Maryland Corporations - Resolution for Any Corporate Action

Description

How to fill out Corporations - Resolution For Any Corporate Action?

Are you presently engaged in a position where you need paperwork for potential business or personal purposes almost every day.

There are numerous authentic document templates available online, but finding reliable ones can be challenging.

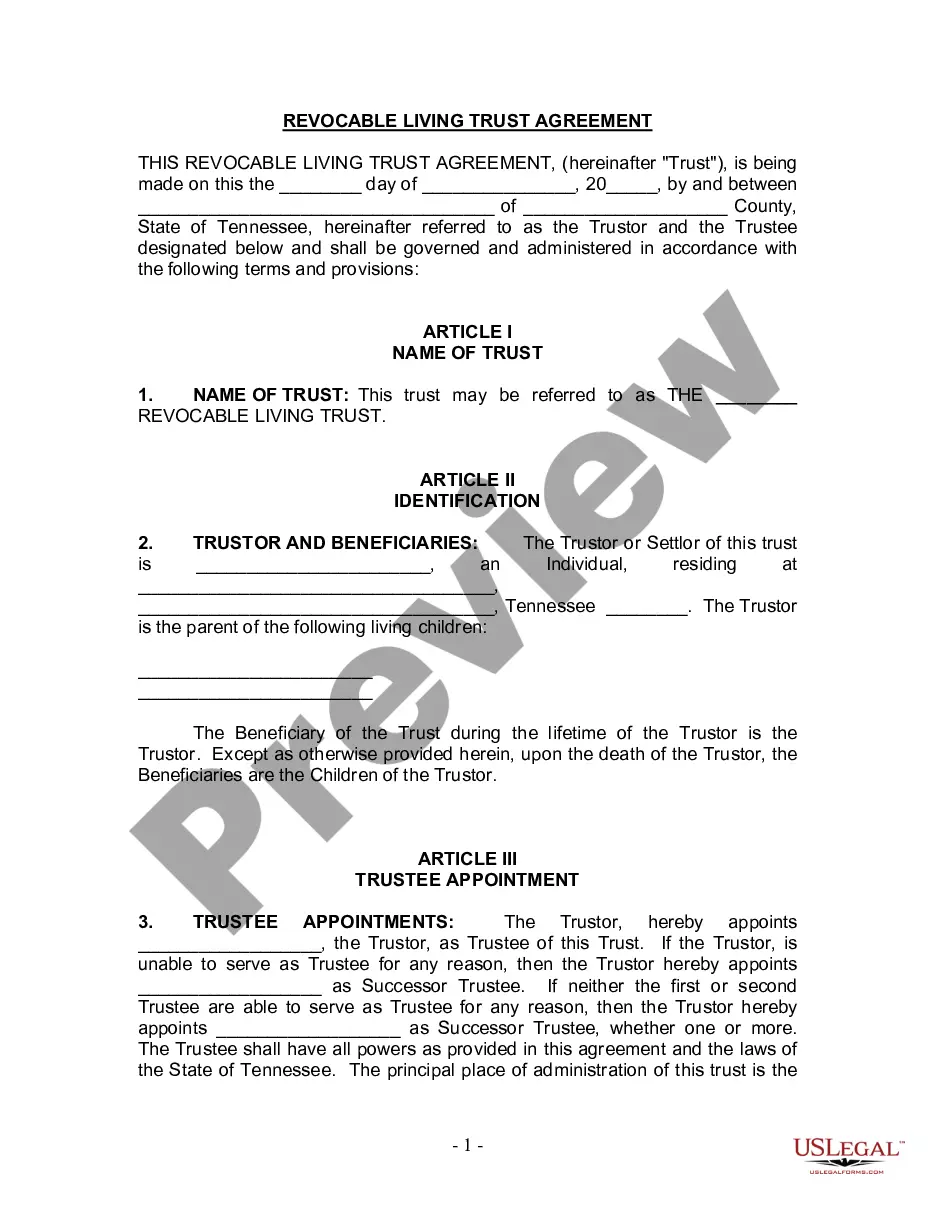

US Legal Forms provides a vast array of form templates, such as the Maryland Corporations - Resolution for Any Corporate Action, designed to comply with federal and state regulations.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Maryland Corporations - Resolution for Any Corporate Action whenever necessary. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Maryland Corporations - Resolution for Any Corporate Action template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the appropriate city/state.

- Use the Review button to check the form.

- Examine the details to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, use the Research section to find a form that fits your needs and requirements.

- Once you find the right form, click Purchase now.

- Choose the payment plan you prefer, enter the required information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

Form popularity

FAQ

No, a sole proprietor in Maryland is not required to file an annual report, unlike corporations and limited liability companies. However, sole proprietors must still adhere to local business licenses and permits. It is important to understand your business structure's requirements under the banner of Maryland Corporations - Resolution for Any Corporate Action.

MD form 510 is filed by corporations, including S Corps and C Corps, operating in Maryland to report their annual income and comply with state tax regulations. All entities must submit this form along with their tax return to avoid penalties. Staying compliant with your filing responsibilities is crucial in the landscape of Maryland Corporations - Resolution for Any Corporate Action.

A corporate signing authority resolution formally designates individuals within the corporation authorized to sign certain documents. This document is essential for ensuring that business transactions are conducted with proper authority and legally binding agreements are recognized. If you need assistance in crafting such a resolution, consider platforms like uslegalforms, focusing on Maryland Corporations - Resolution for Any Corporate Action.

Yes, Maryland recognizes S Corporations, allowing eligible businesses to elect S Corp status for taxation purposes. This status helps avoid double taxation on corporate income, as it passes through to shareholders' personal tax returns. To maintain compliance and leverage benefits, incorporate a solid understanding of your obligations under Maryland Corporations - Resolution for Any Corporate Action.

A corporate resolution for signature authority grants specific individuals the right to sign documents on behalf of the corporation. This resolution ensures that only designated persons can execute contracts and agreements, protecting the integrity of your corporate actions. You can easily manage these resolutions through resources like uslegalforms, specifically designed for Maryland Corporations - Resolution for Any Corporate Action.

Creating a corporate resolution in Maryland involves drafting a document that clearly states the decision made by the board of directors or shareholders. You'll need to include specific details like the date, resolution details, and signatures of the involved parties. Having a well-documented corporate resolution is crucial for maintaining compliance and clarity in your operations, especially when dealing with Maryland Corporations - Resolution for Any Corporate Action.

In Maryland, an LLC and an S Corporation both offer liability protection to their owners, but they differ in structure and taxation. LLCs provide flexible management and pass-through taxation, meaning profits are taxed on the owners' personal tax returns. On the other hand, S Corps have more formalities and can potentially reduce self-employment taxes, making each structure suitable for specific business goals under Maryland Corporations - Resolution for Any Corporate Action.

The purpose of a corporate resolution is to formally document decisions made by a corporation’s board of directors or shareholders. This process ensures that actions taken are legally valid and recorded for future reference. For Maryland Corporations - Resolution for Any Corporate Action, these resolutions provide a solid framework for corporate governance and help maintain clear records.

To obtain the Maryland State Department of Assessments and Taxation (SDAT), you can visit their website and search for your corporation’s information. Alternatively, you may contact them directly for any forms or specific inquiries. This information is important for Maryland Corporations - Resolution for Any Corporate Action since proper documentation is essential for compliance.

A corporate resolution to sell stock is a formal decision made by a corporation's board to authorize the sale of a specified number of shares. This document details the terms of the sale, ensuring all legal requirements are met. It's one of the crucial steps under Maryland Corporations - Resolution for Any Corporate Action, which ensures the sale aligns with corporate governance.