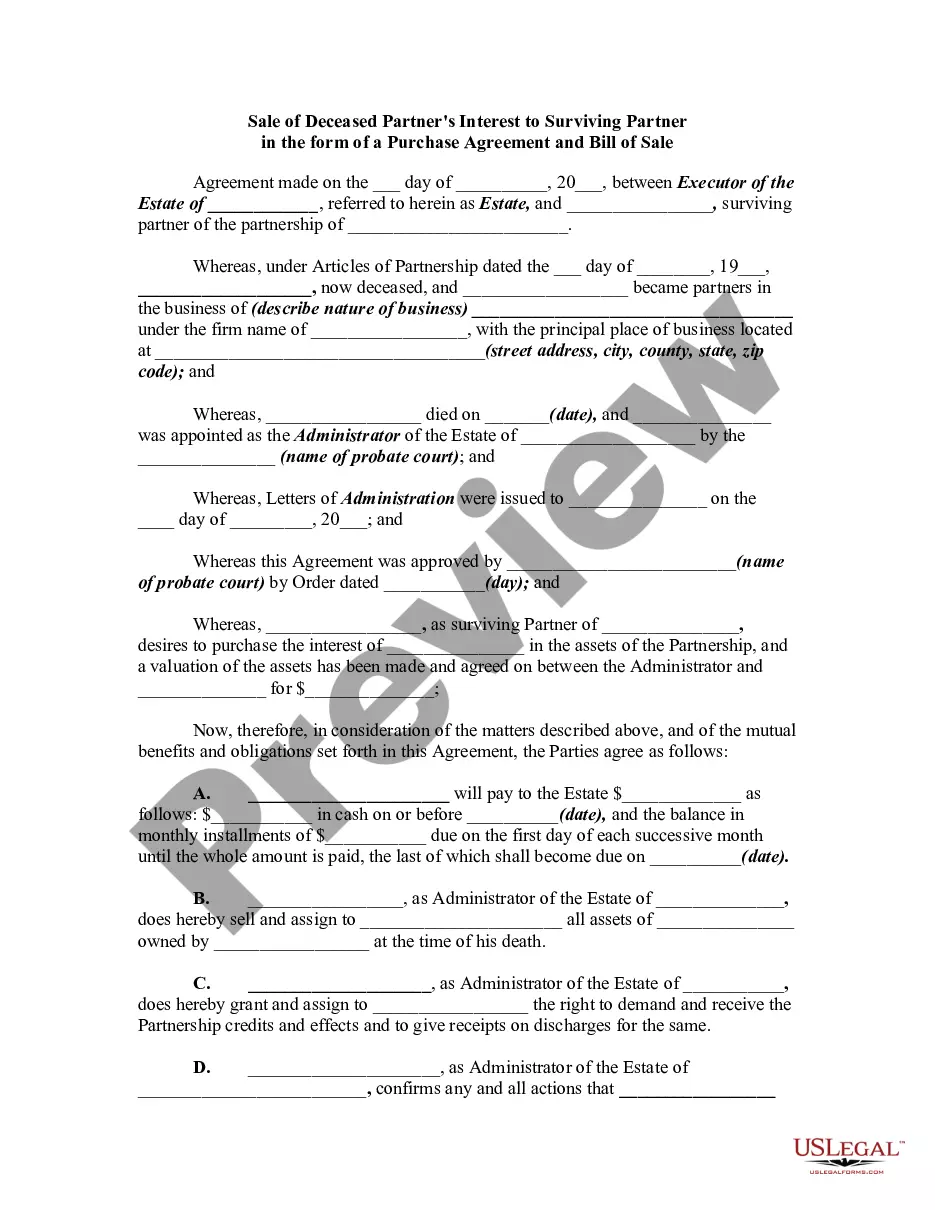

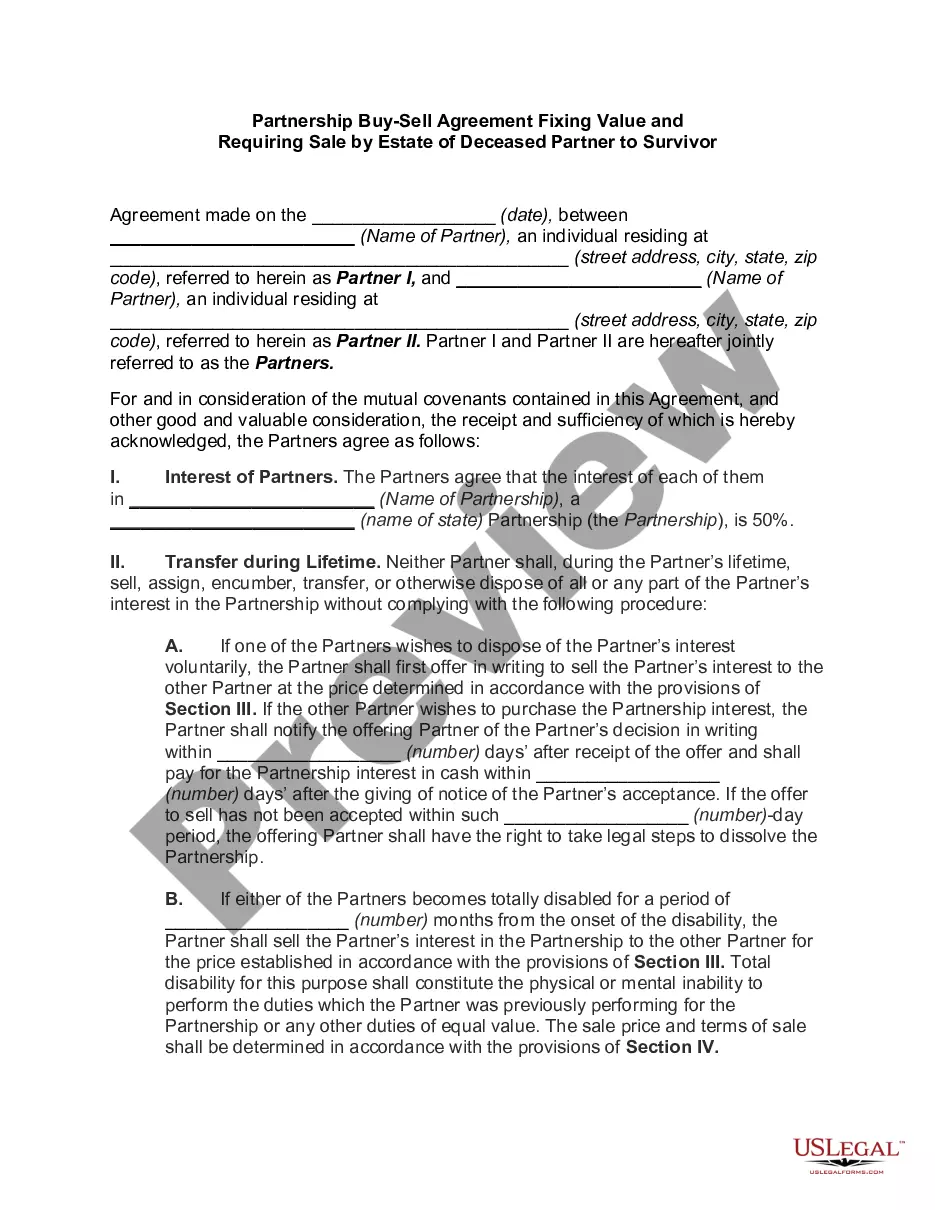

Maryland Sale of Deceased Partner's Interest

Description

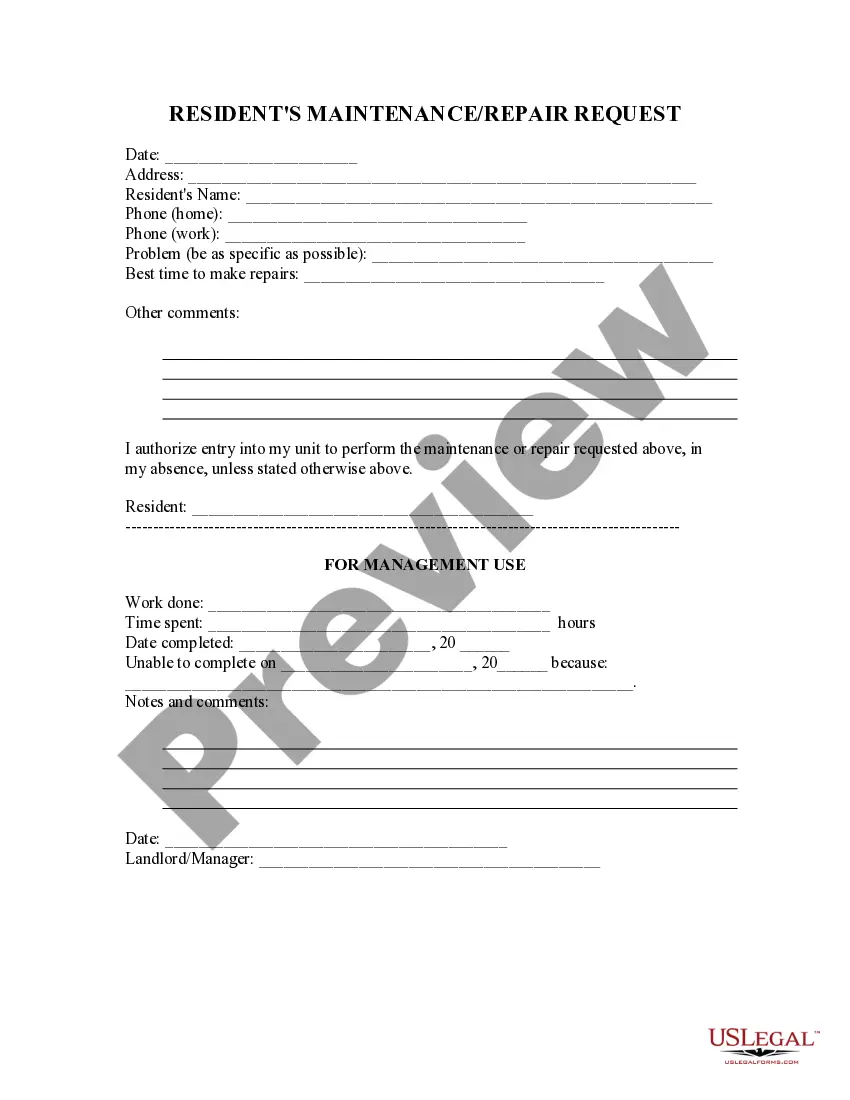

How to fill out Sale Of Deceased Partner's Interest?

If you wish to obtain, download, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, select the Buy now button. Choose the pricing plan you prefer and enter your information to register for the account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Maryland Sale of Deceased Partner's Interest with a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to get the Maryland Sale of Deceased Partner's Interest.

- You can also access forms you have previously downloaded within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review feature to examine the form’s content. Be sure to read the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Remember, credit does not die and continues after the death of the debtor, meaning that creditors have a right to claim from the deceased's estate. Remember, the executor is obliged to pay all the estate's debts before distributing anything to their heirs or legatees of the deceased.

