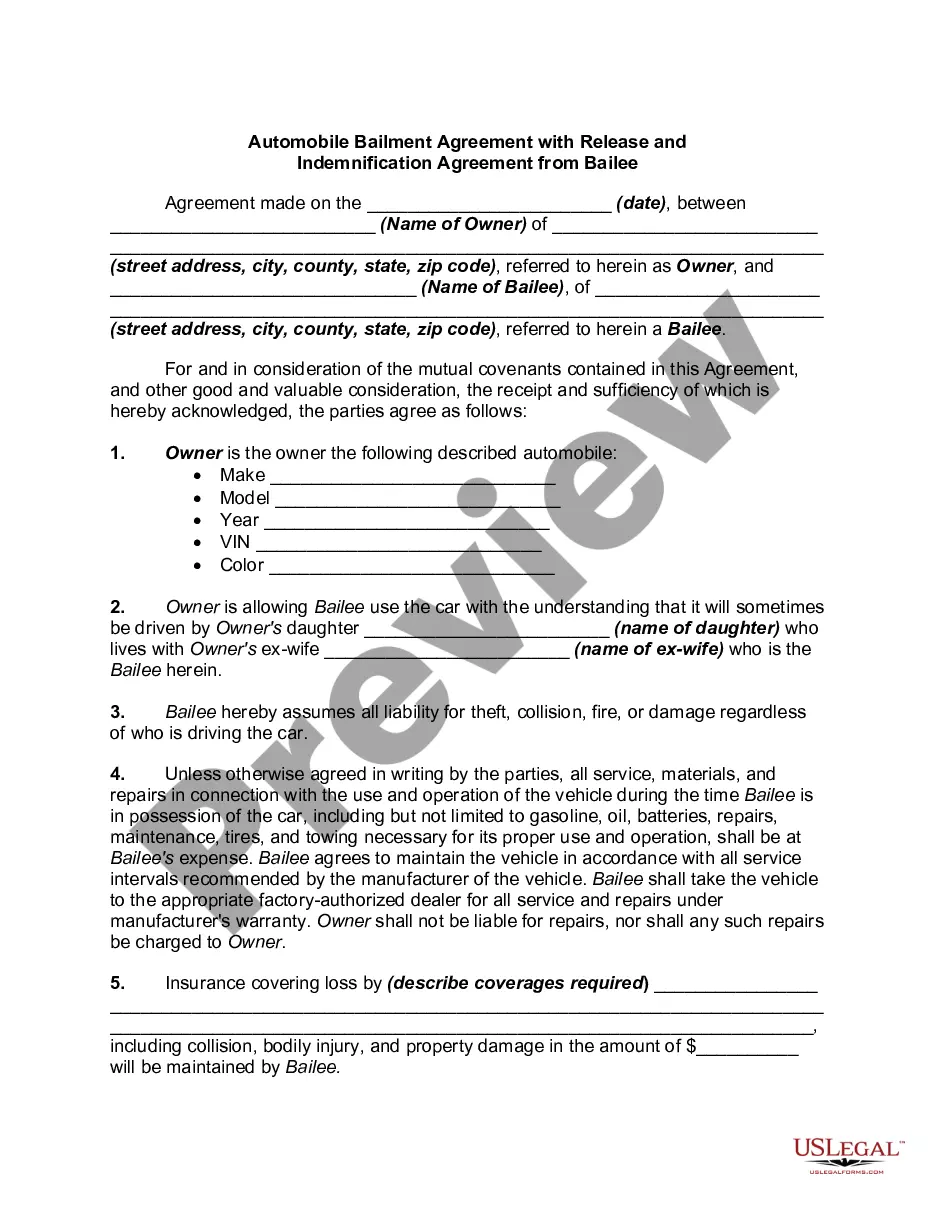

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

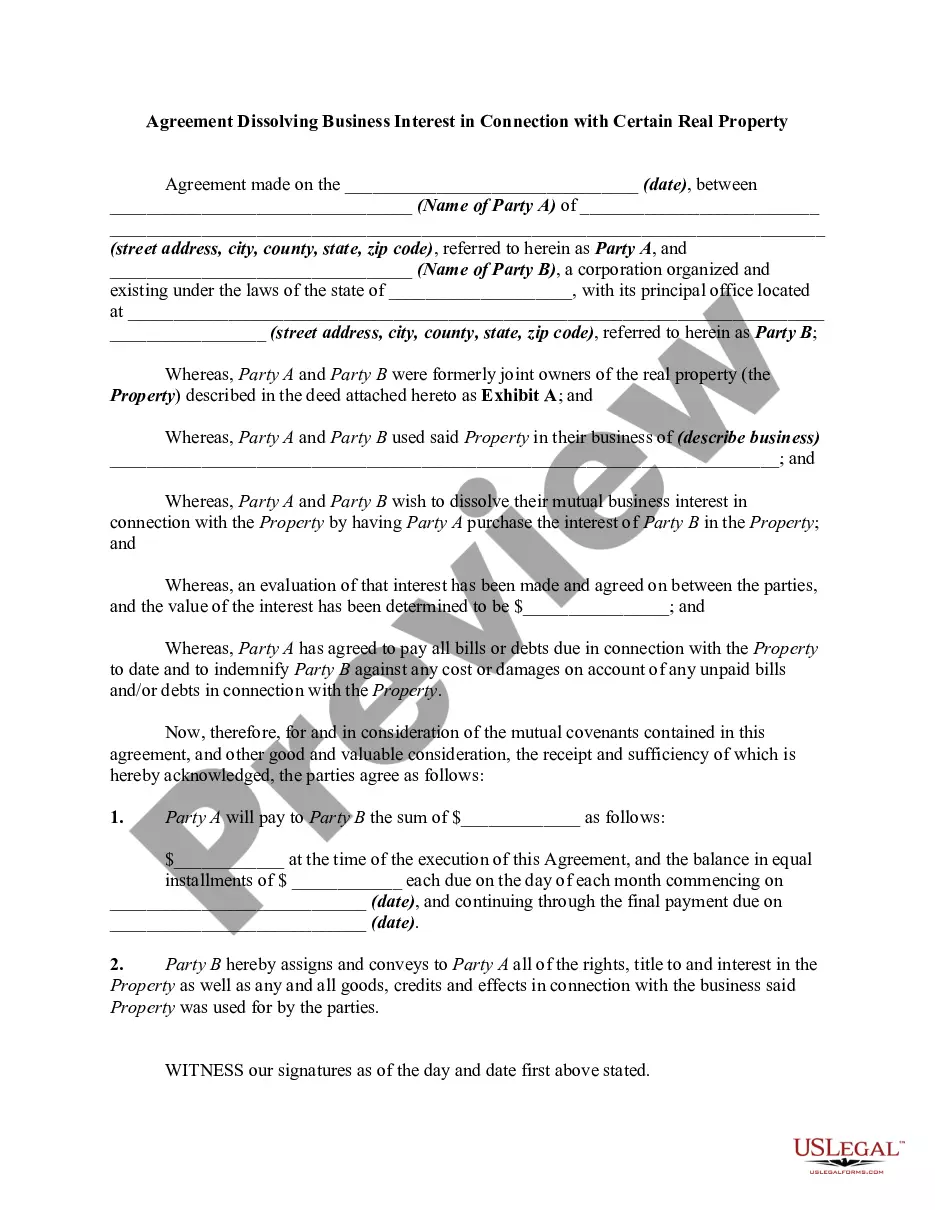

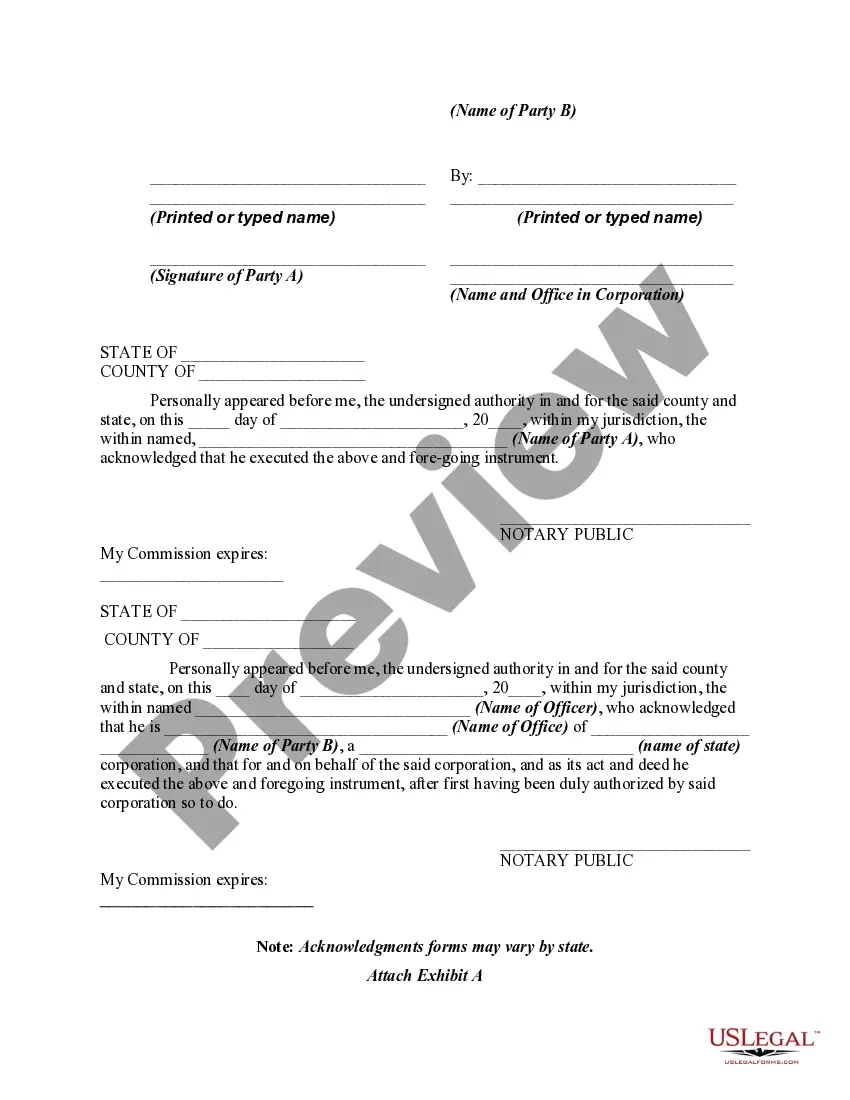

Maryland Agreement Dissolving Business Interest in Connection with Certain Real Property

Description

How to fill out Agreement Dissolving Business Interest In Connection With Certain Real Property?

Finding the appropriate legal document template can be challenging.

Certainly, there are numerous templates available online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Maryland Agreement Dissolving Business Interest in Connection with Certain Real Property, that can be utilized for both business and personal purposes.

You can browse the form using the Review button and check the form description to confirm it is the right one for you.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Maryland Agreement Dissolving Business Interest in Connection with Certain Real Property.

- Use your account to search for the legal forms you have purchased previously.

- Go to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new US Legal Forms user, here are simple steps to follow.

- First, ensure you have selected the correct form for your state/region.

