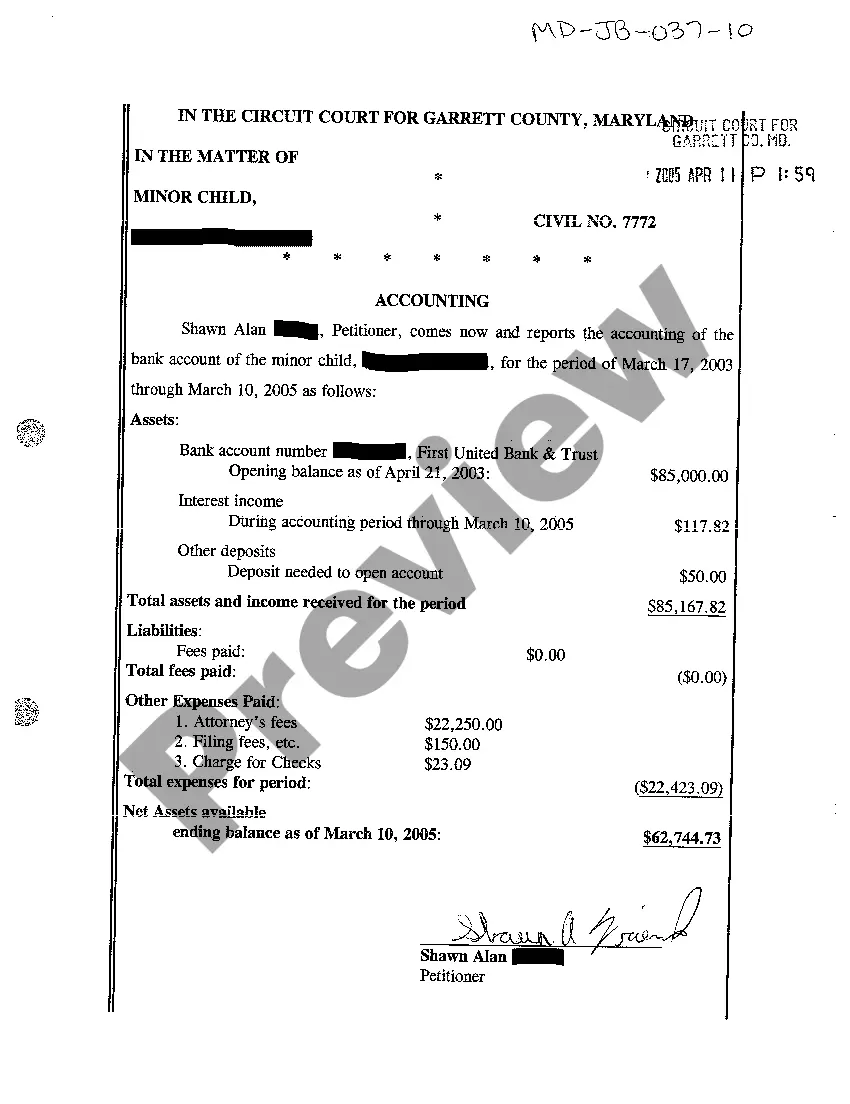

Maryland Accounting

