Maryland Sample Letter for Corrections to Credit Report

Description

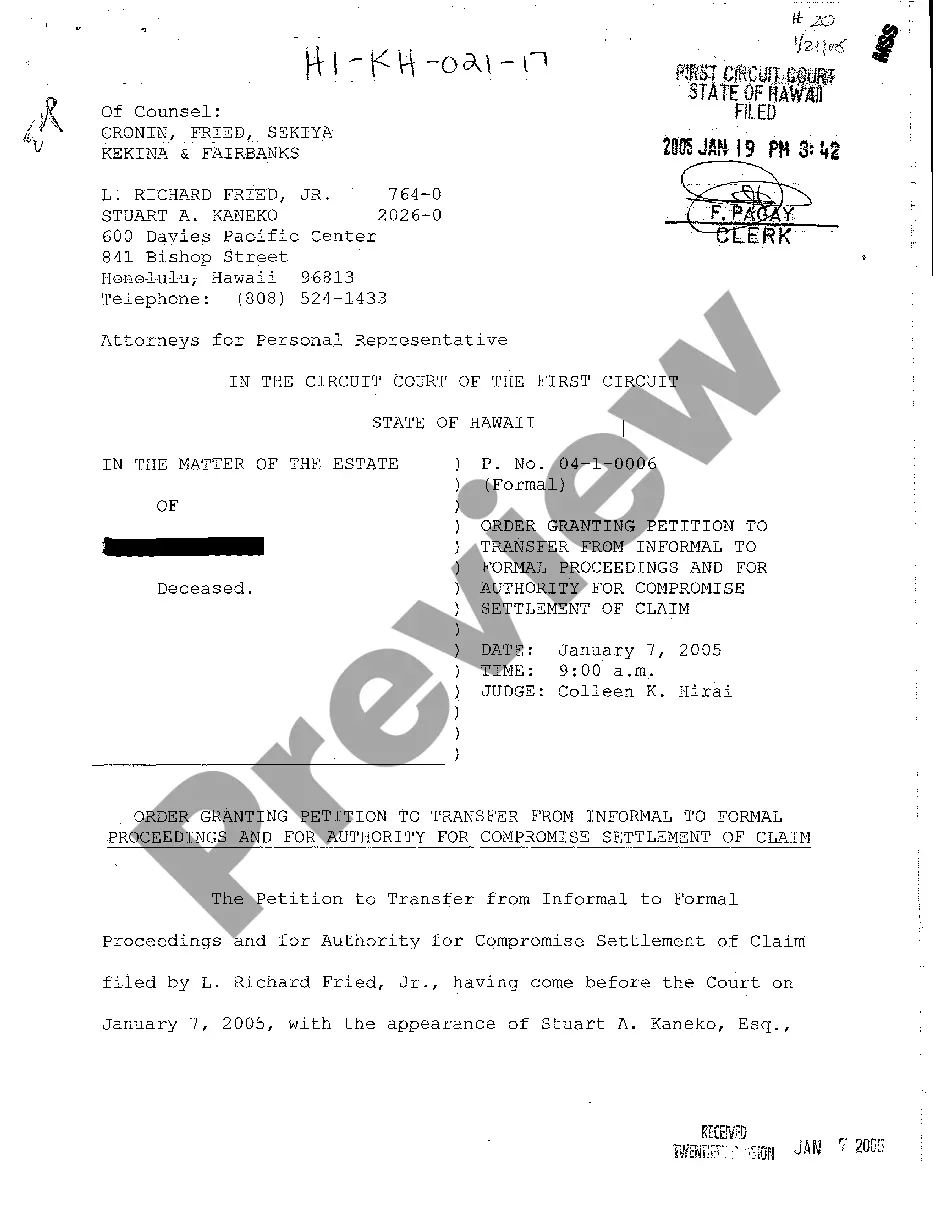

How to fill out Sample Letter For Corrections To Credit Report?

If you need to acquire, download, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and efficient search feature to find the documents you require.

A variety of templates for business and personal purposes are organized by categories and titles, or keywords.

Step 3. If you are unhappy with the form, use the Search box at the top of the page to find alternative versions of the legal form template.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for the account.

- Utilize US Legal Forms to get the Maryland Sample Letter for Corrections to Credit Report in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and press the Download button to obtain the Maryland Sample Letter for Corrections to Credit Report.

- You can also access forms you've previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Utilize the Review option to examine the form’s details. Don’t forget to read the summary.

Form popularity

FAQ

When writing a credit report dispute letter, focus on clarity and accuracy. Express the mistake you spotted in your credit report and provide supporting evidence, if available. Emphasize your request for correction, utilizing the Maryland Sample Letter for Corrections to Credit Report for formatting help. This way, your letter remains professional and effective in addressing the issue.

Creating a credit report dispute letter is straightforward. Begin by clearly stating your intention to dispute an error on your credit report. Include your personal information and details of the incorrect entry, referencing the Maryland Sample Letter for Corrections to Credit Report as a guide. Use concise language and ensure you sign the letter before sending it to the credit bureau.

Removing collections from your credit report often requires disputing the validity of the collection with the credit bureau or the creditor. Start by composing a letter that clearly outlines your reasons for the dispute and include any documentation that supports your claim. A Maryland Sample Letter for Corrections to Credit Report can guide you in drafting an effective communication to facilitate this process.

To correct erroneous information in your credit file, you should file a dispute with the relevant credit bureau, detailing the inaccuracies you have discovered. Attach any evidence that supports your claims and request a formal investigation. A Maryland Sample Letter for Corrections to Credit Report can help you format your dispute in a compelling way, enhancing your chances of success.

A 623 letter is a formal communication that allows consumers to dispute inaccuracies with credit reporting agencies, citing the Fair Credit Reporting Act. This letter prompts creditors to investigate the disputed information. You can leverage a Maryland Sample Letter for Corrections to Credit Report to craft your own effective 623 letter.

Writing a letter to dispute an item on your credit report involves clearly stating your personal information, the details of the dispute, and your request for correction. Be sure to include any supporting documentation that backs your claim. A Maryland Sample Letter for Corrections to Credit Report can serve as a valuable guide in composing your letter.

When disputing information on your credit report, clearly state the specific error you have found and include any relevant documentation. It is crucial to remain factual and concise in your explanation. Utilizing a Maryland Sample Letter for Corrections to Credit Report can further assist you in presenting your case in a structured manner.

To make corrections to your credit report, start by reviewing your reports from major credit bureaus for inaccuracies. After identifying any errors, you can contact the credit bureau to dispute the information. Using a Maryland Sample Letter for Corrections to Credit Report can help you articulate your dispute effectively and provide the necessary details for a thorough investigation.

The 623 credit law refers to a section of the Fair Credit Reporting Act that allows consumers to dispute inaccuracies with creditors. This law mandates that when a consumer identifies an error, the creditor must conduct a reasonable investigation. Having a Maryland Sample Letter for Corrections to Credit Report can ensure your dispute is formally submitted and documented.

A 623 letter example is a template used to challenge inaccurate information listed on your credit report. This type of letter invokes Section 623 of the Fair Credit Reporting Act, requiring creditors to investigate and correct any false information. Utilizing a Maryland Sample Letter for Corrections to Credit Report can streamline this process, making it easier for you to communicate your concerns clearly.