A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

Maryland Conditional Guaranty of Payment of Obligation

Description

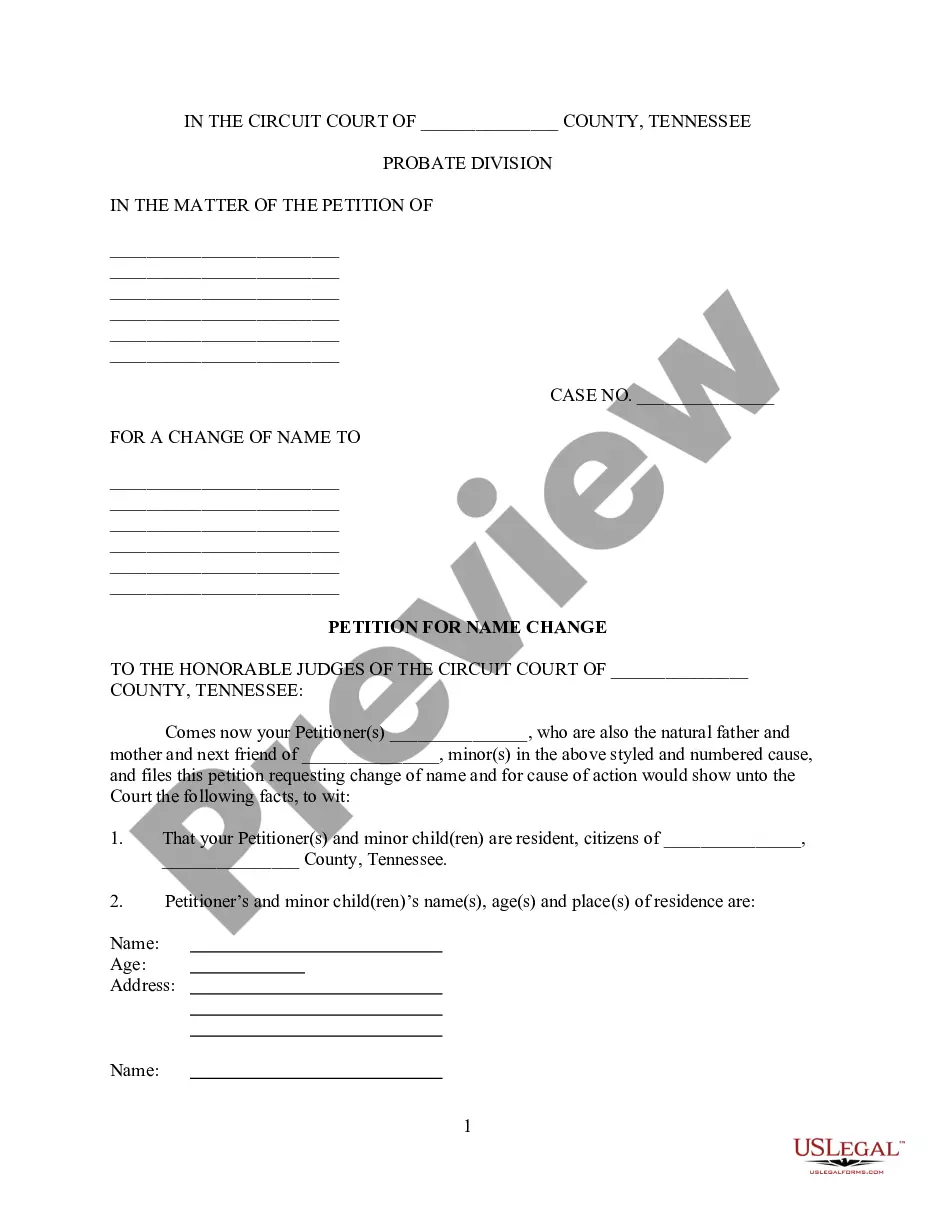

How to fill out Conditional Guaranty Of Payment Of Obligation?