Form popularity

FAQ

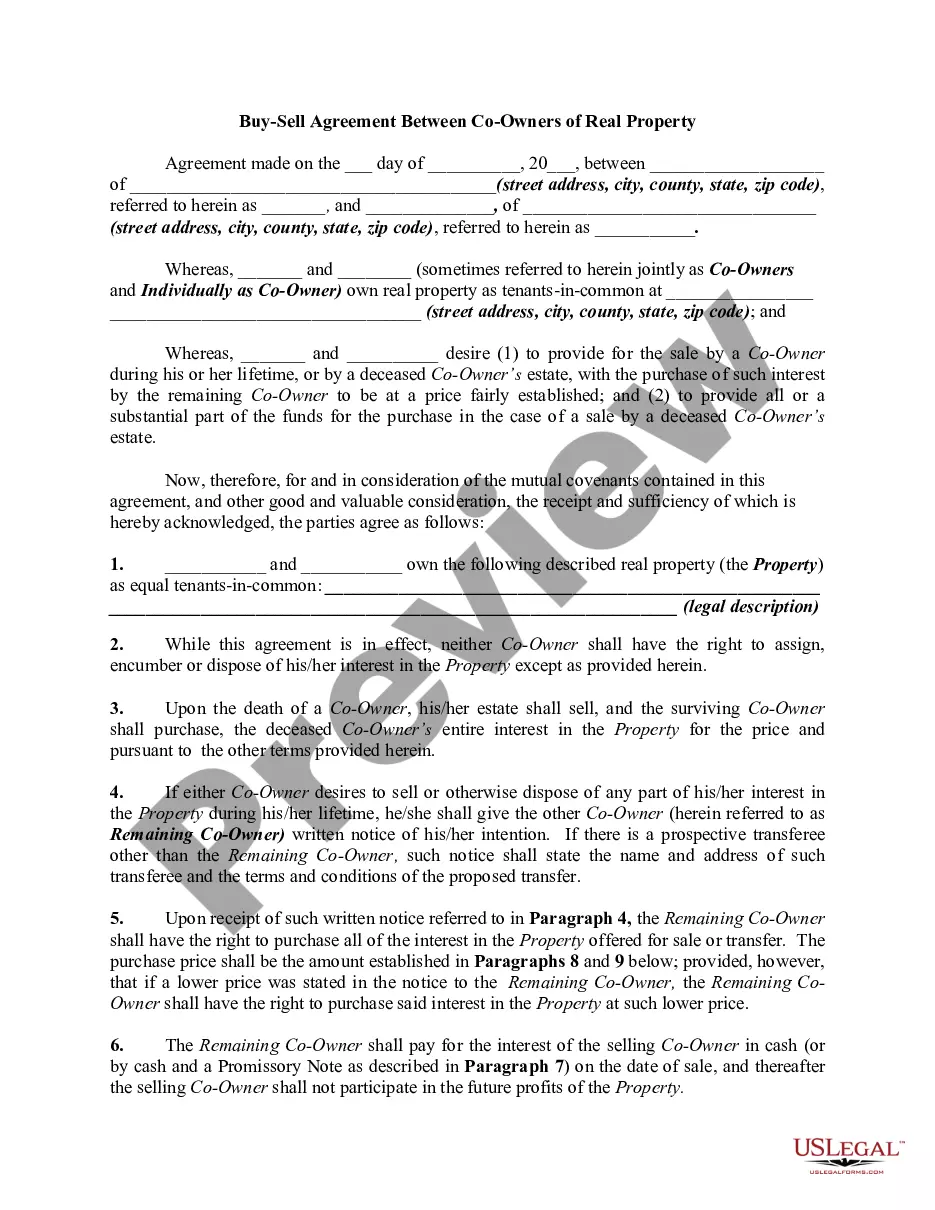

Dissolving a real estate partnership involves several steps, including reviewing your partnership agreement for specific dissolution procedures. Communicate with all partners and legally document the dissolution to protect everyone’s interests. If the dissolution pertains to any real property, consider a Maryland Agreement Dissolving Business Interest in Connection with Certain Real Property to formalize the separation of interests. Resources like US Legal Forms can provide necessary templates and guidance to ensure a smooth process.

In Maryland, changing ownership of an LLC requires you to file the appropriate paperwork with the state and possibly modify your operating agreement. This process keeps your business compliant with state regulations. Additionally, if you are dissolving or modifying business interest related to real property, a Maryland Agreement Dissolving Business Interest in Connection with Certain Real Property could be beneficial. Consider using US Legal Forms for guidance in drafting these documents correctly.

Transferring ownership of an LLC in Maryland involves updating your Articles of Organization with the Maryland Department of Assessments and Taxation. It is essential to draft and sign an operating agreement that outlines the terms of the transfer. If the changes involve property interests, include a Maryland Agreement Dissolving Business Interest in Connection with Certain Real Property to formalize the arrangement. Using resources from US Legal Forms can simplify this process and ensure compliance.

To change ownership of an LLC with the IRS, you must submit a new IRS Form SS-4 to obtain a new Employer Identification Number (EIN). This process is crucial when there is a change in ownership structure. Additionally, ensure that any Maryland Agreement Dissolving Business Interest in Connection with Certain Real Property is properly documented to reflect the changes in your LLC's ownership. A smooth transition can be achieved by consulting with a tax professional or utilizing platforms like US Legal Forms for assistance.

You should consider dissolving your business when it no longer meets your financial goals or if you face insurmountable challenges. Additionally, if your business is not generating revenue or if you have decided to pivot into a different venture, it is wise to take this step. A Maryland Agreement Dissolving Business Interest in Connection with Certain Real Property can provide a clear path for this process. By acting promptly, you can minimize risks and simplify your financial situation.

