Maryland Sample Letter for Agreement to Compromise Debt

Description

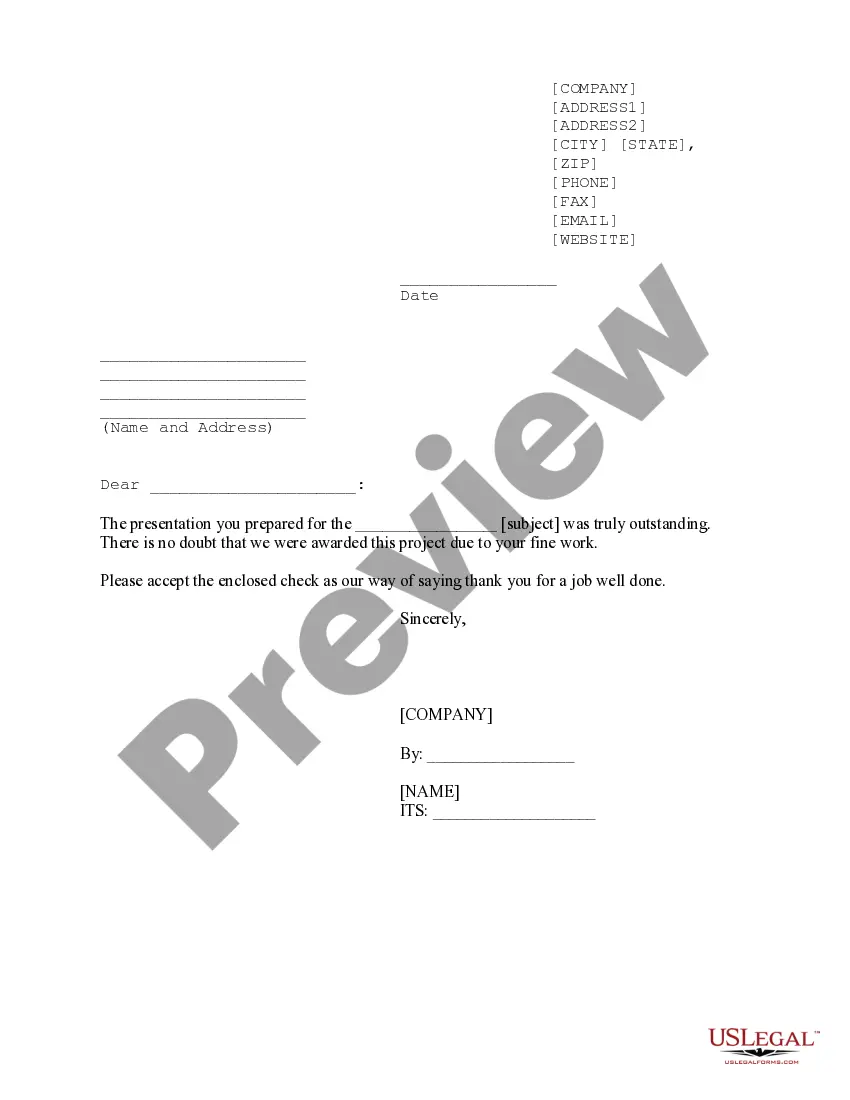

How to fill out Sample Letter For Agreement To Compromise Debt?

Are you in a circumstance where you require documents for potential business or particular objectives almost every day.

There are numerous legal document templates accessible online, but finding forms you can trust isn’t easy.

US Legal Forms offers thousands of document templates, including the Maryland Sample Letter for Agreement to Compromise Debt, which are designed to comply with federal and state regulations.

Once you have the right form, click Acquire now.

Choose the payment plan you prefer, complete the necessary information to create your account, and process your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Then, you can download the Maryland Sample Letter for Agreement to Compromise Debt template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct jurisdiction/state.

- Use the Review button to inspect the form.

- Check the description to confirm that you have selected the appropriate document.

- If the form isn’t what you are looking for, use the Search field to locate the form that fits your needs and requirements.

Form popularity

FAQ

To fill out a debt validation letter, begin by adding your information at the top, along with the debt collector's details. Include a clear statement requesting validation of the debt, followed by details such as account numbers and amounts. Incorporating a Maryland Sample Letter for Agreement to Compromise Debt can assist you in ensuring your letter is thorough and professional, ultimately benefiting your negotiations.

Yes, sending a debt validation letter is a wise strategy when dealing with debt collectors. It ensures that you are aware of your rights and the legitimacy of the debt being claimed. Utilizing a Maryland Sample Letter for Agreement to Compromise Debt can guide you in preparing an effective letter. This approach also adds a layer of protection against potential errors or fraudulent claims.

An example of debt validation involves a letter you send to a creditor, asking them to prove that you owe the debt they claim. This can include requesting documentation, such as the original contract or account statement. By using a Maryland Sample Letter for Agreement to Compromise Debt, you can effectively structure your request, ensuring all necessary details are covered.

Filling out a debt validation letter requires including specific information. Start with your name and address, followed by the debt collector's name and address. Then, clearly state your request for validation of the debt, referencing the Maryland Sample Letter for Agreement to Compromise Debt as a template can be very helpful. This letter should also include relevant details about the debt in question.

Maryland Form 510C is a tax form specifically designed for individuals who are claiming deductions for certain tax credits or adjusting prior year taxes. It serves as an important supplement in the tax filing process. Utilizing accurate forms is crucial, particularly when exploring options like a Maryland Sample Letter for Agreement to Compromise Debt.

Form 656 is the official document used by taxpayers to formally present an offer in compromise to the IRS. This form requires detailed financial information to evaluate your request for a reduced tax liability. When preparing your submission, you might consider referencing a Maryland Sample Letter for Agreement to Compromise Debt as a guideline.

A letter of negotiation for debt collection is a written communication that requests to settle a debt for less than the full owed amount. This letter outlines your financial circumstances and proposes a payment or settlement plan. A well-crafted Maryland Sample Letter for Agreement to Compromise Debt can serve as an effective tool in these negotiations.

Maryland Form 500 is a state tax return used to report income by individual residents of Maryland. This form is essential for those who must file state taxes, and it helps determine any taxes owed or refunds due. It's a key document in financial management, especially when considering a Maryland Sample Letter for Agreement to Compromise Debt.

The 777 rule suggests that you should aim to settle your debt for approximately 70% to 80% within seven months of the last payment. This guideline helps you approach negotiations effectively while ensuring you stay within a manageable timeframe. By using a Maryland Sample Letter for Agreement to Compromise Debt, you can initiate discussions with your creditors and set the stage for reaching a settlement that works for both parties.

A debt agreement should be straightforward and include key elements such as the parties involved, debt amount, and settlement terms. Make sure to specify the payment methods and deadlines to avoid future confusion. A Maryland Sample Letter for Agreement to Compromise Debt can serve as a valuable resource, helping you format the document correctly while covering all essential details for a smooth resolution.