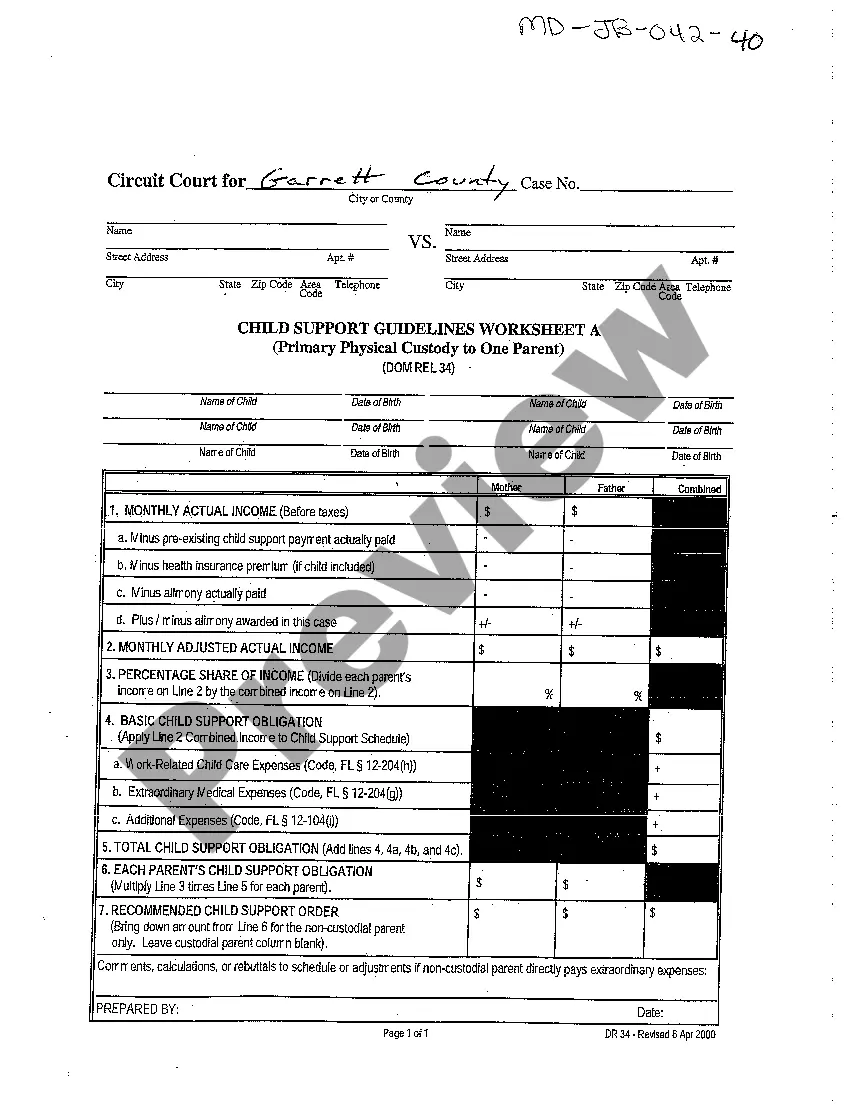

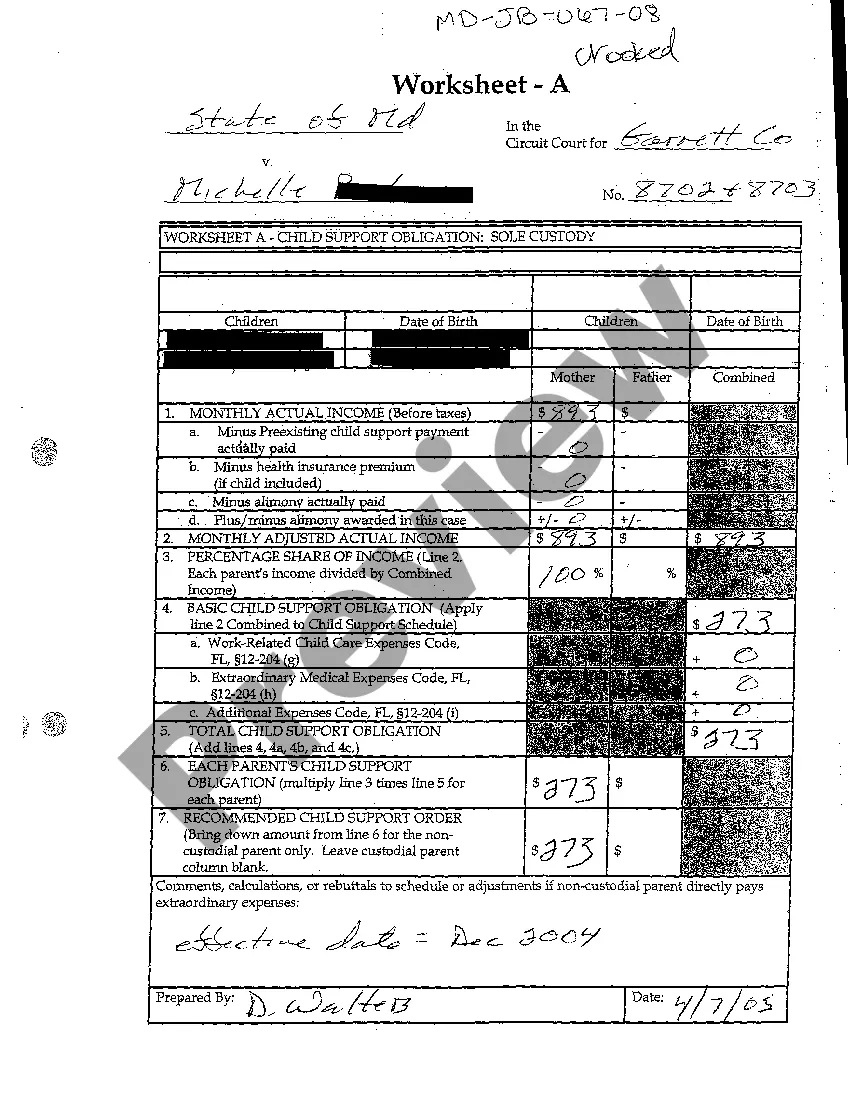

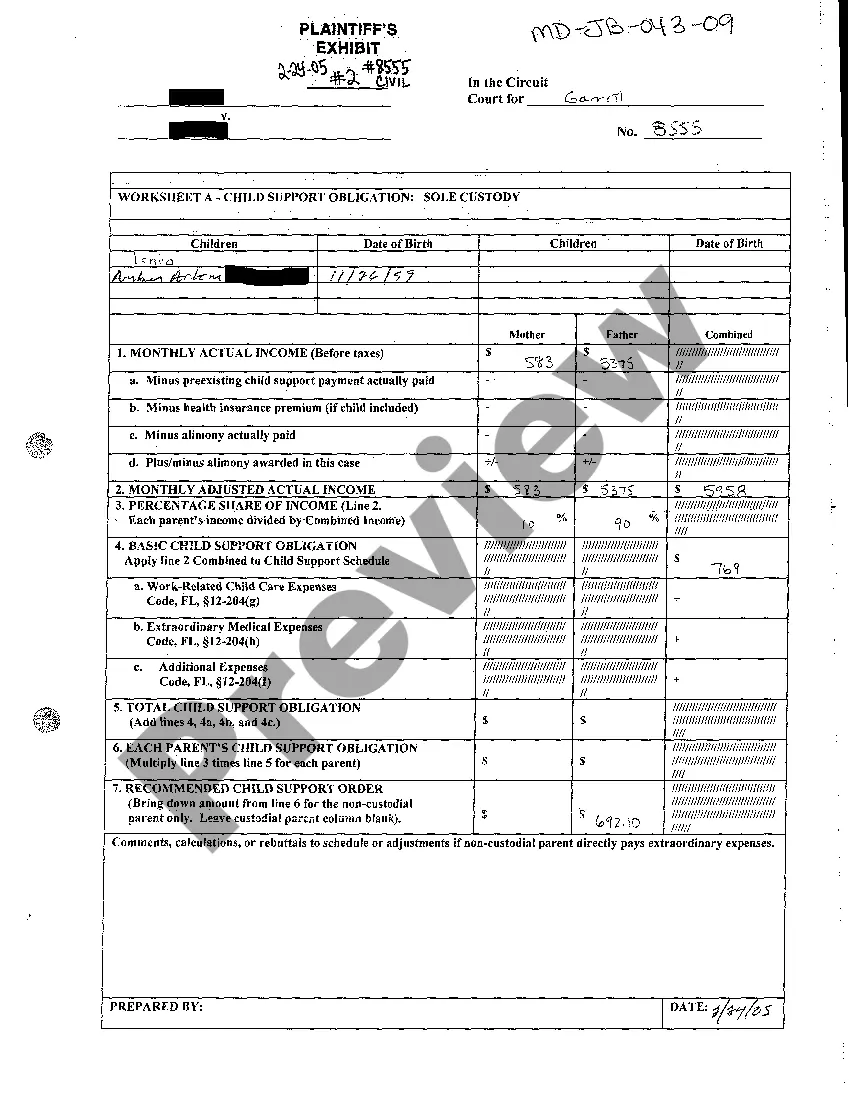

Maryland Exhibit 2 Child Support Worksheet

Description

How to fill out Maryland Exhibit 2 Child Support Worksheet?

