form. Choose the payment plan you want and enter the necessary details. Create your account and finalize your order using your PayPal account or Visa or MasterCard. Choose the document format and download the legal document template to your device. Complete, modify, print, and sign the received Maryland Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. US Legal Forms is the best repository of legal forms where you can find various document templates. Utilize the service to download professionally crafted documents that meet state requirements.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download option to get the Maryland Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

- Use your account to search through the legal forms you may have purchased previously.

- Go to the My documents tab of your account and retrieve another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/state. You can check the form using the Preview option and review the form outline to confirm it suits your needs.

Form popularity

FAQ

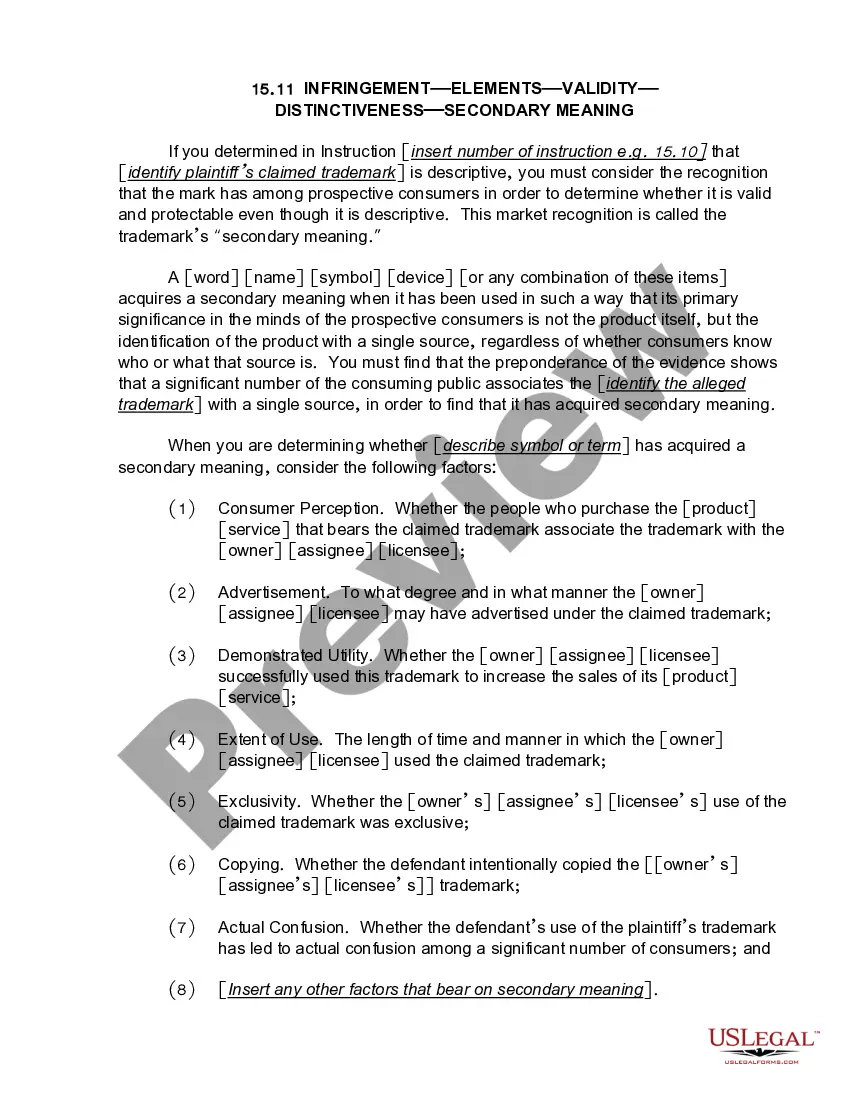

A guarantee is a general term that refers to a promise made to ensure fulfillment or payment of a debt. In contrast, a guaranty agreement is a specific legal document stating the terms under which the guarantor agrees to take on responsibility if the primary party defaults. Understanding this distinction is crucial, especially in the context of Maryland Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, where legal implications can significantly impact financial decisions.

