Maryland Blocked Account Agreement

Description

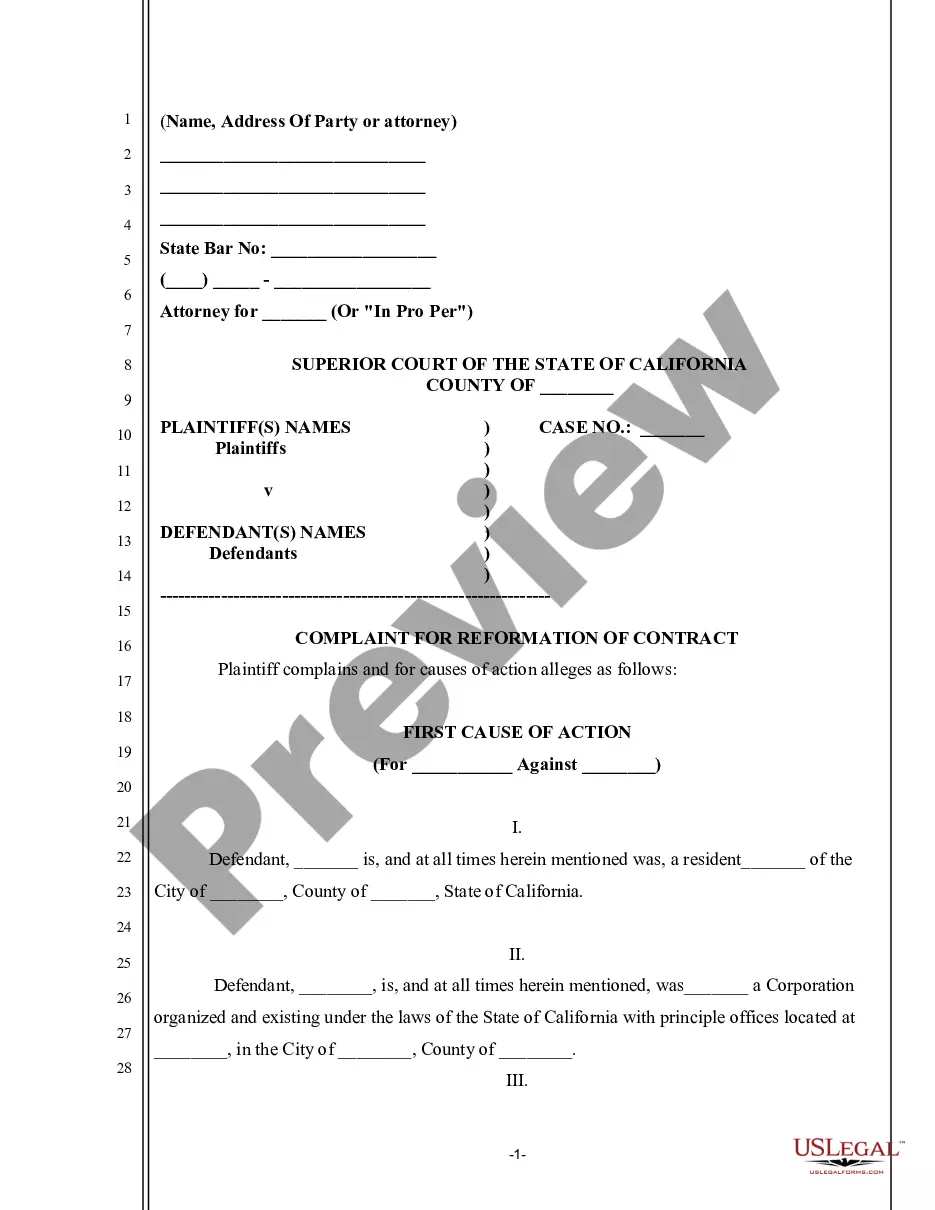

How to fill out Blocked Account Agreement?

Are you currently in the place that you need documents for sometimes company or person purposes almost every day? There are tons of legitimate record layouts available online, but discovering versions you can depend on isn`t easy. US Legal Forms provides a huge number of kind layouts, such as the Maryland Blocked Account Agreement, that are published to fulfill federal and state demands.

If you are previously informed about US Legal Forms web site and also have a free account, merely log in. After that, it is possible to obtain the Maryland Blocked Account Agreement template.

Unless you provide an account and would like to start using US Legal Forms, adopt these measures:

- Obtain the kind you will need and ensure it is for your proper town/area.

- Use the Preview button to review the shape.

- Look at the explanation to actually have selected the right kind.

- If the kind isn`t what you`re seeking, make use of the Research industry to find the kind that meets your needs and demands.

- When you discover the proper kind, click on Purchase now.

- Select the prices prepare you desire, complete the required information to produce your bank account, and pay for the transaction making use of your PayPal or charge card.

- Pick a hassle-free paper file format and obtain your backup.

Find all of the record layouts you have purchased in the My Forms food list. You can obtain a extra backup of Maryland Blocked Account Agreement at any time, if possible. Just select the necessary kind to obtain or print out the record template.

Use US Legal Forms, one of the most substantial selection of legitimate types, to save lots of time and steer clear of blunders. The services provides appropriately created legitimate record layouts which you can use for a selection of purposes. Generate a free account on US Legal Forms and commence generating your way of life easier.

Form popularity

FAQ

If the borrower defaults on the loan, the lender can assume control over the account and instruct the bank to revoke the borrower's ability to make transactions using funds in the account. Active DACAs, or blocked account control agreements (BACA): Only the lender, not the borrower, can make transactions.

A ?blocked? control agreement provides that the borrower will have no access to the funds in the deposit account(s) and that the lender will have complete control over the funds.

A blocked account generally refers to a financial account that has some limitations or restrictions placed upon it, temporarily or permanently. Accounts may be blocked or limited for a variety of reasons, including internal bank policies, external regulations, or via a court order or legal decision.

Blocked accounts restrict account owners from unlimited and unrestricted use of their funds in that account. Accounts may be blocked or limited for a variety of reasons, including internal bank policies, external regulations, or via a court order or legal decision.

If an account is blocked then access is denied and you will not be able to access the money until the block is released. You could open another account at a different bank, but you will not be able to transfer any money into from the blocked account.

Blocked Account Agreement means an agreement among the Borrower, the Agent and a Clearing Bank, in form and substance reasonably satisfactory to the Agent, concerning the collection of payments which represent the proceeds of Accounts or of any other Collateral.

A court must approve and order any withdrawal of funds from a blocked account. The most common reason to petition a court to withdraw funds from a blocked account is to access a blocked account because the account was created for a minor who has subsequently turned 18.

'Blocking' the deposit means that while the money isn't taken from the card (so it won't appear on your bill), you won't be able to spend it until it's unblocked.