Maryland Exhibit 3 Commercial Guaranty

Description

How to fill out Maryland Exhibit 3 Commercial Guaranty?

You are invited to the most extensive collection of legal documents, US Legal Forms. Here, you can obtain any template, including Maryland Exhibit 3 Commercial Guaranty forms, and store as many as you desire.

Prepare official documents in mere hours, instead of days or even weeks, without having to expend a fortune on a lawyer.

Acquire the state-specific form with just a few clicks and be confident knowing it was created by our licensed lawyers.

To create an account, choose a pricing plan. Use a credit card or PayPal account to register. Save the template in the format you prefer (Word or PDF). Print the document and fill it in with your or your business’s details. Once you’ve completed the Maryland Exhibit 3 Commercial Guaranty, present it to your attorney for validation. This is an additional step but a vital one to ensure you’re fully protected. Join US Legal Forms today and gain access to a vast array of reusable templates.

- If you’re already a subscribed user, simply Log In to your account and click Download next to the Maryland Exhibit 3 Commercial Guaranty you require.

- Since US Legal Forms is an online solution, you will usually have access to your saved documents, no matter the device you are using.

- Locate them in the My documents section.

- If you haven't created an account yet, what are you waiting for? Follow our instructions below to get started.

- If this is a state-specific document, verify its validity in your state.

- Review the description (if provided) to determine if it’s the correct example.

