Maryland While You Were Out

Description

How to fill out While You Were Out?

You can spend hours online attempting to locate the valid document template that adheres to the state and federal requirements you need.

US Legal Forms offers thousands of valid templates that have been reviewed by professionals.

It is easy to obtain or create the Maryland While You Were Out using their service.

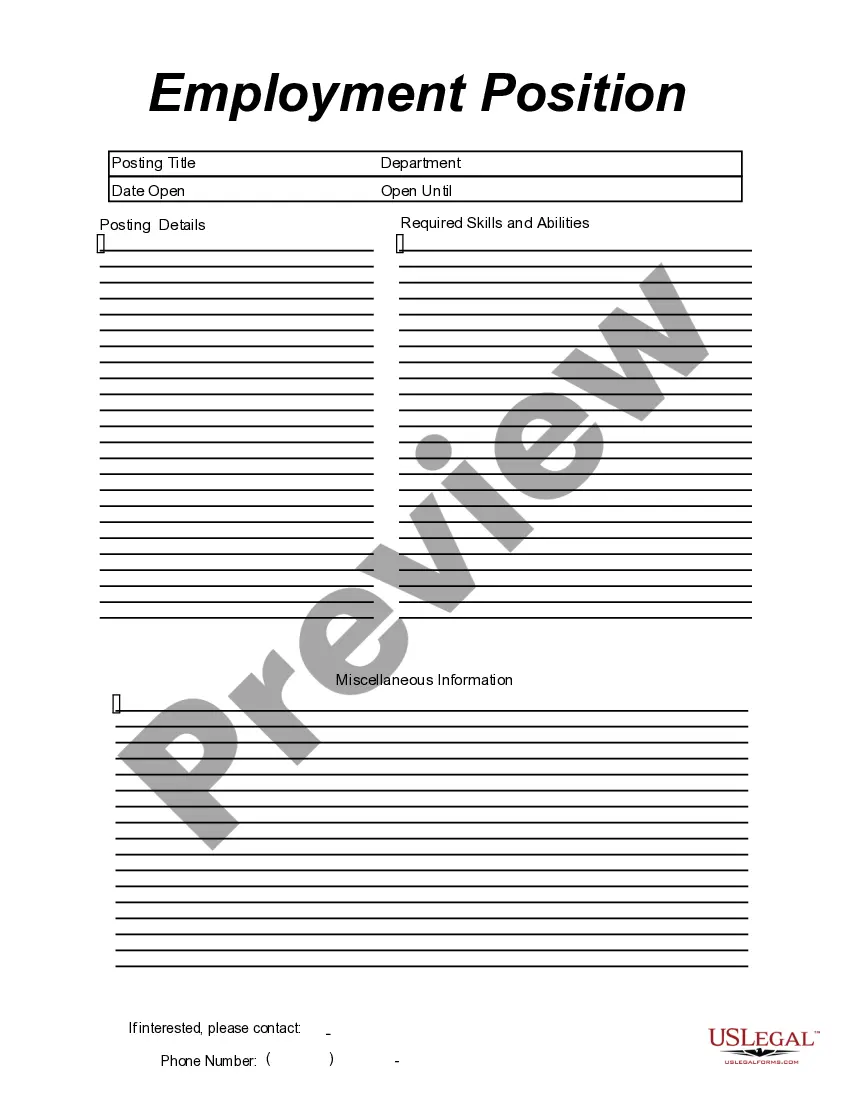

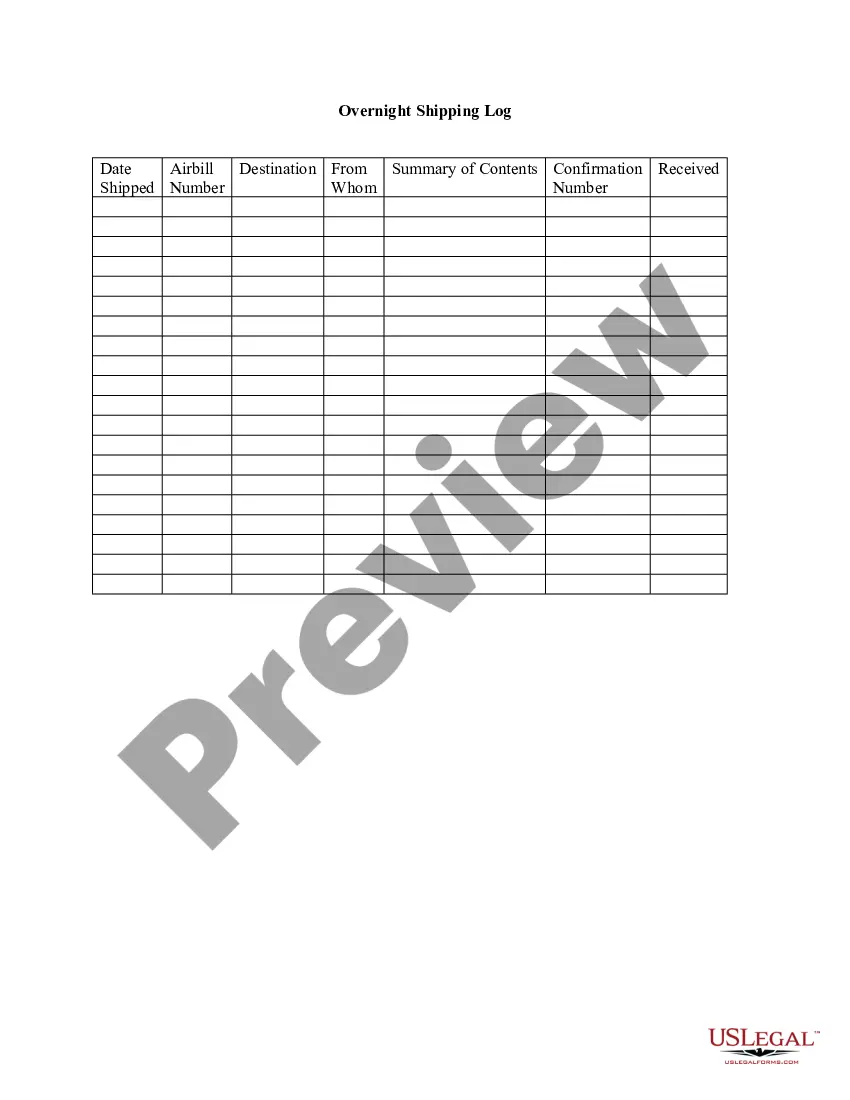

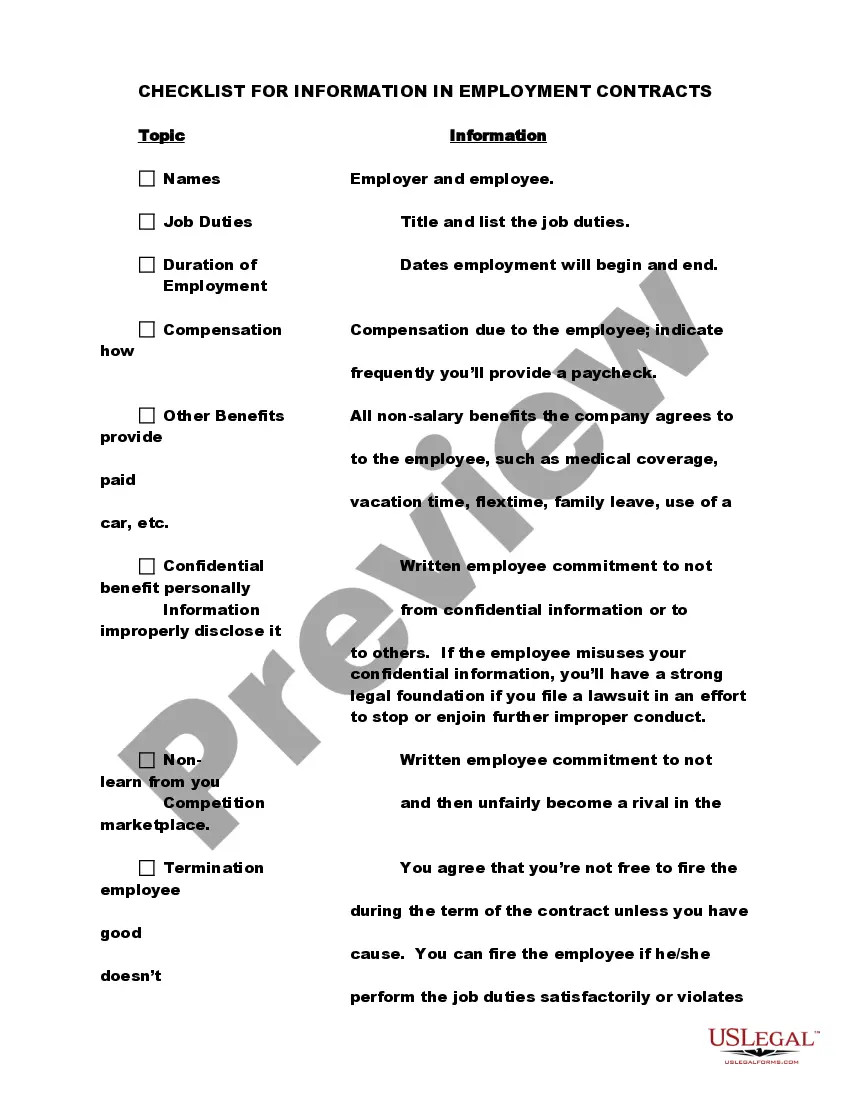

If available, utilize the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- Then, you can complete, edit, print, or sign the Maryland While You Were Out.

- Each valid document template you purchase is yours indefinitely.

- To get another copy of the acquired form, visit the My documents section and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the right document template for the region/area of your choice.

- Check the form description to confirm that you have chosen the correct form.

Form popularity

FAQ

'While You Were Out' explores the journeys of individuals confronting unexpected changes in life. The authors skillfully illustrate the struggles and triumphs faced by characters as they navigate challenges. This book, particularly 'Maryland While You Were Out,' highlights resilience and offers insight into how we deal with the unforeseen, making it a must-read for anyone seeking inspiration.