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

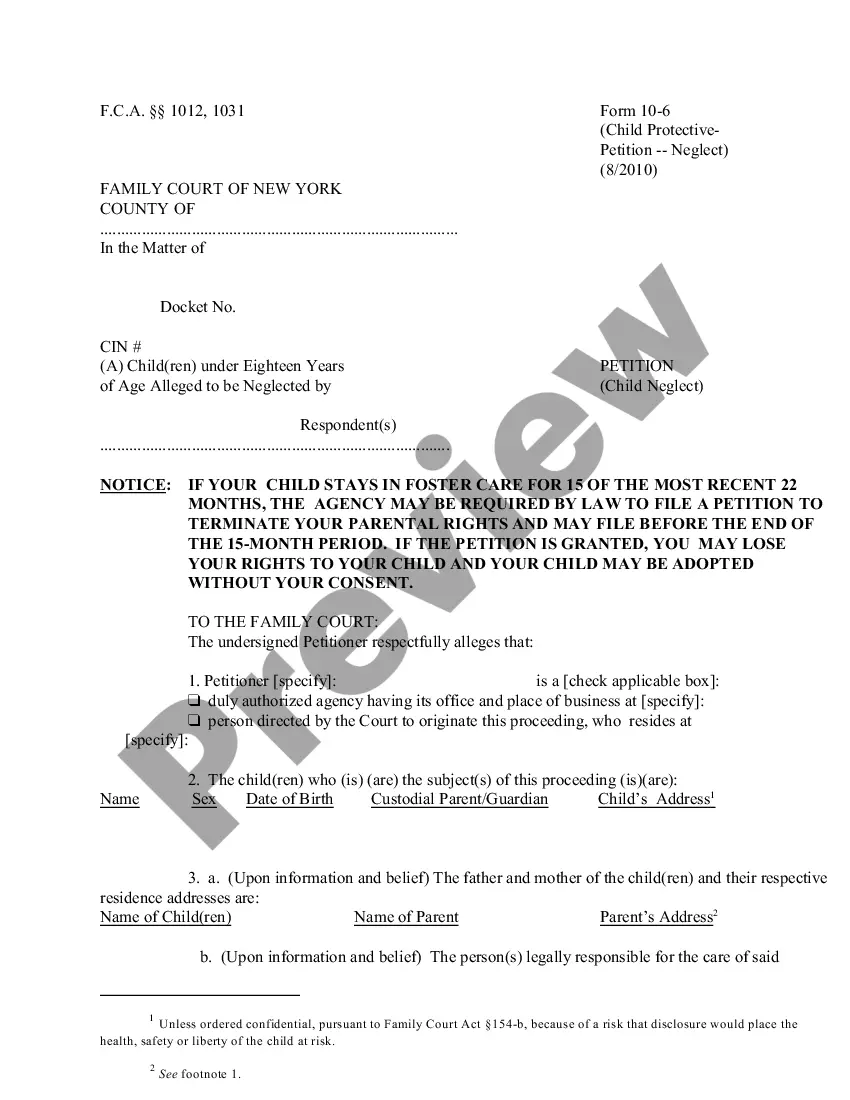

