Both the Model Business Corporation Act and the Revised Model Business Corporation Act provide that any action required or permitted by these Acts to be taken at a meeting of the shareholders or a meeting of the directors of a corporation may be taken without a meeting if the action is taken by all the shareholders or directors entitled to vote on the action. The action should be evidenced by one or more written consents bearing the date of signature and describing the action taken, signed by all the shareholders and/or directors entitled to vote on the action, and delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement

Description

How to fill out Resolutions Of Shareholders And Directors Approving Liquidating Trust Agreement?

Should you require extensive, obtain, or print official document formats, utilize US Legal Forms, the most extensive collection of legal templates available online. Employ the site's straightforward and efficient search feature to find the documents you need.

Various templates for business and personal purposes are organized by categories and states or keywords. Use US Legal Forms to quickly find the Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and select the Download option to access the Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement. You can also retrieve documents you previously obtained in the My documents section of your account.

Every legal document template you acquire is your own forever. You will have access to each form you obtained from your account. Simply navigate to the My documents section and select a form to print or download again.

Compete and download, and print the Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement using US Legal Forms. There is a wide variety of professional and state-specific forms available for your business or personal needs.

- Ensure you have chosen the form relevant to your specific city/region.

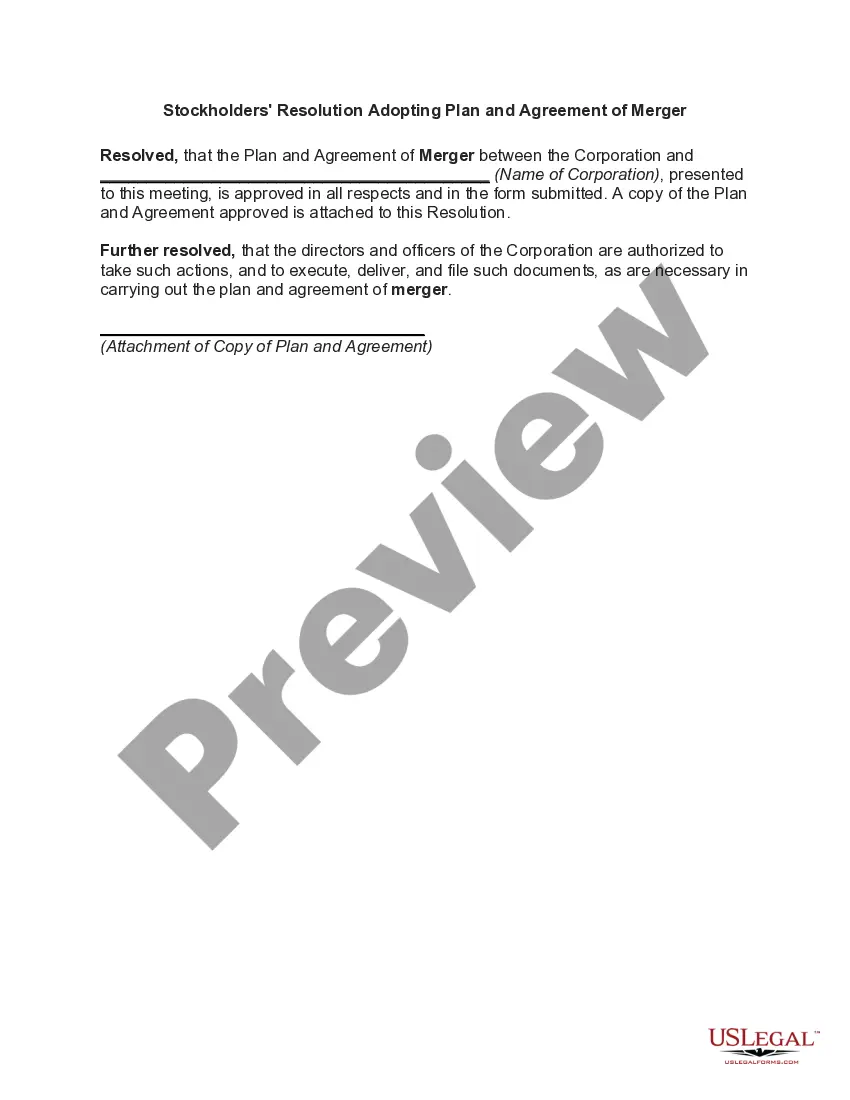

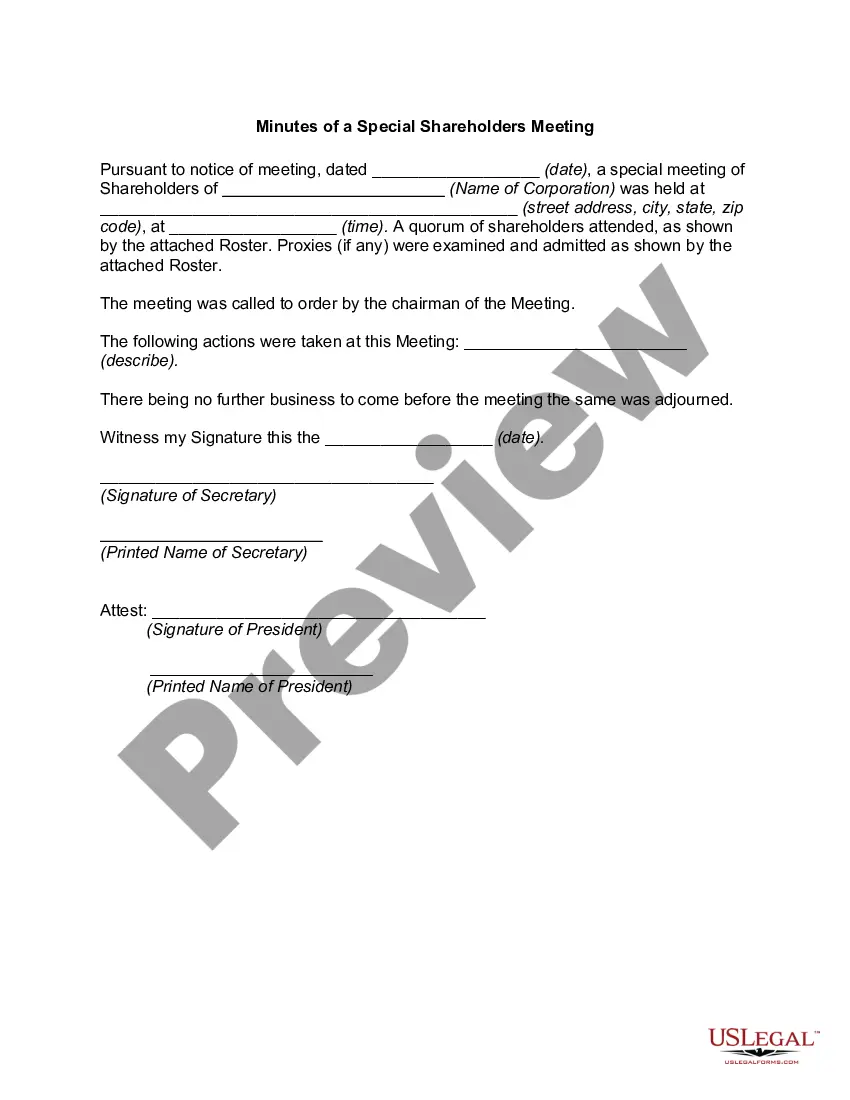

