Maryland Charity Subscription Agreement

Description

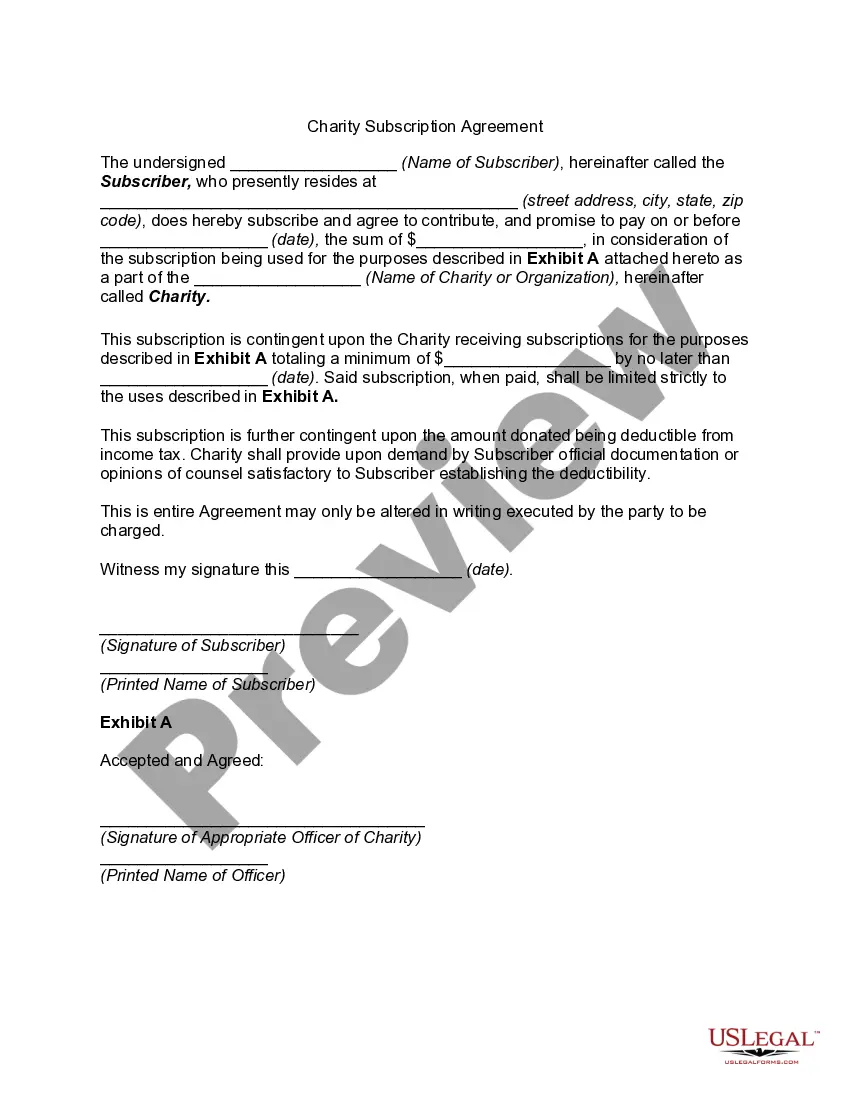

How to fill out Charity Subscription Agreement?

Are you currently in a circumstance where you frequently need documents for both professional or personal reasons.

There are numerous reputable document templates accessible online, but finding ones you can trust can be challenging.

US Legal Forms offers a vast array of form templates, including the Maryland Charity Subscription Agreement, designed to meet state and federal requirements.

Once you have the correct form, click Buy now.

Choose the payment plan you wish, fill in the necessary information to create your account, and complete your purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you will be able to download the Maryland Charity Subscription Agreement template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct state/region.

- Use the Preview button to review the form.

- Check the details to ensure you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that suits your needs.

Form popularity

FAQ

Most courts view charitable pledges as legally enforceable commitments. Failure to enforce pledge collection could result in personal liability for the trustees of a non-profit. IRS rules prohibit donors from fulfilling a legally enforceable pledge from their donor advised fund.

