Maryland Termination and Severance Pay Policy

Description

How to fill out Termination And Severance Pay Policy?

If you require to compile, download, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Leverage the site's user-friendly and straightforward search to discover the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find alternative versions of the legal document template.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your credentials to register for the account.

- Employ US Legal Forms to locate the Maryland Termination and Severance Pay Policy within a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to find the Maryland Termination and Severance Pay Policy.

- You can also access forms you previously saved under the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

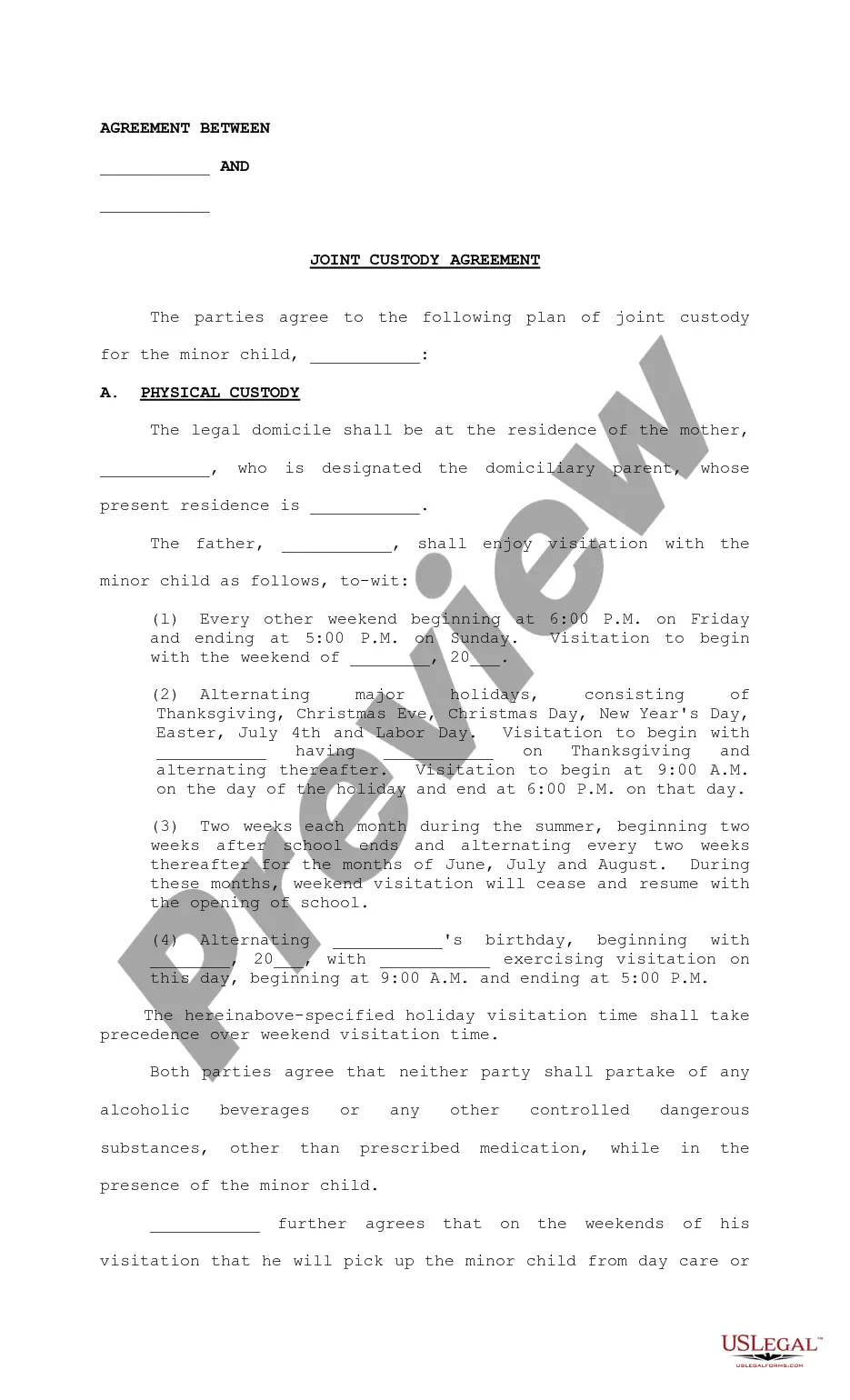

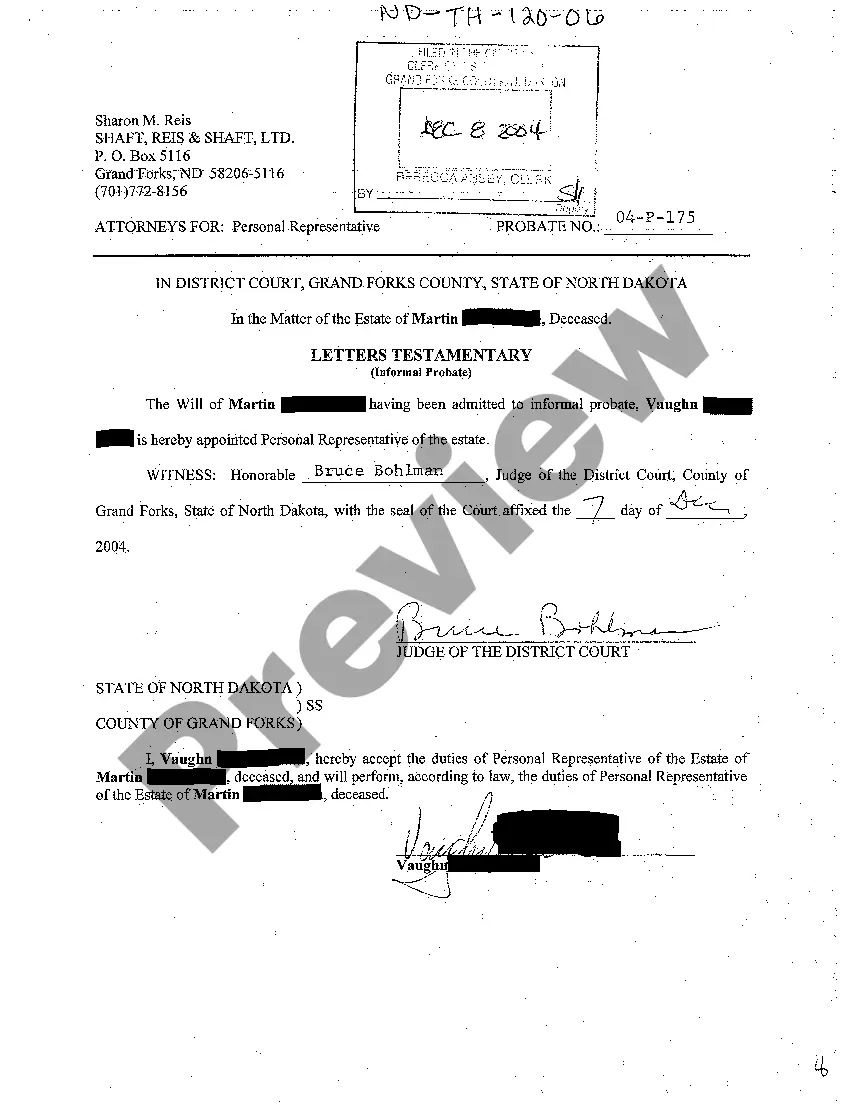

- Step 2. Utilize the Review option to examine the form's content. Don't forget to read the description.

Form popularity

FAQ

Whether you receive severance after termination often depends on your employer's policies and the circumstances of your departure. Under the Maryland Termination and Severance Pay Policy, many employers offer severance pay, but it is not legally required. You should review your employment contract and discuss your situation with HR for clarity. If you find discrepancies, US Legal Forms can help you understand your rights and options.

To receive a severance package under the Maryland Termination and Severance Pay Policy, you typically need to negotiate the terms with your employer after your termination. It's essential to understand your company's policies, as some may have specific guidelines for eligibility. You can also consult with a legal expert to help you navigate the process. Utilizing platforms like US Legal Forms can provide additional resources and templates to assist you in this matter.

In Maryland, the rules for termination adhere to the 'at-will' employment doctrine, which means either the employer or employee can end the employment relationship at any time, for almost any reason. However, exceptions exist, including protections against wrongful termination due to discrimination or retaliation. Understanding the Maryland Termination and Severance Pay Policy helps ensure compliance with these regulations. For further guidance, uslegalforms offers resources that clarify your rights and obligations regarding termination in Maryland.

Termination criteria may include performance issues, violations of company policy, or reductions in workforce. Maryland's at-will employment status means that these criteria can be broadly applied, although employers must avoid illegal reasons for firing. The Maryland Termination and Severance Pay Policy helps clarify acceptable practices for both employers and employees. Familiarizing yourself with these criteria can assist in maintaining a positive workplace.