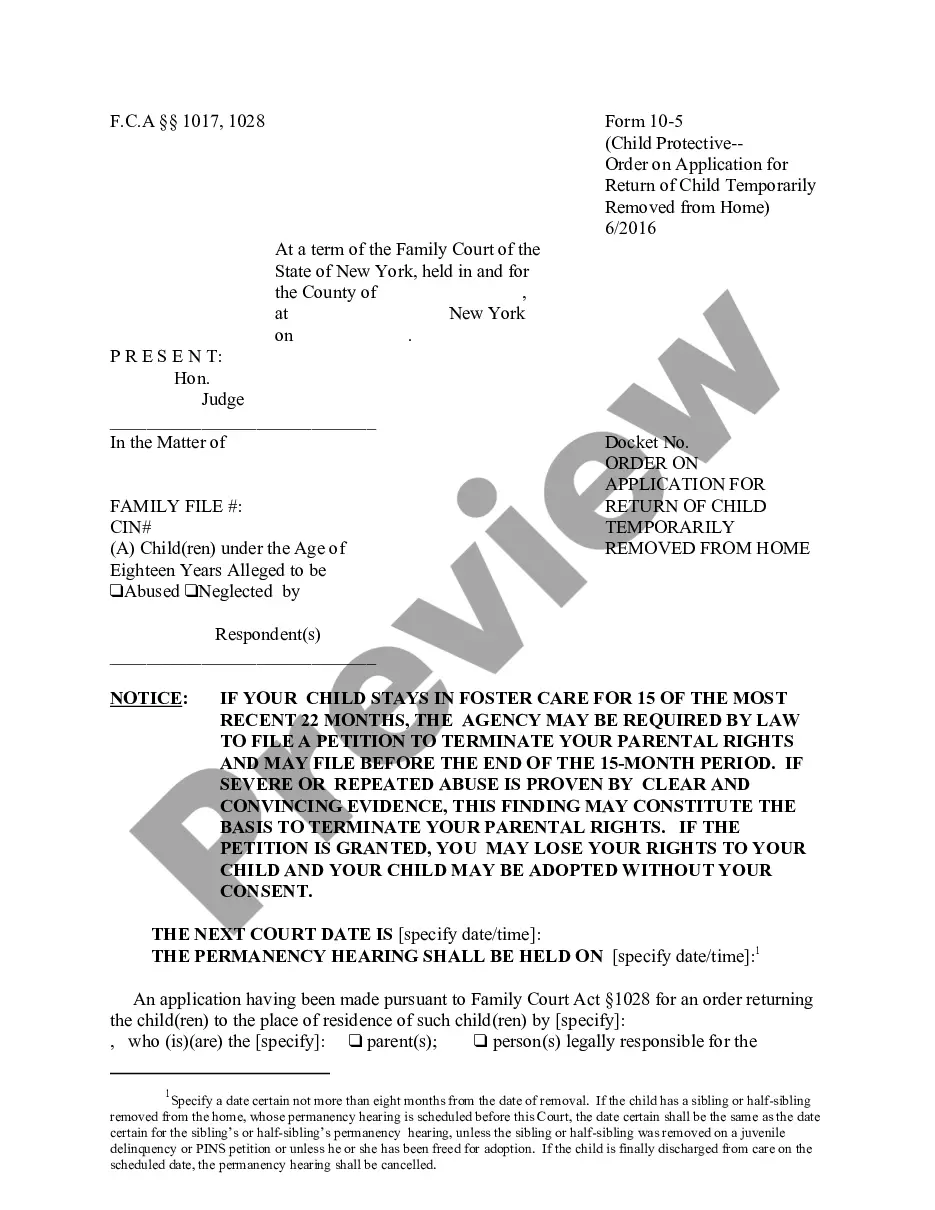

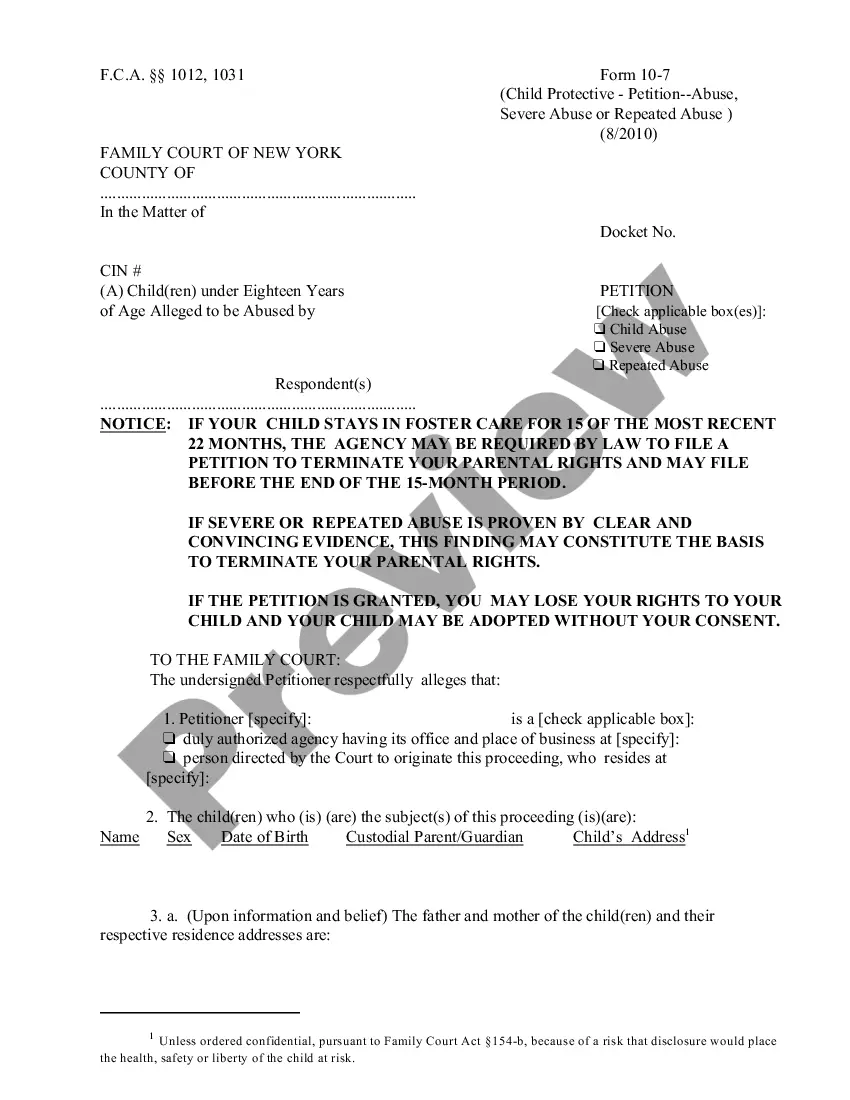

