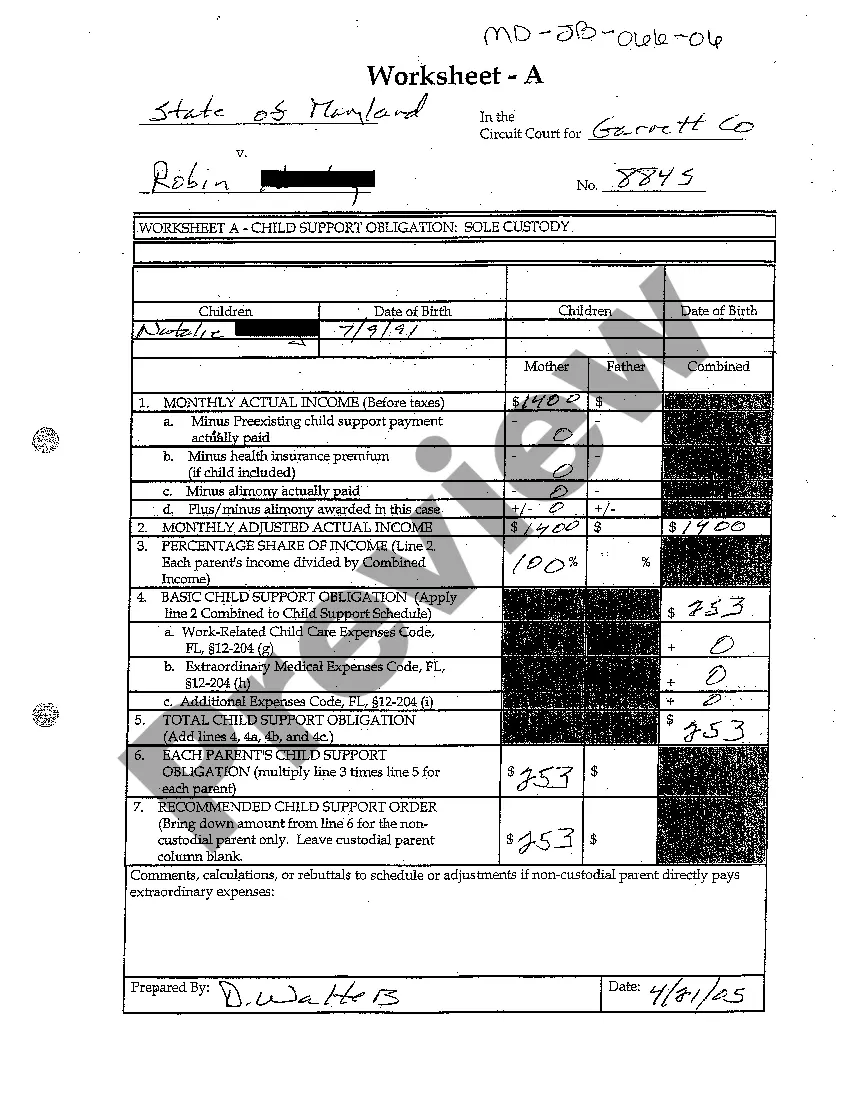

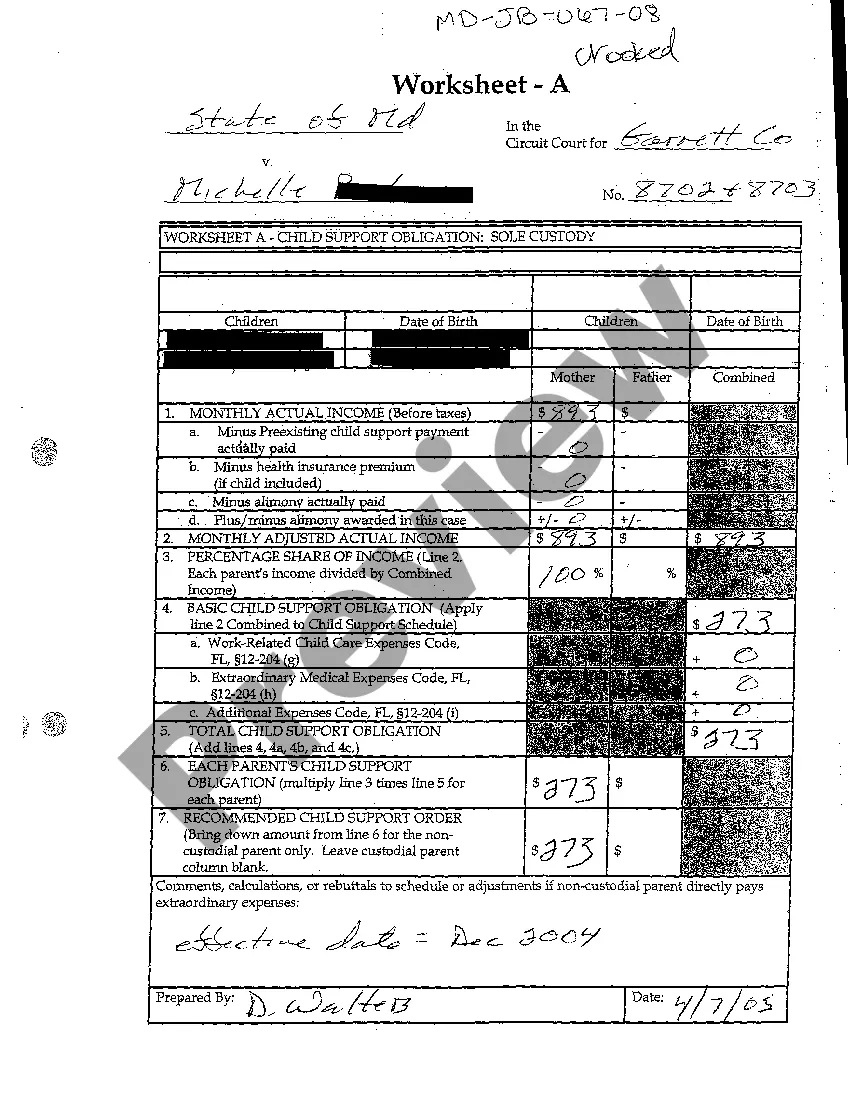

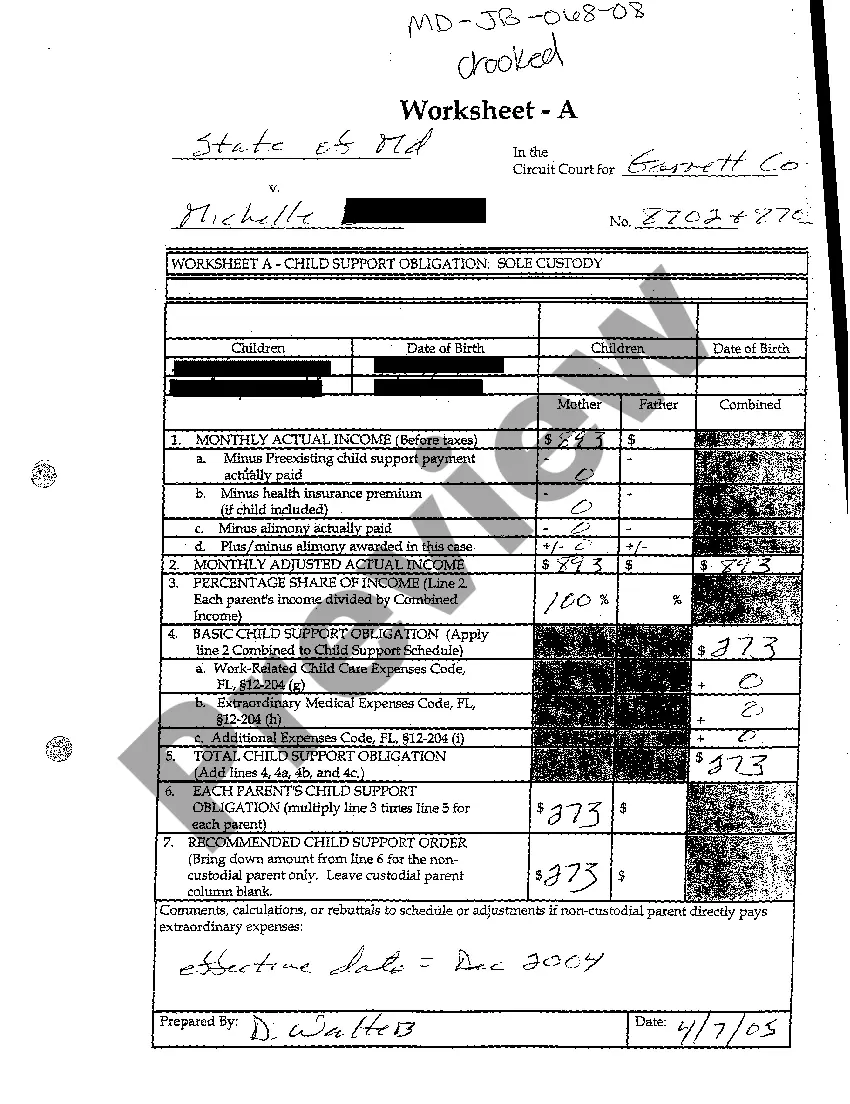

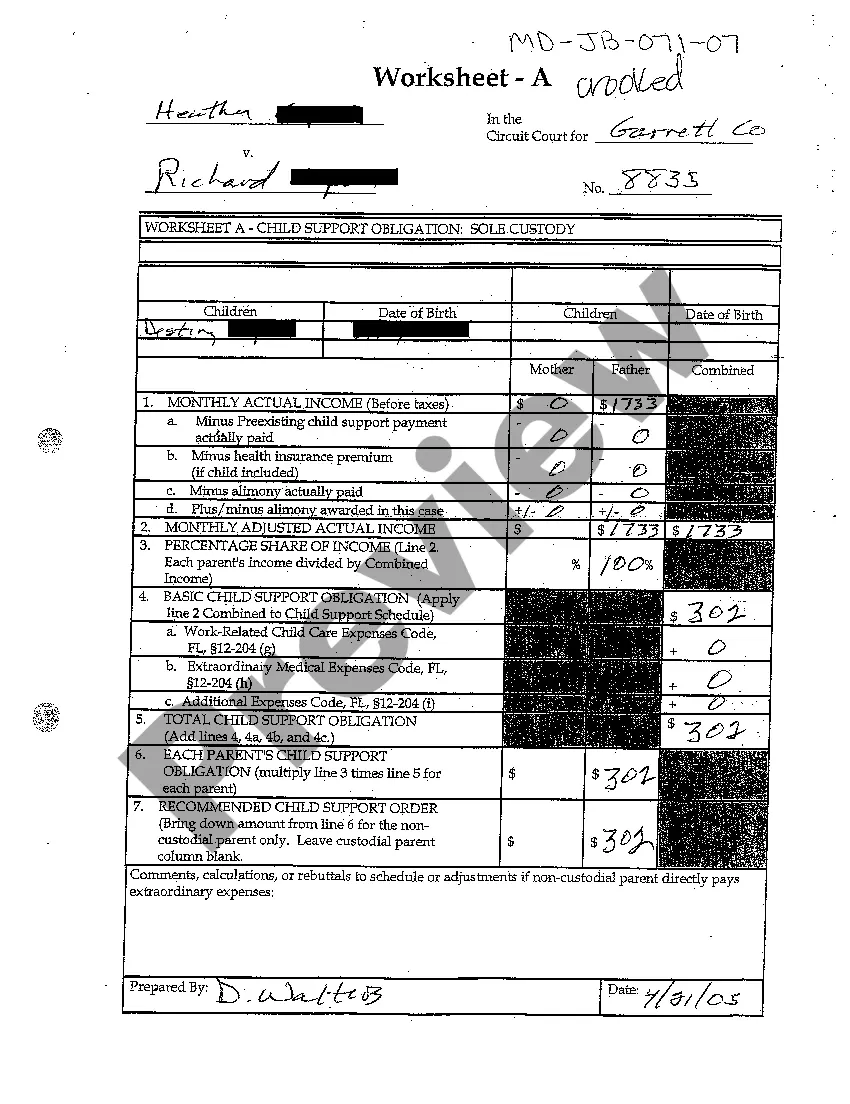

Maryland Worksheet - A Child Support Obligation Sole Custody

Description

Key Concepts & Definitions

A07 worksheet A child support obligation sole refers to a specific form used within the United States to calculate a sole parent's child support obligations. This form takes into account the non-custodial parent's income, the number of children, and other necessary expenses related to the children's welfare.

Step-by-Step Guide

- Gather Financial Documents: Collect all needed financial statements like recent pay stubs, tax returns, and any other relevant financial documentation.

- Fill Out the Worksheet: Complete the A07 worksheet by entering the financial details accurately to determine the support amount.

