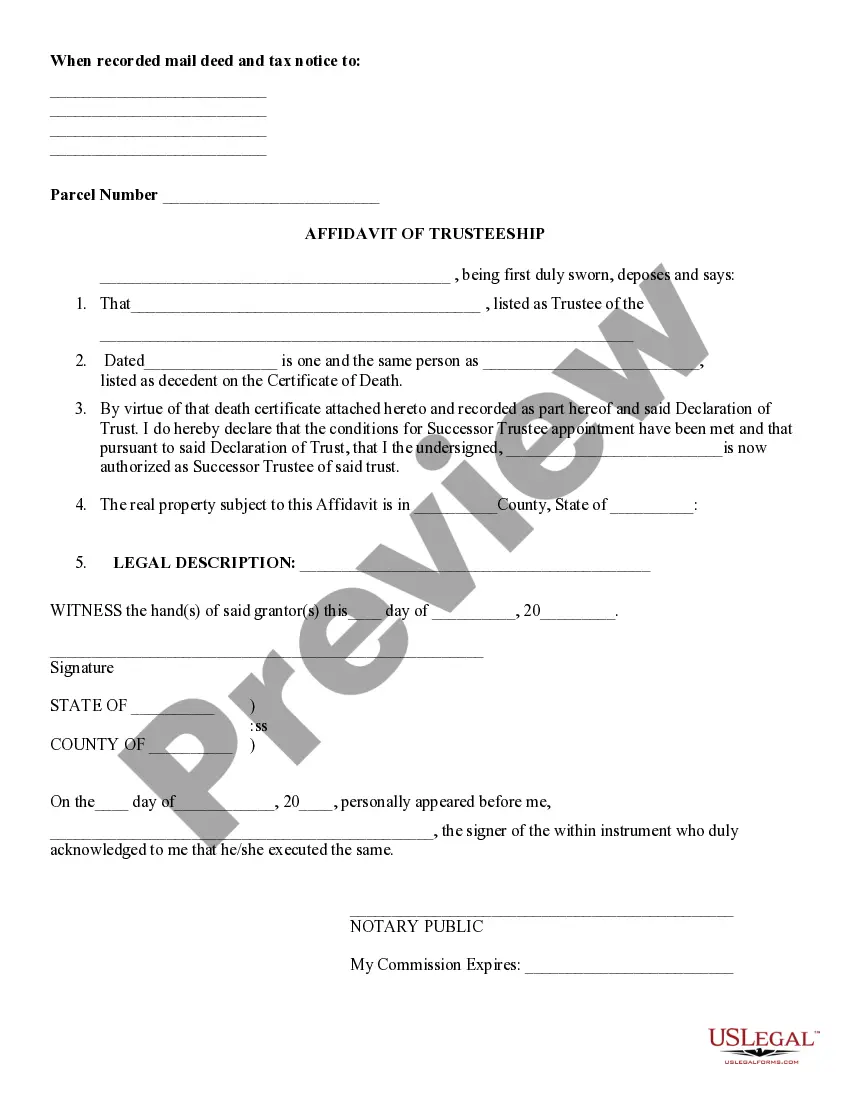

Maryland Certificate of Trust for Successor Trustee

Description

How to fill out Certificate Of Trust For Successor Trustee?

Discovering the right authorized papers web template might be a battle. Of course, there are plenty of layouts available on the Internet, but how can you discover the authorized type you will need? Utilize the US Legal Forms internet site. The assistance delivers 1000s of layouts, like the Maryland Certificate of Trust for Successor Trustee, that can be used for enterprise and personal requirements. All of the varieties are checked by experts and satisfy state and federal needs.

When you are already listed, log in to the bank account and then click the Download option to get the Maryland Certificate of Trust for Successor Trustee. Utilize your bank account to appear with the authorized varieties you might have acquired formerly. Check out the My Forms tab of your bank account and acquire an additional copy of the papers you will need.