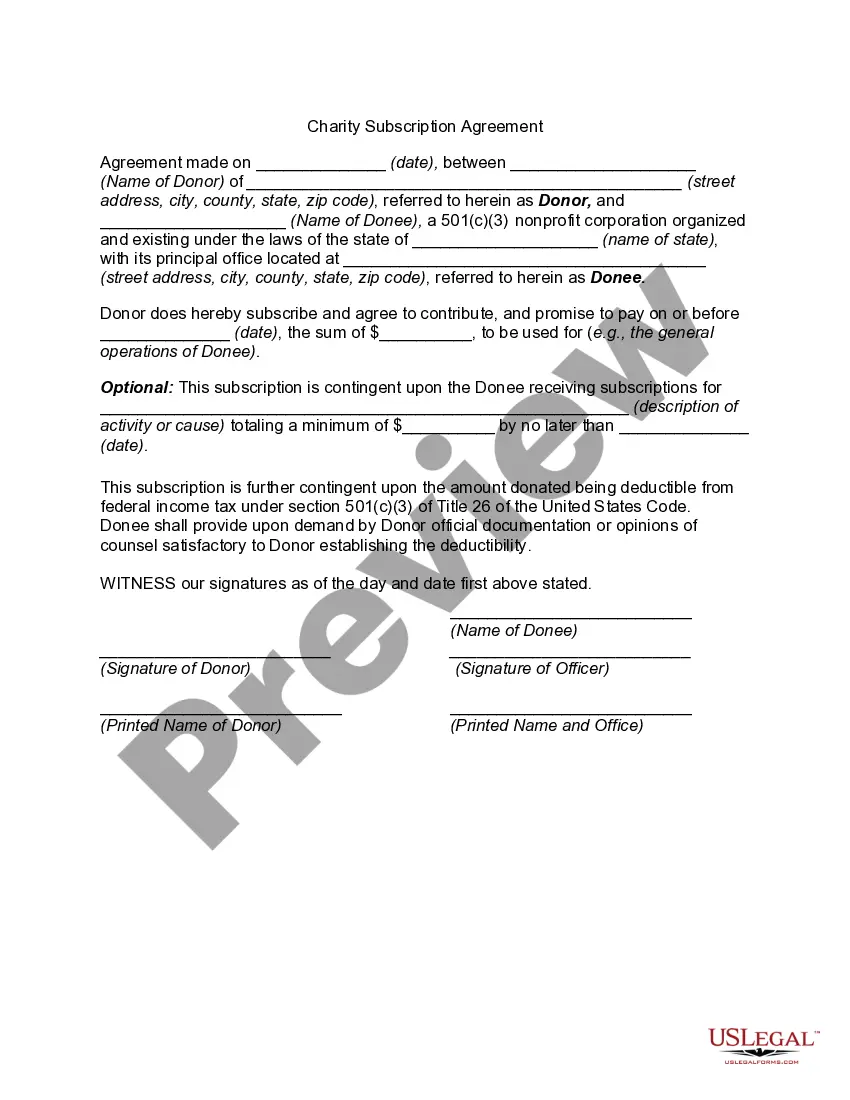

A donation agreement, also called a charitable gift agreement, is a document that established proof of a donation or gift to a charitable organization.

A charitable pledge is enforceable if it is a legally binding contract. A legally binding contract exists when there is agreement between the parties and there has been consideration given in exchange for the pledge.

To report a suspected violation of the Maryland Solicitations Act, please submit a complaint to the Charitable Organizations Division at the Office of the Secretary of State online here or by phone at 410-974-5521.

How to Start a Nonprofit in MarylandName Your Organization.Choose a Maryland nonprofit corporation structure.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.More items...

The Maryland Solicitation Act, contained in the Business Regulation Article under Title 6, provides that a charitable organization must register and receive a registration letter from the Secretary of State of Maryland before the charitable organization may solicit charitable contributions in Maryland, has charitable

In California, a pledge is enforceable as a binding contract only if there is consideration. In certain other states, the rules are less strict: Even a promise to make a payment to a charitable organization without anything given in return may be enforceable as a matter of public policy.

The answer is yes - nonprofits can own a for-profit subsidiary or entity. A nonprofit can own a for-profit entity regardless of whether or not it is a corporation or limited liability company, but there are rules pertaining to any money invested by the nonprofit during the start-up process.

In California, like most other states, charitable pledges are analyzed as a matter of contract law. This means that pledges are not enforceable unless: (1) the pledgor receives consideration for making the pledge; or (2) the charity has detrimentally relied on the pledge.

$25,000 or More: How to Register for Charitable Solicitations in Maryland. An organization that received $25,000 or more in charitable funds, or uses a professional solicitor, must complete form COR-92 (Registration Statement for Charitable Organizations).