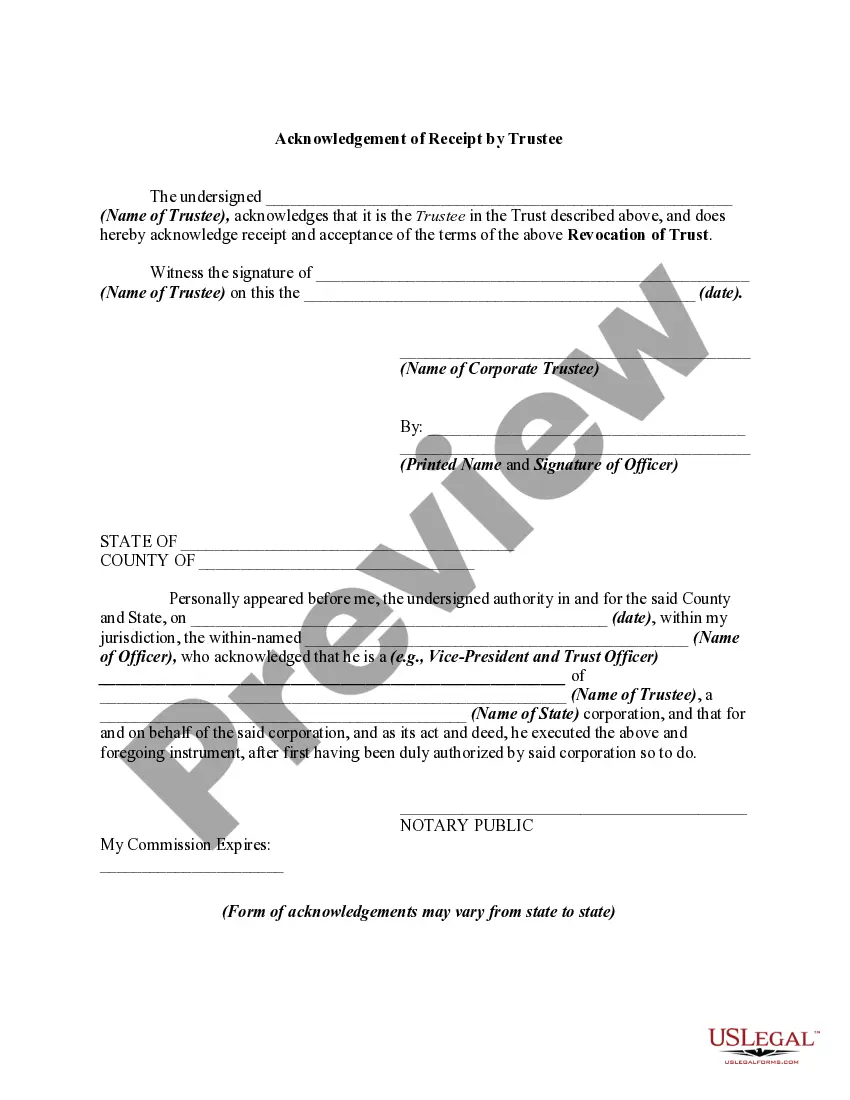

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a revocation of a trust by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maryland Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee

Description

How to fill out Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Revocation By Trustee?

It is feasible to invest multiple hours online attempting to locate the valid document format that aligns with the state and federal standards you need.

US Legal Forms offers an extensive selection of valid forms that have been reviewed by professionals.

You can effortlessly download or print the Maryland Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee from your service.

If available, utilize the Review button to look through the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Maryland Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee.

- Every valid document format you obtain is yours permanently.

- To acquire another copy of the downloaded form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions listed below.

- First, ensure you have selected the correct document format for the county/city of your choice.

- Review the form information to ensure you have selected the right form.

Form popularity

FAQ

The revocation clause in a trust is a specific provision that allows the settlor, or creator of the trust, to cancel the trust entirely. It serves as a legal mechanism to terminate the trust's validity and is often central to the process of the Maryland Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee. Understanding this clause is vital, as it protects settlors' intentions and beneficiaries' rights.

An example of a revocation clause could state, 'I hereby revoke any and all prior trusts created under my name.' This kind of clause clearly communicates the intent to nullify previous trusts, adhering to the Maryland Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee. Such language is essential to avoid confusion and ensure that all parties involved understand the trust's current status.

Yes, a trustee has the authority to revoke a trust, provided the terms of the trust allow for such an action. The revocation process must comply with the specific requirements outlined in the trust document and the Maryland Trust Act. This is particularly relevant when considering the Maryland Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee, as it ensures all actions are legally recognized and documented.

A qualified beneficiary under the Maryland Trust Act includes individuals who are entitled to receive distributions from the trust, either presently or in the future. This category typically encompasses current beneficiaries, those with a future interest, and individuals eligible to receive property if the trust were to be revoked. The concept plays a crucial role in the Maryland Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee, ensuring that beneficiaries are properly informed of their rights.

Yes, you can write your own trust in Maryland, provided you follow the state's legal requirements. It is crucial to ensure that your trust document is clear, unambiguous, and compliant with Maryland law concerning trust documentation. This is especially important when dealing with aspects like the Maryland Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee. To assist you in this process, consider utilizing USLegalForms for user-friendly templates and resources that simplify the creation of your trust.

Whether to have a will or a trust in Maryland depends on your individual needs and circumstances. Trusts can help your estate avoid probate and manage distribution more efficiently, while wills provide clear directives for asset distribution. If you are concerned about the Maryland Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee, a trust may serve as a better option for your estate planning. You can use platforms like USLegalForms to easily explore both options and make an informed choice.

In Maryland, a trust does not legally require notarization to be valid, but having it notarized can simplify verification of authenticity. Notarization can provide additional assurance that the trust's terms are enforceable, particularly when dealing with the Maryland Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee. If you decide to set up a trust, consider using USLegalForms to access notary services or receive guidance tailored to your needs.

Revoking a revocable trust is relatively straightforward, particularly in Maryland. As the grantor, you can revoke the trust at any time by following the necessary legal procedures. Typically, this involves drafting a Maryland Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee to formally communicate your decision. Consider using platforms like uslegalforms for easy and efficient handling of the paperwork.

A revocation of trust is a formal process through which the grantor terminates a trust they created. This action can occur due to a change in circumstances or desires regarding asset management. In Maryland, this process involves executing the Maryland Revocation of Trust and Acknowledgment of Receipt of Notice of Revocation by Trustee, which serves to notify involved parties and ensure legal compliance.

A trust can become null and void for various reasons, such as lack of legal capacity of the grantor or failure to meet the formal requirements under Maryland law. Furthermore, if the trust's purpose is illegal or against public policy, it may be deemed invalid. It’s crucial to follow proper procedures when drafting your trust to avoid such issues. If you need guidance on creating a valid trust, consider resources like uslegalforms to ensure compliance.