When you are a fresh customer of US Legal Forms, here are basic instructions that you should stick to:

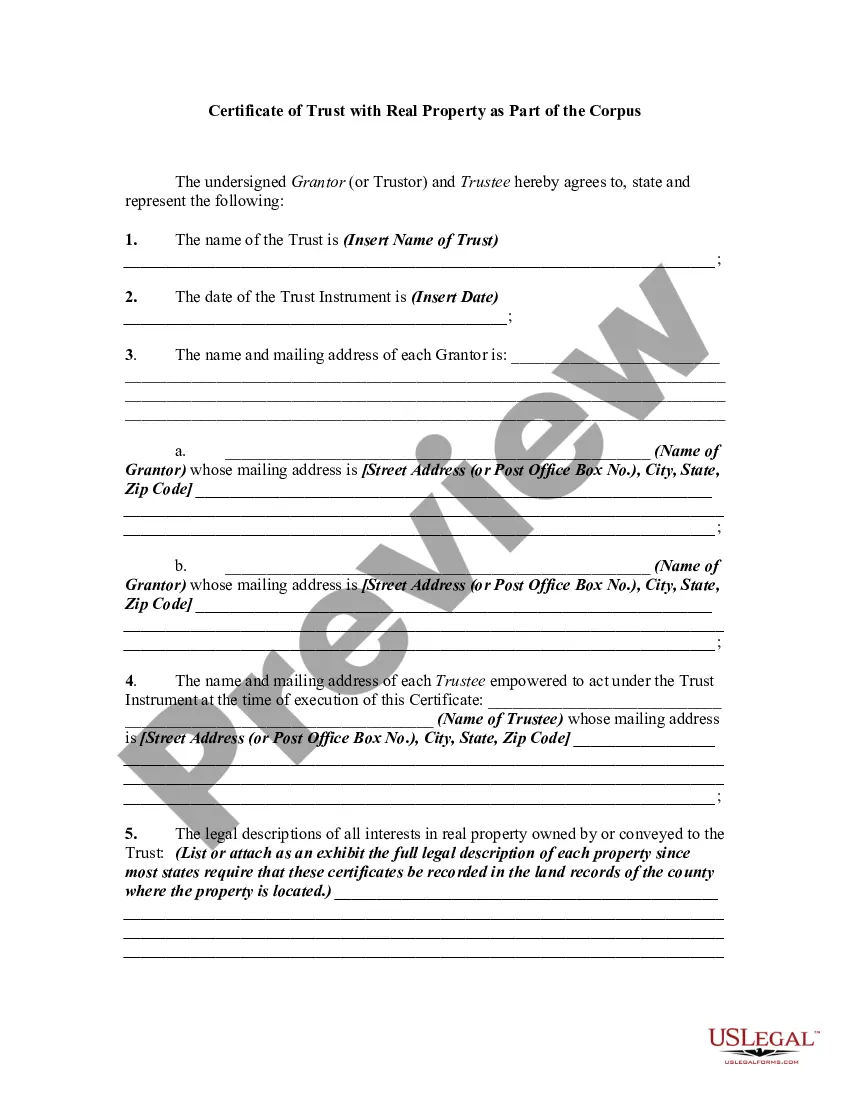

- Initial, make certain you have selected the correct type to your city/state. It is possible to look over the form making use of the Review option and read the form outline to make certain this is the right one for you.

- In the event the type is not going to satisfy your preferences, make use of the Seach industry to find the right type.

- When you are certain the form is proper, click on the Buy now option to get the type.

- Choose the pricing strategy you desire and enter in the required information. Make your bank account and buy the order making use of your PayPal bank account or bank card.

- Choose the submit file format and obtain the authorized papers web template to the gadget.

- Complete, modify and produce and sign the attained Maryland Certificate of Trust for Successor Trustee.

US Legal Forms may be the biggest collection of authorized varieties for which you can see various papers layouts. Utilize the company to obtain professionally-created paperwork that stick to status needs.

Form popularity

FAQ

Hear this out loud PauseThe certification of trust is codified under 14.5--910 of the Estates and Trusts Article of the Maryland Code. The document is an abbreviation of a trust instrument, verifying the trust's existence and the trustee's authority to enter into the impending transaction.

