Maryland Provision in Testamentary Trust with Bequest to Charity for a Stated Charitable Purpose

Description

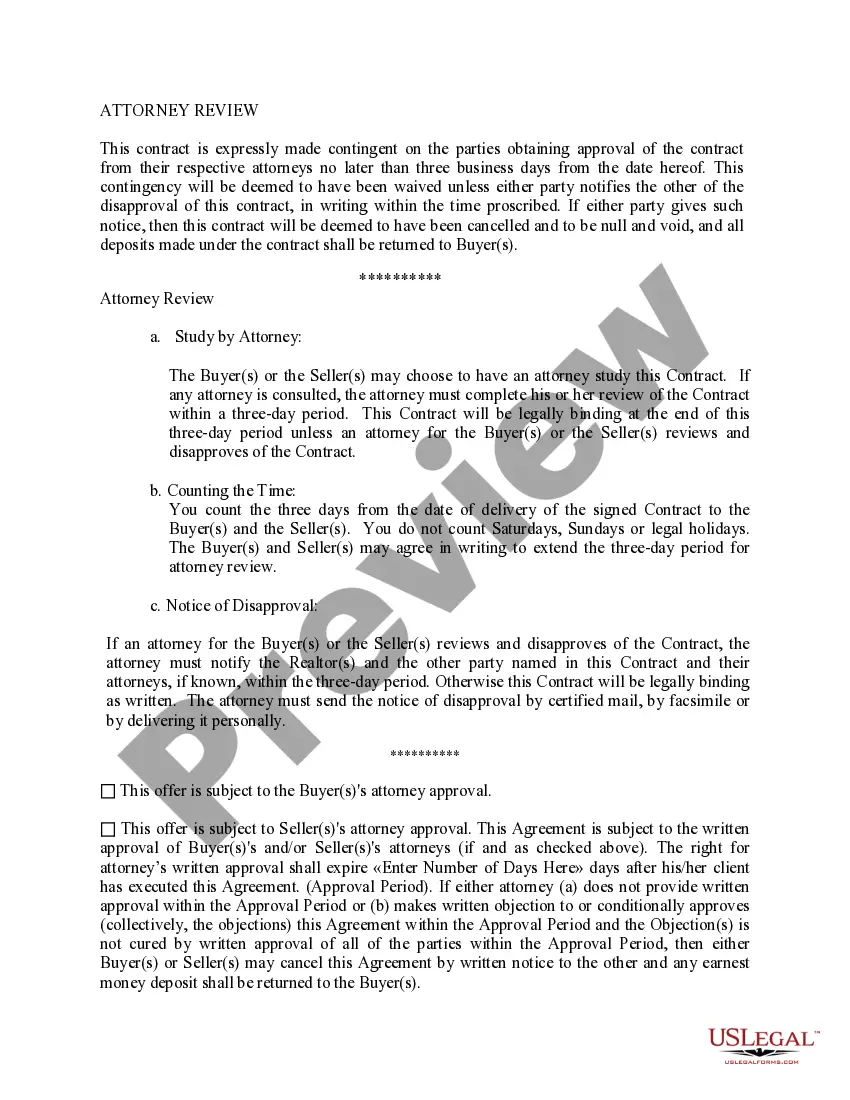

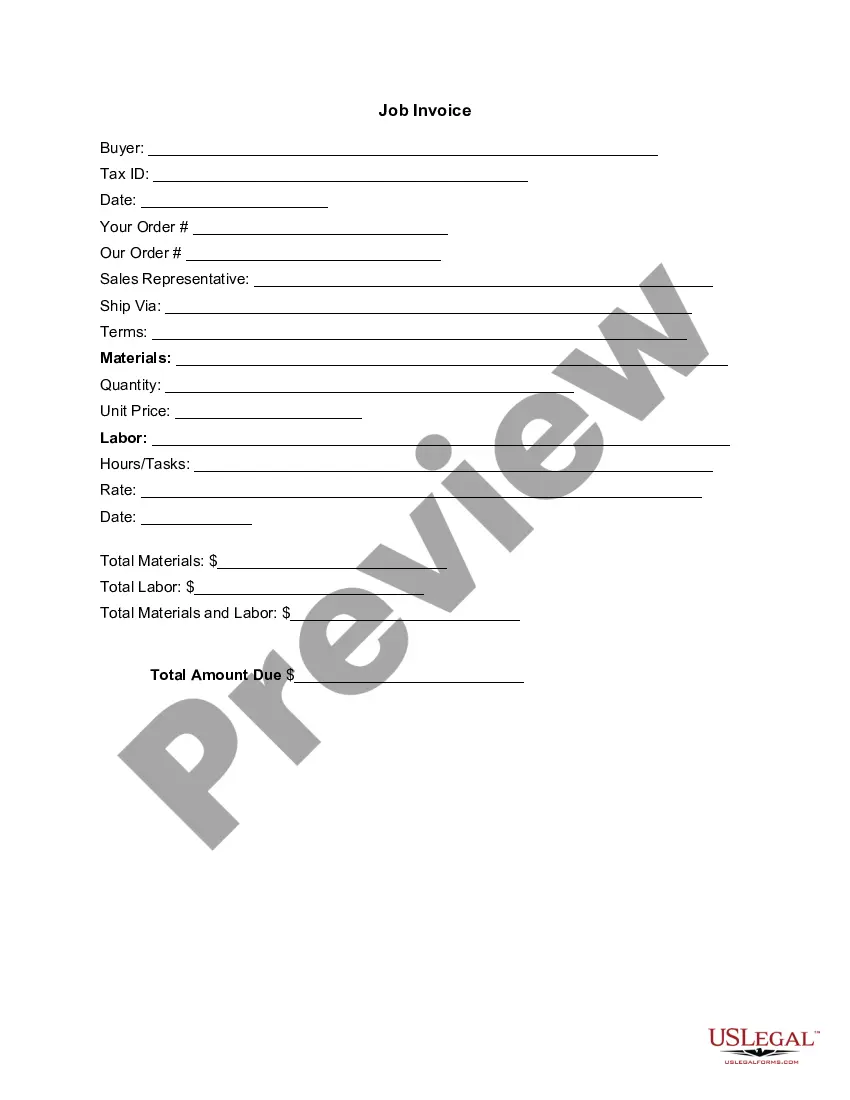

How to fill out Provision In Testamentary Trust With Bequest To Charity For A Stated Charitable Purpose?

You can spend hours online looking for the legal document template that fulfills the federal and state requirements that you have.

US Legal Forms offers thousands of legal documents that are reviewed by experts.

It is easy to download or print the Maryland Provision in Testamentary Trust with Bequest to Charity for a Specified Charitable Purpose from your service.

If available, use the Review button to check the document template as well.

- If you have a US Legal Forms account, you may Log In and then select the Download button.

- Afterward, you may complete, edit, print, or sign the Maryland Provision in Testamentary Trust with Bequest to Charity for a Specified Charitable Purpose.

- Every legal document template you purchase is yours forever.

- To obtain another copy of any purchased document, go to the My documents section and select the appropriate button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the region/city of your choice.

- Review the document description to confirm you have selected the correct document.

Form popularity

FAQ

How does it save tax? A testamentary trust allows the person who controls it to split the income generated by the trust between family members. Importantly, children who receive income from a testamentary trust are taxed at adult tax rates, instead of penalty rates (up to 66%) which apply to other types of trusts.

