Maryland Nominal Bond of Personal Representative

Description

Key Concepts & Definitions

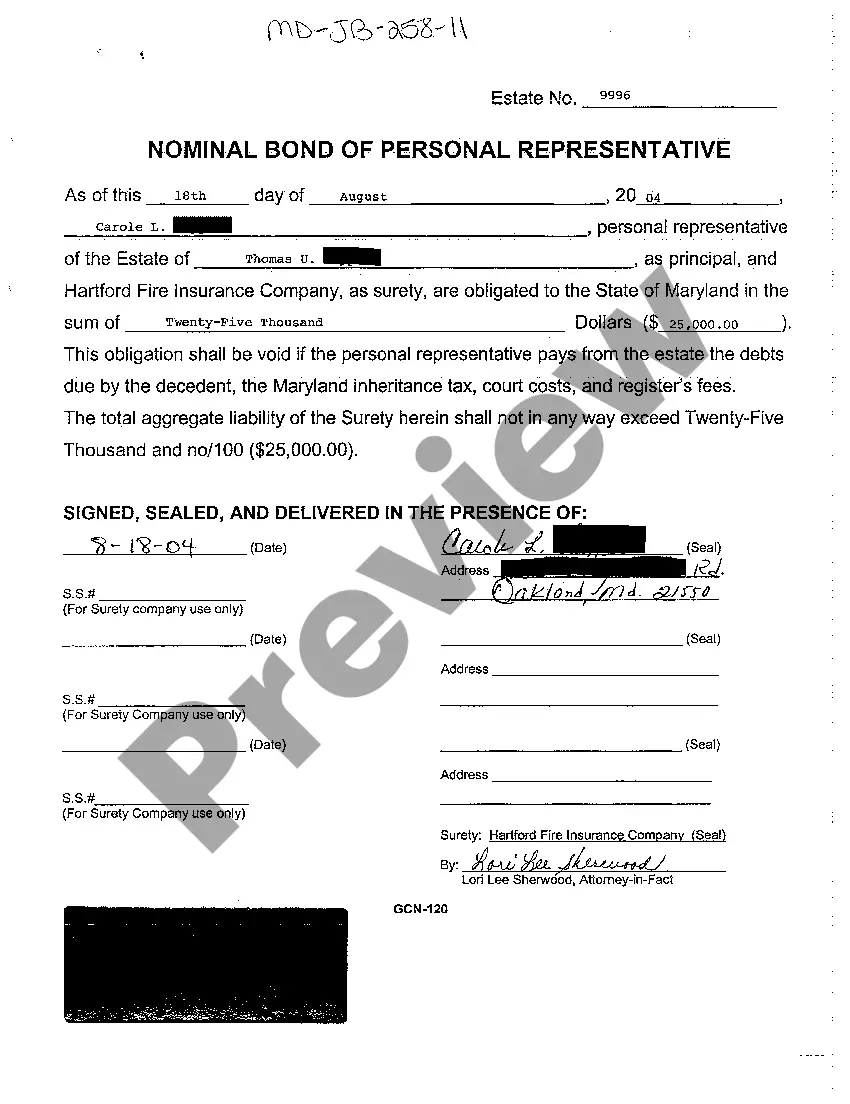

A03 Nominal Bond of Personal Representative: A bond issued by the personal representative of an estate as part of the probate process. This bond is essentially a form of insurance that protects the estate's beneficiaries against improper management of the estates assets by the personal representative.

