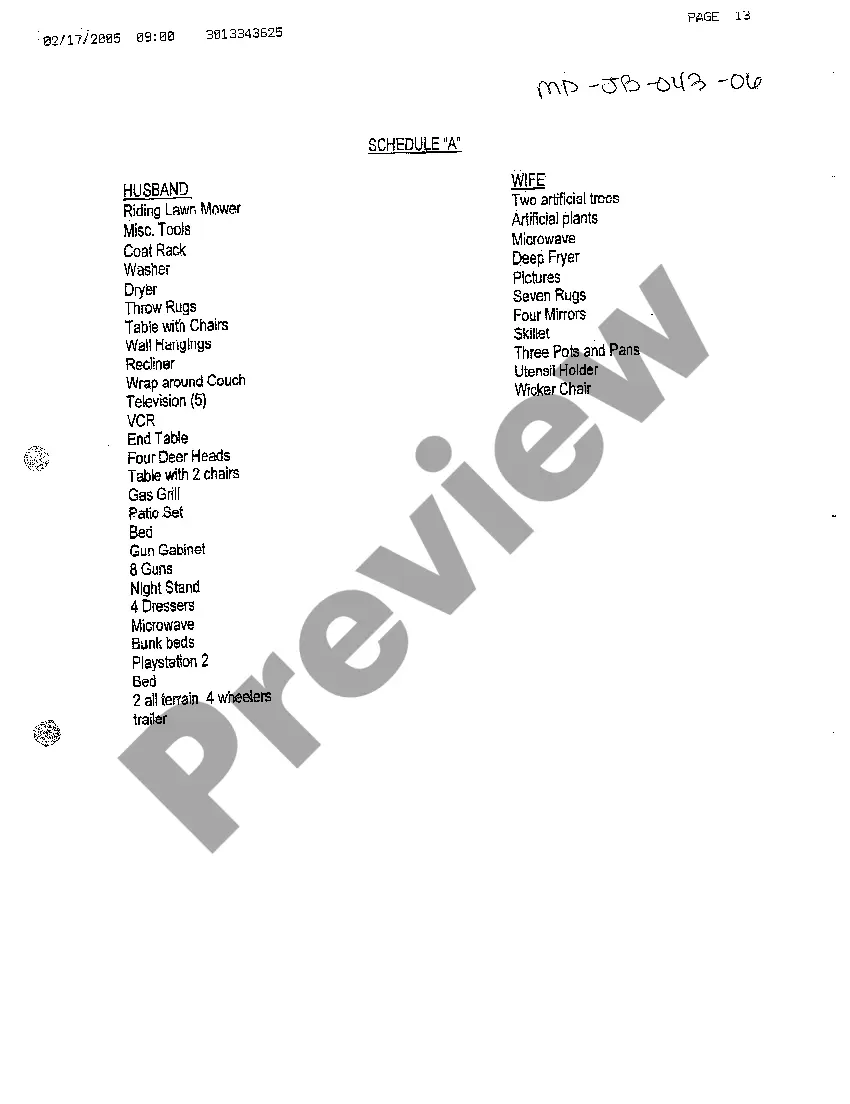

Maryland Schedule A

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Schedule A?

Greetings to the largest legal document repository, US Legal Forms. Here, you can locate any example including Maryland Schedule A forms and acquire them (as many of them as you wish or require). Prepare official documents in just a few hours, instead of days or even weeks, without having to spend an arm and a leg on a lawyer.

Obtain the state-specific template in a few clicks and feel confident knowing that it was crafted by our state-certified legal professionals.

If you’re already a registered user, just Log In to your account and then click Download next to the Maryland Schedule A you require. Since US Legal Forms is an online platform, you’ll always have access to your saved templates, no matter the device you’re using. View them in the My documents section.

Print the document and fill it out with your or your business’s details. Once you’ve completed the Maryland Schedule A, send it to your lawyer for confirmation. It’s an extra step but an essential one to ensure you’re fully protected. Sign up for US Legal Forms now and gain access to a multitude of reusable samples.

- If you don't have an account yet, what are you waiting for? Follow our guidelines below to get started.

- If this is a state-specific document, verify its applicability in your region.

- Check the description (if available) to see if it’s the correct template.

- View additional content with the Preview option.

- If the sample satisfies all your criteria, click Buy Now.

- To create your account, choose a pricing plan.

- Utilize a card or PayPal account to register.

- Download the document in the format you prefer (Word or PDF).

Form popularity

FAQ

To access online forms, select "Individuals" at the top of the IRS website and then the "Forms and Publications" link located on the left hand side of the page. You will then see a list of printable forms, including the 1040, 1040-EZ, 4868 form for an extension of time and Schedule A for itemized deductions.

Registration Renewal Section, Glen Burnie, MD 21062. You can also apply online to obtain a duplicate registration.

Single filers whose gross income meets or exceeds $10,150 and married taxpayers filing jointly with gross income at or above $20,300 are required to file Maryland tax returns.

During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

Download them. You can download tax forms using the links listed below. Request forms by e-mail. You can also e-mail your forms request to us at taxforms@marylandtaxes.gov. Visit our offices.

Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

You may download it for free at: http://www.adobe.com/go/getreader/ . If you need further assistance, you may contact Taxpayer Service at 410-260-7980 from Central Maryland or at 1-800-MD-TAXES from elsewhere.

You can apply for a Maryland title, and registration, in person at any of the MVA's full service branch offices. You also can mail the documents to the MVA's out-of-state title unit in the Glen Burnie office, or go to an MVA licensed tag and title service where they will assist you in applying.

Completed Application for Certificate of Title. All insurance information. Ownership documents like the title or bill of sale. Odometer reading information. A Maryland Safety Inspection Certificate.