The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. TILA applies only to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use. This form was designed to cover an situation where the Seller is not a creditor as defined by the TILA.

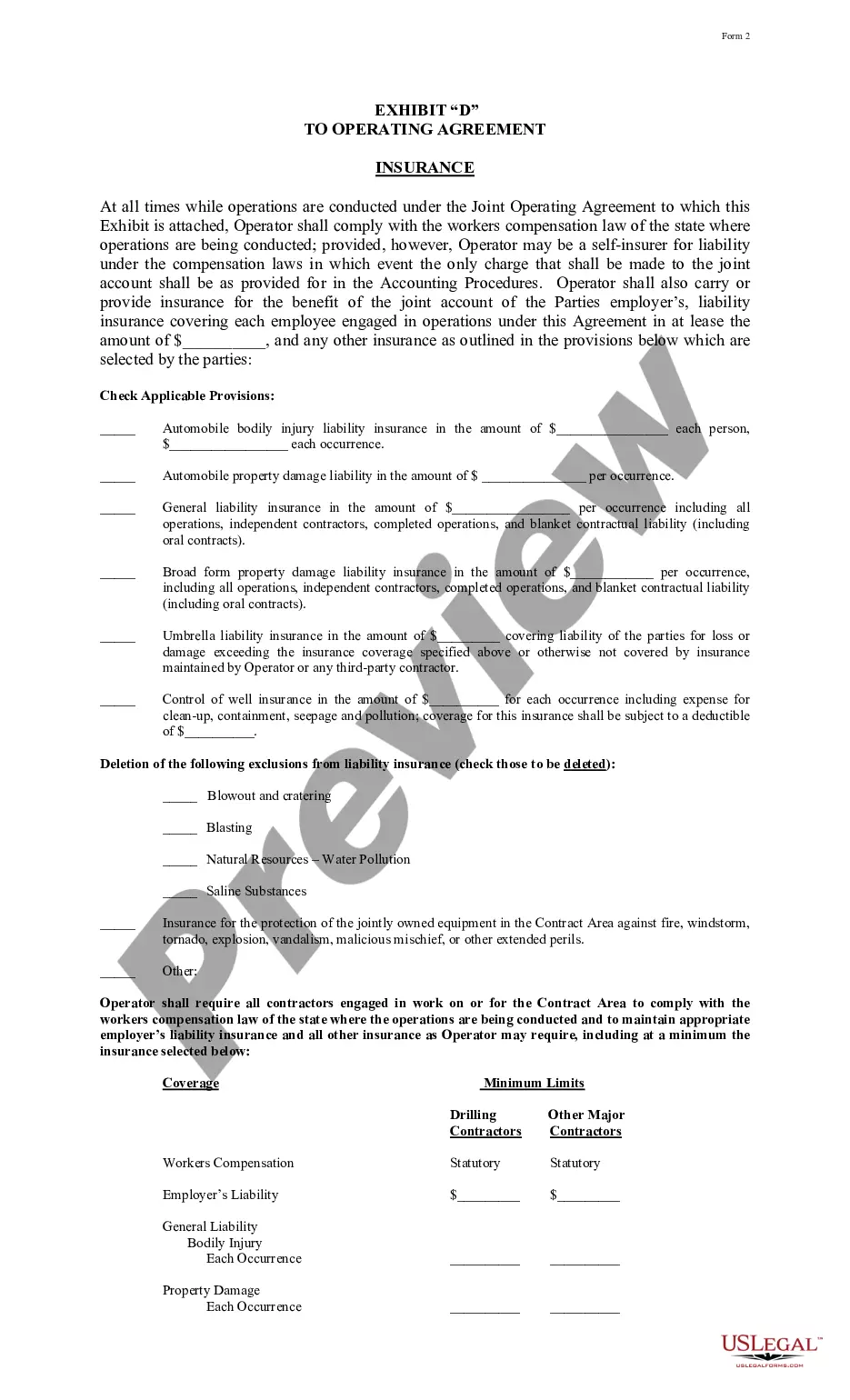

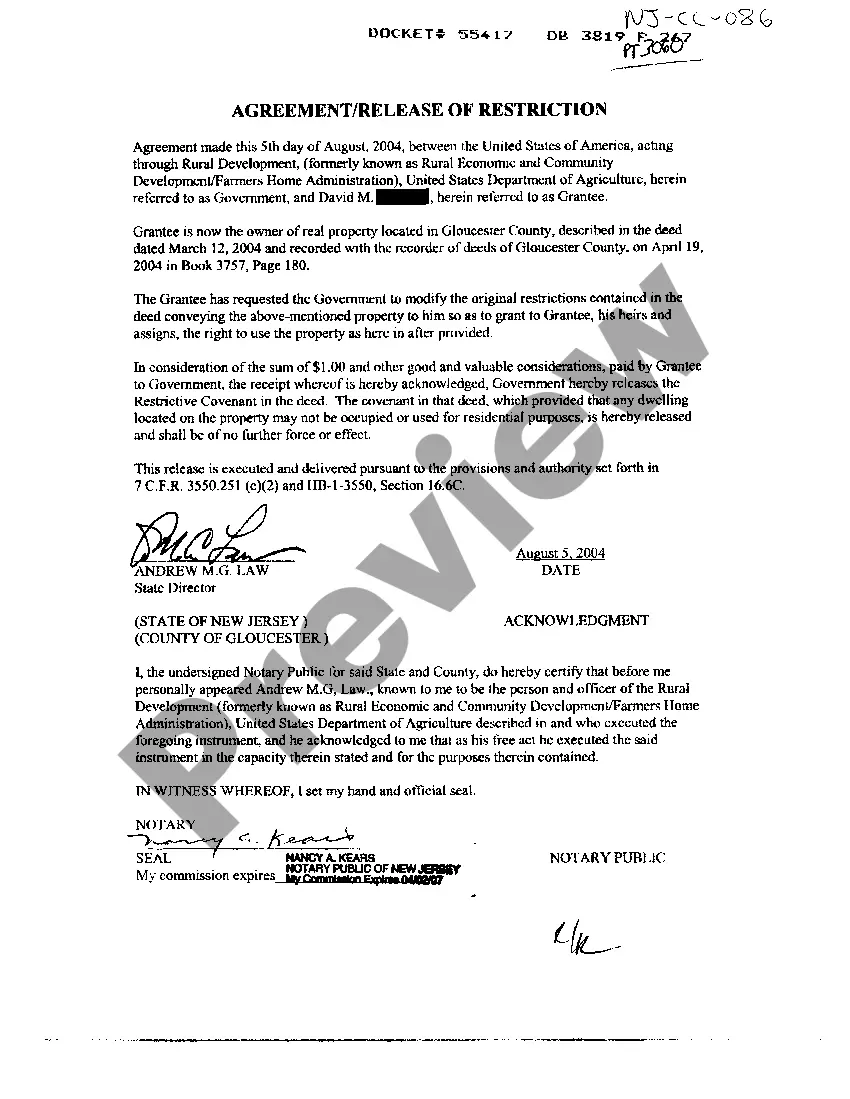

Maryland Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement

Description

How to fill out Installment Sale Not Covered By Federal Consumer Credit Protection Act With Security Agreement?

If you wish to obtain, secure, or print legal document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are categorized by type and region, or by keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to locate the Maryland Installment Sale not governed by the Federal Consumer Credit Protection Act with Security Agreement in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Maryland Installment Sale not covered by the Federal Consumer Credit Protection Act with Security Agreement.

- You can also access forms you've previously acquired in the My documents section of your account.

- If you’re using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Make sure you have selected the form for your specific city/region.

- Step 2. Utilize the Preview option to view the form’s details. Don’t forget to review the outline.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other variations in the legal form template.

Form popularity

FAQ

An example of an ECOA violation is when a lender requires a female applicant to provide a co-signer, while no such requirement is made for male applicants with similar financial backgrounds. This discrepancy highlights unfair treatment that violates the law. Understanding these scenarios helps in managing credit applications effectively, especially in regard to a Maryland Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement.

A red flag for an ECOA violation can include a lender denying credit based on prohibited characteristics without reasonable justification. For example, if an applicant can demonstrate strong creditworthiness but is still turned down while others are approved, this may indicate discrimination. Recognizing these signs can be crucial when navigating a Maryland Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement.

To elect out of installment sale reporting, a borrower typically must notify the lender in writing, indicating their desire to opt-out. It’s important to document this decision to ensure it is officially recognized. If you are entering a Maryland Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, consulting uslegalforms can provide guidance on proper procedures to follow in your specific situation.

