Maryland Telecommuting Policy

Description

How to fill out Telecommuting Policy?

Locating the appropriate legal document template can be a challenge.

Of course, there are numerous templates available online, but how do you find the specific legal form you need.

Utilize the US Legal Forms website. This service provides thousands of templates, such as the Maryland Telecommuting Policy, suitable for both business and personal purposes.

First, ensure you have selected the correct form for your area/state. You can review the document using the Preview button and examine the information to confirm it meets your needs.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Acquire button to access the Maryland Telecommuting Policy.

- Use your account to browse through the legal forms you may have previously obtained.

- Navigate to the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

Form popularity

FAQ

Nonresidents who work in Maryland or derive income from a Maryland source are subject to the appropriate Maryland income tax rate for their income level, as well as a special nonresident tax rate. The special nonresident tax rate has increased from 1.25% to 1.75% in 2016.

Though often away from the office, a teleworker is different from a remote employee because there occasionally some in-person office attendance required though this is not always the case. Another key difference is that a teleworker is often geographically closer to the main office location than a remote worker.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

Telecommuting is a growing trend that allows employees to work remotely from home or some other location. Alternative work schedule includes options such as flextime, compressed work weeks and staggered shifts.

Employers of cross-border workers may also face implications if their employee is working remotely from a different country. Depending on the country involved, the employer might be required to set up a payroll and withhold taxes in the country where the employee works remotely.

Retirement Tax Reduction Act of 2020 Retirees with Maryland income up to $50,000 will pay no state tax whatsoever in the state of Maryland. This tax reduction will be phased in over five years, beginning in FY22.

Telecommuting is the ability for an employee to complete work assignments from outside the traditional workplace by using telecommunications tools such as email, phone, chat and video apps.

Remote work, also called distance working, telework, teleworking, working from home (WFH), mobile work, remote job, and work from anywhere (WFA) is an employment arrangement in which employees do not commute to a central place of work, such as an office building, warehouse, or retail store.