Every Maryland sales contract must include details about the guaranty fund, such as the amount secured and the purpose of the fund. It should also explain the conditions under which the fund can be accessed, ensuring transparency for all parties involved. Including this information helps protect both buyers and sellers by clarifying financial responsibilities. For assistance, the uslegalforms platform offers resources specifically addressing the Maryland Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

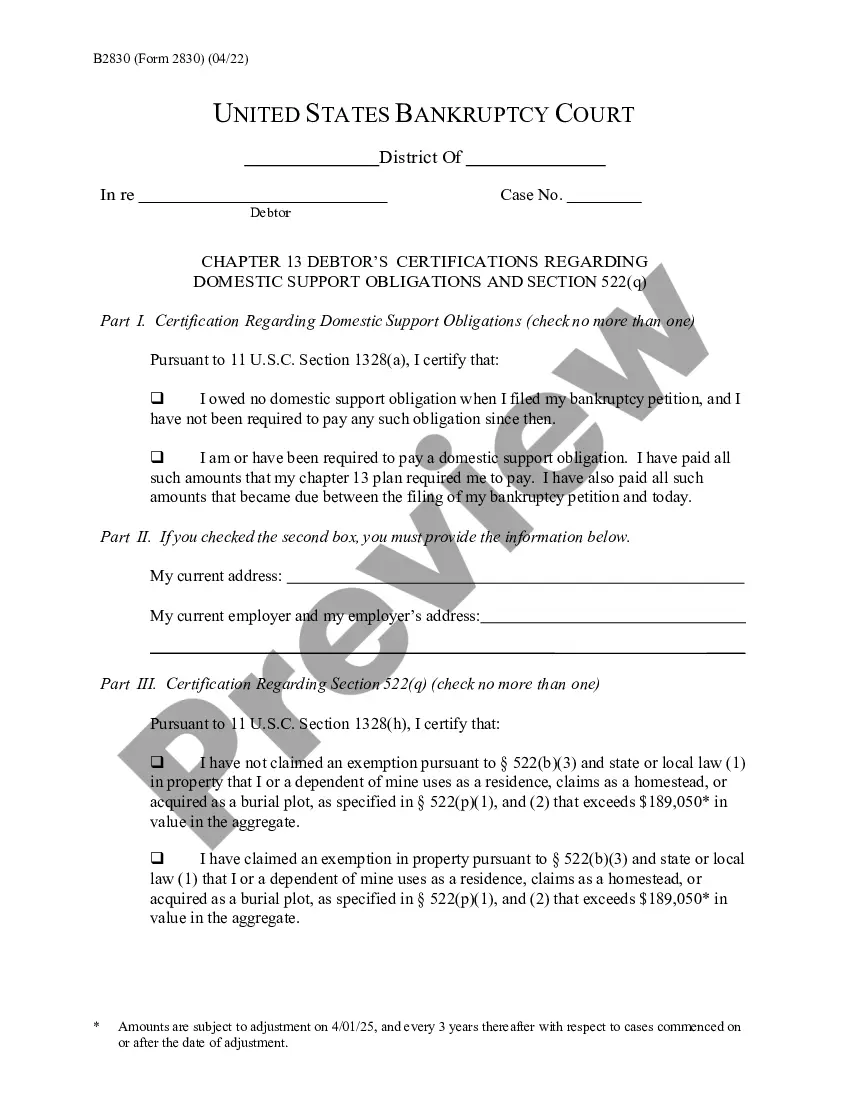

To complete a personal guaranty, start by accurately entering your personal information, including your full name, address, and Social Security number. Next, specify the obligations you are guaranteeing, whether related to lease or purchase agreements. Finally, read through the terms carefully before signing to ensure that you fully understand your responsibilities. Consider using the uslegalforms platform for templates tailored to Maryland Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

A bank guarantee is a promise made by a bank to cover a loss if a borrower defaults, whereas a personal guarantee comes from an individual’s commitment. While both provide security to lenders, a bank guarantee involves financial institutions, while a personal guarantee ties directly to individual liability. When considering a Maryland Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, understanding these nuances is crucial.

