Maryland Notice of Unpaid Invoice

Description

How to fill out Notice Of Unpaid Invoice?

You can spend hours online searching for the legal document template that meets the state and federal criteria you need.

US Legal Forms provides a vast array of legal forms that can be reviewed by professionals.

You can download or print the Maryland Notice of Unpaid Invoice from my service.

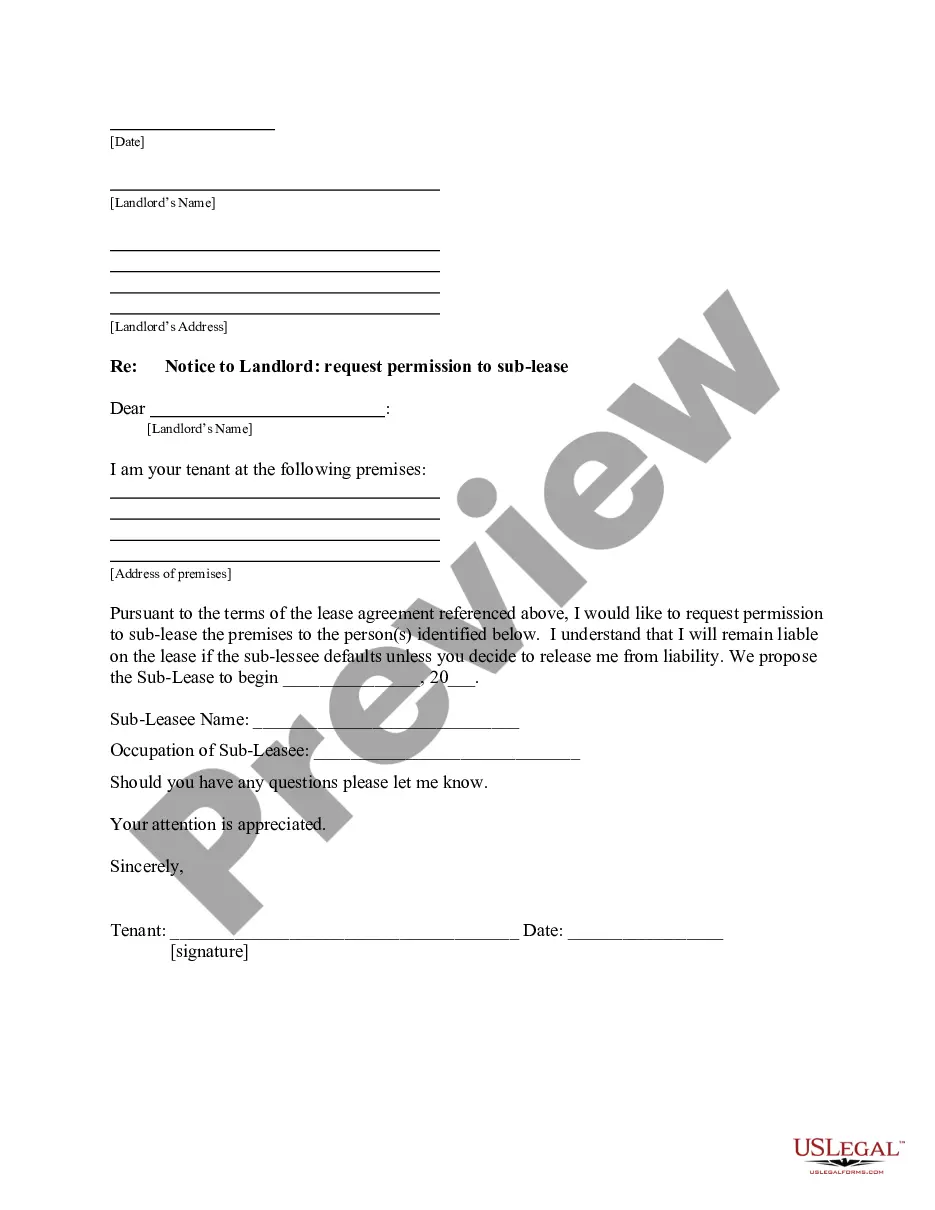

If available, use the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download option.

- After that, you can complete, modify, print, or sign the Maryland Notice of Unpaid Invoice.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the relevant option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/region of your choice.

- Refer to the form details to ensure you have chosen the right form.

Form popularity

FAQ

If you do not have a validated bank account but have a valid mailing address that has been verified by the United States Postal Service, you will be mailed a paper check. No further action is required for recipients with a valid bank account or valid mailing address.

If you believe you owe state taxes but have not received a notice, call our taxpayer service office at 410-260-7980 from Central Maryland or 1-800-MDTAXES from elsewhere. This letter is to inform you that your tax account has been referred to Collections because the balance was not paid.

Your business received a tax notice from the Comptroller of Maryland. Notices are sent from our offices to business taxpayers for a variety of reasons. It could be a missing return, an error on a return. It could be that your IRS return doesn't match your Maryland return.

If you believe you owe state taxes but have not received a notice, call our taxpayer service office at 410-260-7980 from Central Maryland or 1-800-MDTAXES from elsewhere. This letter is to inform you that your tax account has been referred to Collections because the balance was not paid.

If you do not pay your Maryland state taxes, the comptroller may issue a tax lien. This is a legal claim on your property. A tax lien allows the state to seize accounts, wages, and property to resolve your back taxes. A tax lien may damage your credit score and can only be released when the back tax is paid in full.

If your debt meets submission criteria for offset, BFS will reduce your refund as needed to pay off the debt you owe to the agency. Any portion of your remaining refund after offset is issued in a check or direct deposited as originally requested on the return. BFS will send you a notice if an offset occurs.

To. Fictitious correspondence, allegedly issued by the Office of the Comptroller of the Currency (OCC) or other government entities regarding funds purportedly under the control of the OCC, is in circulation. Correspondence may be distributed via email, fax, or postal mail.

Acting as Maryland's chief accountant, the comptroller pays the state's bills, maintains its books, prepares financial reports, and pays state employees.

What Is a Notice of Intent to Offset? The Notice of Intent to Offset is telling you that you have taxes owed and the government is going to seize part or all of your federal payments. The IRS commonly offsets Federal tax refunds, but they can also take other types of federal payments as well.

In a nutshell, a Notice of Intent to Offset is an informational letter that tells you what's about to happen. It means that you owe the IRS back taxes or you owe a significant chunk of money to a different government agency. It also means that the IRS is planning on seizing your tax refund.