Maryland Resolution of Directors of a Close Corporation Authorizing Redemption of Stock

Description

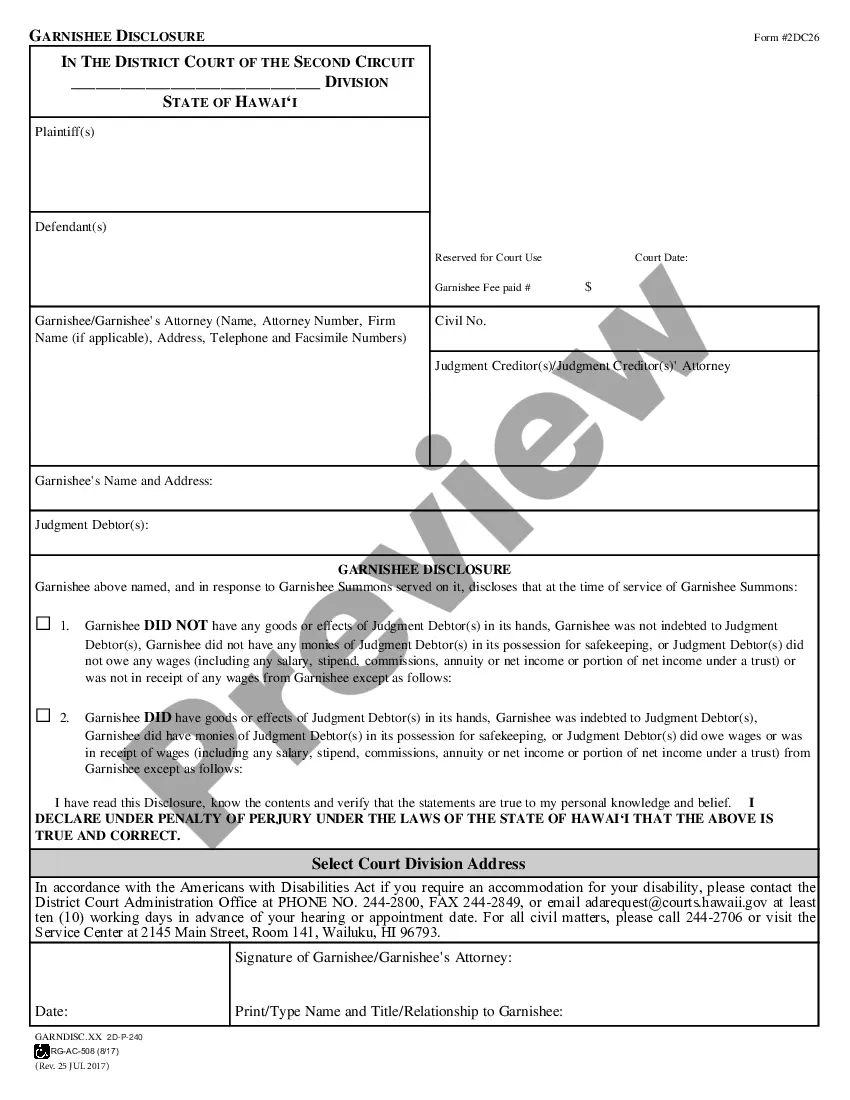

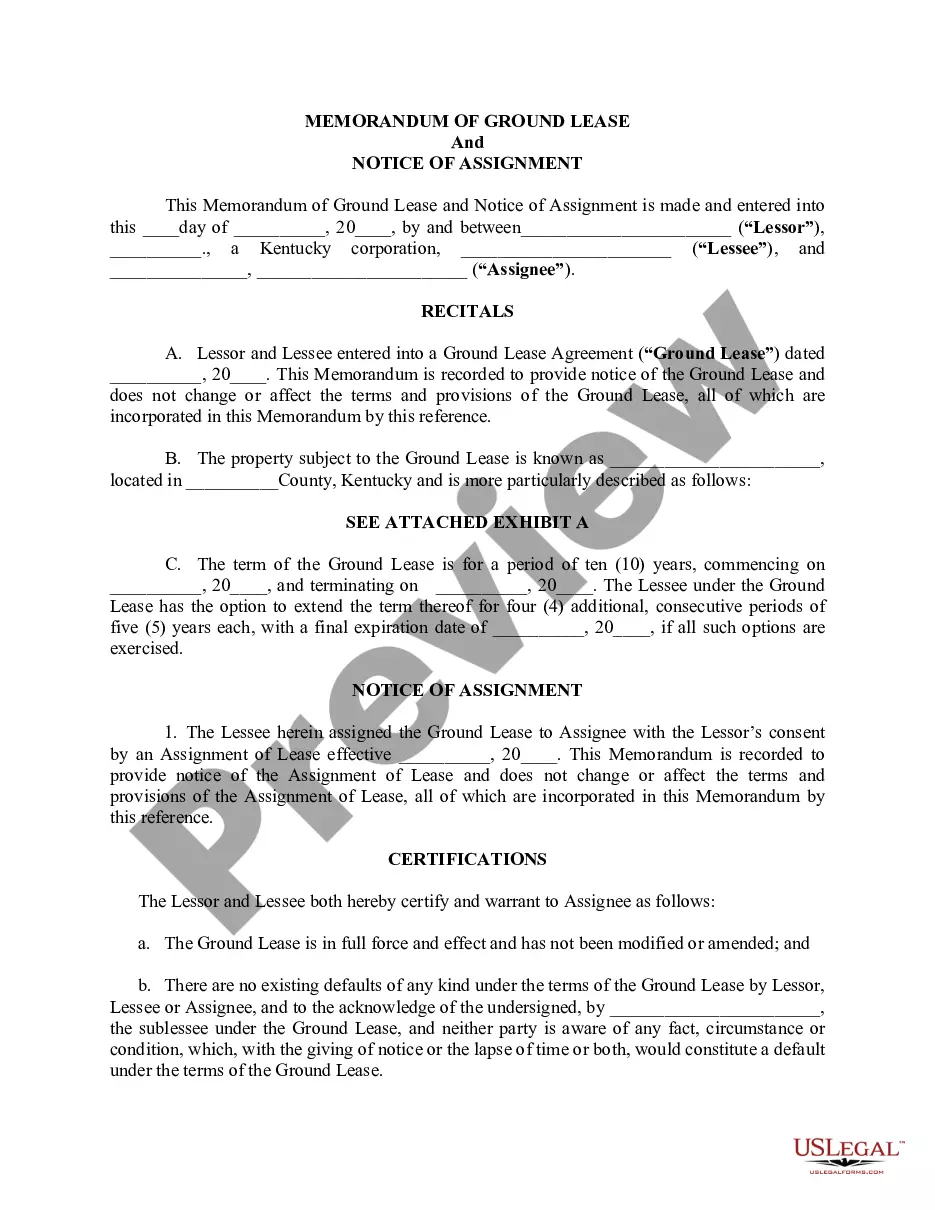

How to fill out Resolution Of Directors Of A Close Corporation Authorizing Redemption Of Stock?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal template documents that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the most recent versions of forms such as the Maryland Resolution of Directors of a Close Corporation Authorizing Redemption of Stock in just seconds.

Examine the form summary to make sure you have chosen the correct form.

If the form does not meet your requirements, use the Search field at the top of the screen to find the appropriate one.

- If you already possess a subscription, Log In and download the Maryland Resolution of Directors of a Close Corporation Authorizing Redemption of Stock from the US Legal Forms library.

- The Download option will appear on every form you view.

- You can access all previously obtained forms in the My documents section of your account.

- To get started with US Legal Forms for the first time, here are simple instructions to follow.

- Ensure you have selected the correct form for your city/state.

- Click the Preview option to review the contents of the form.

Form popularity

FAQ

The resolution of share redemption refers to a formal decision made by a corporation to buy back its own shares from shareholders. It is an important action outlined in the Maryland Resolution of Directors of a Close Corporation Authorizing Redemption of Stock. This process can affect shareholder equity and corporate structure, so understanding its implications is vital for any corporation considering this step.

A director's resolution does not need to be signed by every director. Typically, a simple majority of signatures is adequate for the Maryland Resolution of Directors of a Close Corporation Authorizing Redemption of Stock. This approach balances the need for collective agreement with practical decision-making.

To fill out a corporate resolution form effectively, you should clearly outline the purpose of the resolution, such as authorizing the redemption of stock. Include the date, the names of the directors or officers, and specific details about the action being approved. Utilizing resources like US Legal Forms can provide templates and guidelines to ensure compliance with the Maryland Resolution of Directors of a Close Corporation Authorizing Redemption of Stock.

