Maryland Salary Adjustment Request

Description

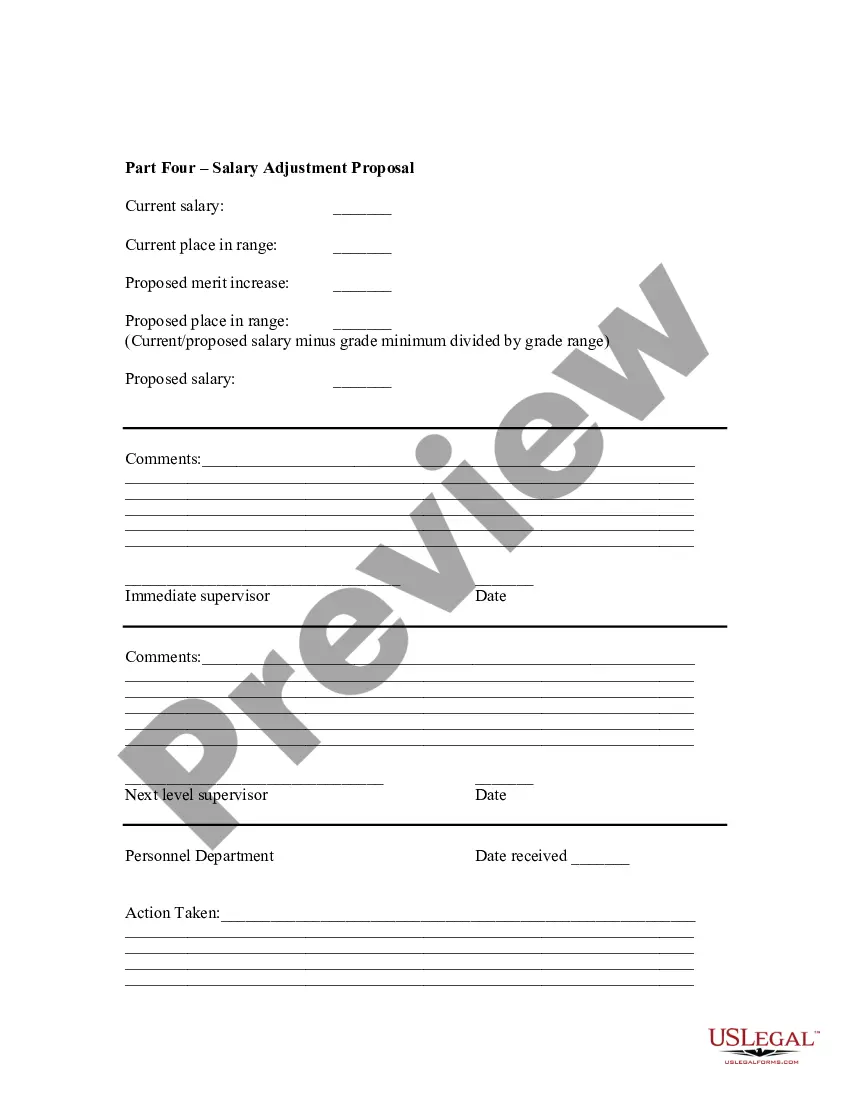

How to fill out Salary Adjustment Request?

Have you ever been in a location where you need documentation for either business or personal purposes almost every time.

There are numerous legitimate document templates accessible online, but identifying ones you can trust is not easy.

US Legal Forms offers an extensive range of form templates, including the Maryland Salary Adjustment Request, which can be filled out to comply with federal and state regulations.

Once you find the correct form, simply click Buy now.

Select the payment plan you prefer, complete the required information to set up your payment, and finalize the order using your PayPal, Visa, or Mastercard. Choose a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Maryland Salary Adjustment Request anytime, if necessary. Just follow the necessary form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and minimize errors. The service provides professionally created legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maryland Salary Adjustment Request template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/state.

- Use the Preview button to check the form.

- Read the description to confirm that you have selected the appropriate form.

- If the form is not what you're looking for, use the Lookup field to locate the form that suits your requirements.

Form popularity

FAQ

A salary adjustment is an acknowledgement that your salary is not in line with the salaries for the job you do. True at the end of the day it is money coming from the same company but your request will be looked at differently.

When you've researched your salary range and chosen a good time to broach the subject, make the ask. Email your manager and explain that you'd like to connect to review your compensation. Outline your impact clearly and concisely. Prepare compelling bullet points that describe exactly how you've excelled in your role.

When to Ask for a RaiseYour Employer Posted Strong Quarterly Earnings.You Aced a Performance Review.You Made a Significant Achievement.You Find Out You're Being Underpaid.You Took On More Job Responsibilities.You Received a Job Offer from Another Company.You Just Hit the One-Year Mark.You Received a Promotion.

This 1% COLA will have the effect of equalizing the annual salary of each grade and step between the STD and ASTD salary scales. Effective July 1, 2022, State regular and contractual employees will receive a 3% COLA. Effective July 1, 2023, State regular and contractual employees will receive a 2% COLA.

A pay adjustment is a change in an employee's pay rate. You can change an employee's hourly wage or salary. Typically, compensation adjustment is an increase in the pay rate, such as when an employee earns a raise.

How to Write a Letter Asking for a RaiseDo your salary research. You're not going to get very far if the amount you ask for is not in line with the realities of today's job market.Pick the right time.Make the request.Back it up.Express appreciation for the consideration.

A salary adjustment is an acknowledgement that your salary is not in line with the salaries for the job you do. True at the end of the day it is money coming from the same company but your request will be looked at differently.

Promotion (Rate above standard promotional rate) - A base salary adjustment awarded when an employee moves to a higher graded job. Compensation Guidelines allow agencies to set promotional salaries within the range.

Pay increases tend to vary based on inflation, location, sector, and job performance. Most employers give their employees an average increase of 3% per year. Consistent job switching may have an impact on the rate at which your salary increases.