You are invited to the most important legal documents collection, US Legal Forms. Here you will discover any example including Maryland Exhibit 2 Child Support Worksheet forms and save them (as many as you need/desire). Create official files in just a few hours, rather than days or even weeks, without spending a fortune on an attorney. Obtain the state-specific form in a few clicks and feel assured knowing it was created by our state-certified lawyers.

If you’re already a registered customer, simply Log In to your account and click Download next to the Maryland Exhibit 2 Child Support Worksheet you require. Because US Legal Forms is online, you’ll typically have access to your stored files, regardless of the device you’re using. Find them in the My documents section.

If you don’t have an account yet, what are you waiting for? Review our instructions below to begin.

Once you’ve finished the Maryland Exhibit 2 Child Support Worksheet, provide it to your attorney for validation. It’s an additional step but a necessary one for ensuring you’re completely protected. Register for US Legal Forms today and gain access to thousands of reusable templates.

- If this is a state-specific form, verify its applicability in your residing state.

- Review the description (if available) to determine if it’s the correct template.

- Examine more details using the Preview feature.

- If the document satisfies all your requirements, click Buy Now.

- To create your account, select a pricing plan.

- Utilize a credit card or PayPal account for registration.

- Save the document in the format you require (Word or PDF).

- Print the document and fill it with your/your company's information.

Form popularity

FAQ

The deadbeat dad law in Maryland addresses non-payment of child support. It establishes legal consequences for parents who fail to meet their financial obligations established by the Maryland Exhibit 2 Child Support Worksheet. This law aims to ensure that all children receive the support they need for their well-being. If you are facing issues related to child support payments, using the Maryland Exhibit 2 Child Support Worksheet can help you understand your responsibilities and rights.

To estimate your child support obligations in Maryland, you can use the Maryland Exhibit 2 Child Support Worksheet. This tool provides a structured format to assess both parents' income and expenses, leading to an estimate of the fair support amount. You might find it beneficial to use online resources or consult experts from US Legal Forms for guidance. Understanding the calculation process helps parents plan for their financial responsibilities more effectively.

The amount of child support for two kids in Maryland is calculated using the Maryland Exhibit 2 Child Support Worksheet. Typically, the support amount reflects a percentage of the non-custodial parent's income, alongside other relevant factors. While the exact amount can vary greatly depending on individual circumstances, it is essential to complete the worksheet to obtain a precise figure. This method ensures both parents contribute appropriately to their children's well-being.

The new MD child support guidelines provide for $2,847 per month in basic child support for an aggregate monthly income of $15,000. As with the old guidelines, the Court will have discretion in setting the support level for parties and individuals with income above the maximum under the guidelines of $15,000 per month.

In determining a parent's income for child support purposes, courts typically look at the parent's gross income from all sources. They then subtract certain obligatory deductions, like income taxes, Social Security, health care, and mandatory union dues.

The new MD child support guidelines provide for $2,847 per month in basic child support for an aggregate monthly income of $15,000. As with the old guidelines, the Court will have discretion in setting the support level for parties and individuals with income above the maximum under the guidelines of $15,000 per month.

Child support is not paid to the child; however, the payments to the custodial parent are intended to be used to pay for the basic needs of the child, such as housing, food, clothing and the like. The parent paying child support cannot deduct those payments from his or her income when filing taxes.

Maryland's child support guidelines allow parents to calculate their support obligation by inputting their combined incomes and the number of children they have together. A percentage of the total support obligation is assigned to each parent based on that parent's income percentage.

Maryland's child support guidelines allow parents to calculate their support obligation by inputting their combined incomes and the number of children they have together. A percentage of the total support obligation is assigned to each parent based on that parent's income percentage.

Maryland law requires continuation of child support payments for children who turn 18 while still enrolled in high school. The court can order a parent to pay for his or her children's college expenses as child support if the parents have made an agreement and that agreement is incorporated into a court order.