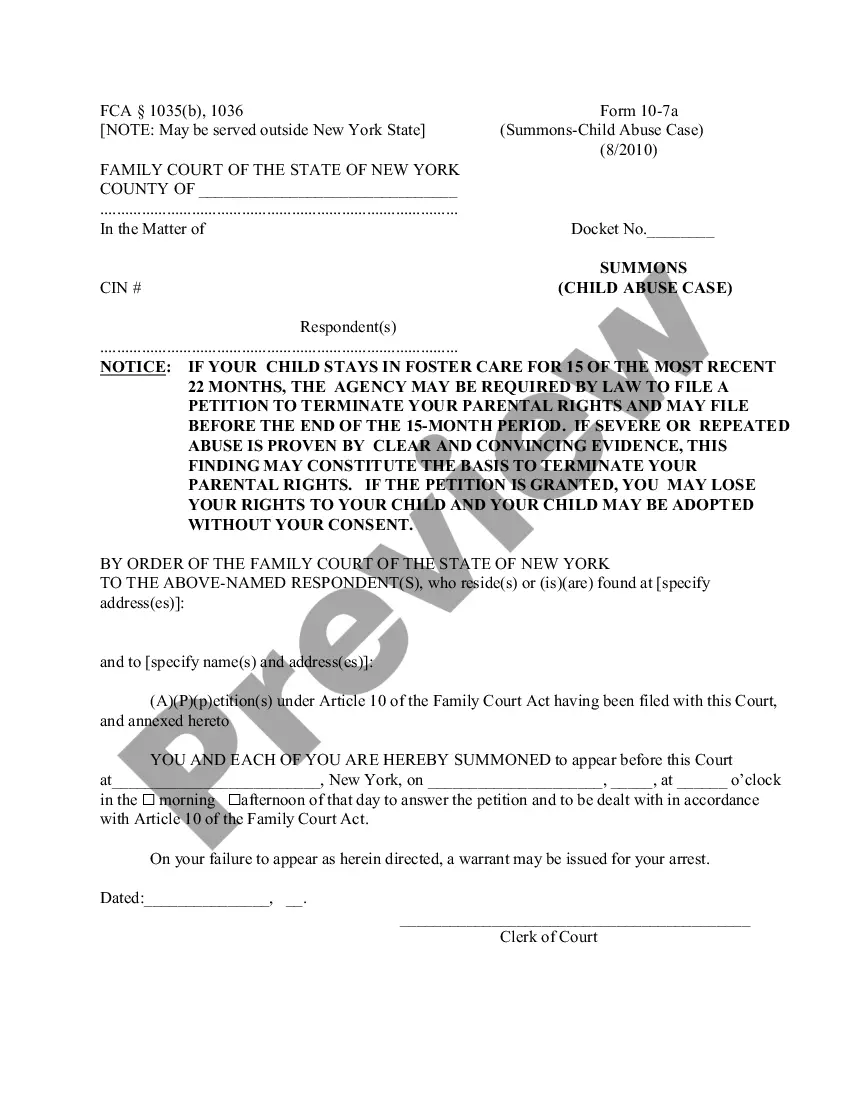

How to fill out Maryland Accounting?

