Maryland Employment Application for Accountant

Description

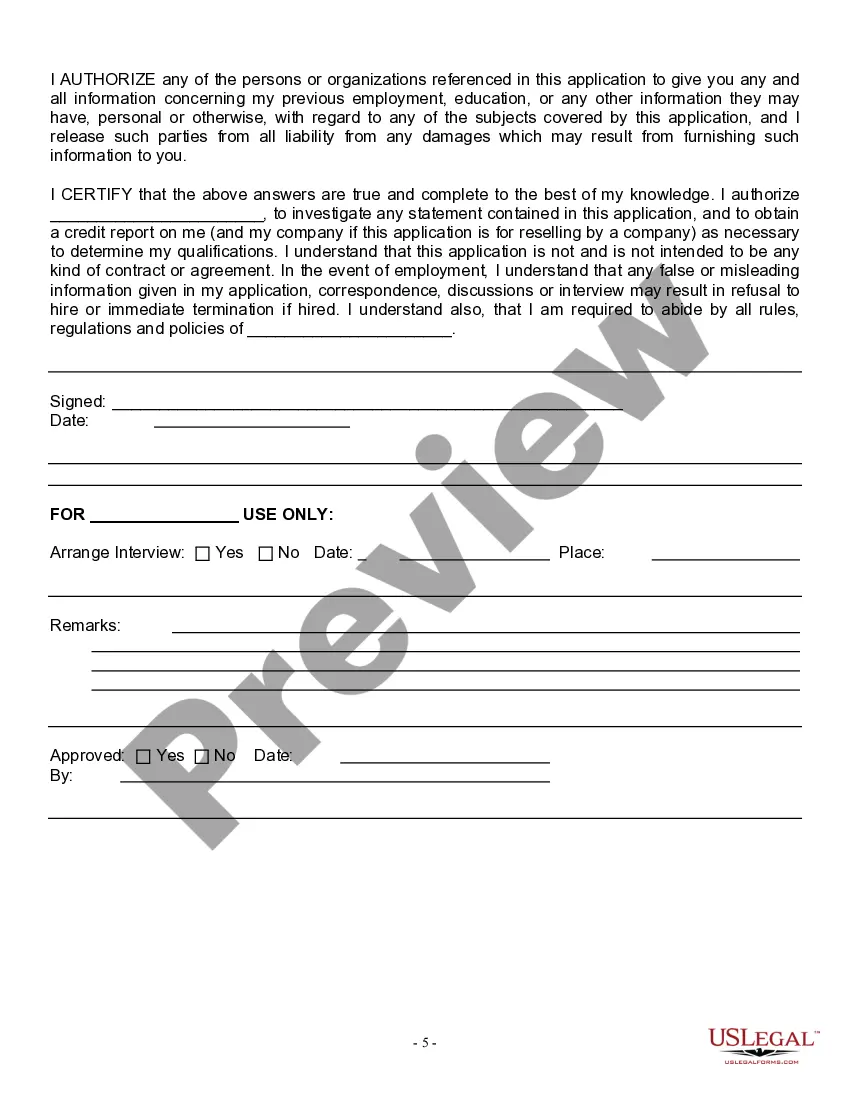

How to fill out Employment Application For Accountant?

It is feasible to invest hours online looking for the legal document format that complies with the state and federal requirements you desire.

US Legal Forms offers a vast array of legal documents that are verified by professionals.

You can effortlessly download or print the Maryland Employment Application for Accountant from the service.

Review the document description to ensure you have chosen the appropriate form.

- If you already possess a US Legal Forms account, you may Log In and then hit the Download button.

- Afterward, you can complete, edit, print, or sign the Maryland Employment Application for Accountant.

- Every legal document format you purchase is yours permanently.

- To obtain another copy of the purchased document, navigate to the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, confirm that you have selected the correct format for your state/city of interest.

Form popularity

FAQ

The first phase towards becoming qualified begins with registering at any accredited institution that offers a Bachelor of Commerce: Accounting or a Bachelor of Science: Accounting and Finance degree or diploma. A National Senior Certificate that meets the requirements for a diploma or degree course is a prerequisite.

What does a Staff Accountant do? Staff Accountants prepare and review financial documents, reports, and statements. They oversee all accounting procedures (e.g. tax returns, month-end closures, budgeting) and advise on general financial matters.

Alberta Post-Secondary Institutions Degree ProgramsThe quickest path to becoming a Chartered Professional Accountant is to get a bachelor's degree in accounting. Here is a list of Alberta post-secondary institutions that offer degree programs recognized by the CPA profession.

Staff accountants must possess strong time management and analytical skills, attention to detail, and solid communication abilities. Candidates must have a bachelor's degree in accounting or finance. Strong technology skills are critical, particularly expertise with Microsoft Excel.

A Staff Accountant is an important position in many large businesses. A Staff Accountant aids in preparing financial forms and statements on behalf of the company. In addition to this, a Staff Accountant analyzes financial information and informs management of the best practices the field of accounting.

Staff accountant A mid-level accounting position between junior accountant and senior accountant. At public accounting firms, staff accountant may be an entry-level position. Staff accountants typically have bachelor degrees but are not necessarily Certified Public Accountants.

You can, in fact, become an accountant without an accounting degree. If your bachelor's degree is in something other than accounting, having at least two years of work experience can qualify you to take the CMA exam.

Aspiring accountants need a bachelor's degree in accounting or business to begin work in the field. A bachelor's degree usually takes about four years and 120 credits to complete. Those with an associate degree might enter the field as bookkeepers or accounting clerks.

Staff accountants hold more credentials and train for more specific or higher-level tasks. Entry-level accountants can focus more on balance sheets, budgeting and expense tracking, whereas a staff accountant may complete larger projects like helping with budget expansions or planning for large purchases.

While not always required, most accountants have a bachelor's degree in accounting or finance. Tax accountants who take courses in tax law are particularly well prepared for their profession. Some employers seek out tax accountants that have master's degrees in accountancy or business administration.