Maryland Motion to Modify or Amend Divorce Decree to Provide for Decrease in Amount of Child Support

Description

How to fill out Motion To Modify Or Amend Divorce Decree To Provide For Decrease In Amount Of Child Support?

Finding the right authorized record template could be a have a problem. Obviously, there are tons of layouts available on the Internet, but how would you discover the authorized form you want? Use the US Legal Forms site. The support delivers a large number of layouts, such as the Maryland Motion to Modify or Amend Divorce Decree to Provide for Decrease in Amount of Child Support, which you can use for business and personal requirements. All of the varieties are checked out by professionals and meet federal and state demands.

In case you are previously registered, log in in your bank account and click the Down load button to have the Maryland Motion to Modify or Amend Divorce Decree to Provide for Decrease in Amount of Child Support. Use your bank account to search with the authorized varieties you might have bought previously. Proceed to the My Forms tab of your respective bank account and get another duplicate of the record you want.

In case you are a new consumer of US Legal Forms, here are basic instructions so that you can comply with:

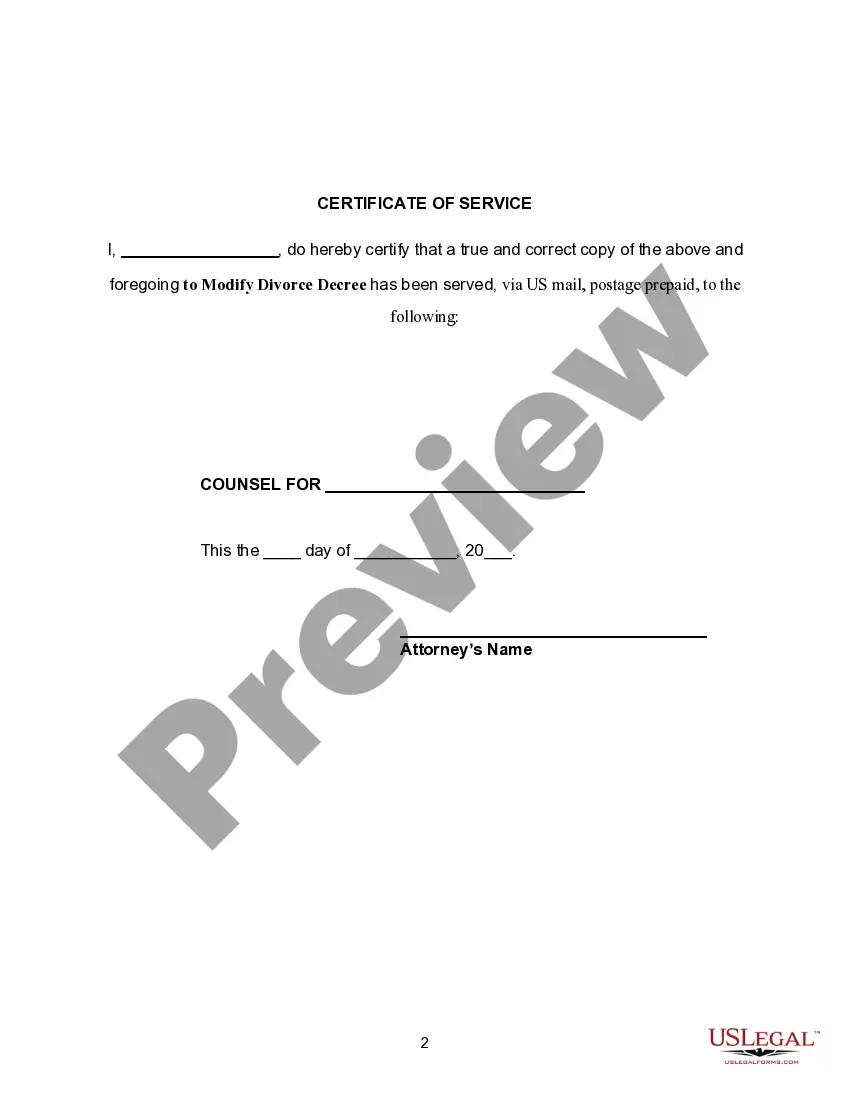

- First, make certain you have chosen the appropriate form for your metropolis/region. You are able to look over the form while using Preview button and browse the form description to guarantee it will be the right one for you.

- In the event the form does not meet your expectations, use the Seach field to obtain the proper form.

- Once you are certain the form would work, click the Get now button to have the form.

- Opt for the costs strategy you want and enter in the required info. Make your bank account and pay for the order using your PayPal bank account or charge card.

- Opt for the submit file format and obtain the authorized record template in your system.

- Full, change and produce and signal the attained Maryland Motion to Modify or Amend Divorce Decree to Provide for Decrease in Amount of Child Support.

US Legal Forms will be the greatest catalogue of authorized varieties in which you can discover different record layouts. Use the company to obtain expertly-made files that comply with express demands.

Form popularity

FAQ

INSTRUCTIONS FOR COMPLETING FORM CC-DR-006 There are three ways you can do this: (1) obtain the service of an attorney to handle your case; (2) go to the child support enforcement office in your county; or (3) file the case yourself by using the Domestic Relations forms.

The minimum child support payment for Maryland is currently set at $2,847 for a combined monthly income of $15,000. The most a person could pay for child support in the state is $180,000 annually, or $15,000 per month.

The Maryland Code of Family Law Section 10?203 establishes the penalties for failure to support a minor child, making it clear that all parents have a legal obligation to provide financial support for their children.

Figure out each parent's actual income. Figure out each parent's adjusted actual income or imputed income. Add up both parents' adjusted actual incomes or their imputed incomes. The combined amount is plugged into the Guidelines chart to determine the "basic child support obligation."

Parents may, and often do, reach agreement relating to the issue of child support. However, because the law requires that a child's best interests must always be paramount, the court must approve a child support settlement, even when the terms are agreed upon by the parties.

Both parents have a legal duty to support their child based on their ability to provide that support. Since 1990, Maryland has had child support guidelines, which provide a formula for calculating child support based on a proportion of each parent's gross income.

For example, basic child support for one child would increase from $1,040 to $1,271 (at the $10,000 aggregate monthly income level), with a maximum for one child of $1,942.

A parent cannot avoid child support obligations by not making enough money on purpose. This is called voluntary impoverishment. In such a situation, the parent with a support obligation is making a free and conscious choice to be without adequate resources (not enough money) to meet their obligation.