It is not uncommon for employers to make loans to their new executives. The purpose of such a loan may be to assist the executive in the purchase of a home or other relocation expenses. Frequently, the loan is forgivable over a period of time provided the executive remains employed. The loan also may be forgivable if the executive's employment terminates for specified reasons (e.g., death, disability or termination by the employer without cause).

Maryland Promissory Note - Forgivable Loan

Description

How to fill out Promissory Note - Forgivable Loan?

Are you presently in a position where you need documentation for potentially business or specific purposes nearly every day.

There are numerous legal document templates accessible online, but finding those you can trust is not simple.

US Legal Forms provides thousands of form templates, such as the Maryland Promissory Note - Forgivable Loan, that are designed to comply with federal and state regulations.

Once you find the right form, click Get now.

Choose the payment plan you prefer, fill in the necessary information to process your payment, and place an order with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maryland Promissory Note - Forgivable Loan template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it is for the correct city/state.

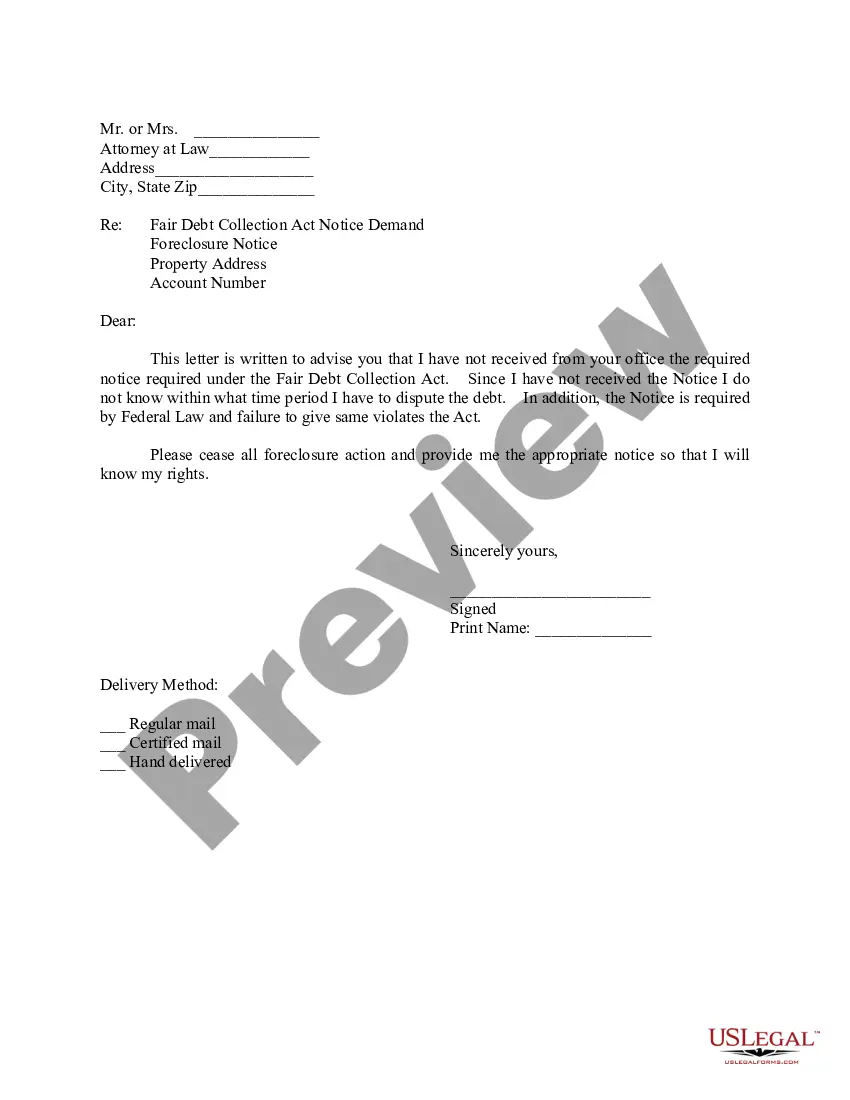

- Use the Preview button to review the form.

- Check the description to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to locate the form that suits your requirements.

Form popularity

FAQ

There is no legal requirement for most promissory notes to be witnessed or notarized in Maryland (a promissory note that involves a mortgage, however, must be witnessed and notarized). Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

"A promissory note is enforceable through an ordinary breach of contract claim." In other words, it's not required that the loan be secured; an unsecured loan is still enforceable as long as the promissory note is fully completed. Lender and borrower information.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

Circumstances for Release of a Promissory Note The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.