Step-by-Step Guide

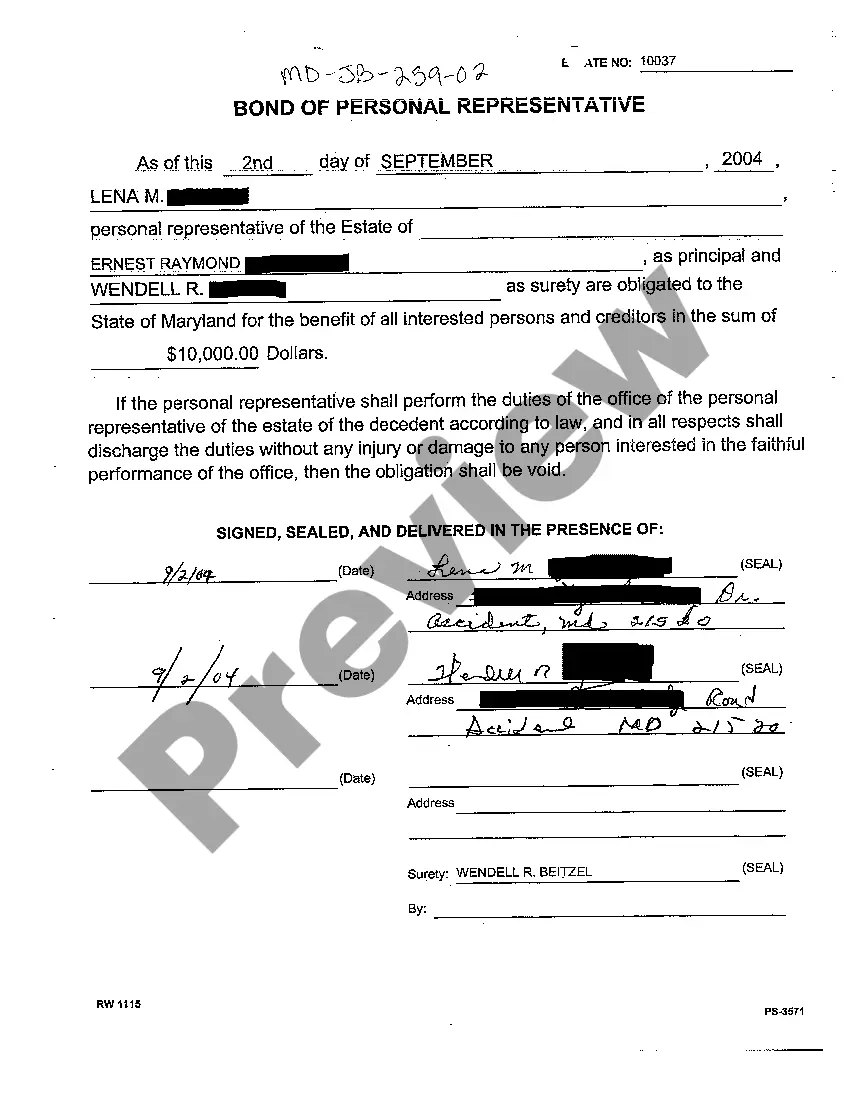

- Understand the Requirement: Determine if the probate court requires a bond for personal representatives in your jurisdiction.

- Select a Bond Provider: Choose a reputable company that issues surety bonds. Make sure they are licensed to operate in your state.

- Submit the Necessary Documents: Provide documents such as the will, the death certificate, and a list of the estates assets.

- Determine the Bond Amount: Generally, the bond amount is based on the value of the estate's assets. The court typically sets the required amount.

- Pay for and Secure the Bond: Pay the premium, which is a percentage of the bond amount, to secure the bond.

- File the Bond with the Probate Court: Submit the bond to the court as part of the estate administration process.

Risk Analysis

- Financial Risk: Failure to secure a bond when required can lead to personal financial liability for the personal representative.

- Legal Risk: Improper management without a bond in place can result in legal action against the personal representative.

- Reputational Risk: Non-compliance with bonding requirements can damage the personal representatives reputation, affecting future fiduciary appointments.

Best Practices

- Consult with an Attorney: Legal advice is crucial in understanding the specifics of estate administration and bonding requirements.

- Keep Detailed Records: Maintain meticulous records of all transactions and decisions regarding the estates assets.

- Communicate Transparently: Regularly update the beneficiaries and the court on the progress of estate management.