The three types of discrimination prohibited under the ECOA include disparate treatment, disparate impact, and retaliation. Disparate treatment occurs when someone is treated differently based on prohibited characteristics. Disparate impact involves policies that may be neutral on the surface but disproportionately affect a protected group. Under Maryland Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, understanding these types can help protect your rights.

Yes, the Equal Credit Opportunity Act (ECOA) is a federal law that protects consumers against discrimination in lending practices. It applies across all states, including Maryland, ensuring that everyone has equal access to credit opportunities. For those engaged in a Maryland Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, understanding ECOA can help you navigate your rights and obligations effectively.

Consumer credit file rights under state and federal law involve the right to access your credit report and dispute inaccuracies. Both Maryland state laws and federal regulations require lenders to disclose this information to consumers. Knowing your rights can be vital, especially when considering options like a Maryland Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, where clear disclosures are essential.

In Maryland, the Equal Credit Opportunity Act protects consumers from discrimination in lending. This act ensures that all applicants receive fair consideration for credit, promoting equal opportunity in financial transactions. If you're exploring a Maryland Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, this law is particularly relevant for its consumer protections.

The Equal Opportunity Act is implemented through the Fair Housing Act, which ensures equal access to housing without discrimination. This regulation promotes fair lending practices, particularly relevant to the Maryland Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement. Homebuyers in Maryland should be aware of these protections to avoid any discriminatory practices.

Certain entities are exempt from the Maryland Online Data Privacy Act, including government agencies and certain non-profit organizations. These exemptions allow specific groups to operate without stringent data protection requirements. However, for businesses participating in a Maryland Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, awareness of these exemptions is important for maintaining compliance.

Violations of the Data Privacy Act occur when businesses fail to protect consumer data or misuse personal information. This can include unauthorized data sharing or inadequate safeguarding measures. For those involved in a Maryland Installment Sale not covered by Federal Consumer Credit Protection Act with Security Agreement, understanding these violations is key to ensuring compliance and protecting consumer rights.