Maryland Sample Letter Explaining the Purposes of the Waiver and Consent regarding an Estate

Description

How to fill out Sample Letter Explaining The Purposes Of The Waiver And Consent Regarding An Estate?

US Legal Forms - one of the greatest libraries of lawful forms in the United States - offers an array of lawful papers web templates it is possible to down load or produce. Using the site, you can find a huge number of forms for enterprise and person reasons, sorted by classes, says, or keywords and phrases.You will discover the most recent versions of forms much like the Maryland Sample Letter Explaining the Purposes of the Waiver and Consent regarding an Estate within minutes.

If you already possess a subscription, log in and down load Maryland Sample Letter Explaining the Purposes of the Waiver and Consent regarding an Estate through the US Legal Forms local library. The Obtain switch will show up on each form you look at. You have access to all in the past delivered electronically forms in the My Forms tab of your respective account.

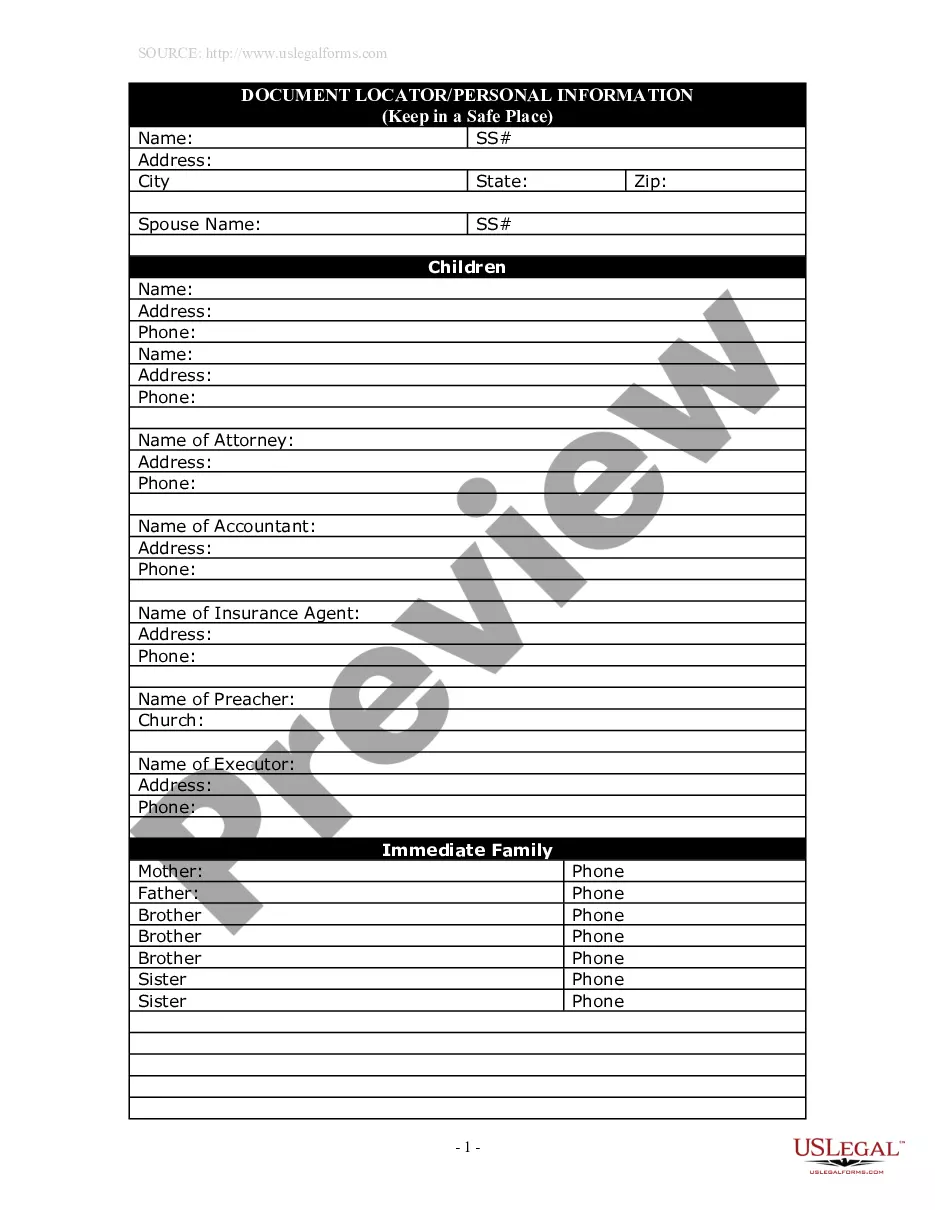

If you wish to use US Legal Forms the very first time, here are straightforward recommendations to obtain began:

- Be sure to have picked the right form for the town/region. Select the Preview switch to check the form`s articles. Browse the form description to actually have chosen the proper form.

- In case the form doesn`t suit your specifications, take advantage of the Research discipline towards the top of the display screen to find the the one that does.

- When you are happy with the shape, verify your option by simply clicking the Buy now switch. Then, opt for the rates strategy you want and provide your references to sign up for the account.

- Approach the deal. Make use of credit card or PayPal account to finish the deal.

- Select the file format and down load the shape on your product.

- Make modifications. Complete, revise and produce and indicator the delivered electronically Maryland Sample Letter Explaining the Purposes of the Waiver and Consent regarding an Estate.

Each and every design you put into your bank account does not have an expiration particular date and is also your own for a long time. So, in order to down load or produce one more version, just proceed to the My Forms section and click around the form you need.

Gain access to the Maryland Sample Letter Explaining the Purposes of the Waiver and Consent regarding an Estate with US Legal Forms, one of the most comprehensive local library of lawful papers web templates. Use a huge number of specialist and state-specific web templates that meet up with your company or person demands and specifications.

Form popularity

FAQ

What are Letters of Administration in Maryland? Obtaining Letters of Administration grants the personal representative the authority to handle the deceased person's assets, pay off their debts, address any tax liability, and distribute their remaining assets to the rightful heirs.

In granting letters, the register observes an order of priority as established by Maryland law. Priority of appointment begins with person(s) named in the will to serve, surviving spouse, children, etc., to creditors or any other person.

Generally, the Intestacy statutes provide for property to be distributed to a decedent's closest living relatives, i.e., to a surviving spouse and children, if there are any; to children in equal shares if there is no surviving spouse; to parents if there are no spouse and children; and so on to more distant relatives.

Children in Maryland Inheritance Law Intestate Succession: Spouses and ChildrenInheritance SituationWho Inherits Your PropertyChildren but no spouse? Children inherit everythingSpouse but no children or parents? Spouse inherits everythingSpouse and children who are minors? Spouse inherits half ? Children inherit half2 more rows ?

Property outside of probate include assets like a family home that is owned as Joint Tenants because the surviving joint tenant becomes the owner of the property. Another example is Tenancy by the Entirety where assets are owned by a married couple. Beneficiary Designations on assets is yet another example.

If only the spouse survives, he/she is entitled to 1/2 of the decedent's augmented estate. Maryland has greatly expanded the types of assets to include when calculating the augmented estate. This broadening of the law is beneficial because the electing spouse may be entitled to receive more assets than before.

If the person named in the will cannot act or there is no will, then there's an order of priority for who may be appointed a personal representative. The order of priority is any surviving spouse or domestic partner, then a child, then a grandchild, then a parent, and then a sibling.

Ideally, you should be able to close the estate within 13 months of the decedent's death. However, depending on the size and complexity of the estate, it may take longer. In any case, it's important to keep meticulous records throughout the process to prove to the court that you've fulfilled all your fiduciary duties.