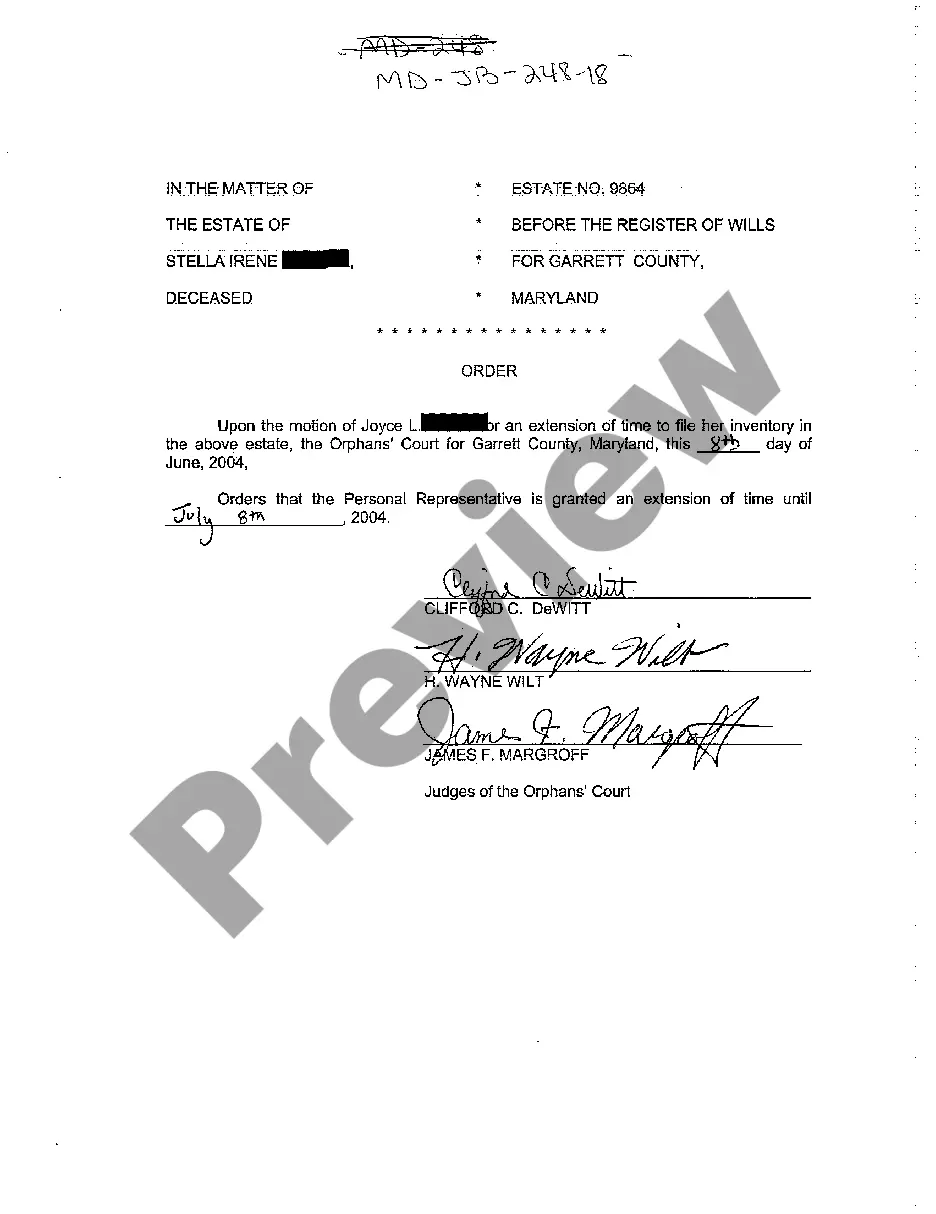

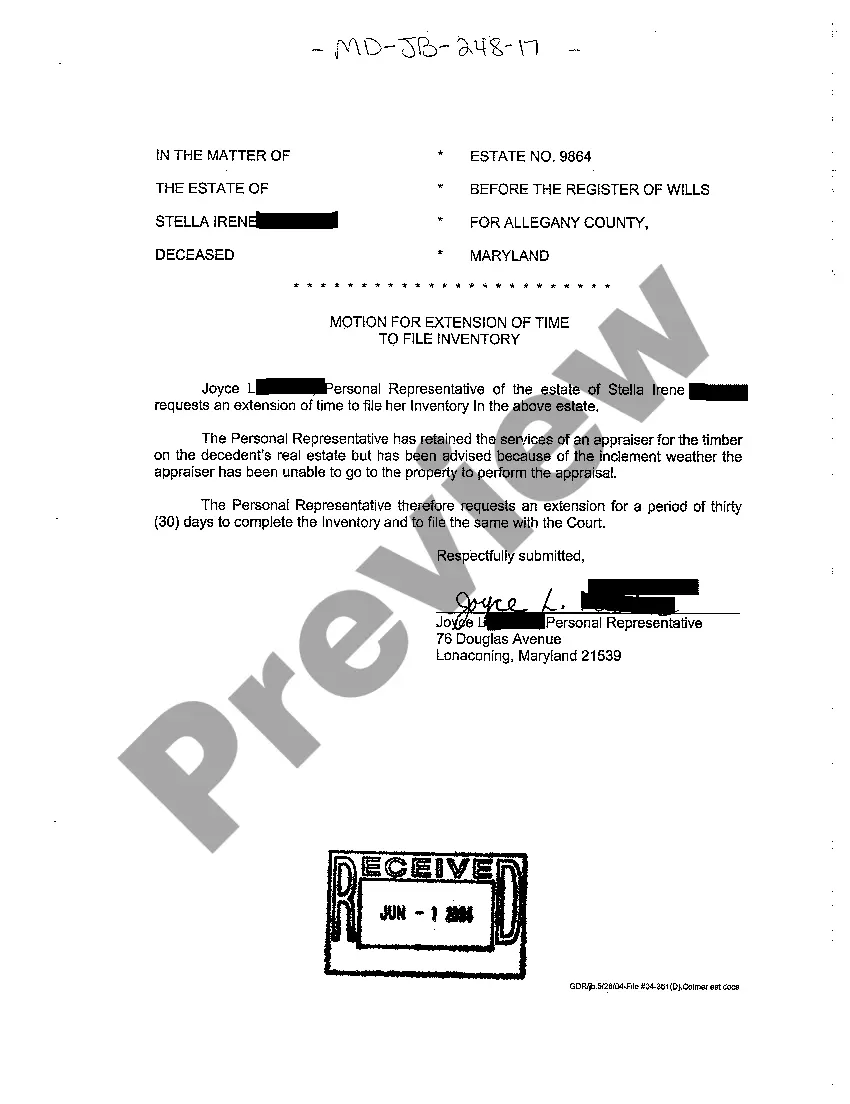

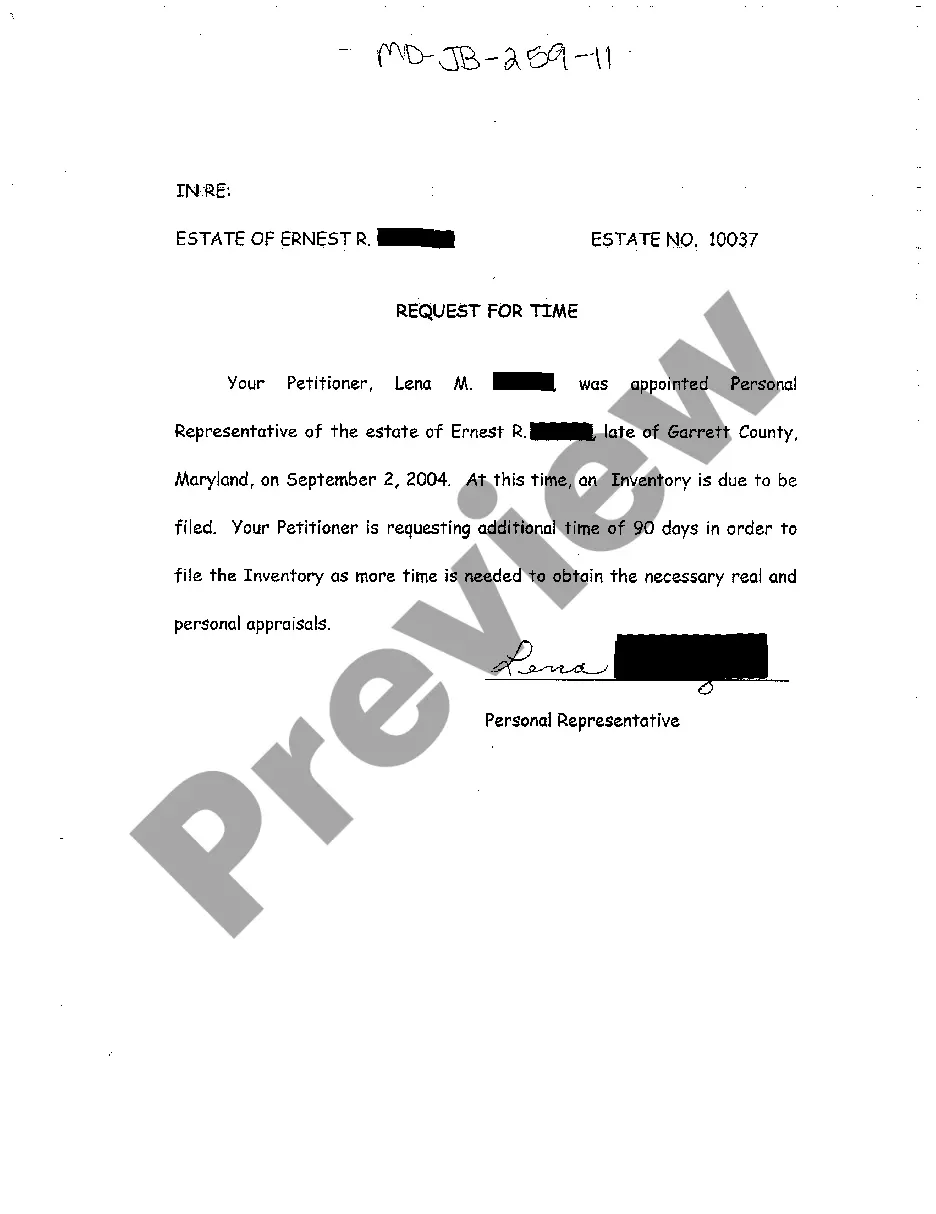

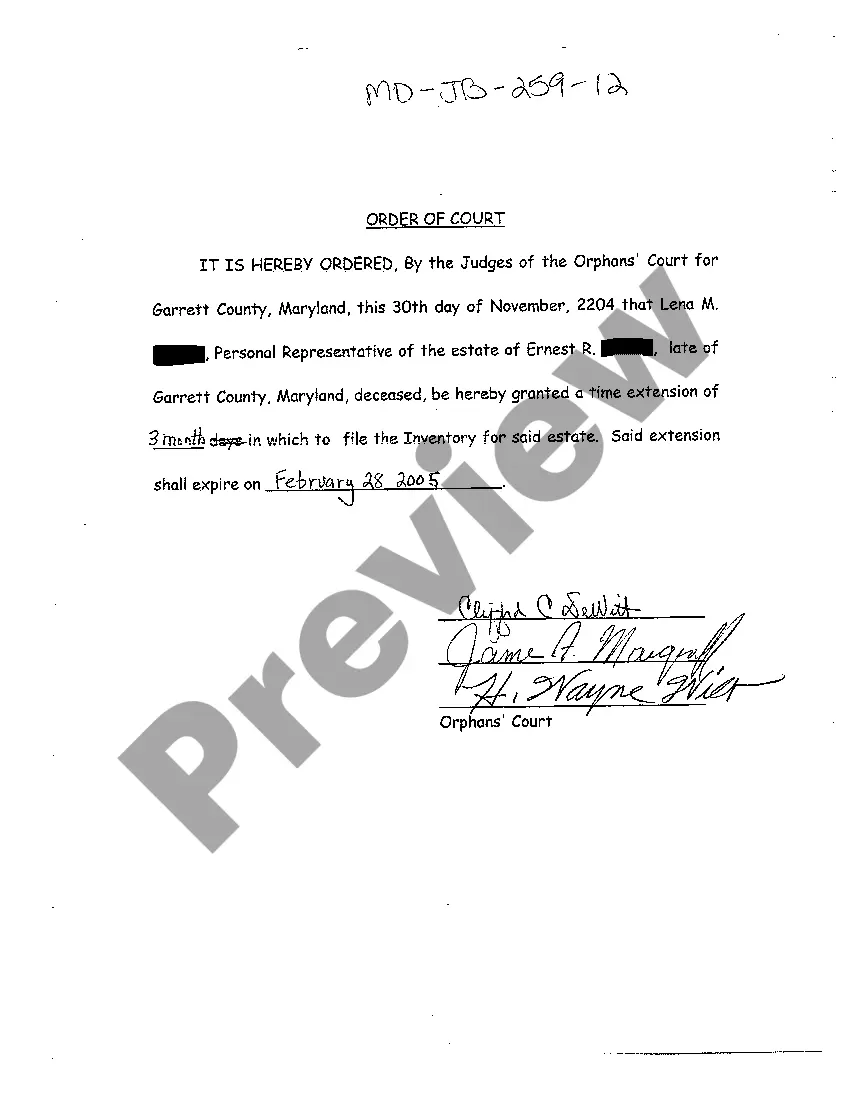

Maryland Order Granting Extension of Time to File Inventory

Description

How to fill out Maryland Order Granting Extension Of Time To File Inventory?

Greetings to the most essential legal documents library, US Legal Forms. Here you can discover any template including Maryland Order Granting Extension of Time to File Inventory templates and obtain them (as many as you prefer/require). Prepare official documents in just a few hours, instead of days or weeks, without shelling out a fortune with a legal expert.

Get your state-specific template in clicks and feel assured with the assurance that it was crafted by our licensed attorneys.

If you’re already a registered user, just Log In to your account and click Download next to the Maryland Order Granting Extension of Time to File Inventory you require. Because US Legal Forms is online, you’ll always have access to your saved documents, regardless of the gadget you’re using. Find them in the My documents section.

- If you don't have an account yet, what are you waiting for.

- Review our instructions below to get started.

- If this is a state-specific document, confirm its legitimacy in the state where you reside.

- Check the description (if available) to ensure it’s the appropriate template.