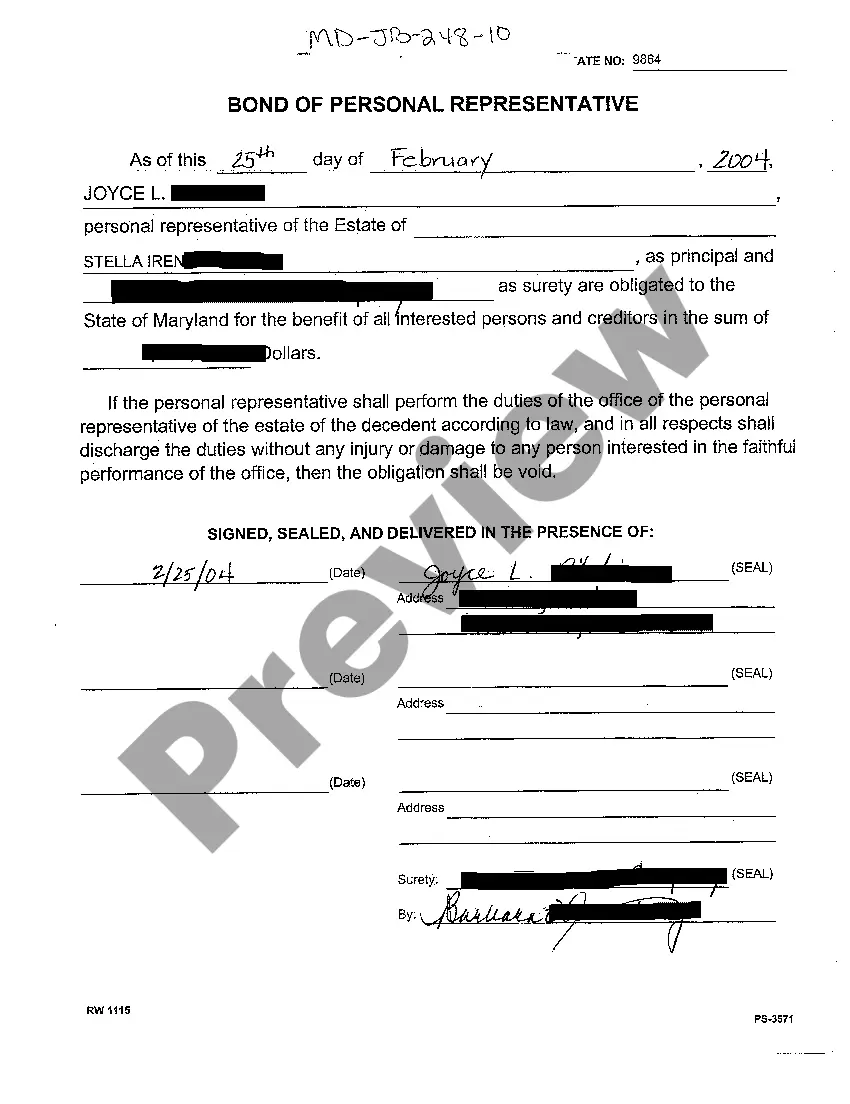

How to fill out Maryland Nominal Bond Of Personal Representative?

Greetings to the most extensive legal document repository, US Legal Forms. Here you will discover any template including Maryland Nominal Bond of Personal Representative documents and download them (as many as you desire/require). Prepare official files in just a few hours, rather than days or weeks, without spending a fortune with a legal expert. Obtain your state-specific template in a handful of clicks and feel assured knowing that it was created by our experienced legal professionals.

If you’re already a subscribed user, simply Log In to your account and click Download next to the Maryland Nominal Bond of Personal Representative you need. Since US Legal Forms is an online service, you will always have access to your downloaded documents, regardless of the device you are using. Find them within the My documents section.

If you do not have an account yet, what are you waiting for? Follow our instructions below to get started.

Once you’ve finalized the Maryland Nominal Bond of Personal Representative, send it to your attorney for review. It’s an extra step but a vital one to ensure you’re completely protected. Register for US Legal Forms now and receive a large number of reusable templates.

- Verify its applicability for your state if this is a state-specific template.

- Review the description (if available) to determine if it’s the appropriate template.

- View additional content with the Preview feature.

- If the template meets all of your needs, simply click Buy Now.

- To create an account, select a pricing option.

- Sign up using a credit card or PayPal account.

- Save the template in the format you need (Word or PDF).

- Print the document and complete it with your/your business’s details.

Form popularity

FAQ

The Estate Administration Act states that a personal representative must have a probate bond.The court may also require a bond, at its discretion, if any interested party applies to the court to request one. In such cases, a bond is required whether or not the personal representative is an Alberta resident.

The Maryland statutes say that the maximum personal representative fee is 9 percent of the estate's value if the estate is worth $20,000 or less. That would equal $900 on a $10,000 estate. The fee is $1,800 for estates greater than $20,000, plus 3.6 percent of the estate's value over $20,000.

A nominal bond of personal representative, also known as a bond of personal representative, is a type of protection to ensure the person fulfilling the job of a personal representative of an estate will do so lawfully and rightfully.

A nominal bond (also referred to as a conventional bond in Canada and the U.K.) is a bond which makes payments of a fixed amount, rather than a fixed real (inflation-adjusted) value. Most bonds are nominal, so the term is normally used only when contrasting nominal bonds with real-return bonds such as I Bonds or TIPS.