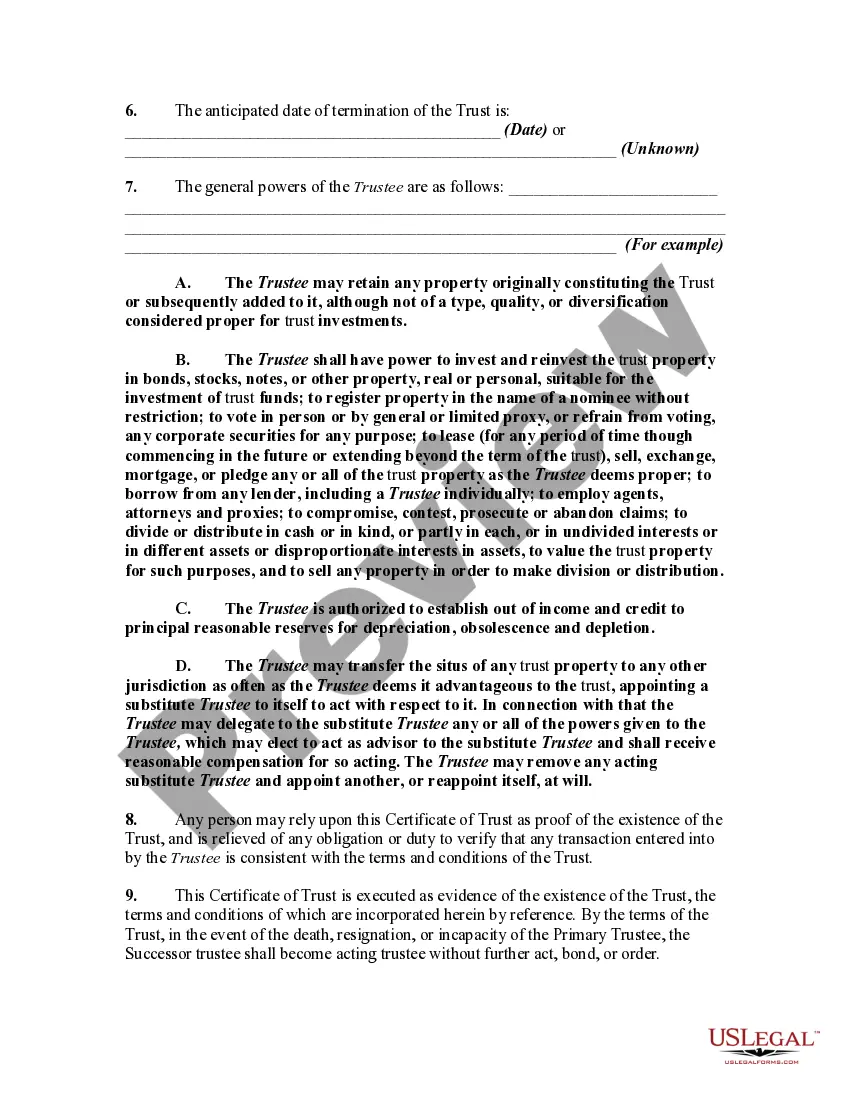

Hear this out loud Pause2.2 Trustees are likewise entitled to commissions for their services in administering a trust. These commissions are two-fold: an income based commission and a commission based on corpus. The income portion is graduated from 6.5% on the first $10,000; 6% on the next $10,000; 4% on the next $10,000 and 3% thereafter.

The certification of trust is codified under 14.5--910 of the Estates and Trusts Article of the Maryland Code. The document is an abbreviation of a trust instrument, verifying the trust's existence and the trustee's authority to enter into the impending transaction.

