Maryland Sample Letter for Tax Deeds

Description

How to fill out Sample Letter For Tax Deeds?

Are you currently in a scenario where you require documents for either business or personal reasons almost all the time.

There is a range of legal document templates available online, but locating forms you can trust is not easy.

US Legal Forms provides thousands of form templates, including the Maryland Sample Letter for Tax Deeds, that are designed to comply with both federal and state regulations.

Once you find the right form, click Get now.

Choose the payment plan you prefer, enter the required information to create your account, and pay for the order using your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Maryland Sample Letter for Tax Deeds at any time if needed. Just click the desired form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid mistakes. The service offers expertly crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maryland Sample Letter for Tax Deeds template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

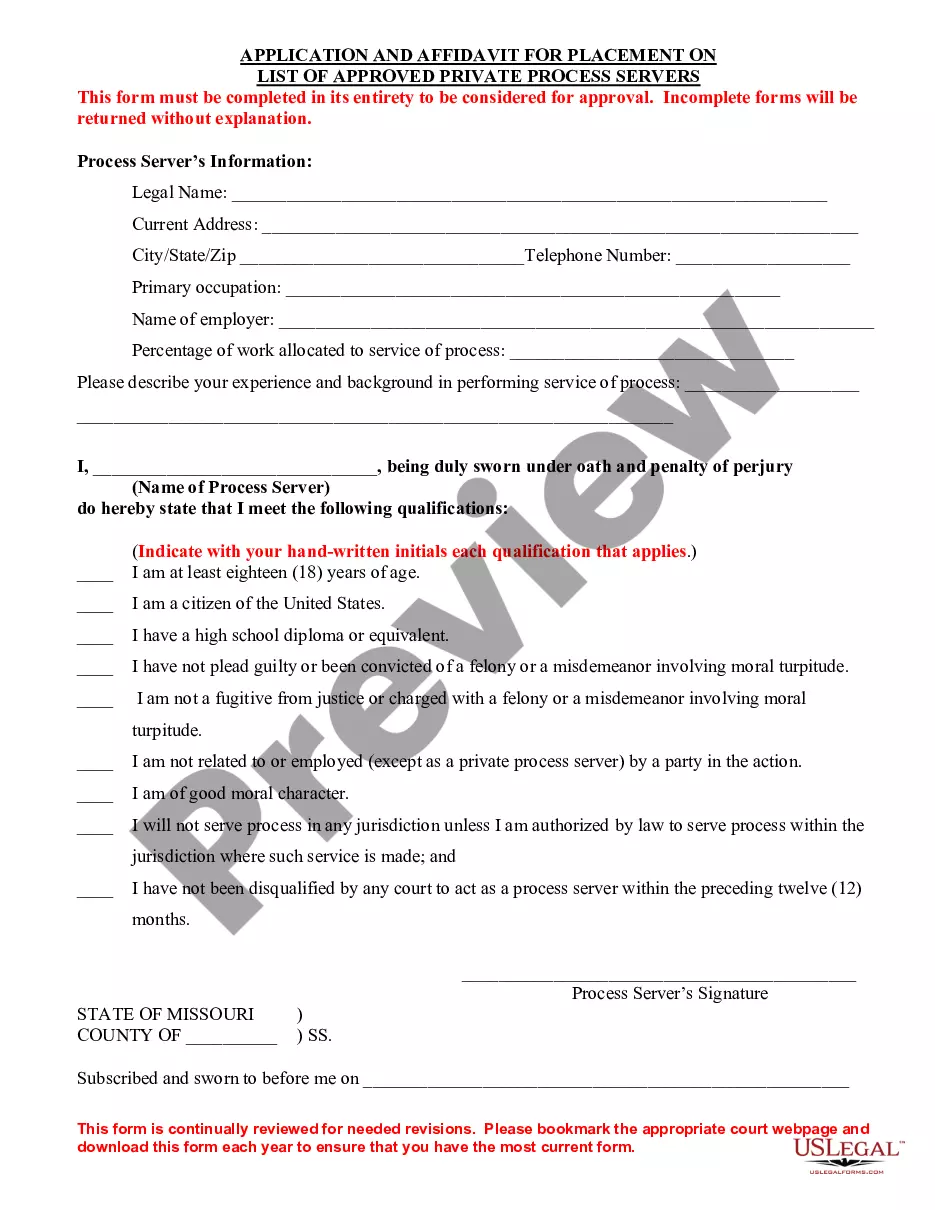

- Use the Preview button to examine the form.

- Review the outline to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search area to find the form that meets your needs.

Form popularity

FAQ

In Maryland, if you are behind at least $250 on property taxes, those taxes become a lien on your property. A lien is a debt that is attached to your property, like a mortgage. In Baltimore City you must be behind at least $750 to face tax sale.

Go to Maryland Case Search to search for court judgments against the property's owner. Unpaid taxes on the property may result in a lien. Visit your local county or city's finance office to find property tax or other municipal liens.

The only way to get a tax lien released is to pay your Maryland tax balance. After doing so, you can visit the applicable circuit court to obtain a certified copy of the lien release. This can be submitted to the three major credit agencies so your credit report will reflect the lien release.

There are numerous types of Property Tax Exemptions available through the State, some of the most used ones include exemptions for: charitable or educational properties; dwelling house of blind individual, surviving spouse; dwelling house of disabled veteran, surviving spouse; government properties; and properties ...

Penalty charges for late payments can be up to 25 percent of the amount of tax you owe.

Annual tax bills are due September 30th. First semi-annual installments are due September 30th. Supplemental and revised tax bills are due 30 days from the time of issue. Pursuant to Maryland Law, tax payments must be made on or before the due date to avoid interest and penalty charges.

Any unpaid balances due past December 31 are considered delinquent and subject to accrued interest, penalties and tax sale. On March 1, a Final Tax Sale notice is mailed. This allows you 30 days to pay the property taxes, along with accrued interest and penalties.

When you don't pay your property taxes, the past-due amount becomes a lien on your home. This type of lien almost always has priority over other liens, including mortgages. (See "What Happens to My Mortgage in a Tax Sale" below.)