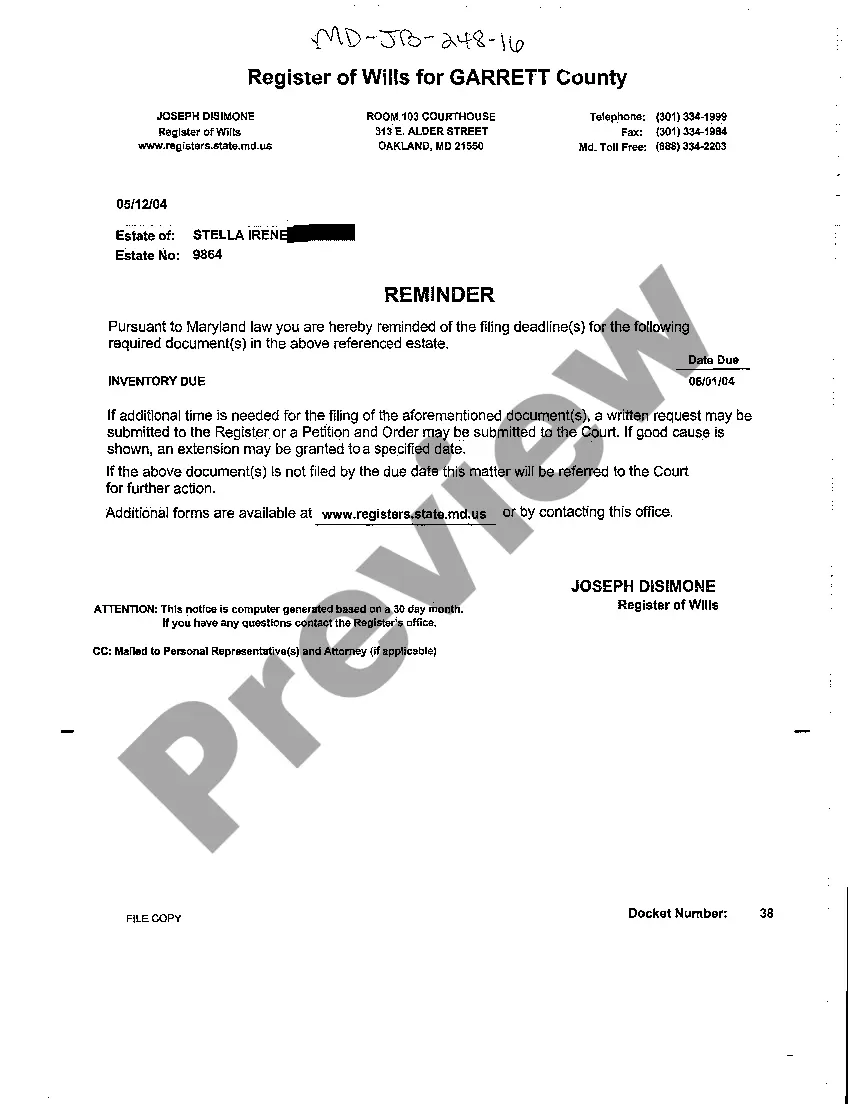

- View additional content with the Preview option.

- If the template meets all of your requirements, click Buy Now.

- To create an account, select a subscription plan.

- Utilize a credit card or PayPal account to sign up.

- Download the document in the format you need (Word or PDF).

- Print the file and fill it out with your/your business’s details.

- After you’ve completed the Maryland Order Granting Extension of Time to File Inventory, send it to your attorney for validation.

- It’s an extra step but a vital one for ensuring you’re completely protected.

- Become a member of US Legal Forms now and access thousands of reusable templates.

Form popularity

FAQ

In Maryland, you can renew a judgment indefinitely, but it must be done within the limitations set by state law. Each renewal extends the life of the judgment for another ten years. If you require additional time to file related documents, consider obtaining a Maryland Order Granting Extension of Time to File Inventory for peace of mind.

Apply extension in Minutes With our step-by-step filing process and clear help text, you can easily e-file your Form 7004 with the IRS in minutes.

Maryland law provides an extension of time to file, but in no case can an extension be granted for more than seven months beyond the original due date. To access Form 510E, from the main menu of the Maryland return, select Miscellaneous Forms and Schedules > Extension (Form 510E).

Extensions - Maryland allows an automatic extension if a federal extension is filed with the IRS and no Maryland tax is due. This extension is for filing only and does NOT extend the time to pay.

Maryland Court of Appeals: Full cite with pin point page: Lansdowne v. State, 287 Md. 232, 239 (1980). Short cite: Landsdowne, 287 Md.

If you cannot file your Colorado income tax return by the extended deadline of May 17, 2021, you may take advantage of the state's automatic six-month extension of time to file.If you owe tax, you must either pay through Revenue Online or submit your payment with the Extension Payment Form (DR 0158-I).

If no tax is due and you did not request a federal extension, you can request a six-month Maryland extension online or by calling 410-260-7829 from Central Maryland or toll-free 1-800-260-3664 from elsewhere.

Individual tax filers, regardless of income, can use Free File to electronically request an automatic tax-filing extension.To get the extension, you must estimate your tax liability on this form and should also pay any amount due.

To file, you must download and print the Annual Personal Property Return form from the Secretary of State website. Then, complete it mail in to the Maryland State Department of Assessments and Taxation along with the filing form.

If no tax is due and you did not request a federal extension, you can request a six-month Maryland extension online or by calling 410-260-7829 from Central Maryland or toll-free 1-800-260-3664 from elsewhere.