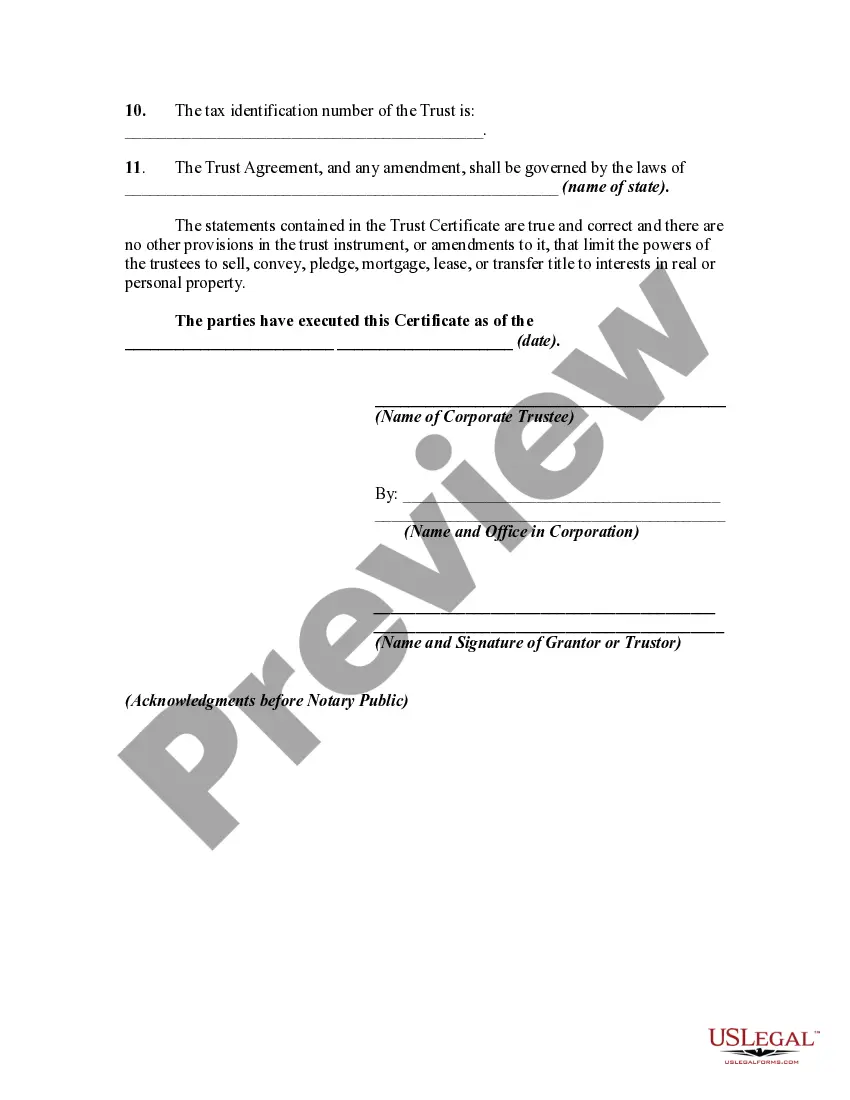

There are three ways to get a certificate of trust made: With a lawyer. An estate planning attorney can draft a certificate of trust for you to accompany your trust. With estate planning software. ... With a state-specific form from a financial institution or notary public.

The cost of creating a trust in Maryland varies depending on the complexity of your estate and the attorney's fees. The average cost for a basic Revocable Living Trust ranges from $1,000 to $3,000, while more complex trusts may cost more.

Hear this out loud PauseThe Maryland Trust Act Title 145-110 defines a qualified beneficiary as a current distributee of income or principal. A person would be a current distributee if either the interest of the current distributee is terminated or the trust is terminated.

List of the decedent's probate assets are filed on the public record. By contrast, with a revocable trust, neither the trust agreement nor the trust assets become part of the public record. Still, using a revocable trust cannot guarantee that your assets will remain completely confidential.

To create a living trust in Maryland you create a Declaration of Trust which is a written document. Oral trusts are valid in Maryland but are very difficult to enforce and manage. You sign the Declaration in front of a notary public. Assets are then transferred into the trust to fund the trust.

Technically, trusts do not need to be in writing, but execution of a trust is almost impossible unless it is in writing. In the declaration, the grantor transfers legal ownership of the property to be placed in trust to the trustee and names the beneficiary. The grantor must be legally competent to make the trust.

Hear this out loud PauseSection 14.5-813 - Duties in General. (a) Unless unreasonable under the circumstances, a trustee shall promptly respond to the request of a qualified beneficiary for information related to the administration of the trust, including a copy of the trust instrument.