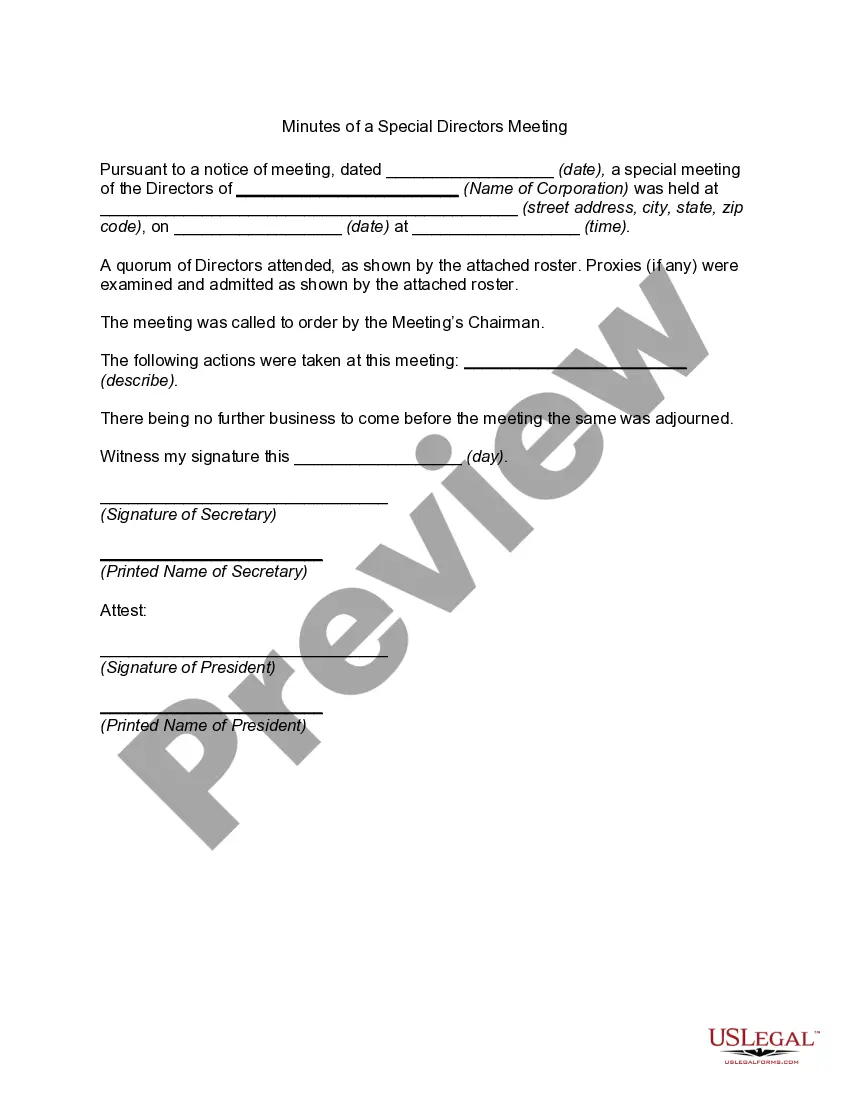

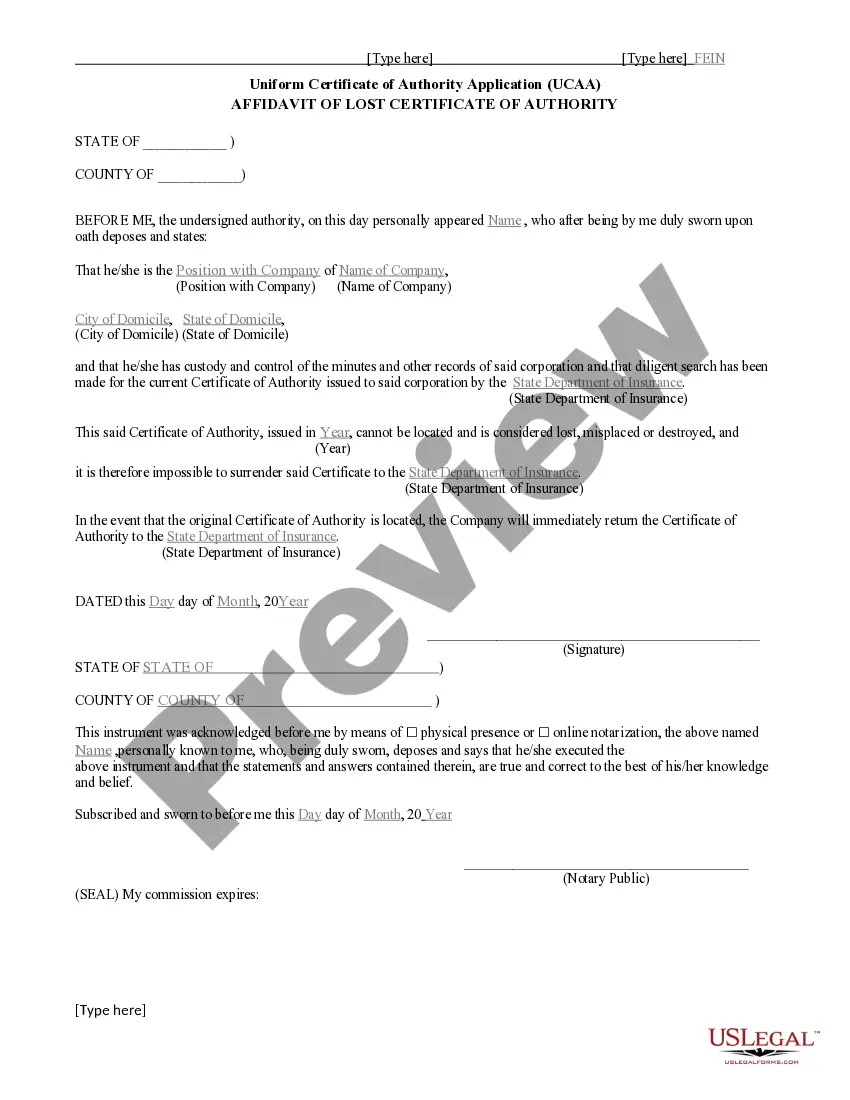

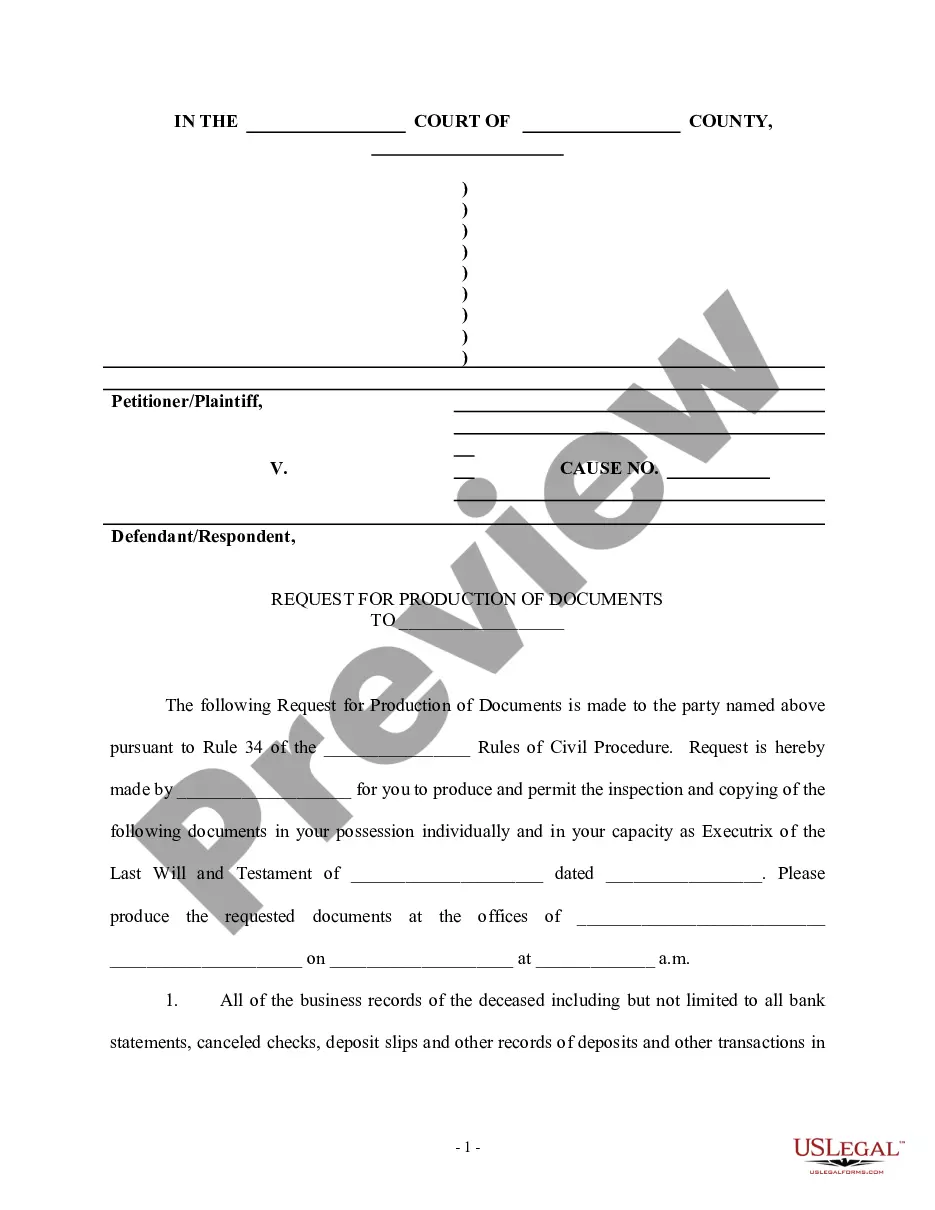

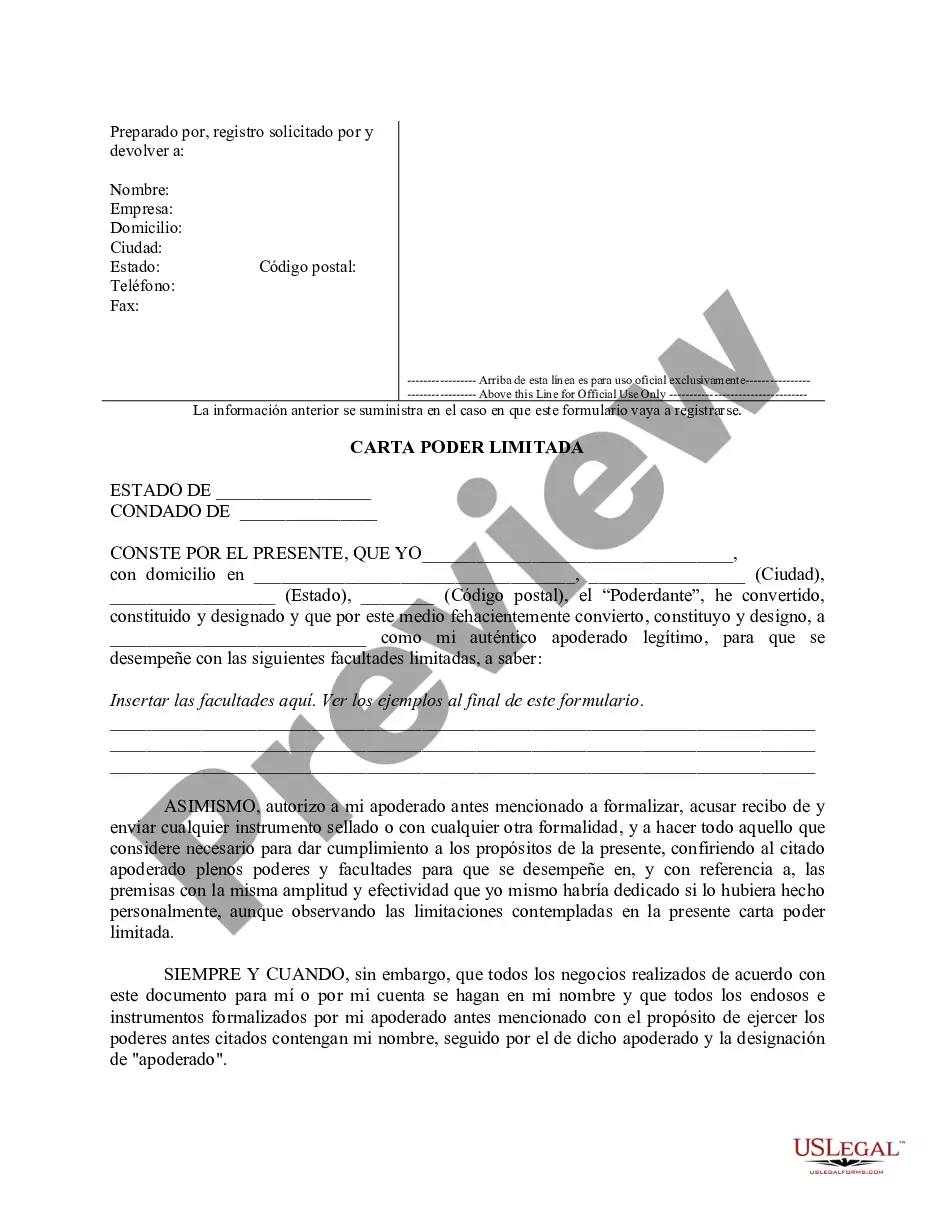

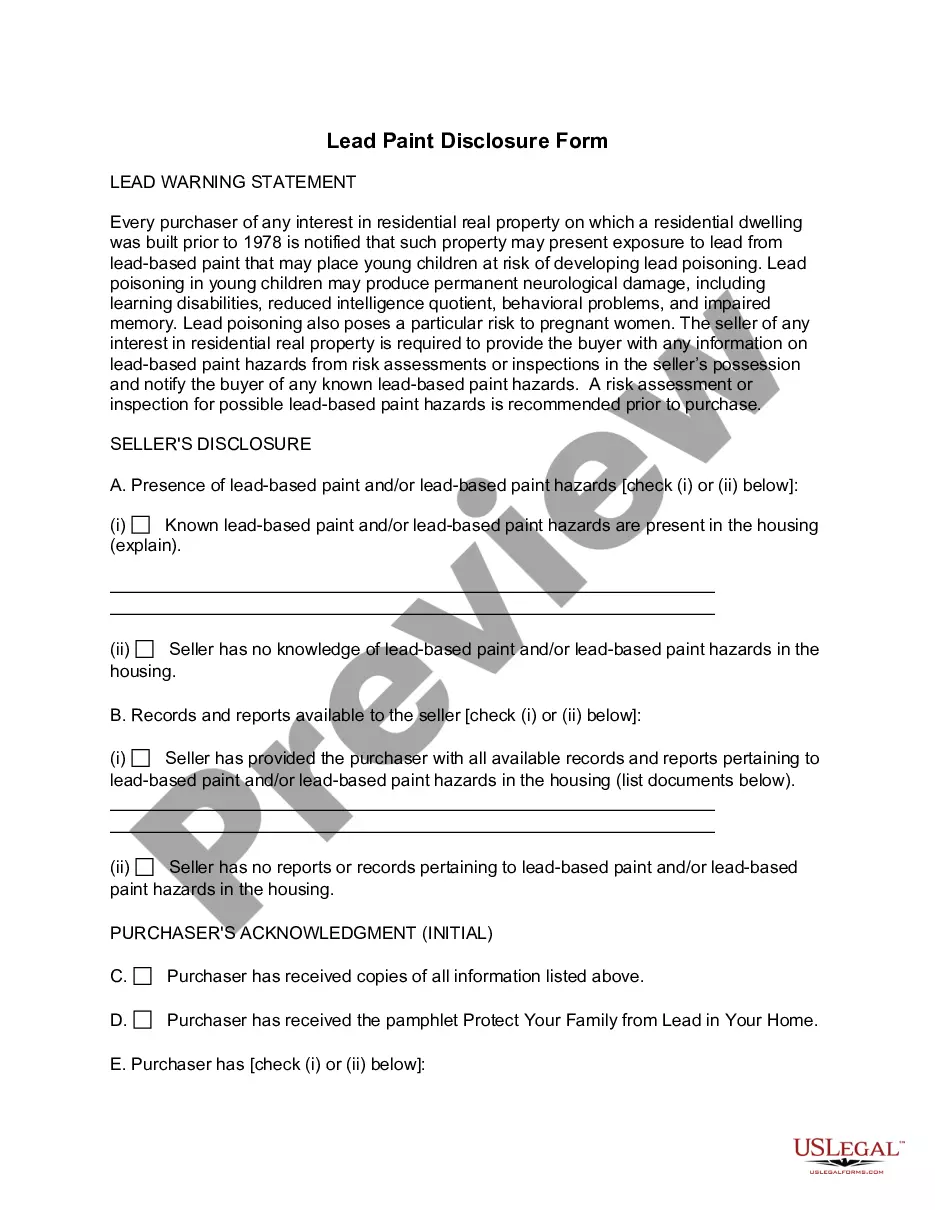

- Utilize the Preview feature to review the content of the form. Be sure to read the description.

- If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal template.

- Once you have identified the desired form, click the Buy now button. Choose the payment plan you prefer and provide your details to set up an account.

- Complete the payment process. You may use a credit card or PayPal account to finish the transaction.

- Select the format of the legal document and download it to your device.

- Finalize, edit, and print or sign the Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.

Form popularity

FAQ

Filing articles of dissolution is vital to formally close your business and limit any ongoing liabilities. This legal step ensures that your entity no longer exists and