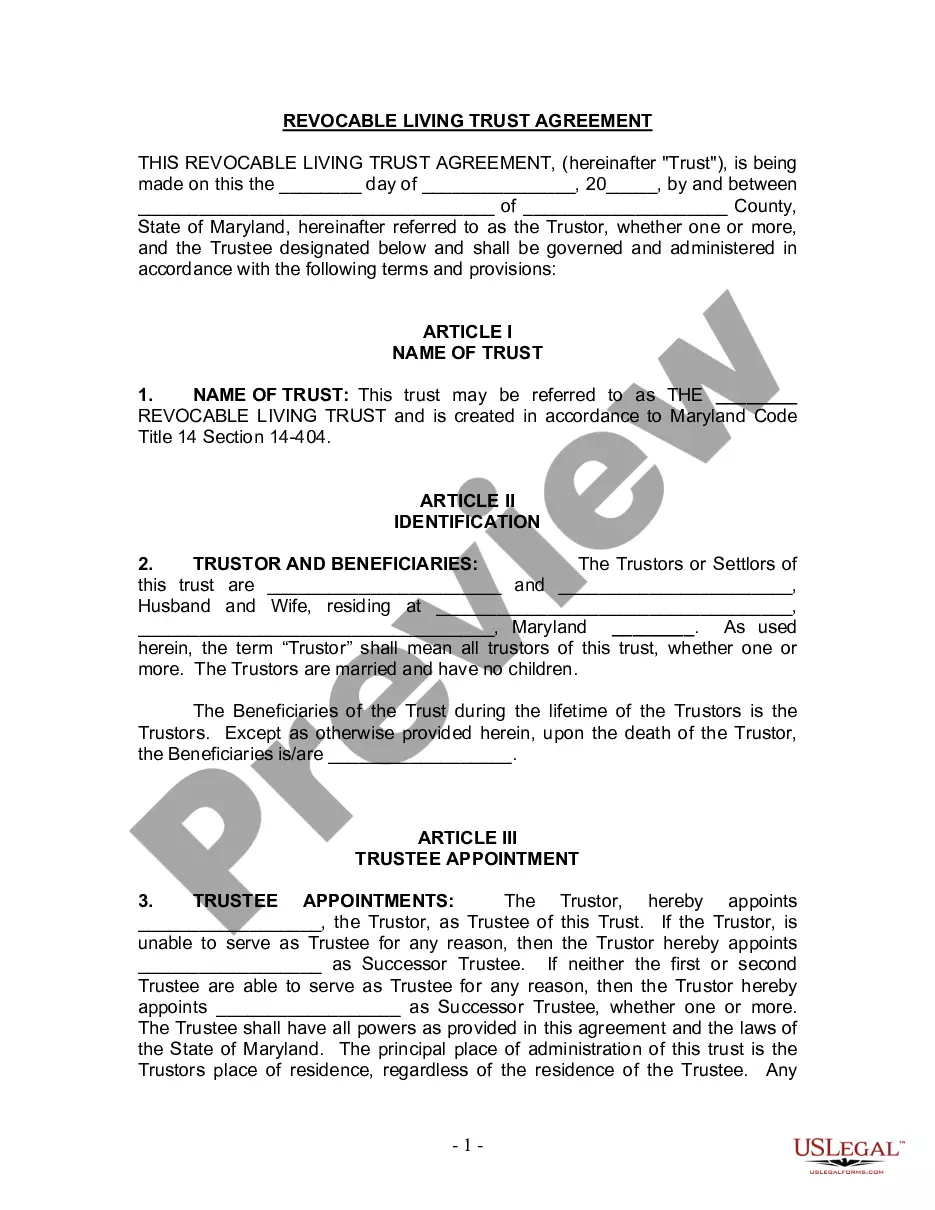

Maryland Living Trust for Husband and Wife with No Children

Description

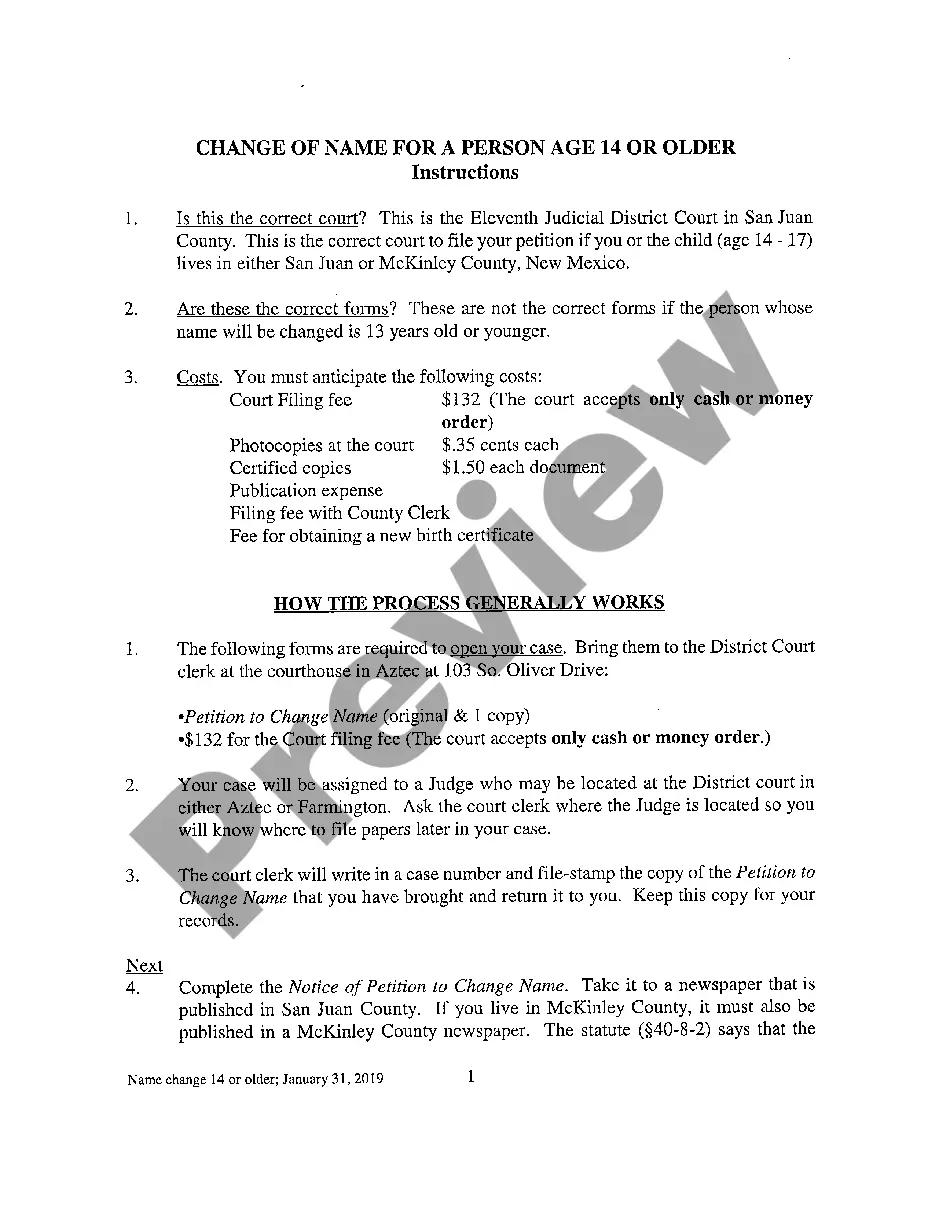

How to fill out Maryland Living Trust For Husband And Wife With No Children?

You are welcome to the greatest legal files library, US Legal Forms. Here you can find any template including Maryland Living Trust for Husband and Wife with No Children forms and download them (as many of them as you wish/need). Get ready official documents with a couple of hours, rather than days or weeks, without spending an arm and a leg with an lawyer. Get the state-specific sample in clicks and be confident understanding that it was drafted by our qualified attorneys.

If you’re already a subscribed consumer, just log in to your account and then click Download next to the Maryland Living Trust for Husband and Wife with No Children you want. Because US Legal Forms is web-based, you’ll generally get access to your saved files, regardless of the device you’re using. Locate them within the My Forms tab.

If you don't come with an account yet, what exactly are you waiting for? Check our instructions listed below to begin:

- If this is a state-specific document, check out its validity in the state where you live.

- See the description (if offered) to learn if it’s the right example.

- See much more content with the Preview feature.

- If the document matches all of your needs, just click Buy Now.

- To make an account, choose a pricing plan.

- Use a credit card or PayPal account to join.

- Download the document in the format you want (Word or PDF).

- Print out the file and complete it with your/your business’s information.

Once you’ve completed the Maryland Living Trust for Husband and Wife with No Children, send away it to your legal professional for verification. It’s an extra step but an essential one for making confident you’re fully covered. Join US Legal Forms now and access a large number of reusable examples.