You are invited to the most crucial legal documents library, US Legal Forms. Here you can obtain any template including Maryland Accounting forms and store them (as many as you desire). Prepare formal papers within a few hours, instead of days or weeks, without spending a fortune on a lawyer. Acquire the state-specific form in just a few clicks and be confident knowing that it was created by our experienced attorneys.

If you’re already a subscribed client, just Log Into your account and then click Download next to the Maryland Accounting you need. Since US Legal Forms is an online service, you’ll always have access to your saved documents, regardless of the device you’re utilizing. Find them within the My documents section.

If you haven't created an account yet, what are you waiting for? Follow our instructions below to get started.

After you’ve completed the Maryland Accounting, submit it to your attorney for verification. It’s an extra step but an essential one to ensure you’re fully protected. Join US Legal Forms today and gain access to thousands of reusable templates.

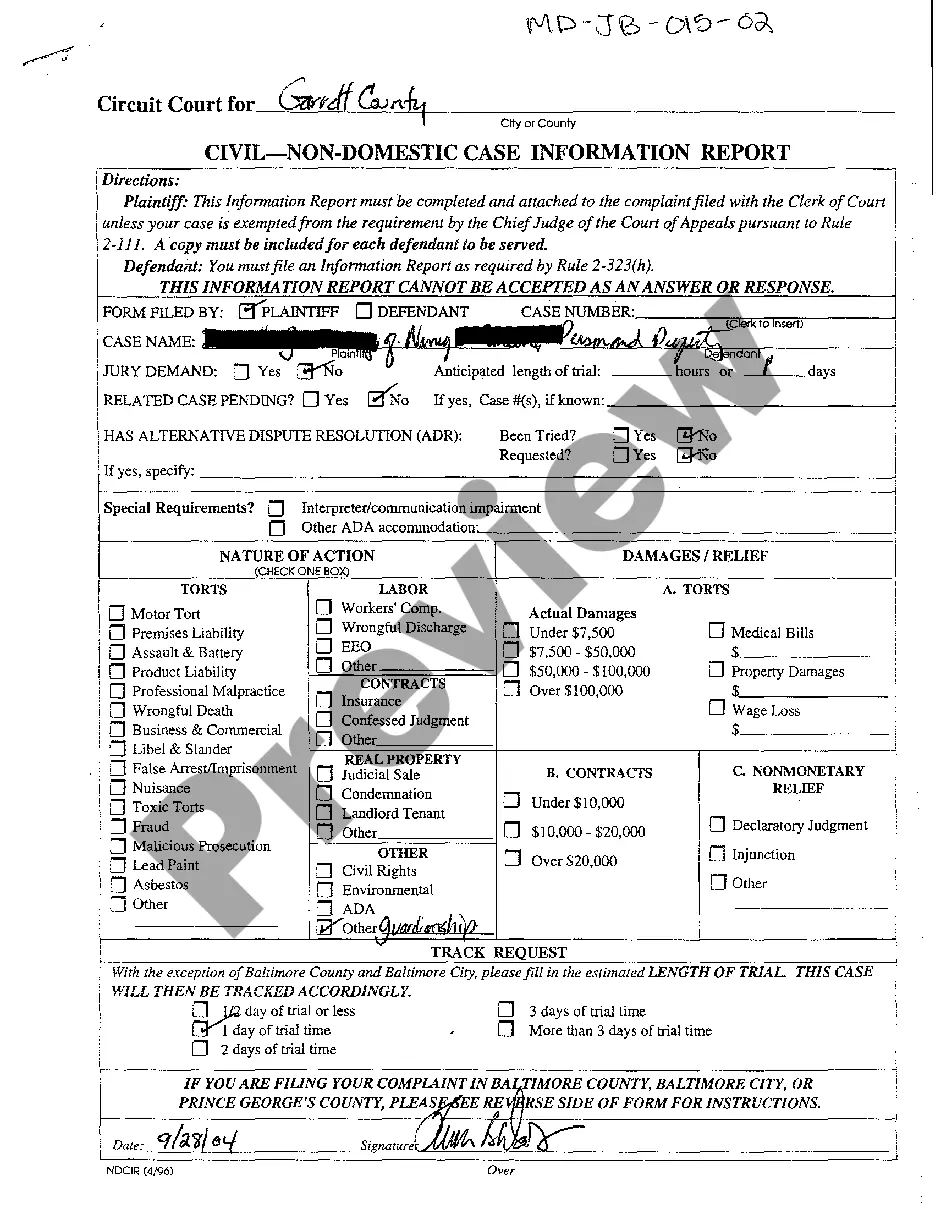

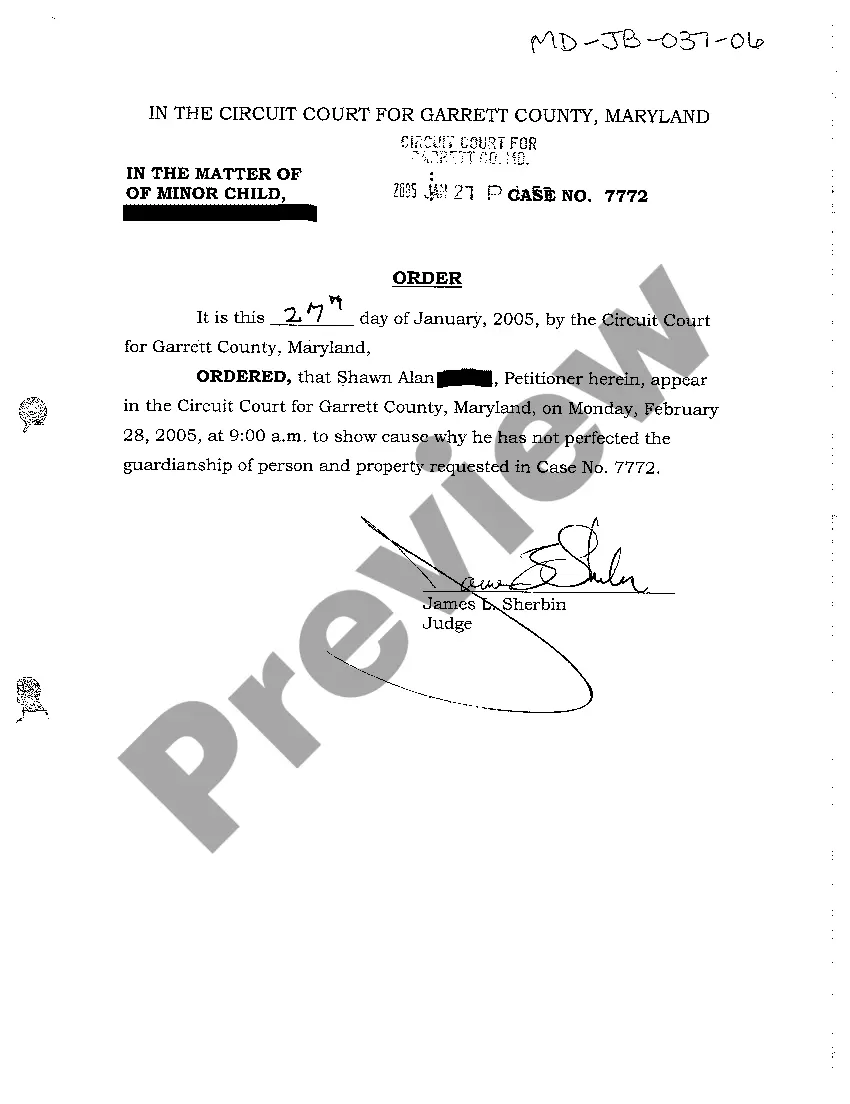

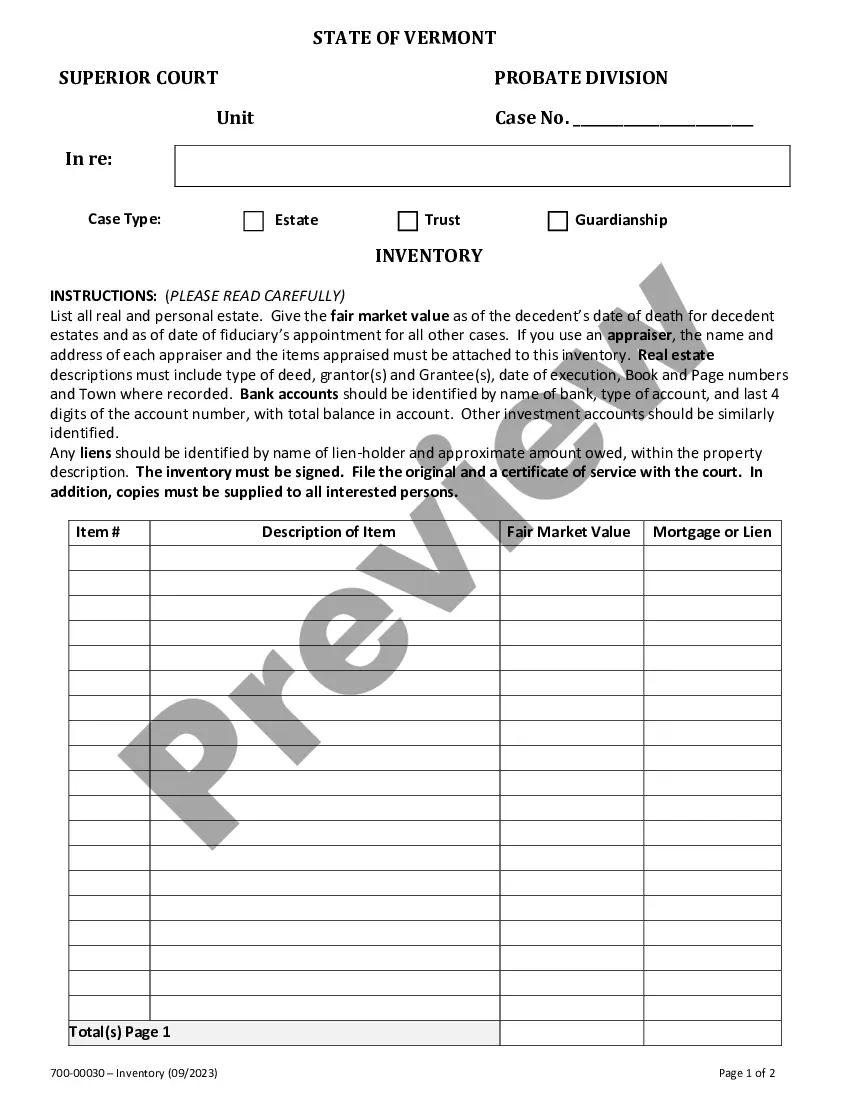

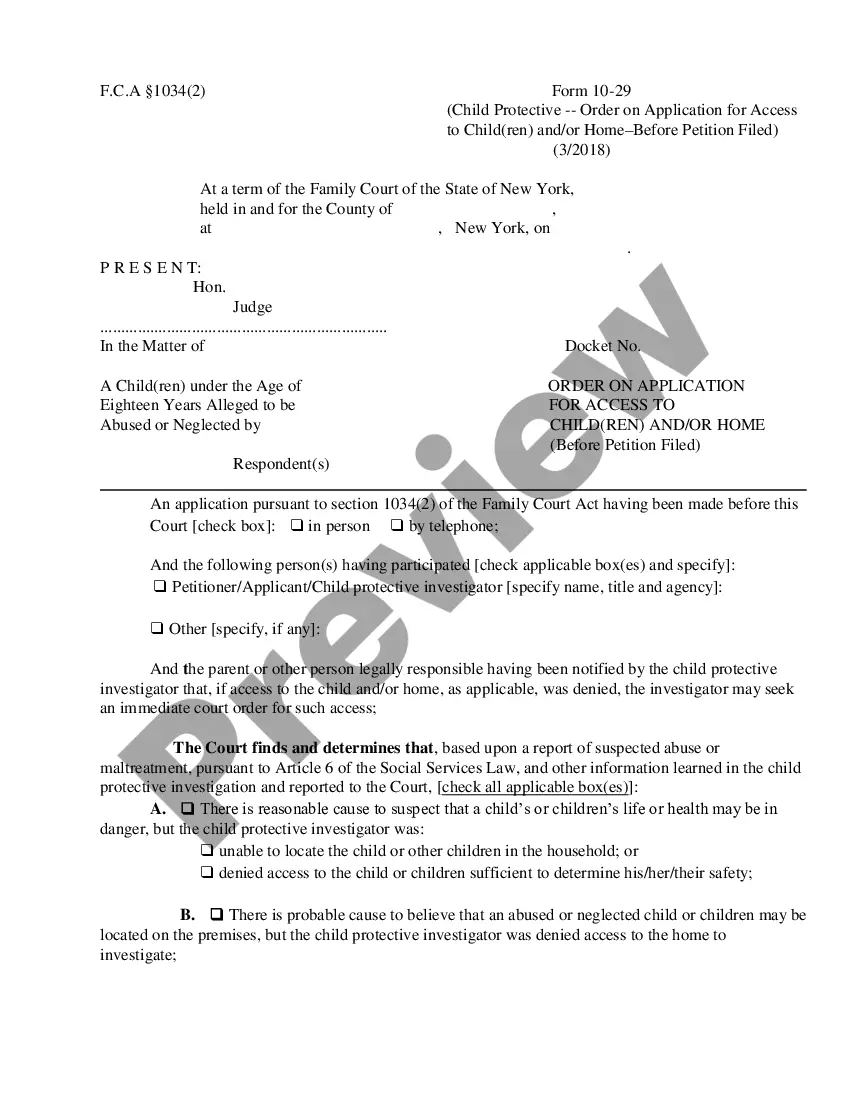

- If this is a state-specific document, check its validity in your jurisdiction.

- Review the description (if available) to determine if it’s the right sample.

- Explore more details using the Preview feature.

- If the sample meets your requirements, simply click Buy Now.

- To create your account, choose a pricing plan.

- Utilize a credit card or PayPal account to sign up.

- Download the document in your preferred format (Word or PDF).

- Print the document and complete it with your or your business’s information.

Form popularity

FAQ

The American Institute of Certified Public Accountants (AICPA) alone has over 335,000 members and is nearly three times the size of the Institute of Chartered Accountants in England and Wales.

