Maryland Equity Share Agreement

Description

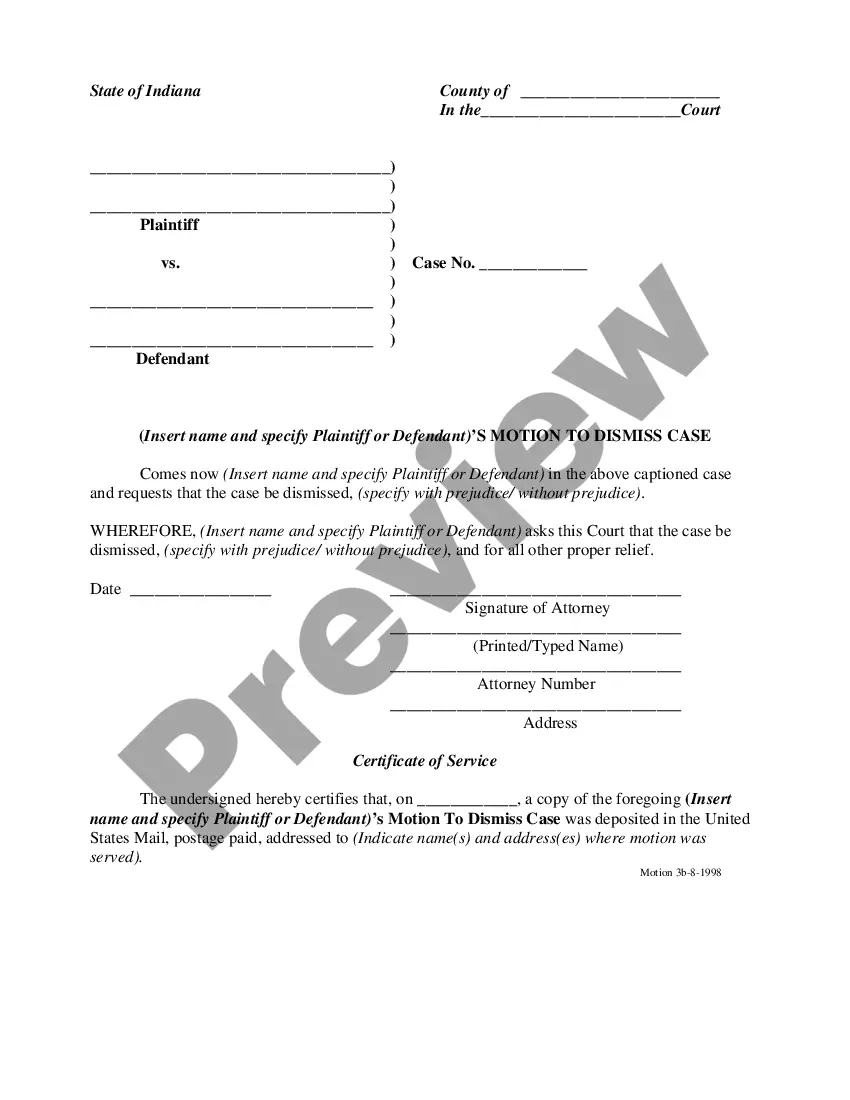

How to fill out Equity Share Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers an extensive selection of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Maryland Equity Share Agreement in just minutes.

If you already hold a subscription, Log In and obtain the Maryland Equity Share Agreement from the US Legal Forms library. The Download button will appear on every form you view. You can find all previously downloaded forms under the My documents tab in your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded Maryland Equity Share Agreement. Every template you save to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Maryland Equity Share Agreement through US Legal Forms, the most extensive repository of legal document templates. Take advantage of thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Make sure you have chosen the correct form for your city/county.

- Click the Preview button to review the content of the form.

- Examine the form summary to confirm that you have selected the right document.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to locate the appropriate one.

- If you are satisfied with the form, validate your choice by selecting the Buy now option.

- Next, choose the pricing plan you wish to use and provide your details to create an account.

Form popularity

FAQ

One drawback of a Maryland Equity Share Agreement is the potential loss of equity in your home. If property values decline, both parties may face losses, impacting future sales. Additionally, this arrangement may lead to complications with decision-making regarding the property, especially if disagreements arise. To navigate these challenges effectively, using a reliable resource like UsLegalForms can help create solid agreements and guidelines.

Dave Ramsey often advises caution regarding any financial agreements, including Maryland Equity Share Agreements. He emphasizes understanding the risks involved before entering such agreements, especially concerning debt and long-term financial commitments. While there are cases where equity sharing can be advantageous, he advocates for a careful examination of one’s financial health first. Always consider consulting with a financial advisor to assess your situation.

A common example of a Maryland Equity Share Agreement involves two parties: a homeowner and an investor. The investor contributes funds to help the homeowner cover down payments or renovations in exchange for a share in the property's equity. This arrangement allows the homeowner to benefit from additional resources while the investor shares in the potential appreciation of the home's value. Such agreements can crucially depend on the unique circumstances of each case.

An effective Maryland Equity Share Agreement typically outlines the terms of the equity investment, including the percentage of ownership and profit-sharing arrangements. It should include details about maintenance responsibilities and exit strategies for all parties involved. Transparency and clarity are crucial in these documents to prevent future disputes. Using a platform like UsLegalForms can help ensure that your agreement is comprehensive and legally sound.

A Maryland Equity Share Agreement, or HEA, can be a beneficial option for many homeowners. It allows individuals to access their home equity without traditional loans. Moreover, it can foster collaboration between homeowners and investors, creating a win-win scenario. However, it is essential to consider your personal financial situation before deciding.

To obtain a Maryland Equity Share Agreement, first assess your home’s equity and overall financial health. Next, research potential lenders and their terms. It is also wise to consult a financial advisor to discuss implications. Platforms like UsLegalForms streamline the process, offering guidance and tools to navigate your agreement.

A Maryland Equity Share Agreement can be worth it if you need funds without taking on additional debt. This option allows you to access your home's equity while not impacting your credit score. However, it's vital to evaluate your long-term goals and financial situation to determine if this agreement fits. UsLegalForms offers resources that can help you make an informed decision.

Choosing the best lender for a Maryland Equity Share Agreement depends on your financial needs and goals. Look for lenders with a proven track record in equity agreements and quality customer service. Comparing interest rates, terms, and fees is also essential. Platforms like UsLegalForms can help you find reputable lenders tailored to your requirements.

A downside of a Maryland Equity Share Agreement is that it may limit your control over your property. You share ownership with the lender, which means they have a stake in any future appreciation of your home. Additionally, if property values rise, you may end up sharing more gains than you expected. This arrangement can dilute the financial benefits of homeownership.

Equity share can be a good idea if you seek alternative pathways to homeownership without bearing the full financial responsibility alone. This arrangement can make homes more affordable, enabling you to invest alongside others. When considering a Maryland Equity Share Agreement, you'll find it important to evaluate your long-term goals and ensure that the partnership aligns with your financial plans.