The corporate resolution is typically signed by the authorized officers of the corporation, which may include the president, secretary, or other designated individuals. When creating a Maryland Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, it is important to understand who has the authority to sign on behalf of the corporation. The officers' signatures confirm that the corporation agrees to the terms outlined in the resolution.

No, a resolution does not need to be signed by all directors to be valid. When dealing with the Maryland Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, a majority signature often suffices. This allows for efficiency in decision-making while still maintaining compliance with legal standards.

Typically, the directors present at the meeting where the Maryland Resolution of Directors of a Close Corporation Authorizing Redemption of Stock is adopted will sign it. Each participating director confirms their approval and support for the resolution through their signature. This process ensures that the decisions reflect the collective agreement of the directing body.

In the context of the Maryland Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, it is not always necessary for all directors to sign the resolution. Generally, a majority of the directors is sufficient to execute a valid resolution. However, it's best to check your corporate bylaws for specific requirements regarding signatures.

While close corporations offer many advantages, they come with potential drawbacks, such as limited access to capital and restrictions on share transfers. This structure can also lead to tensions among shareholders due to fewer formal governance guidelines. Understanding these disadvantages is crucial, especially when considering a Maryland Resolution of Directors of a Close Corporation Authorizing Redemption of Stock to address ownership changes or financial challenges.

The Maryland Close corporation is a specific type of business entity recognized in Maryland law, designed for small businesses that prefer a more flexible structure. It allows for fewer formalities and provides protections for shareholders against unwanted transfers of stock. The Maryland Resolution of Directors of a Close Corporation Authorizing Redemption of Stock can be essential for managing ownership transitions smoothly within this framework.

A close corporation is a type of business entity that limits the number of shareholders and often operates privately. These companies typically restrict the transfer of shares to maintain control among a small group. In the context of the Maryland Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, this structure allows for simplified decision-making and governance tailored to the needs of its shareholders.