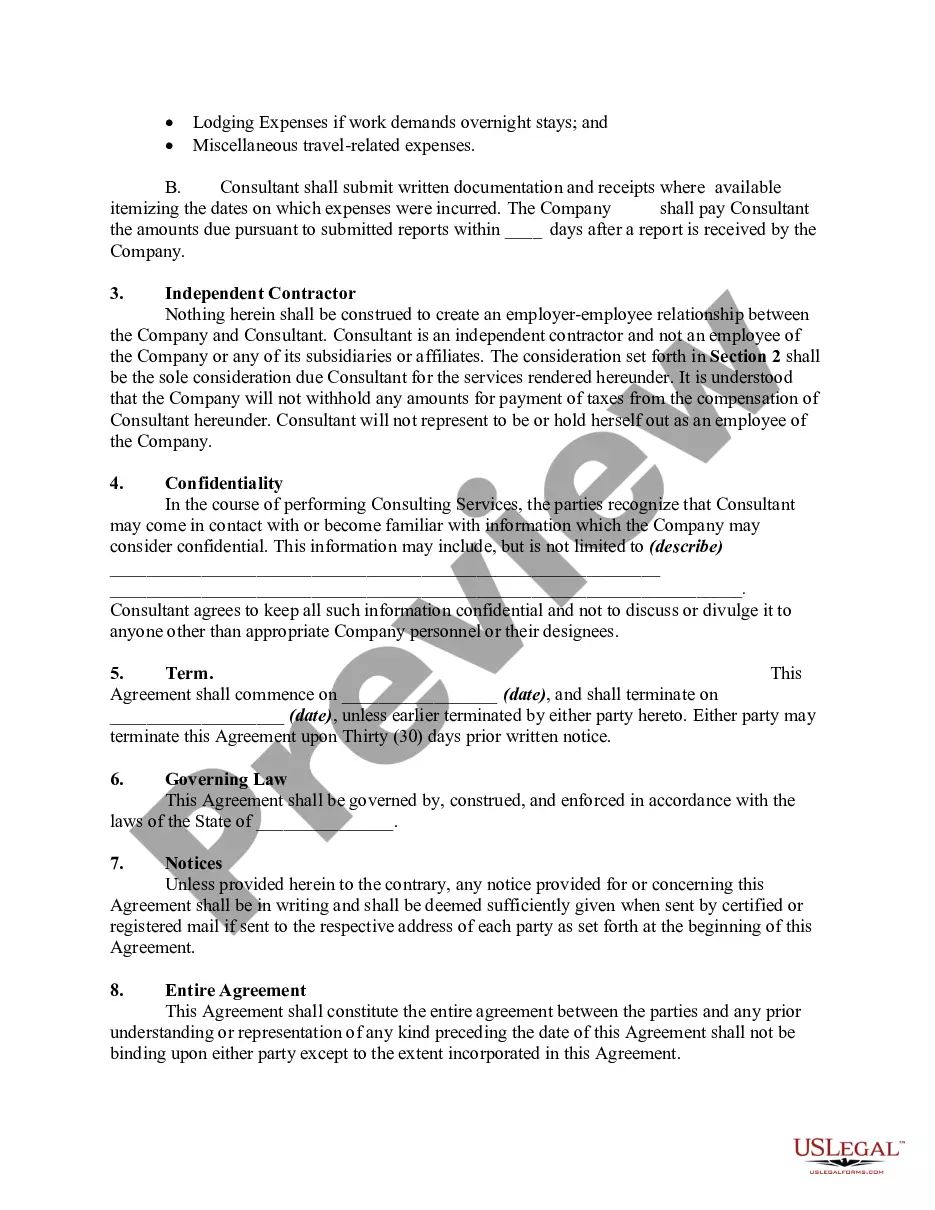

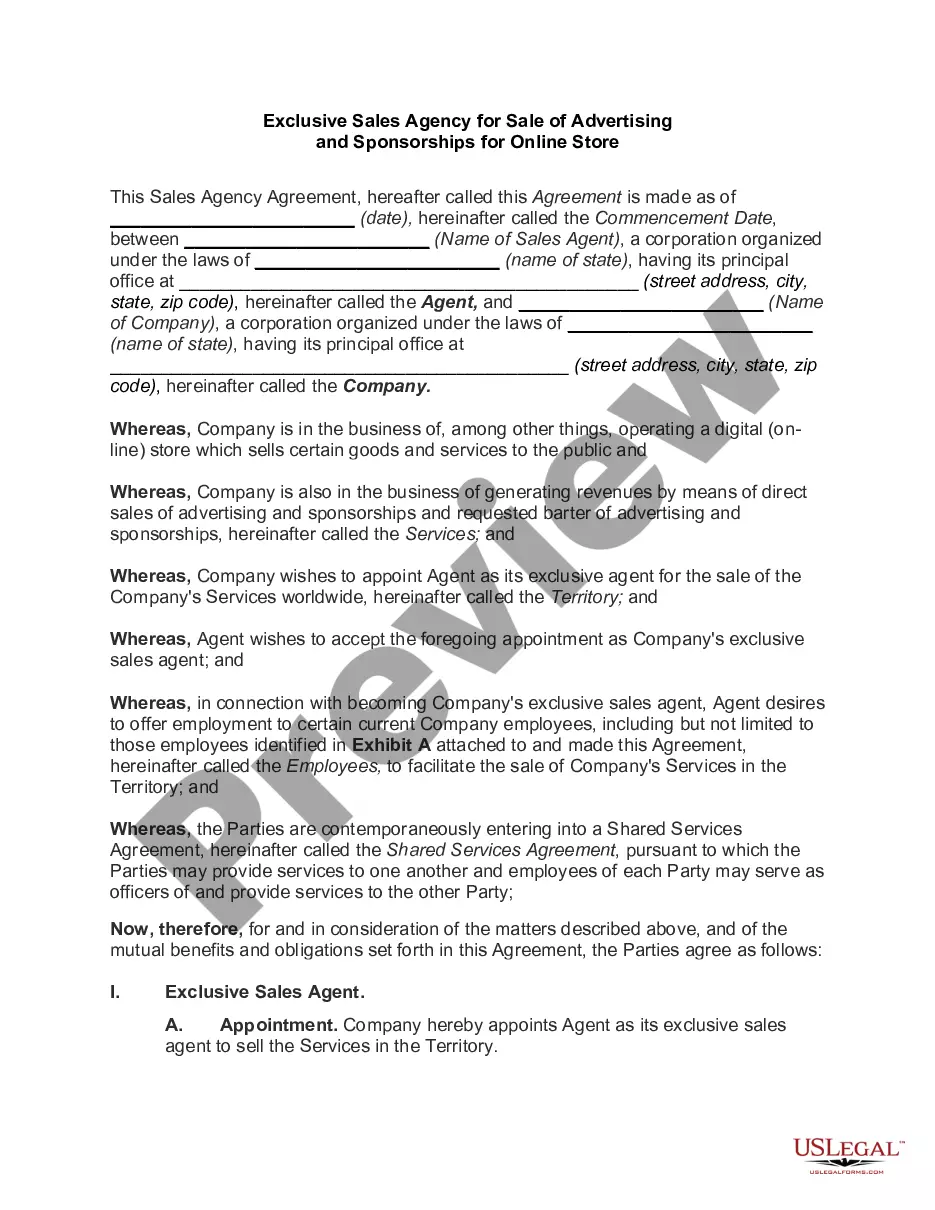

A consultant is someone who gives expert or professional advice. Consultants are ordinarily hired on an independent contractor basis, therefore, the hiring party is not liable to others for the acts or omissions of the consultant. As distinguished from an employee, a consultant pays their own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.