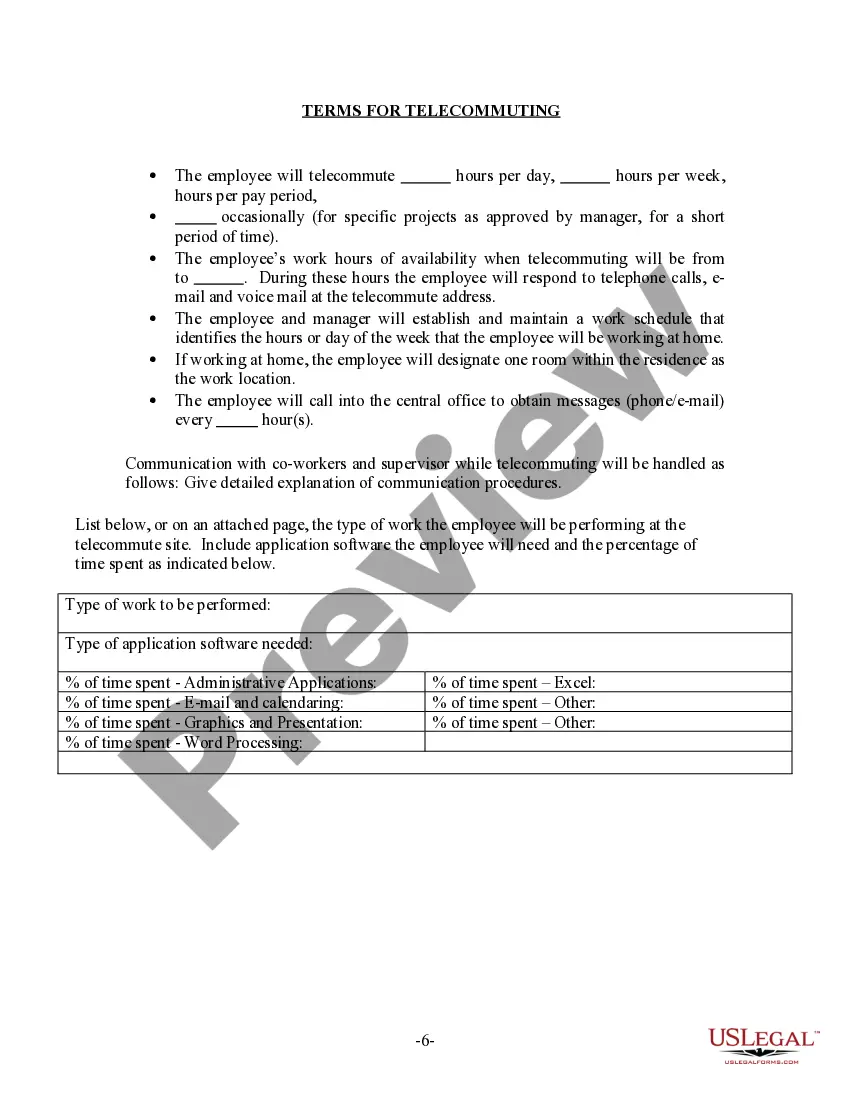

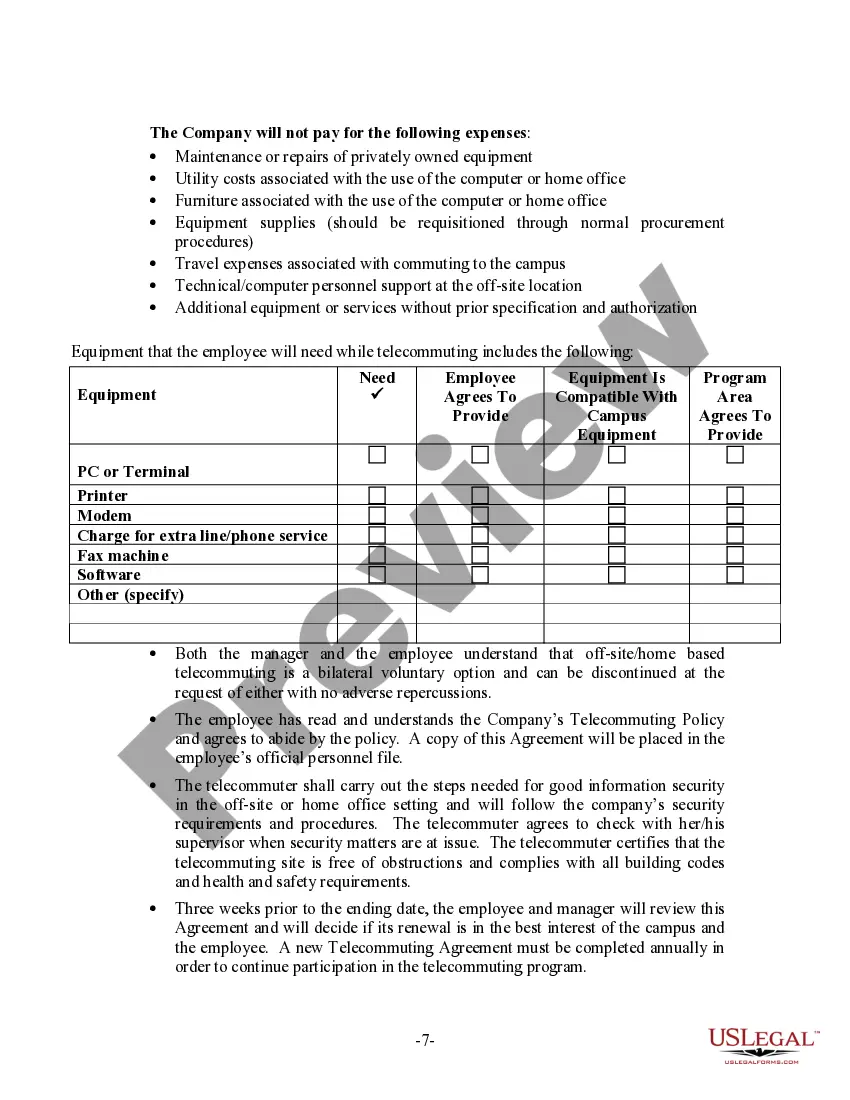

Objective. Telecommuting allows employees to work at home, on the road or in a satellite location for all or part of their workweek. Company Name considers telecommuting to be a viable, flexible work option when both the employee and the job are suited to such an arrangement.

Yes, the same situation would be applicable to 2020. MD would not tax the income earned working for the MD company but remotely in NH. You would allocate two months to MD for the two months you physically worked in MD as a non-resident. MD did not change it's business nexus rules due to COVID 19.