Maryland Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

Finding the appropriate valid document template can be a challenge. Of course, there are numerous designs available online, but how can you obtain the valid template you need? Utilize the US Legal Forms website.

The service offers a multitude of templates, including the Maryland Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, which you can utilize for business and personal needs. All the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to find the Maryland Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. Use your account to search for the legal forms you have purchased previously. Navigate to the My documents tab of your account and download another copy of the document you need.

Complete, modify, print, and sign the acquired Maryland Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. US Legal Forms is the largest repository of legal templates where you can find a variety of document designs. Use the platform to obtain professionally crafted paperwork that adheres to state regulations.

- If you are a new user of US Legal Forms, follow these simple instructions.

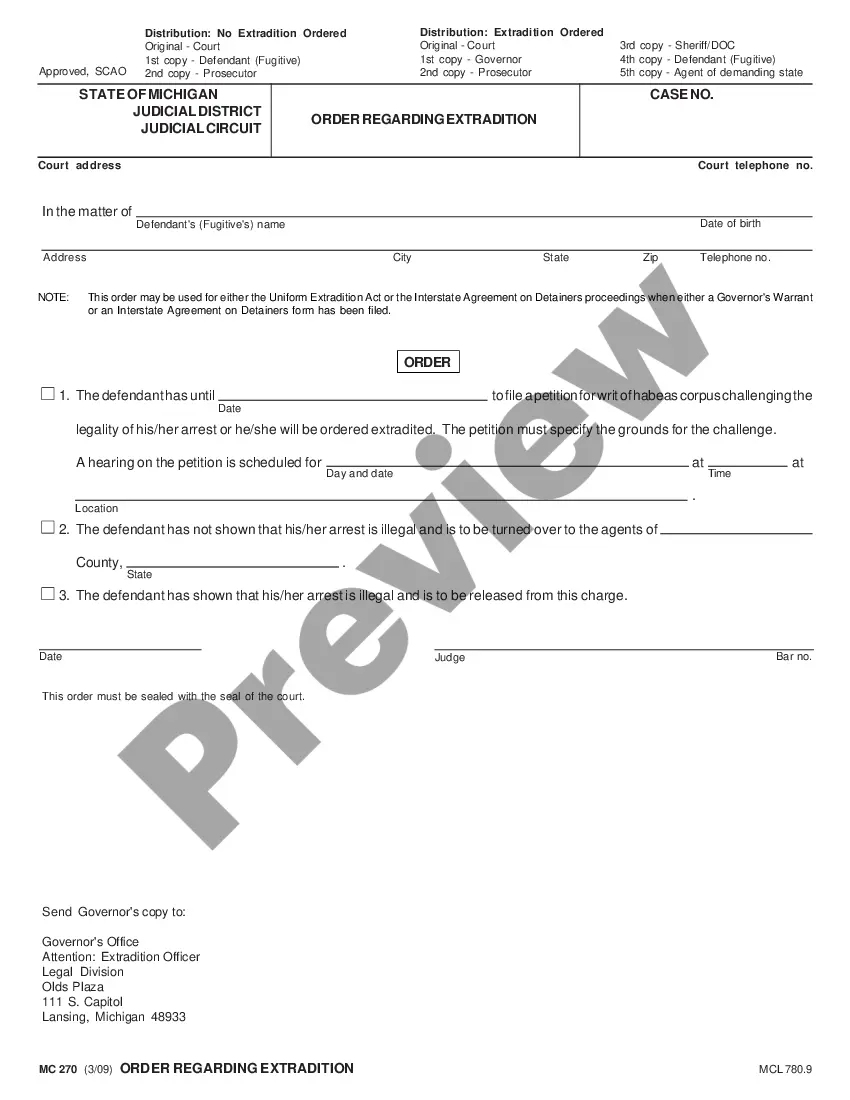

- First, make sure you have selected the correct template for your area/region. You can view the form using the Review button and read the form details to ensure it is the right one for you.

- If the template does not meet your needs, use the Search field to find the right form.

- Once you are confident the form is suitable, click the Get now button to obtain the form.

- Select the pricing plan you desire and enter the required information. Create your account and purchase the order using your PayPal account or Visa or Mastercard.

- Choose the document format and download the valid document template for your requirement.

Form popularity

FAQ

A limitation of liability clause in a service agreement outlines the extent to which one party can be held responsible for any losses or damages. This clause serves to protect both parties by capping potential financial exposure in case of a lawsuit or dispute. Including this clause in your Maryland Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can prevent excessive liabilities and clarify expectations. It's wise to consult legal resources or platforms like uslegalforms to draft and navigate these agreements effectively.

To write an independent contractor agreement, outline the services the contractor will provide and include their payment structure. Clearly state the relationship between the contractor and your business to avoid misclassification issues. Incorporate clauses that address confidentiality, ownership of work, and a limitation of liability clause to protect your assets. A Maryland Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause addresses many of these key aspects efficiently.

When crafting a consultancy agreement, start by clearly defining the scope of work, including deliverables and timelines. Specify payment terms and conditions to ensure both parties understand their financial obligations. It’s essential to incorporate provisions regarding confidentiality and termination to protect your interests. Using a Maryland Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can further safeguard your legal standing.

To become an independent contractor in Maryland, start by choosing a business structure and registering your business. Ensure you obtain any necessary permits and licenses for your specific services. Familiarize yourself with contracts, especially a Maryland Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, to protect yourself legally. Platforms like uslegalforms can help you navigate the paperwork involved in this process.

Writing a contract agreement for services involves outlining the terms clearly. Begin by stating the names of the parties involved and detailing the scope of services provided. Be sure to include payment terms and a limitation of liability clause, especially in a Maryland Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. Using a platform like uslegalforms can simplify this process by providing templates tailored to Maryland's specific requirements.

In Maryland, whether you need a license to operate as a contractor depends on the nature of the work you perform. Many types of contracting work require specific licenses, while others do not. It's crucial to research the requirements based on your services to maintain compliance. A well-drafted Maryland Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can help clarify responsibilities and legal obligations.

A limitation of liability clause for a consultant defines the extent to which a consultant is responsible for damages or losses in the course of providing services. This clause limits the financial exposure of the consultant in case something goes wrong. It acts as a safeguard for consultants, ensuring they are not held liable beyond what is agreed in the contract. Including such clauses in your Maryland Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause is essential for risk management.

As an independent contractor, you typically need to fill out various forms, including tax forms like the IRS W-9. Additionally, any contracts pertinent to your work should be prepared and signed before starting the service. Keeping your documentation organized supports easy access for tax purposes. Utilizing a Maryland Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can streamline this process.

The independent contractor agreement in Maryland is a legal document defining the relationship between a client and an independent contractor. It outlines the terms of service, payment details, and responsibilities of both parties. This agreement protects the interests of both sides while clarifying expectations. Using a comprehensive Maryland Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause ensures clarity in the agreement.

An independent contractor in Maryland is a self-employed individual who provides services to clients without being classified as an employee. These contractors enjoy the freedom to determine how they complete their work while being responsible for their own taxes and insurance. This structure allows various professionals, such as consultants, to operate effectively. Crafters of Maryland Contracts with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can establish clear expectations and protect their interests.