Yes, receiving severance does not automatically disqualify you from collecting unemployment in Maryland. However, the amount you receive in severance may impact your eligibility and benefits. It is essential to review the Maryland Termination and Severance Pay Policy to understand how severance relates to unemployment benefits. Being informed can make a difference in your financial recovery after job loss.

Yes, under Maryland law, an employer can terminate an employee without prior warning, given the at-will employment policy. However, firing for specific discriminatory reasons is against the law. The Maryland Termination and Severance Pay Policy ensures that employees understand their rights, emphasizing the importance of fair treatment in the workplace. Knowing your rights can empower you during challenging situations.

Employers in Maryland must provide a final paycheck to employees who have been terminated. The final paycheck includes payment for all hours worked and any accrued leave. Under the Maryland Termination and Severance Pay Policy, employees should receive their final pay promptly to avoid delays. Understanding these rules can help ensure you receive fair compensation as you transition after employment.

In Maryland, individuals seeking an abortion must have a consultation with a healthcare provider. The law requires informed consent and a waiting period in certain circumstances. It's crucial to review healthcare policies along with the Maryland Termination and Severance Pay Policy, as workplace rights may impact access to care. Ensuring you are well-informed can help you make the best decisions for your health.

Maryland follows the principle of 'at-will' employment, which means employers can terminate employees for almost any reason, as long as it's not illegal. However, this also allows employees to leave a job without notice or reason. The Maryland Termination and Severance Pay Policy outlines that companies must abide by fair practices and cannot discriminate against employees. It's vital to understand these laws to navigate the employment landscape effectively.

In Maryland, collecting unemployment benefits after being fired is possible, but eligibility depends on the circumstances surrounding your termination. If you were let go for misconduct, you may be disqualified. Understanding the Maryland Termination and Severance Pay Policy and consulting resources like US Legal Forms can help clarify your options for seeking unemployment benefits.