The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

Maryland Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the Court

Description

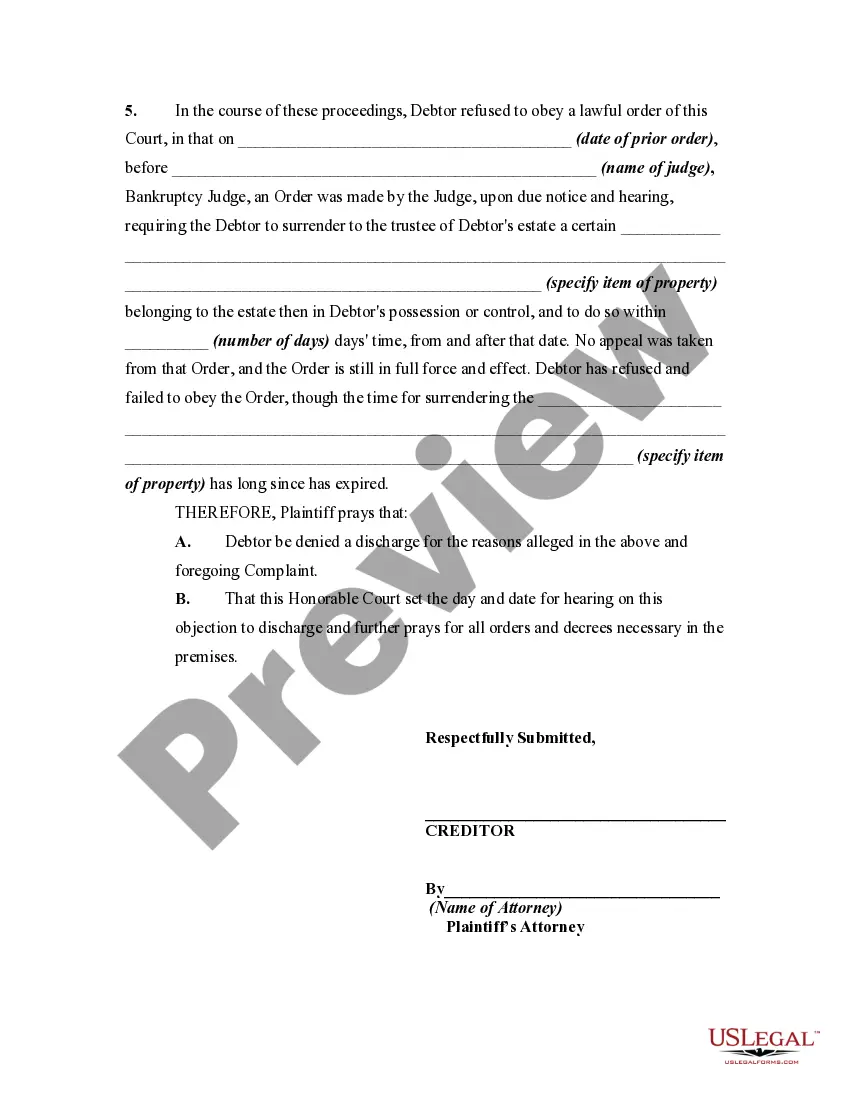

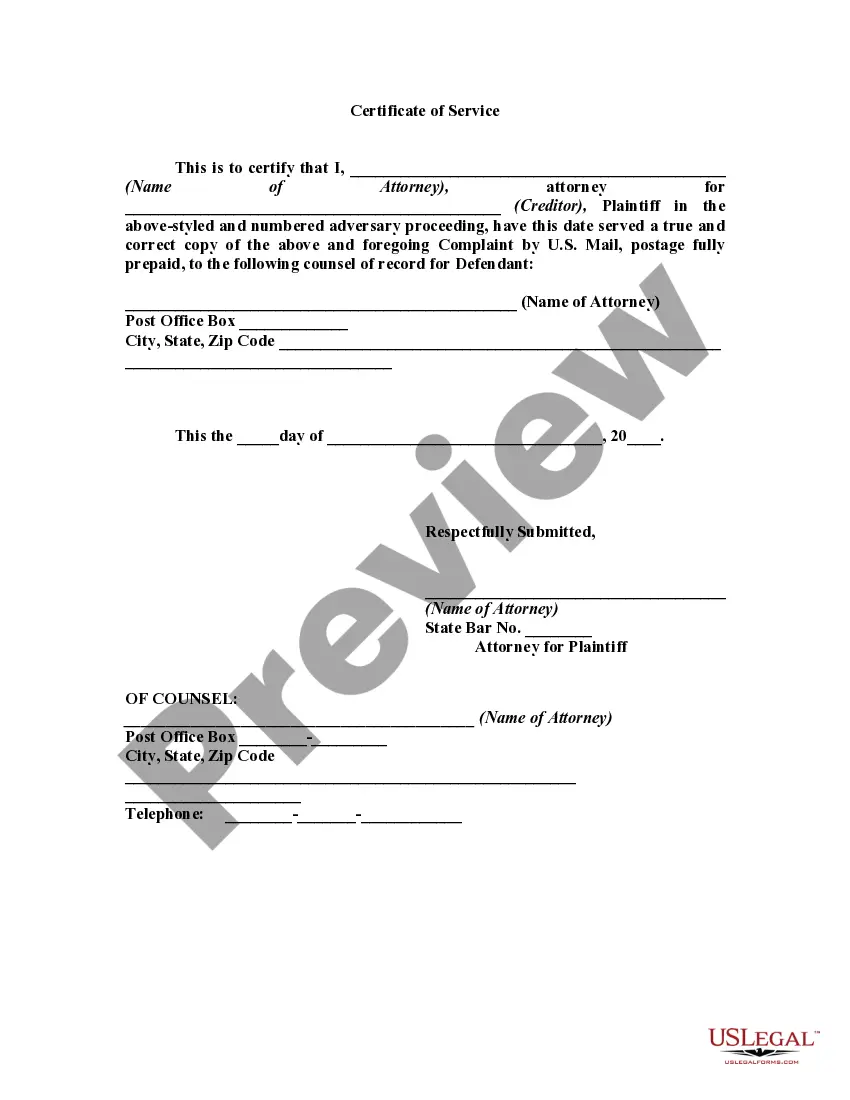

How to fill out Complaint Objecting To Discharge Of Debtor In Bankruptcy Proceedings For Refusal By Debtor To Obey A Lawful Order Of The Court?

Finding the right authorized record design could be a have a problem. Naturally, there are a lot of layouts available on the Internet, but how will you find the authorized type you require? Make use of the US Legal Forms web site. The service offers a huge number of layouts, like the Maryland Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the, that you can use for enterprise and private requirements. All the forms are checked by specialists and meet up with state and federal demands.

Should you be previously listed, log in to the account and click the Obtain switch to get the Maryland Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the. Utilize your account to look with the authorized forms you have purchased previously. Visit the My Forms tab of your own account and have yet another version in the record you require.

Should you be a fresh customer of US Legal Forms, listed below are simple guidelines for you to follow:

- Initial, be sure you have chosen the correct type for your town/region. You can look over the shape using the Preview switch and look at the shape outline to ensure this is basically the right one for you.

- If the type does not meet up with your preferences, use the Seach discipline to get the proper type.

- When you are certain the shape is acceptable, go through the Purchase now switch to get the type.

- Choose the prices prepare you desire and enter the necessary info. Design your account and pay money for an order making use of your PayPal account or bank card.

- Choose the submit formatting and acquire the authorized record design to the system.

- Total, revise and print and sign the acquired Maryland Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the.

