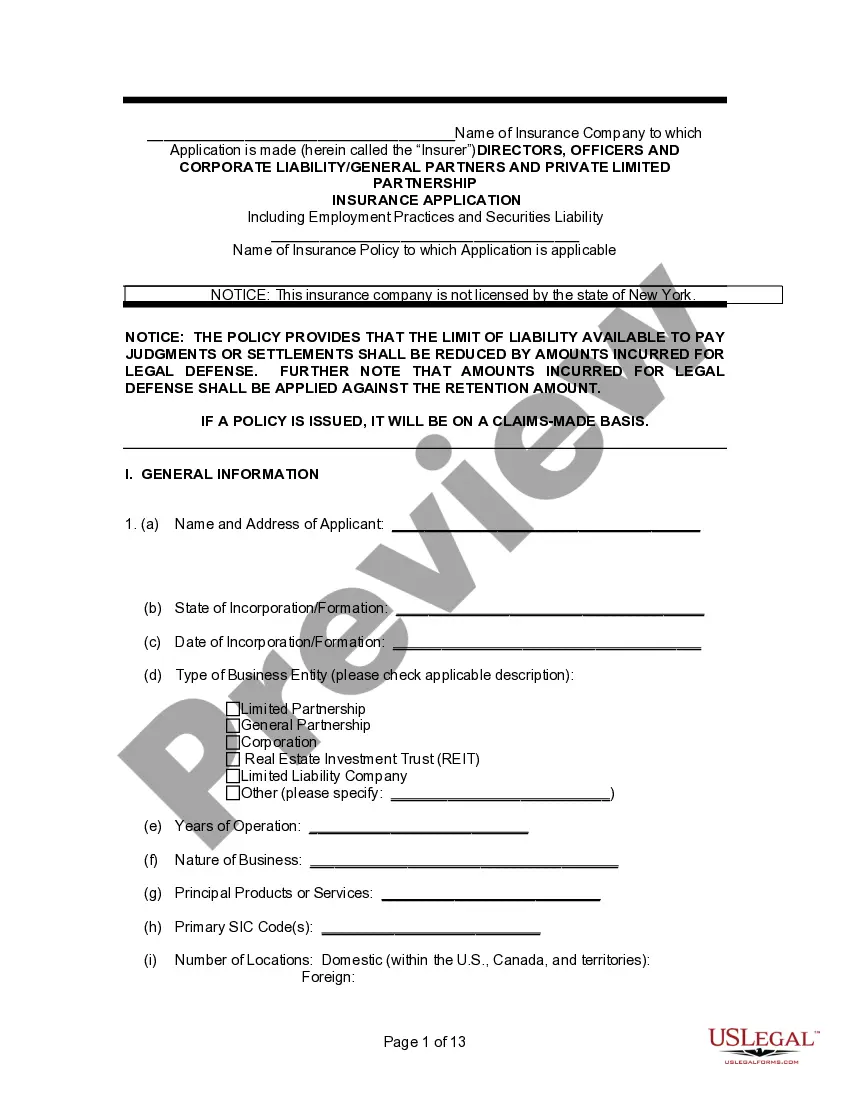

Maryland Self-Insured Employers Application To Add A Subsidiary is an application form used by employers who are self-insured in Maryland to add a subsidiary to their existing self-insurance plan. This application is used to provide the state with detailed information about the company, the subsidiary, and the insurance coverage that will be provided. There are two types of Maryland Self-Insured Employers Application To Add A Subsidiary: one for Group Self-Insured Employers and one for Non-Group Self-Insured Employers. The application requires detailed information about the company and the subsidiary, including legal documents, financial statements, and a description of the insurance coverage that will be provided. The application must be completed in full and submitted to the Maryland Insurance Administration for approval. Once approved, the employer will be able to add the subsidiary to their self-insured plan.

Maryland Self-Insured Employers Application To Add A Subsidiary

Description

How to fill out Maryland Self-Insured Employers Application To Add A Subsidiary?

How much duration and resources do you generally allocate towards creating official documents.

There is a more efficient method to obtain such forms than employing legal professionals or squandering hours searching online for an appropriate template.

Another advantage of our service is that you can retrieve previously downloaded documents that you securely keep in your profile under the My documents tab. Access them anytime and re-complete your paperwork as frequently as needed.

Conserve time and energy when preparing formal documents with US Legal Forms, one of the most reliable online services. Register with us today!

- Browse the form content to ensure it adheres to your state’s regulations. To verify this, consult the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, find an alternative using the search feature at the top of the page.

- If you possess an account with us, Log In and download the Maryland Self-Insured Employers Application To Add A Subsidiary. Otherwise, move on to the next steps.

- Click Buy now once you locate the appropriate document. Select the subscription plan that best fits your needs to access the complete offerings of our library.

- Register for an account and pay for your subscription. You can complete your payment using your credit card or through PayPal - our service is entirely trustworthy for that.

- Download your Maryland Self-Insured Employers Application To Add A Subsidiary onto your device and complete it on a physical hard copy or digitally.

Form popularity

FAQ

The rate for serious disability in Maryland comp is 75% of your AWW, not to exceed $1,004/week. Therefore, an award of 250 weeks with a maxed out average weekly wage would be worth around a quarter of a million dollars.

Businesses do not have to provide workers' compensation benefits to independent contractors or self-employed workers. An independent contractor provides their services to a business but is not formally classified as an employee.

With few exceptions, every employer in the State of Maryland with one or more employees is required by law to provide workers' compensation coverage for their employees.

Maryland's Workers' Compensation Law provides a way for employees who are injured on the job to receive payment for lost wages and medical expenses related to the injury. Almost every Maryland employer is required to have workers' compensation insurance to pay the cost of employee injury.

Maryland Workers' Compensation Requirements Corporate officers are included for coverage, but can elect to be exempt. LLC Members who provide a service for monetary compensation are statutorily covered. Those covered, but owning more than 20% or more interest in the LLC may elect to be exempt.

If you are deemed to be an independent contractor, no one is liable for your injuries sustained on the job. However, if the person for whom you were doing the work should have been paying you and treating you as an employee, they will be liable.

Businesses do not have to provide workers' compensation benefits to independent contractors or self-employed workers. An independent contractor provides their services to a business but is not formally classified as an employee.