Although not required, most accountants attend college and earn a bachelor's degree. However, a bachelor's degree in accounting or a related field is considered the minimum education requirement for those who plan to become a CPA.

Complete education requirements of 150 undergraduate semester hours. Apply online to take the Uniform CPA Examination. Take and pass the Uniform CPA Examination. Complete 2000 hours (12 months) of Practical Work Experience in accounting under the supervision of a licensed CPA.

Tax ID no. The Maryland Association of Certified Public Accountants is a statewide professional association that provides leadership, training, advocacy and resources for its nearly 10,000 certified public accountant-members, who are employed in private practice, industry, government, and education.

According to NASBA, the United States currently has about 654,375 actively licensed CPAs.

Accounting errors happen from time to time, but many common accounting mistakes can be avoided with proper planning and preparation. We all know that it usually takes more time to correct a mistake than to get it right the first time.

Go to the Maryland website to register online for the exam part you wish to take within 180 days. Go to NASBA's website to print your NTS when you receive notification it is available from NASBA. Schedule your exam appointment with Prometric. To check your scores, you will log onto Maryland's website.

Flexibility & Ease: It's a Single Level Online exam with just 4 Papers; one can easily clear the exams in less than a year.

Woislaw: CPA Exam scores can be transferred to any state for the purpose of getting a license, so a student can take the exam in whichever state works best for them.If the state does not have firm mobility, you have to get another license and apply it to the state board of accountancy.