protects you from unnecessary obligations. Additionally, incorporating Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement in your dissolution process can clarify the terms and conditions surrounding the termination of your entity.

Filing an article of dissolution involves submitting a specific form that officially terminates your business entity. This form typically requires details about your business and the reason for dissolution. It is essential to reference or include Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement to ensure compliance and protect yourself from future legal complications.

To file articles of dissolution in Maryland, you must complete the necessary form that indicates your intent to dissolve your business. This form can be filed online or by mail with the Maryland State Department of Assessments and Taxation. Including Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement can streamline your dissolution process and mitigate future liabilities.

Dissolving a nonprofit in Maryland requires you to follow specific legal steps. First, you must hold a meeting of the board and obtain their approval for dissolution. Subsequently, you will need to file the proper paperwork with the state, including the Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement to finalize the process.

To file articles of organization in Maryland, you need to complete the required form provided by the Maryland State Department of Assessments and Taxation. You can submit this form online or via mail. This process is crucial for officially establishing your entity and is often a step before obtaining Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.

After a corporate dissolution, shareholders may receive their proportional share of the company's remaining assets. These assets are distributed according to the terms outlined in the Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement. It is essential for shareholders to be informed about their rights and obligations during this process. Using resources like USLegalForms can simplify this transition and help ensure shareholders receive their due distributions correctly.

Yes, shareholders typically must approve the dissolution of a company through a Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement. This approval process ensures that all shareholders have a say in the decision to dissolve the corporation. It is crucial for maintaining transparency and protecting the interests of the shareholders involved. Understanding this process can help facilitate smoother transitions during corporate dissolutions.

The requirements for a liquidating trust include proper documentation detailing the trust agreement, identification of the trustee, and the clear outline of how assets will be managed and distributed. Creating a liquidating trust allows for an organized and efficient way to distribute assets while protecting the interests of creditors and shareholders. Utilizing Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement can streamline the setup and ensure compliance with legal standards.

Liquidation signifies that a company will cease operations, sell its assets, and distribute any remaining funds to shareholders after settling liabilities. For shareholders, this means that they must prepare for potential losses, but also have the opportunity to recoup some of their investments. Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement outline the steps necessary for an orderly liquidation, helping to protect shareholder interests.

A shareholder resolution to liquidate details the decision of shareholders to close a company and manage its assets responsibly. This type of resolution ensures that all stakeholders are on board with the liquidation process and that there is a documented agreement on how to proceed. By utilizing Maryland Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, shareholders can navigate this complex process with clarity and legal compliance.