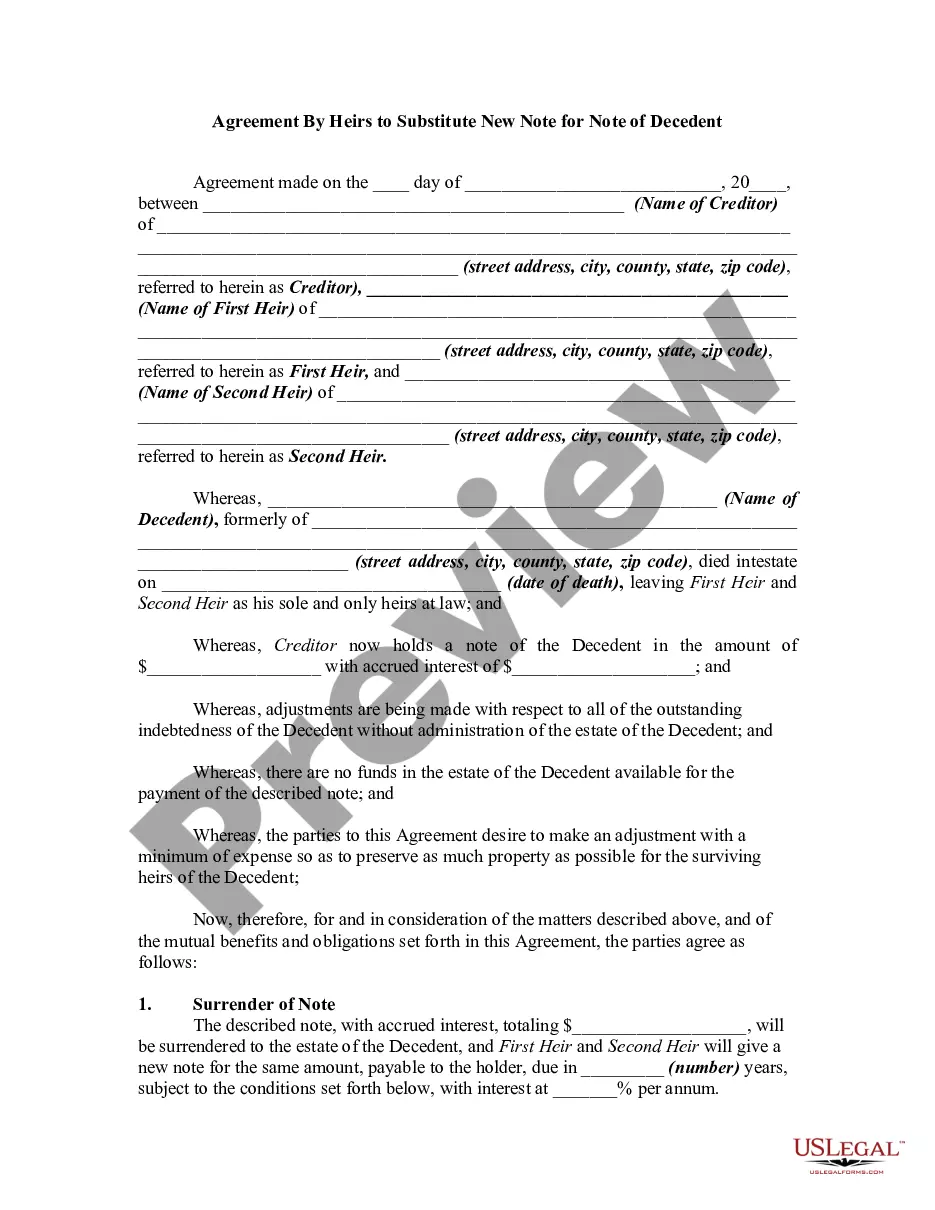

A corporate guarantee involves a business taking responsibility for a debt on behalf of a third party, while a personal guarantee is an individual's commitment tied to their personal assets. The key difference lies in the type of entity responsible for the obligation. Understanding these differences is important for those involved in a Maryland Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

A personal guaranty agreement is a legal document wherein an individual agrees to take personal responsibility for a debt or obligation. This contract often serves as a safety net for lenders and lessors, ensuring they can recover funds if the primary party defaults. Creating a comprehensive Maryland Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate is essential to protect both parties involved.

For a contract to be legally binding in Maryland, it must have an offer, acceptance, consideration, and mutual assent, meaning all parties agree to the terms. Additionally, the object of the contract must be legal, and the parties involved must have the capacity to enter a contract. A well-drafted Maryland Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate can help ensure all these elements are satisfied.

A guarantee may refer to the general promise to fulfill a debt or obligation, while a personal guaranty explicitly ties the individual's personal assets to that obligation. This means if the primary debtor defaults, the guarantor's personal finances are at stake. This distinction is especially important in contracts related to Maryland Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

The terms 'guarantee' and 'guaranty' are often used interchangeably, but they can have distinct meanings. 'Guarantee' refers to the act of assuring a commitment, while 'guaranty' specifically denotes a formal promise, typically in a written contract. When crafting a Maryland Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, it is important to use the correct terminology to avoid confusion.

To fill out a personal guarantee, you should first ensure you have all necessary information, such as the names of the parties involved and the specifics of the obligation. Next, clearly state your intent to act as a guarantor, emphasizing your personal commitment to fulfill the responsibility. Utilizing resources from US Legal Forms can simplify this process and help you draft a proper Maryland Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.