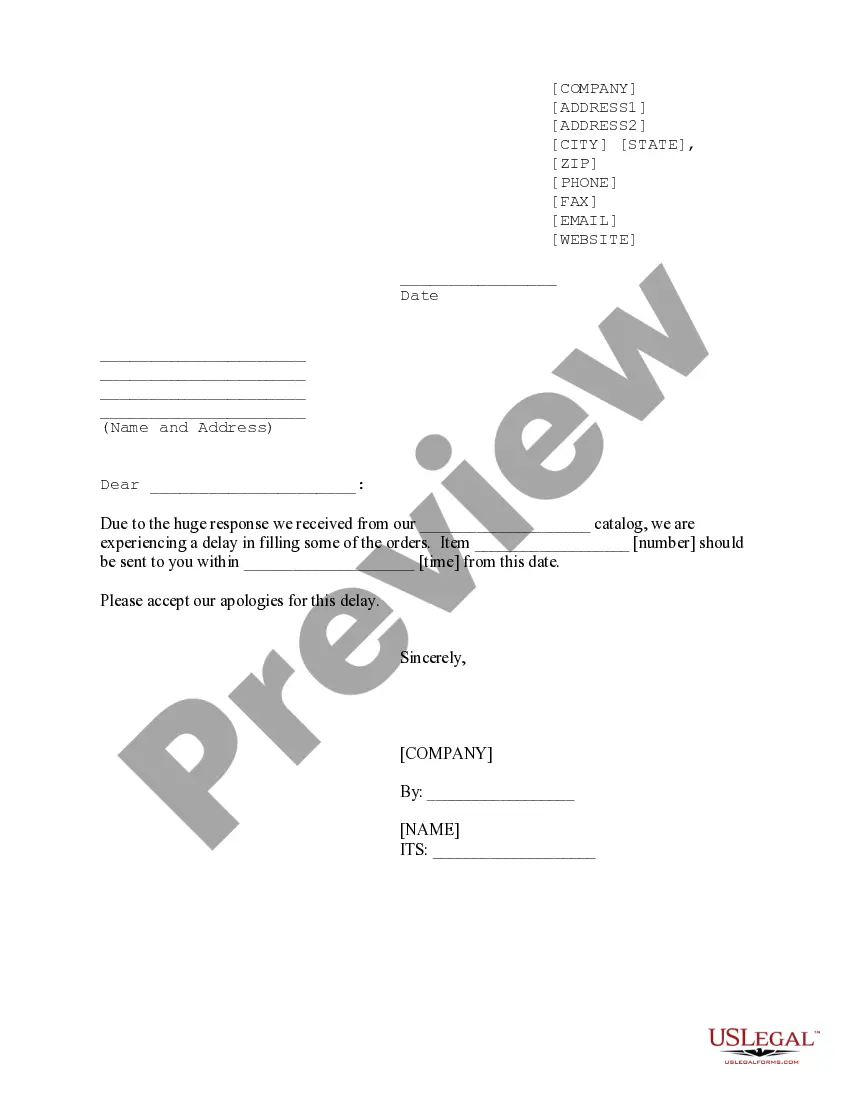

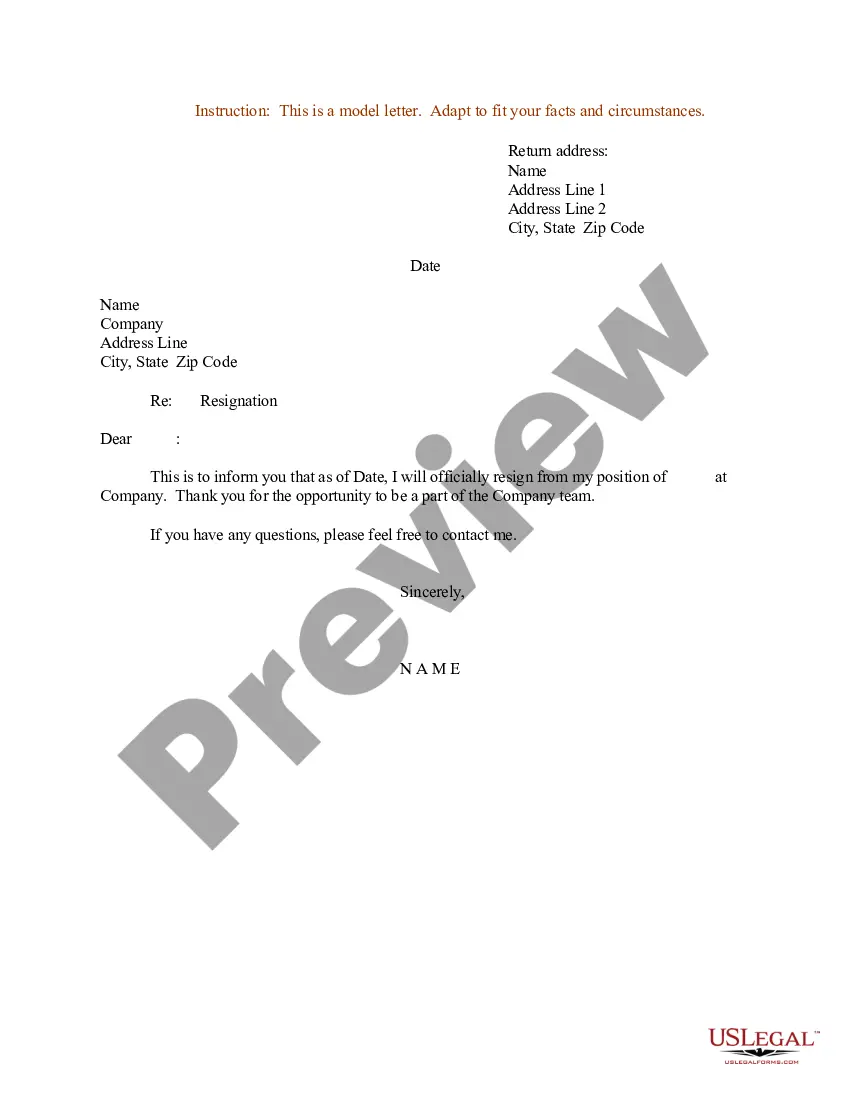

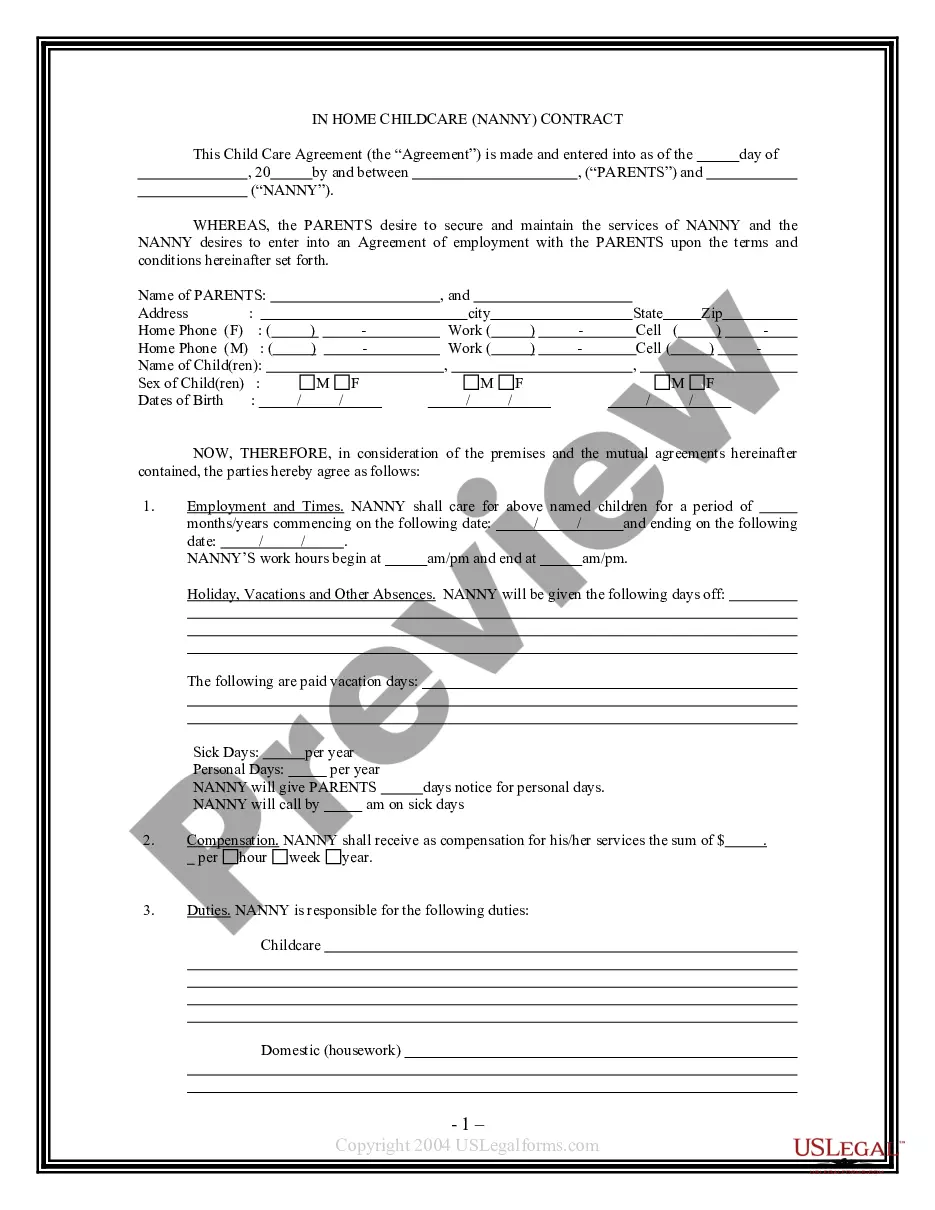

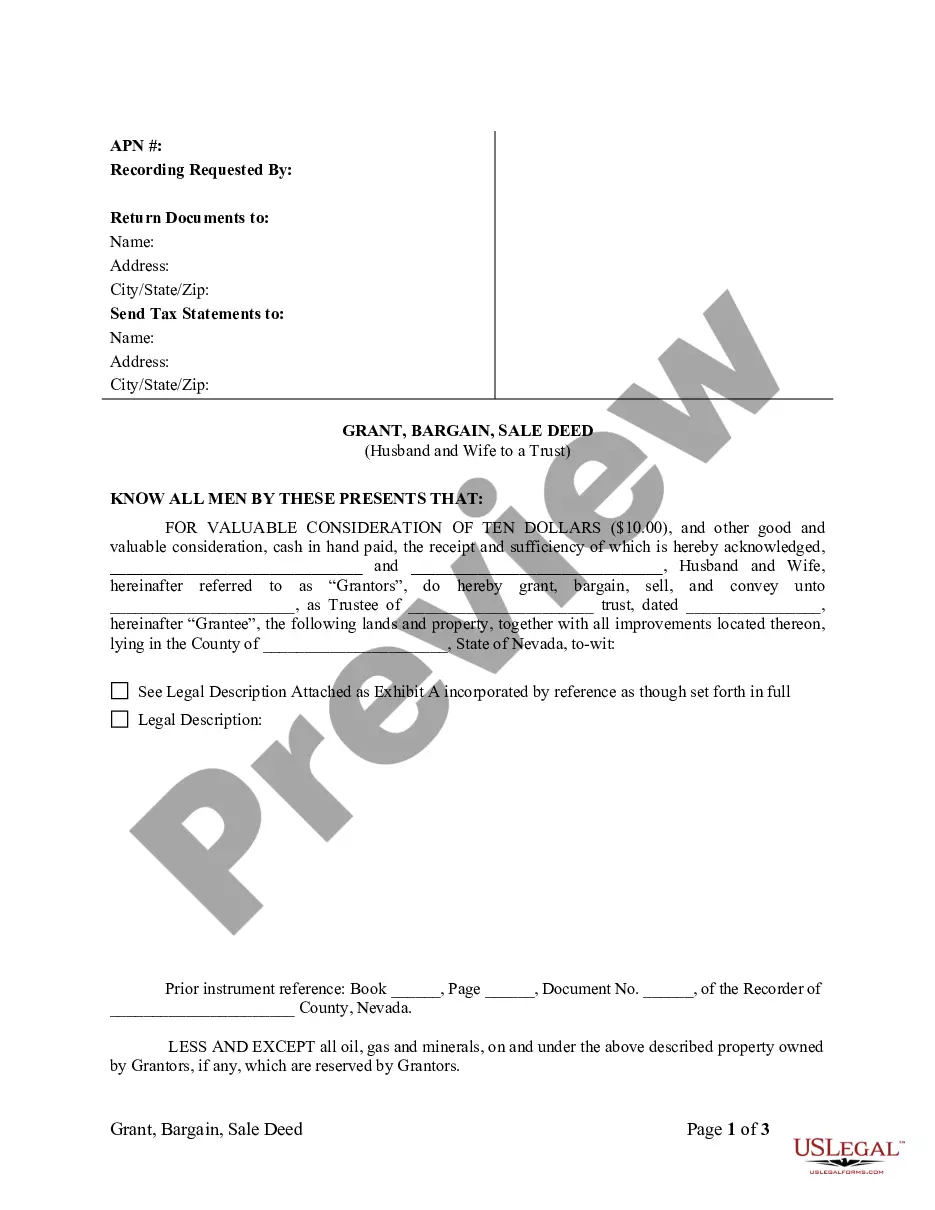

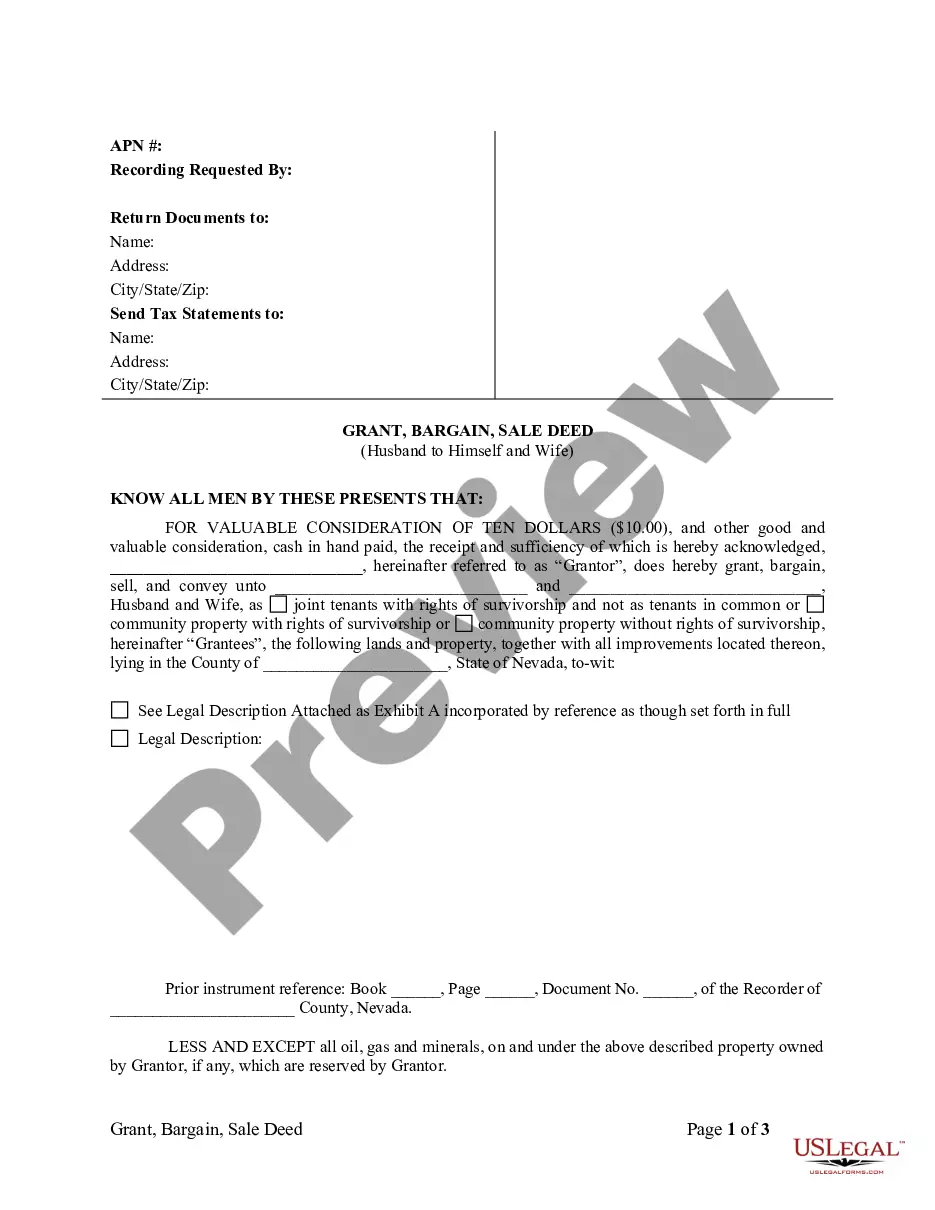

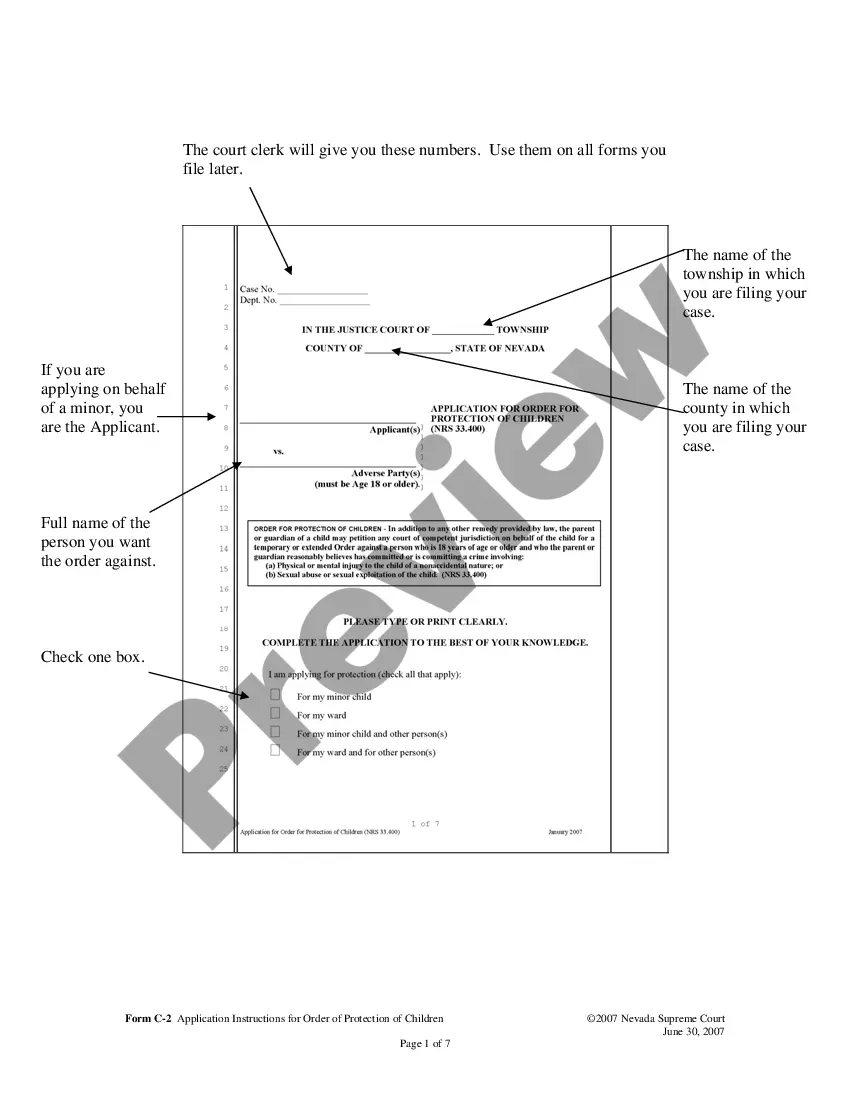

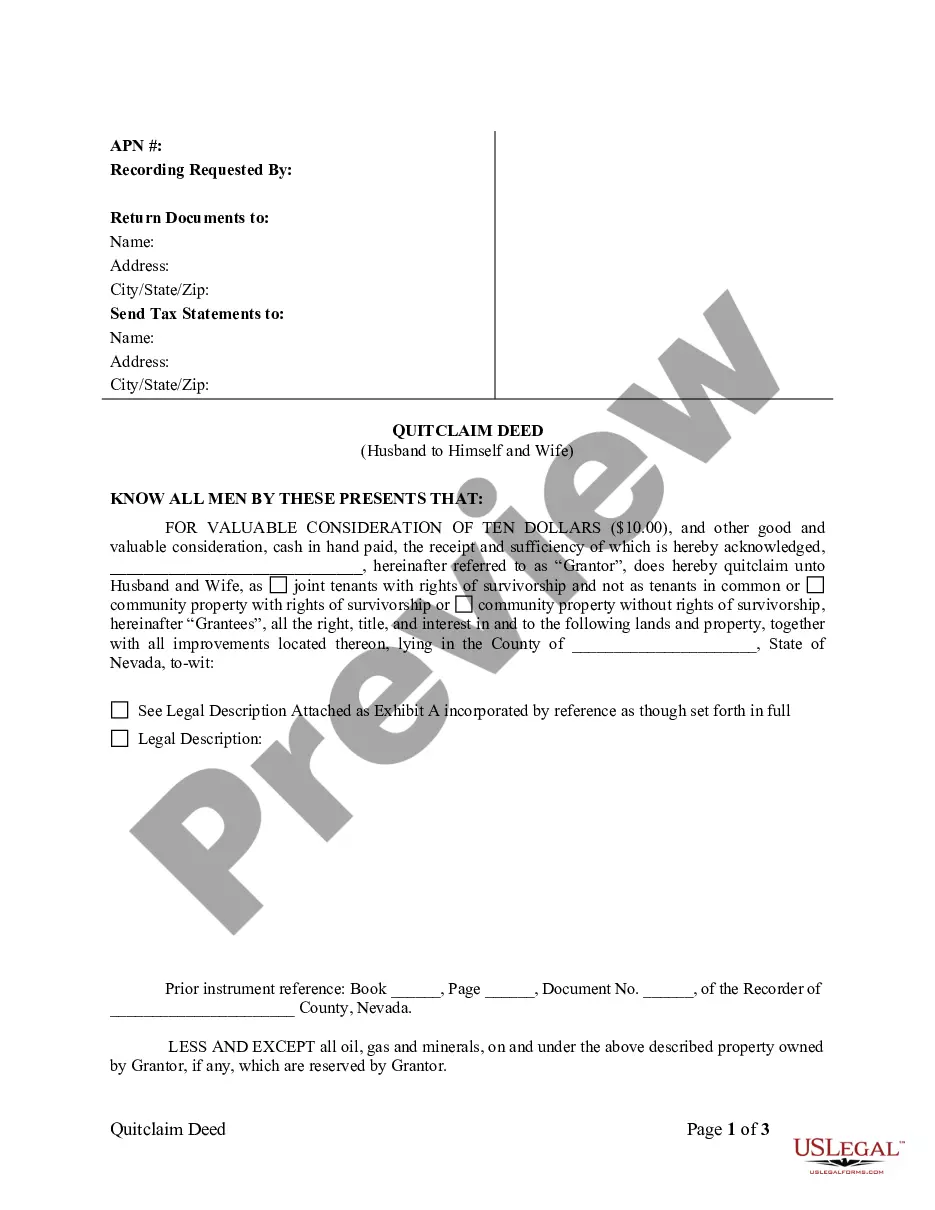

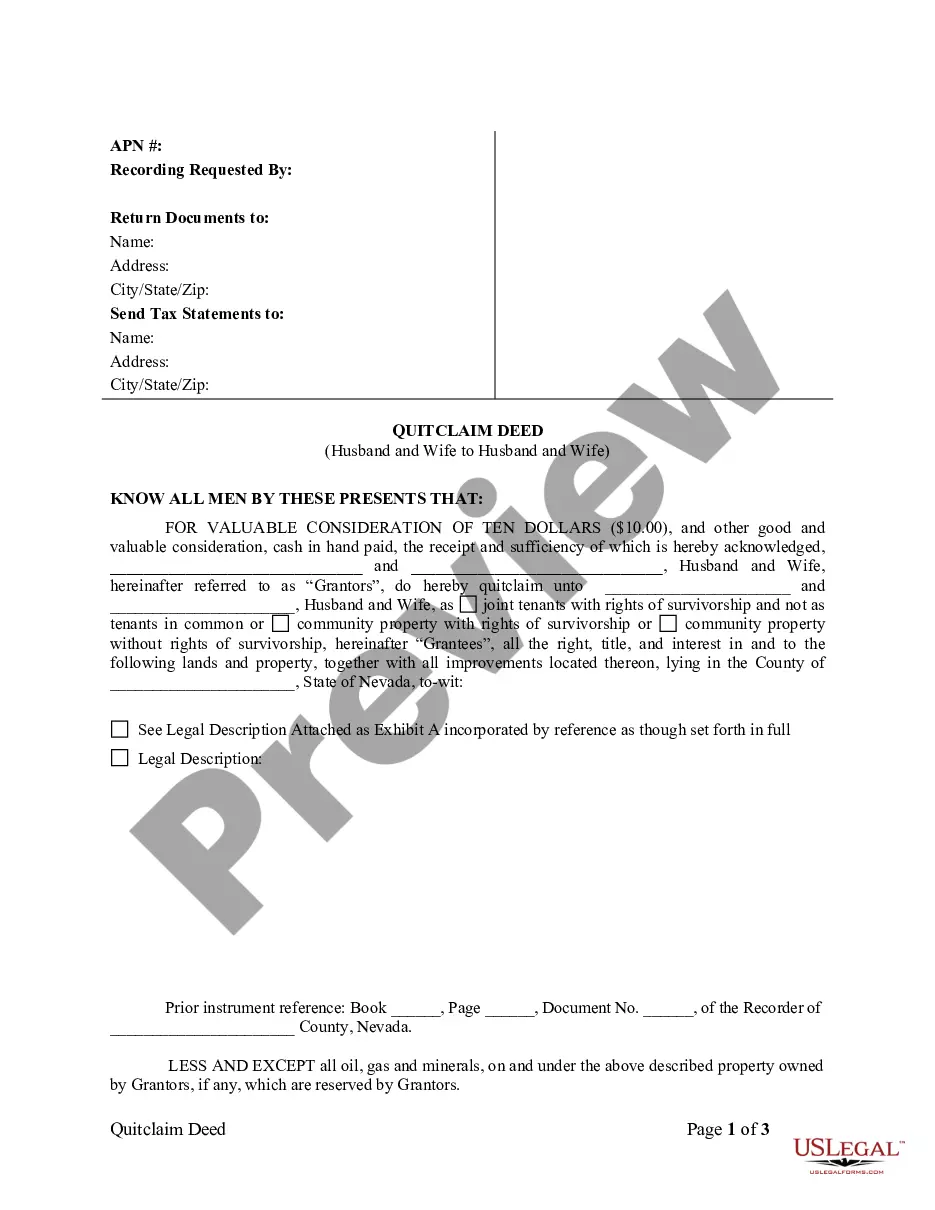