Creditors have six months from the date of death to submit a claim. Once the assets have been distributed, probate must remain open for at least six months to allow for a creditor to come forward.

Property passing to a child or other lineal descendant, spouse of a child or other lineal descendant, spouse, parent, grandparent, stepchild or stepparent, siblings or a corporation having only certain of these persons as stockholders is exempt from taxation. 10% on property passing to other individuals.

Inheritances are not considered income for federal tax purposes, whether you inherit cash, investments or property. However, any subsequent earnings on the inherited assets are taxable, unless it comes from a tax-free source.

How long do you have to make a claim? The Act has a strict time limit for making a claim of six months from the date of the Grant of Probate or Letters of Administration. In very exceptional circumstances this may be extended to allow a late claim, but as a rule you must stick to the six month deadline.

Collateral Inheritance Tax at the rate of 10% applies to distributions to persons or organizations not identified as exempt.

In Maryland, the statute of limitations on debt collection is three years. This means creditors have up to three years to file a lawsuit against you for the debt you supposedly owe.

Any Interest in an Annuity or other Public or Private Employee Pension or Benefit Plan. Any held Life Estates/Terms of Years. Payable-On-Death or Transfer-On-Death accounts. Real or Leasehold property owned by the decedent and located outside of Maryland.

Maryland is one of a few states with an inheritance tax. The tax focuses on the privilege of receiving property from a decedent. The Maryland inheritance tax rate is 10% of the value of the gift. It is currently only imposed on collateral heirs like a niece, nephew or friend.

In any event, where it is accepted that payment is due, the executor can seek to pay you (the creditor) from the deceased's estate. There is normally a six-month period from the deceased's death for creditors to advise the executor of any sums due to them from the estate.