Maryland Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

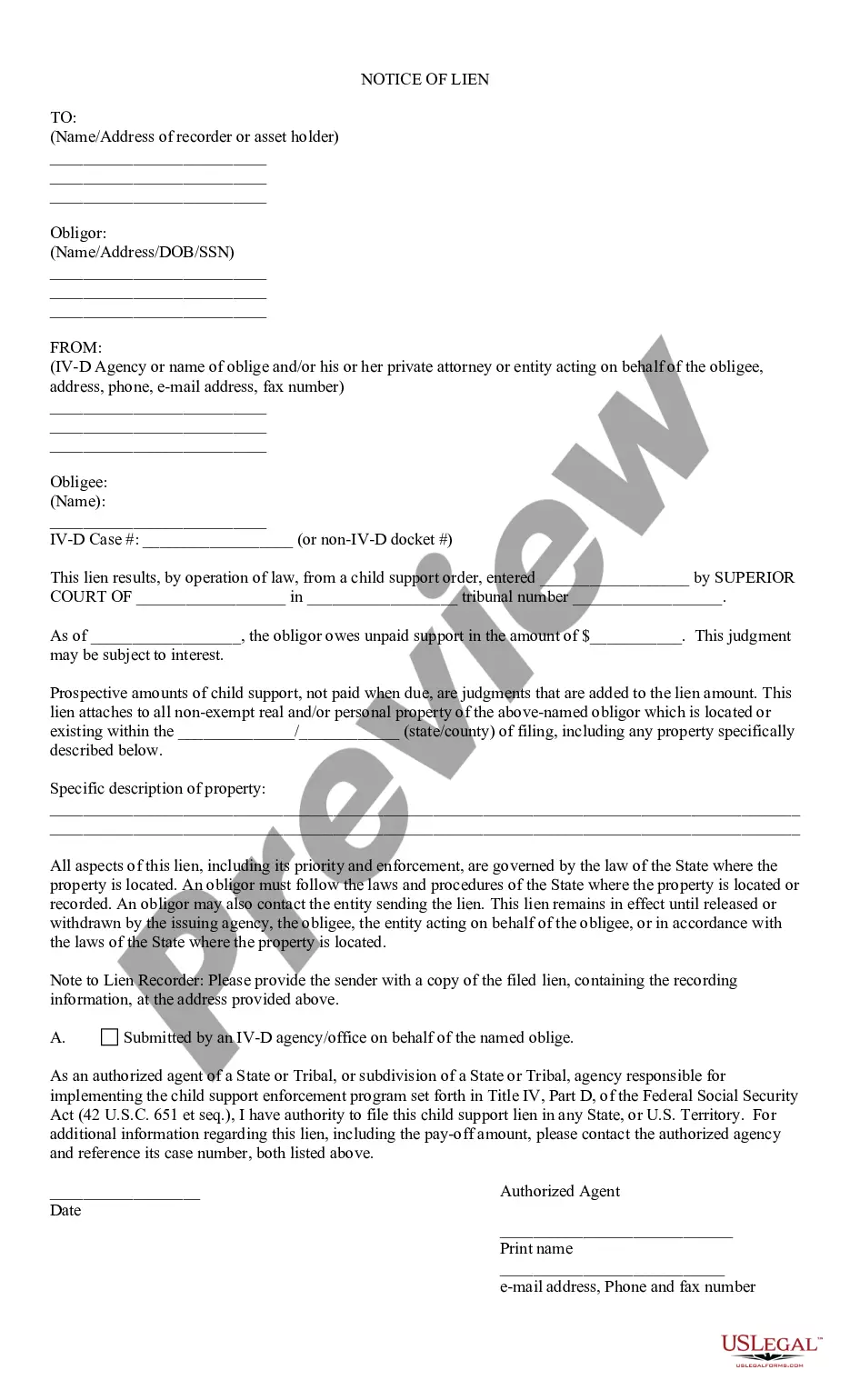

How to fill out Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

If you desire to acquire, obtain, or generate sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's straightforward and convenient search to find the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You may use your Visa or Mastercard or PayPal account to finish the transaction.

- Utilize US Legal Forms to obtain the Maryland Charitable Trust with Creation Dependent on Eligibility for Tax Exempt Status with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Maryland Charitable Trust with Creation Dependent on Eligibility for Tax Exempt Status.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the summary.

- Step 3. If you are unsatisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Description. A Certificate to be accomplished and issued by a Payor to recipients of income not subject to withholding tax. This Certificate should be attached to the Annual Income Tax Return - BIR Form 1701 for individuals, or BIR Form 1702 for non-individuals. Filing Date.

You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. For more information and forms, visit the university Tax Office website.

The personal exemption is $3,200. This exemption is reduced once the taxpayer's federal adjusted gross income exceeds $100,000 ($150,000 if filing Joint, Head of Household, or Qualifying Widow(er) with Dependent Child).

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

The taxable income of a trust is generally calculated in the same manner as the taxable income of an individual, but the tax may be paid by the trust or by a combination of the trust and its beneficiaries. This is true because trusts are entitled to a deduction known as the Income Distribution Deduction (IDD).

However, a charitable trust is not treated as a charitable organization for purposes of exemption from tax. Accordingly, the trust is subject to the excise tax on its investment income under the rules that apply to taxable foundations rather than those that apply to tax-exempt foundations.

In order to be eligible for the exemption certificate, the applying entity must own the property or the entity must obtain written confirmation from the owner that it is qualified to make purchases of construction materials and/or warehouse equipment subject to the exemption under § 11-232 or A§ 11-236 of the Tax

Maryland follows the federal income tax treatment for fiduciaries of trusts and estates. Under the federal income tax rules, generally any income that is distributed by the fiduciary of the trust or estate during the tax year is not taxable to the trust or estate. Instead, that income is taxable to the beneficiary.

Exemption Requirements - 501(c)(3) Organizations To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.