Charitable bequests from your will combine philanthropy and tax benefits. Bequests are gifts that are made as part of a will or trust. A bequest can be to a person, or it can be a charitable bequest to a nonprofit organization, trust or foundation. Anyone can make a bequestin any amountto an individual or charity.

Trusts can be grouped into several different categories, but two of the most common are simple trusts and complex trusts. By definition, simple trusts are not permitted to make charitable contributions, as all the income generated through a simple trust must be distributed to the trust's beneficiaries.

You can give any amount (up to a maximum of $100,000) per year from your IRA directly to a qualified charity such as Trust for Public Land without having to pay income taxes on the money.

A testamentary trust (a trust established by will after death) is subject to tax at graduated income tax rates. Conversely, an inter vivos trust (a trust created during a settlor's lifetime) is taxed at the highest marginal tax rate applicable to individuals (currently 43.7% in BC).

Although we commonly think of trust beneficiaries as single individuals, it is also possible to name an organization, such as a charity, as the beneficiary of a revocable trust. The process of naming the charity as the beneficiary is virtually no different than the one used to name an individual.

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years.

Subject to the terms of the trust deed, the trustee can distribute income or capital to a charity.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

The trust can also be used to reduce estate tax liabilities and ensure professional management of the assets. A disadvantage of a testamentary trust is that it does not avoid probatethe legal process of distributing assets through the court.