- View additional content using the Preview option.

- If the sample meets all your criteria, click Buy Now.

Form popularity

FAQ

One reason could be the need to take a loan yourself. However, a bank may not allow a guarantor to withdraw from the role unless the borrower gets another guarantor or brings in additional collateral.

Lenders have their own rules and guidelines, but usually guarantors will: be over 21 years old. have a good credit history. have a separate bank account to the borrower you may be able to guarantee a loan for a spouse or partner, but only if you have separate bank accounts.

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.

At law, the giver of a guarantee is called the surety or the "guarantor". The person to whom the guarantee is given is the creditor or the "obligee"; while the person whose payment or performance is secured thereby is termed "the obligor", "the principal debtor", or simply "the principal".

As nouns the difference between guarantee and guarantor is that guarantee is anything that assures a certain outcome while guarantor is a person, or company, that gives a guarantee.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform.A guaranty contract provides the obligee with an alternative to a surety agreement to guarantee or ensure the successful performance of a promise.

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.

A guarantor for a commercial loan or apartment loan is: An individual or other that signs the loan note stating that in the event of default by the borrower, the guarantor will step up and make good on the borrower's obligation to repay the commercial loan note.

A surety is an insurer of the debt, whereas a guarantor is an insurer of the solvency of the debtor. A suretyship is an undertaking that the debt shall be paid; a guaranty, an undertaking that the debtor shall pay.A surety binds himself to perform if the principal does not, without regard to his ability to do so.