- Consult Guidelines: Review the state-specific child support guidelines to ensure the calculations align with local laws.

- File the Worksheet: Submit the completed worksheet to the relevant court or child support enforcement agency.

- Wait for Approval: Await confirmation or any potential adjustments from the court or the child support enforcement agency.

Risk Analysis

- Inaccuracy in Information: Incorrect or incomplete information can lead to wrong calculation of support payments.

- Legal Repercussions: Deviating from state guidelines can result in legal challenges or penalties.

- Updates in Law: Changes in child support laws may affect the relevance of the A07 worksheet outcomes.

Key Takeaways

Using A07 worksheet A child support obligation sole correctly is crucial for ensuring fair and lawful support arrangements. It requires accurate input and adherence to state guidelines.

Common Mistakes & How to Avoid Them

- Not Updating Financial Information: Always use the most current and comprehensive financial data when filling out the worksheet.

- Ignoring Local Guidelines: Ensure understanding and compliance with the specific state guidelines applicable to your case.

FAQ

Q: What happens if there is an error in the worksheet calculations?

A: Errors can be contested and corrected through legal means or by directly contacting the child support enforcement agency.

Q: Can the A07 worksheet be filed online?

A: This depends on the state's provisions for handling child support documentation; some states may allow online submissions, while others might not.

How to fill out Maryland Worksheet - A Child Support Obligation Sole Custody?

You are invited to the biggest legal document library, US Legal Forms. Here you can acquire any template such as the Maryland Worksheet - A Child Support Obligation Sole Custody forms and retrieve them (as many of them as you need). Prepare official documents within a few hours, rather than days or weeks, without spending a fortune on a legal expert. Obtain the state-specific template in just a few clicks and feel assured knowing that it was created by our state-certified legal experts.

If you’re already a registered user, simply Log In to your account and click Download next to the Maryland Worksheet - A Child Support Obligation Sole Custody you need. Since US Legal Forms is internet-based, you’ll consistently have access to your stored documents, no matter what device you are using. Find them in the My documents section.

If you don’t have an account yet, what are you waiting for? Follow the instructions below to begin.

- If this is a state-specific form, verify its validity in your jurisdiction.

- Examine the description (if available) to determine if it’s the correct template.

- Explore additional content using the Preview option.

- If the template meets all your criteria, click Buy Now.

- To create an account, select a pricing plan.

- Utilize a card or PayPal account to register.

- Download the document in the format you prefer (Word or PDF).

- Print the document and complete it with your/your company's information.

Form popularity

FAQ

The biggest mistake in a custody battle is often failing to prioritize the child's best interests. Engaging in negative behavior toward the other parent can damage your credibility and affect the child's well-being. Focus instead on demonstrating your commitment to shared parenting values and reference the Maryland Worksheet - A Child Support Obligation Sole Custody to show your financial responsibility.

Shared physical custody does not require a 50/50 split of time.In Maryland, there is no rebuttable presumption in favor of shared custodywhether physical or legal. Furthermore, neither parent is presumed to have a greater right to custody over the other, and there is no preference for one gender over the other.

Maryland expects both parents to contribute to their child's care in proportion to how much they earn. A formula determines how much each parent should spend. Usually, the parent who sees the child less pays all or part of their share to the other parent as child support.

Complete a Complaint for Custody (CC-DR-004) to ask to the court to grant you custody. File the form in the Circuit Court where the child lives or where either parent lives. Make enough copies for the other parent and keep at least one copy for yourself.

The new MD child support guidelines provide for $2,847 per month in basic child support for an aggregate monthly income of $15,000. As with the old guidelines, the Court will have discretion in setting the support level for parties and individuals with income above the maximum under the guidelines of $15,000 per month.

Maryland's child support guidelines allow parents to calculate their support obligation by inputting their combined incomes and the number of children they have together. A percentage of the total support obligation is assigned to each parent based on that parent's income percentage.

Under Maryland law, child support continues until the minor child reaches the age of 18. It may be extended to age 19 if the child is still enrolled in high school. If there is past-due child support, the agency will continue to enforce payment until the arrears are paid in full, regardless of the age of the child.

Under Maryland law, a person cannot agree with a spouse in order to avoid a court-ordered obligation to pay child support. Rather, there is a worksheet provided by the State of Maryland that allows you to input your own unique factors in order to estimate the amount the court will order you to pay.