Maryland Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

How to fill out Sample Letter Regarding Information For Foreclosures And Bankruptcies?

Are you currently in a placement in which you need to have paperwork for sometimes organization or specific reasons almost every time? There are a variety of lawful record web templates available online, but locating ones you can trust isn`t easy. US Legal Forms delivers a huge number of develop web templates, like the Maryland Sample Letter regarding Information for Foreclosures and Bankruptcies, which are created in order to meet state and federal needs.

When you are previously familiar with US Legal Forms site and get your account, basically log in. Following that, you are able to obtain the Maryland Sample Letter regarding Information for Foreclosures and Bankruptcies web template.

Should you not have an bank account and would like to begin to use US Legal Forms, abide by these steps:

- Discover the develop you need and ensure it is for the right town/county.

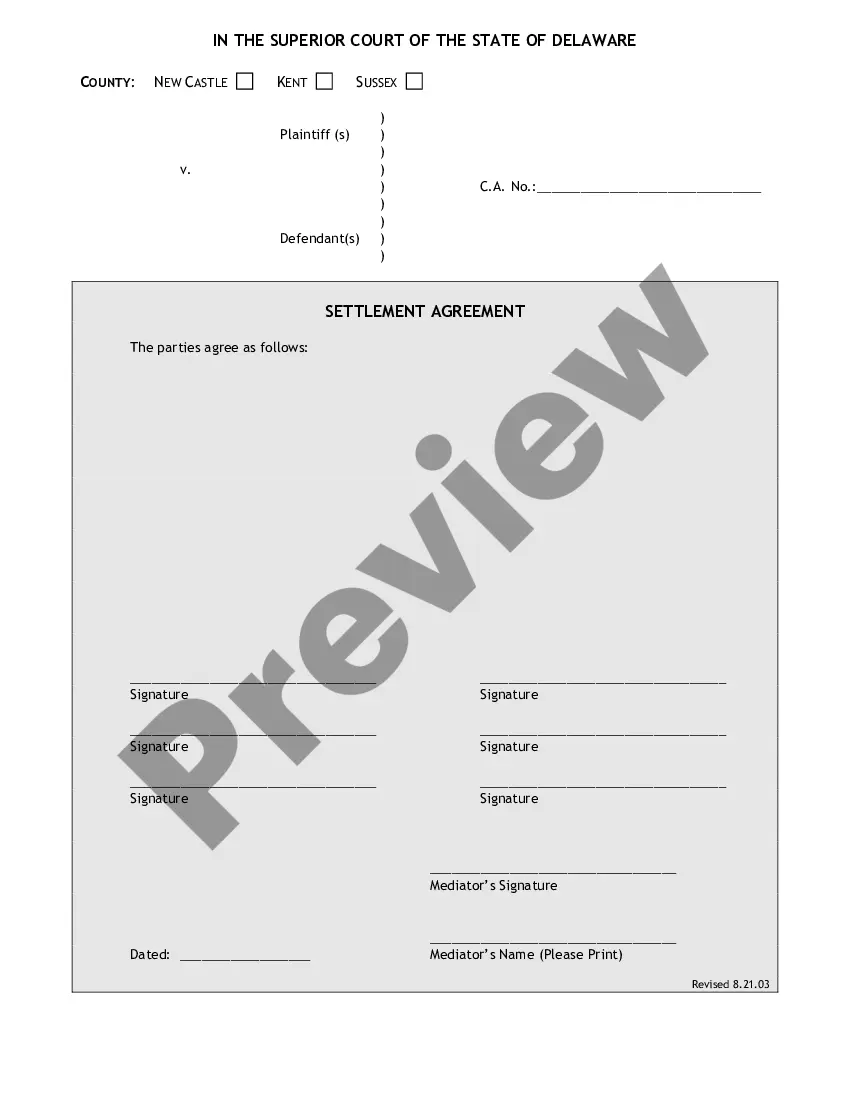

- Take advantage of the Preview option to analyze the shape.

- Look at the explanation to actually have selected the appropriate develop.

- In the event the develop isn`t what you`re seeking, take advantage of the Lookup discipline to get the develop that meets your needs and needs.

- Once you discover the right develop, click on Purchase now.

- Choose the rates plan you desire, fill in the specified details to generate your account, and purchase the transaction using your PayPal or bank card.

- Choose a practical data file file format and obtain your backup.

Discover all of the record web templates you possess bought in the My Forms food list. You can obtain a more backup of Maryland Sample Letter regarding Information for Foreclosures and Bankruptcies anytime, if needed. Just select the required develop to obtain or printing the record web template.

Use US Legal Forms, the most extensive assortment of lawful kinds, to save lots of time as well as prevent blunders. The service delivers skillfully manufactured lawful record web templates that you can use for an array of reasons. Make your account on US Legal Forms and commence creating your life easier.

Form popularity

FAQ

Foreclosure Process Foreclosure proceedings can legally begin when you have not paid your mortgage for 90 days. The next step is a ?Notice of Foreclosure Action.? Maryland law requires that the notice be sent both certified and first class mail at least 45 days before filing a foreclosure action.

Bankruptcy Is The Only Guaranteed Way to Stop Foreclosure in Maryland. Chapter 13 and Chapter 11 bankruptcy is the only guaranteed way to stop a foreclosure and pay back what you owe, short of paying off the amount that you are behind in full as reinstatement.

A residential eviction after foreclosure sale follows this timeline: purchaser buys the property at foreclosure sale. purchaser notifies tenant of termination of tenancy, giving the tenant 90 days to move. if tenant does not leave, purchaser files a Motion for Judgment of Possession.

4) Foreclosure Sale and Eviction If the homeowner does not request mediation, the sale can occur as soon as 45 days after receipt of a Final Loss Mitigation Affidavit, or 30 days from the date the Final Loss Mitigation Affidavit was mailed to the homeowner.

The lender or mortgage servicer mails a Notice of Intent to Foreclose (NOI) to the homeowner after the first missed payment or other contractual default on a mortgage. The NOI is a warning notice that a foreclosure could be filed in court. It must be sent no less than 45 days before the foreclosure is filed.

If you do not contest the foreclosure, the process may take as little as 90 days to complete in Maryland.

Bankruptcy Is The Only Guaranteed Way to Stop Foreclosure in Maryland. Chapter 13 and Chapter 11 bankruptcy is the only guaranteed way to stop a foreclosure and pay back what you owe, short of paying off the amount that you are behind in full as reinstatement.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.