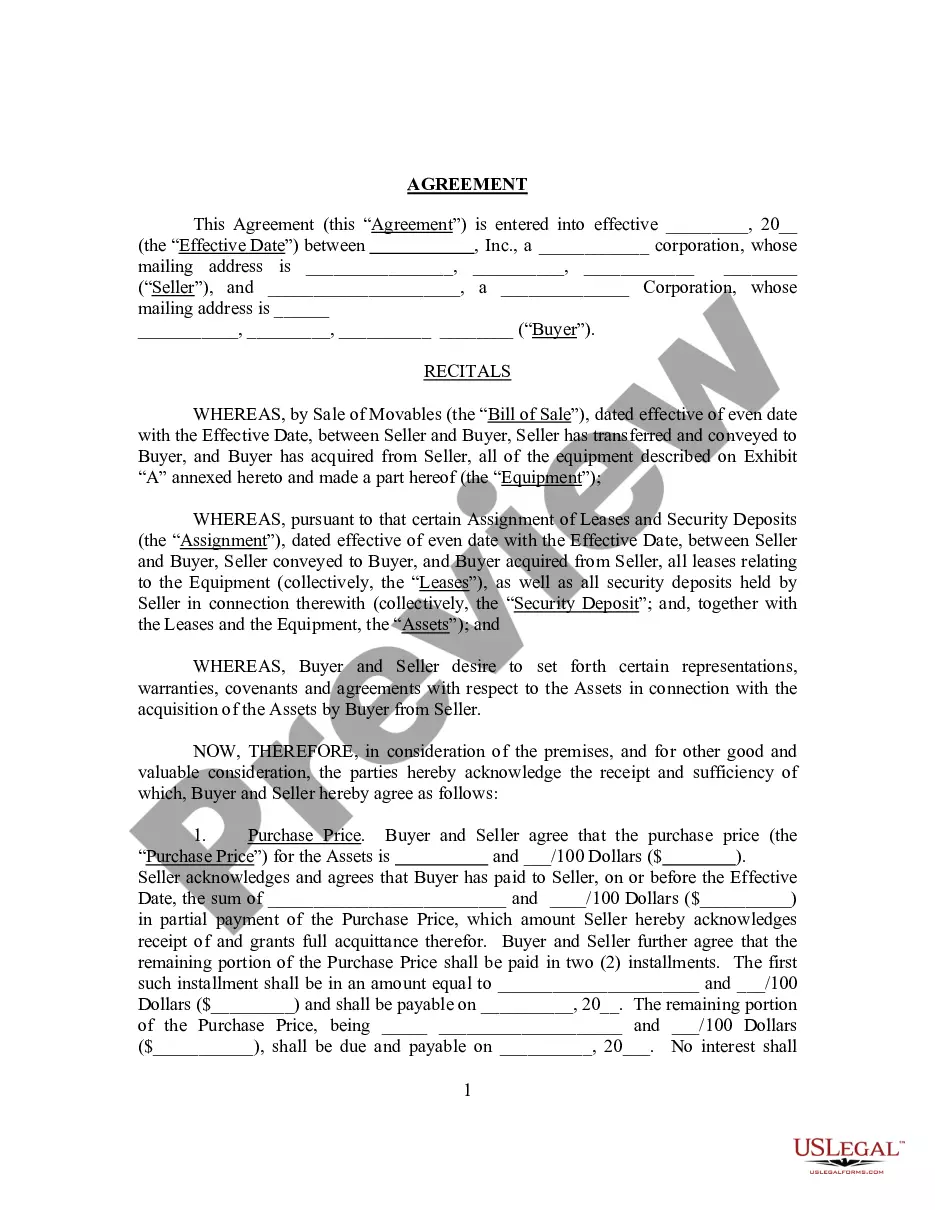

Maryland Agreement Replacing Joint Interest with Annuity

Description

How to fill out Agreement Replacing Joint Interest With Annuity?

Finding the appropriate legal document format can be challenging.

Of course, there are numerous templates accessible online, but how do you acquire the legal form you desire.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure you have selected the correct form for your region/area. You can preview the form using the Preview button and review the form summary to confirm this is right for you.

- The service provides a vast array of templates, such as the Maryland Agreement Replacing Joint Interest with Annuity, which you may use for business and personal needs.

- All forms are reviewed by professionals and meet state and federal regulations.

- If you are currently a registered user, Log In to your account and click the Download button to access the Maryland Agreement Replacing Joint Interest with Annuity.

- Use your account to view the legal forms you have previously purchased.

- Go to the My documents section of your account and retrieve another copy of the document you need.

Form popularity

FAQ

So what is not allowable in a 1035 exchange? Single Premium Immediate Annuities (SPIAs), Deferred Income Annuities (DIAs), and Qualified Longevity Annuity Contracts (QLACs) are not allowed because these are irrevocable income contracts.

Under the ruling, a beneficiary can perform a Section 1035 exchange on an inherited annuity, but the exchange must conform to all the other rules that apply to inherited annuities. Non-qualified annuities can't be rolled over into an individual retirement account or other qualified annuity.

The annuitant is the person on whose life expectancy the contract is based. It is common for the annuity owner to name him or herself as the annuitant. However, sometimes an annuity owner elects to name a younger representative as the annuitant to stretch out payments and extend the tax liability.

Jointly owned annuities are similar to annuities owned by a single person in that the death benefit is triggered by the death of one of the owners. This means that although the second owner is still alive, the annuity will pay out the death benefit to the beneficiary.

Jointly owned annuities are similar to annuities owned by a single person in that the death benefit is triggered by the death of one of the owners. This means that although the second owner is still alive, the annuity will pay out the death benefit to the beneficiary.

Definition: Replacement is any transaction where, in connection with the purchase of New Insurance or a New Annuity, you lapse, surrender, convert to Paid-up Insurance, Place on Extended Term, or borrow all or part of the policy loan values on an existing insurance policy or an annuity.

A joint life annuity allows you and your spouse to receive monthly income payments for as long as you both live. Once you pass away, your surviving spouse will receive payments for the rest of their life, but it will only amount to a smaller amount of your original payment.

The owner is the person who buys an annuity. An annuitant is an individual whose life expectancy is used as for determining the amount and timing when benefits payments will start and cease. In most cases, though not all, the owner and annuitant will be the same person.

The new owner of the annuity can start receiving payments, change beneficiaries, and cash out the policy whenever they want. To give the annuity away, you simply contact the insurance company and state that you want to gift the ownership of the annuity policy to someone else or a trust.

Annuities outside of an IRA structure can be transferred as a nontaxable event by using the IRS approved 1035 transfer rule. Annuities within an IRA can transfer directly to another IRA with an annuity carrier, and not create any tax consequences as well.