US Legal Forms will be the greatest collection of authorized forms where you will find a variety of record layouts. Make use of the service to acquire skillfully-made paperwork that follow condition demands.

Form popularity

FAQ

The most common reason a denial of discharge is requested and granted is because the debtor is believed to have been dishonest on his or her bankruptcy petition or he or she failed to keep accurate financial records. Once filed, you will be served with the complaint to deny the discharge.

The debtor knowingly made a false oath or account, presented a false claim, etc. Failure to comply with a bankruptcy court order.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

The court may deny an individual debtor's discharge in a chapter 7 or 13 case if the debtor fails to complete "an instructional course concerning financial management." The Bankruptcy Code provides limited exceptions to the "financial management" requirement if the U.S. trustee or bankruptcy administrator determines ...

Filing for Chapter 7 bankruptcy eliminates credit card debt, medical bills and unsecured loans; however, there are some debts that cannot be discharged. Those debts include child support, spousal support obligations, student loans, judgments for damages resulting from drunk driving accidents, and most unpaid taxes.

When the bankruptcy court denies your discharge in a Chapter 7 case, you remain responsible for paying back all your debts. Denial of your Chapter 7 discharge doesn't end the case, though. The Chapter 7 trustee will still gather and liquidate any non-exempt assets; all you lose is your fresh start free of those debts.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

A Chapter 7 bankruptcy case can be reopened after discharge and case closure under certain circumstances. Bankruptcy Code Section 350(b) authorizes the bankruptcy court to reopen a case for various reasons including to ?administer assets, to relief to the debtor, or for other cause.? Fed.