'While You Were Out' draws inspiration from real-life experiences, blending fiction with genuine situations. This unique approach allows readers to connect with the characters on a personal level. Maryland While You Were Out offers a relatable familiarity, captivating audiences and prompting them to reflect on their own lives.

Non-residents in Maryland should use Form 505, the Non-Resident Income Tax Return. This form allows you to report any Maryland-source income while ensuring you are correctly taxed. For easy navigation and completion of this form, the 'Maryland While You Were Out' feature can streamline the process, making it user-friendly.

Nonresidents who work in Maryland or derive income from a Maryland source are subject to the appropriate Maryland income tax rate for your income level, as well as a special nonresident tax rate of 1.75%.

Any individual who maintains a place of abode in Maryland and spends in the aggregate 183 days or more in Maryland is considered a resident for Maryland personal income tax purposes and must file a Maryland Resident Personal Income Tax Return.

You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. For more information and forms, visit the university Tax Office website.

Nonresidents are subject to a special tax rate of 2.25%, in addition to the state income tax rate. Maryland's 23 counties and Baltimore City also levy a local income tax, which is collected on the resident state tax return as a convenience to local governments.

Were you a resident of Maryland for part of the year? If you either established or abandoned Maryland residency during the calendar year, you must file as a part-year resident, using Form 502. You may also be required to file a return with your other state of residence.

Maryland State Retirement Pickup Contributions (Maryland STPICKUP) are entered as "Maryland state retirement pickup" contributions in the Federal Q&A, or directly on Form W-2 Wage and Tax Statement. This information will then transfer to Line 3 of Maryland Form 502.

Maryland taxes residents' income earned in the state and out of state. If Maryland residents pay income tax to another state for income earned there, Maryland allows them a credit against Maryland's state tax but not its county tax. Maryland also taxes nonresident income earned in the state.