If you want to be thorough, acquire, or print legal document templates, use US Legal Forms, the top collection of legal documents available online.

Take advantage of the website's straightforward and convenient search to find the documents you need.

Many templates for business and personal purposes are sorted by categories and locations, or keywords.

Every legal document template you obtain is yours indefinitely. You have access to each form you saved in your account. Click the My documents section and select a form to print or download again.

Be proactive and download, and print the Maryland Conditional Guaranty of Payment of Obligation with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Use US Legal Forms to find the Maryland Conditional Guaranty of Payment of Obligation in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to get the Maryland Conditional Guaranty of Payment of Obligation.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/region.

- Step 2. Utilize the Preview option to review the content of the form. Be sure to read the information.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other templates in the legal form format.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Maryland Conditional Guaranty of Payment of Obligation.

Form popularity

FAQ

A guarantor obligation arises when a guarantor agrees to fulfill the payment duties of a borrower if that borrower defaults. Essentially, the guarantor steps in to cover the debt or obligation promised in the contract. In a Maryland Conditional Guaranty of Payment of Obligation, the guarantor provides assurance to the creditor, which can make financing more accessible for the borrower.

A guarantor is a person or entity that agrees to be responsible for another party’s obligation. For instance, in a rental agreement, a parent may act as a guarantor for their child, ensuring that rental payments will be covered. In the world of a Maryland Conditional Guaranty of Payment of Obligation, businesses often use similar arrangements to secure financing for operations.

The risks of a personal guarantee include potential liability for the full amount of the debt if the borrower defaults. This can impact your personal finances and credit score. When engaging with a Maryland Conditional Guaranty of Payment of Obligation, it is critical to thoroughly assess your financial position and consult with a qualified attorney to understand these risks.

To get out of a guaranty, you generally need the consent of the lender or a legal release. It's important to formally document any changes to the obligation to avoid future liability. When considering a Maryland Conditional Guaranty of Payment of Obligation, consult legal advice to understand your potential options and the implications of seeking release.

The guaranty of recourse obligations refers to a situation where the guarantor agrees to repay an obligation if the primary borrower defaults. This means that the lender can pursue the guarantor for payment, effectively giving them a greater security net. When dealing with a Maryland Conditional Guaranty of Payment of Obligation, understanding this concept is vital for both parties involved.

Yes, a personal guarantee acts as a form of security for lenders, providing them with a fallback if the primary borrower defaults. It enhances the lender's confidence in extending credit or entering into contracts. In situations involving a Maryland Conditional Guaranty of Payment of Obligation, this level of assurance can significantly influence the terms of the agreement.

A personal guarantee form is a legal document where an individual agrees to be responsible for another party's debt or obligation. This form is critical in transactions where lenders seek additional security beyond the borrower's creditworthiness. In the context of a Maryland Conditional Guaranty of Payment of Obligation, this document solidifies the personal commitment of the guarantor.

The financial guarantee clause ensures that a specific party will be responsible for fulfilling financial obligations if the principal party cannot. In a Maryland Conditional Guaranty of Payment of Obligation context, this clause protects lenders by providing an additional layer of security. Understanding the importance of this clause is vital, and resources from US Legal Forms can guide you in drafting this essential component.

A payment guarantee is a commitment from a guarantor to cover a payment if the responsible party defaults. In the realm of a Maryland Conditional Guaranty of Payment of Obligation, this assurance can significantly benefit businesses and lenders by minimizing the risk of non-payment. Utilizing an appropriate legal framework, such as US Legal Forms, can help you effectively draft and implement these guarantees.

The payment clause refers to the section of a contract that details how payments are to be made under the agreement. In a Maryland Conditional Guaranty of Payment of Obligation, this clause specifies the timing, method, and conditions under which payments should occur. Clear payment clauses safeguard both parties by ensuring mutual understanding and transparency in financial dealings.