Maryland Commercial Partnership Agreement in the Form of a Bill of Sale

Description

How to fill out Commercial Partnership Agreement In The Form Of A Bill Of Sale?

US Legal Forms - one of the largest repositories of legal templates in the United States - offers a diverse selection of legal document categories that you can obtain or create.

By utilizing the platform, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords.

You can find the latest versions of documents like the Maryland Commercial Partnership Agreement formatted as a Bill of Sale in just moments.

Review the document description to confirm you’ve chosen the correct template.

If the document does not meet your requirements, utilize the Search section at the top of the screen to find one that does.

- If you already have an account, Log In to access the Maryland Commercial Partnership Agreement formatted as a Bill of Sale in the US Legal Forms repository.

- The Download button will appear on every document you view.

- You can find all previously downloaded documents in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you’ve selected the appropriate template for your location/region.

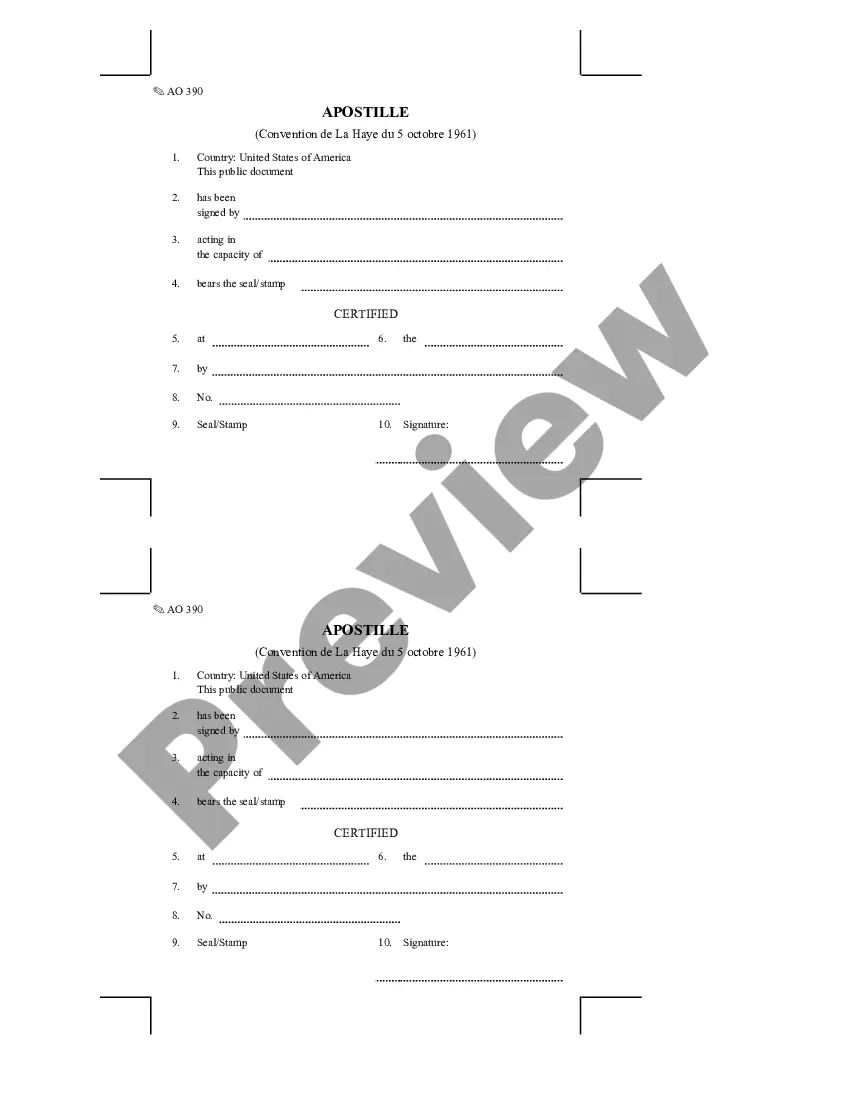

- Click the Preview button to examine the content of the document.

Form popularity

FAQ

In Maryland, both parties do not need to be present to transfer a title, but it is highly recommended. When executing a Maryland Commercial Partnership Agreement in the Form of a Bill of Sale, having both the buyer and seller involved can help resolve any questions or issues on the spot. To simplify this process, consider using uslegalforms for templates and instructions, so you're well-prepared for the transaction.

Yes, Maryland is often referred to as a two-title state because it issues a title for both the vehicle and its ownership. This means that each vehicle transaction may require a Maryland Commercial Partnership Agreement in the Form of a Bill of Sale, along with the vehicle title transfer. Understanding both titles is crucial for a smooth transaction. You can find useful resources on uslegalforms to guide you through this process.

Reading a Maryland title requires you to understand the various sections outlined on the document. Look for information such as the vehicle identification number (VIN), the owner's name, and the title's effective date. If you're considering a Maryland Commercial Partnership Agreement in the Form of a Bill of Sale, the title will also play a key role in establishing ownership. For clarity, consider using tools available on uslegalforms to ensure you interpret the details correctly.

A partnership agreement should stipulate the roles of each partner, how profits and losses will be shared, the decision-making process, procedures for adding or removing partners, and conditions for dissolving the partnership. These elements help create a strong foundation for your business partnership. Incorporating a Maryland Commercial Partnership Agreement in the Form of a Bill of Sale can effectively cover these crucial areas.

To write up a business partnership agreement, ensure you cover essential elements such as the partnership name, business purpose, and the contributions of each partner. Clearly delineate the financial arrangements, including how profits and losses will be managed. A comprehensive Maryland Commercial Partnership Agreement in the Form of a Bill of Sale can guide you through this process, ensuring all vital aspects are addressed.

Writing a partnership agreement for a business starts with outlining the basic terms of the partnership, including duration, purpose, and partners involved. It is crucial to detail how profits and losses will be shared and under what conditions a partner can leave the partnership. Utilizing a Maryland Commercial Partnership Agreement in the Form of a Bill of Sale simplifies this task by offering a structured template.

Structuring a business partnership involves defining the roles and responsibilities of each partner, as well as establishing the decision-making process. Consider the ownership percentages and how profits and losses will be shared amongst partners. Having a solid Maryland Commercial Partnership Agreement in the Form of a Bill of Sale helps ensure clarity and prevent future disputes.

To write a business partnership proposal, start by clearly stating the purpose of the partnership. Include details about the roles, responsibilities, and contributions of each partner. Make sure to specify how the partnership aligns with your business goals. A well-drafted Maryland Commercial Partnership Agreement in the Form of a Bill of Sale can serve as a guiding document throughout this process.

Yes, in Maryland, you can obtain a title using a bill of sale, but you must ensure it includes all required information. The bill of sale acts as proof of ownership and should be accompanied by the title application when submitted to the Maryland Vehicle Administration. If you’re establishing a Maryland Commercial Partnership Agreement in the Form of a Bill of Sale for a vehicle, ensure all documents are complete to facilitate a smooth title transfer.

Filing Form 1 late in Maryland may incur late fees and could jeopardize your business’s standing. These penalties can hinder your plans, especially if you're working on a Maryland Commercial Partnership Agreement in the Form of a Bill of Sale that relies on timely submissions. To avoid these issues, utilize a system to keep track of due dates for filing necessary documents to keep everything on track.