If a business is not in good standing in Maryland, it can face various penalties, including fines and the inability to legally conduct business. This status can complicate the dissolution process, particularly when dealing with a Maryland Agreement Dissolving Business Interest in Connection with Certain Real Property. It is crucial to address any outstanding issues before proceeding with dissolution. Consulting a service like uslegalforms can help you navigate these complications effectively.

To dissolve a business in Maryland, you need to follow a structured process. Begin by obtaining member approval and preparing a Maryland Agreement Dissolving Business Interest in Connection with Certain Real Property. After filing this document with the state, you must settle any debts and notify stakeholders. Utilizing platforms like uslegalforms can facilitate your compliance with state requirements, easing the overall procedure.

Dissolving an LLC can seem challenging, but it can be manageable with the right guidance. You need to complete specific steps, including obtaining member approval and filing the Maryland Agreement Dissolving Business Interest in Connection with Certain Real Property. Many find that using a reliable platform like uslegalforms simplifies the process, ensuring you meet all legal requirements efficiently. With the right resources, you can dissolve your LLC without undue stress.

Business personal property in Maryland refers to movable assets owned by a business, such as equipment, furniture, and supplies, that are not permanently affixed to real estate. This type of property can play a significant role when you are considering a Maryland Agreement Dissolving Business Interest in Connection with Certain Real Property. Understanding your business personal property is essential in the dissolution process. Properly valuing and disbanding these assets can safeguard your interests.

Yes, you must notify the IRS if you close your business. This notification is an important step, especially if you have employees or have filed taxes as a business entity. Include information related to the Maryland Agreement Dissolving Business Interest in Connection with Certain Real Property in your final tax return. Proper communication with the IRS helps avoid any future complications.