Form popularity

FAQ

If someone dies without a will, the money in his or her bank account will still pass to the named beneficiary or POD for the account.The executor has to use the funds in the account to pay any of the estate's creditors and then distributes the money according to local inheritance laws.

It is a customary estate planning practice for each spouse to have his or her own will. While some practitioners may draft a joint will for a married couple, it is not recommended.

If a person owns assets in his or her individual name and dies without a Will, assets remaining after payment of administration expenses, debts and taxes (if any) are distributed to the person's heirs as provided under Maryland Intestacy Laws (the person is said to have died intestate).

Tip 1: You absolutely need a will It's important for couples without kids to have wills because they don't have natural heirs to inherit their wealth. Generally speaking, if you die without a will, your assets will go to your spouse.Then your spouse's will would determine who gets what.

Who Gets What: The Basic Rules of Intestate Succession.Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

With a few important exceptions, all the property acquired during a marriage is considered marital property. Marital property normally includes such things as houses, cars, furniture, appliances, stocks, bonds, jewelry, bank accounts, pensions, retirement plans, and IRA's.

In Maryland, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Separate trusts provide more flexibility in the event of a death in the marriage. Since the trust property is already divided, separate trusts preserve the surviving spouse's ability to amend or revoke assets held within their own trust, while ensuring that the deceased spouse's trust cannot be amended after death.