This office lease form is regarding the renewal or other extension of the lease as it relates to the "Base Year Taxes" and the "Base Year for Operating Expenses".

Massachusetts Option to Renew that Updates the Tenant Operating Expense and Tax Basis

Description

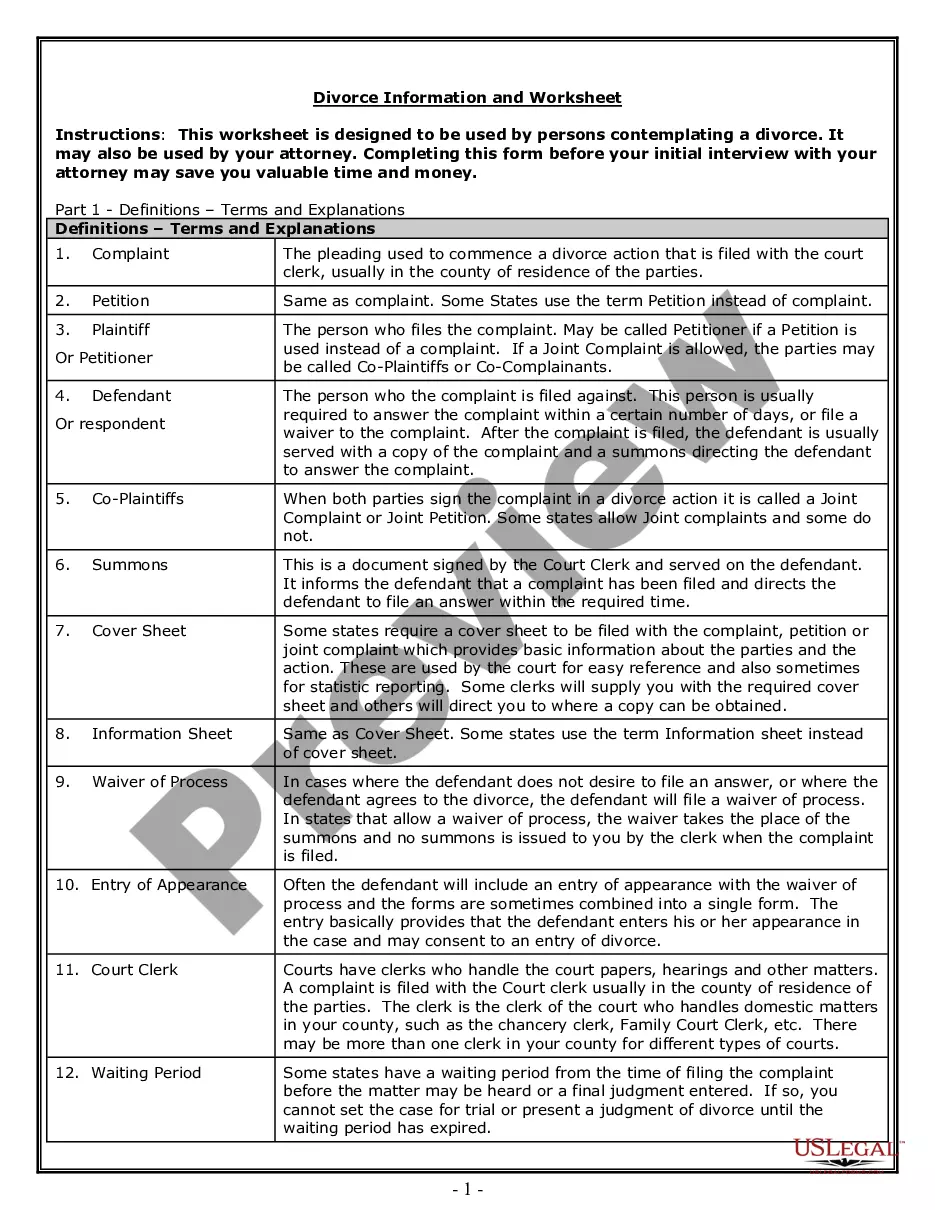

How to fill out Option To Renew That Updates The Tenant Operating Expense And Tax Basis?

US Legal Forms - one of the most significant libraries of legal varieties in the USA - offers a wide range of legal file web templates it is possible to down load or printing. Making use of the internet site, you will get a huge number of varieties for organization and personal purposes, categorized by groups, says, or keywords and phrases.You will discover the most recent versions of varieties like the Massachusetts Option to Renew that Updates the Tenant Operating Expense and Tax Basis in seconds.

If you already have a subscription, log in and down load Massachusetts Option to Renew that Updates the Tenant Operating Expense and Tax Basis in the US Legal Forms collection. The Obtain option will show up on each and every kind you view. You gain access to all formerly acquired varieties within the My Forms tab of your respective bank account.

If you wish to use US Legal Forms initially, listed here are basic instructions to help you started:

- Make sure you have chosen the right kind for the city/region. Select the Preview option to analyze the form`s content material. Look at the kind outline to actually have selected the right kind.

- In case the kind does not suit your demands, take advantage of the Lookup discipline towards the top of the screen to get the one which does.

- In case you are satisfied with the form, affirm your option by visiting the Acquire now option. Then, select the pricing program you prefer and provide your credentials to register to have an bank account.

- Approach the purchase. Utilize your charge card or PayPal bank account to finish the purchase.

- Select the format and down load the form in your device.

- Make changes. Fill out, change and printing and sign the acquired Massachusetts Option to Renew that Updates the Tenant Operating Expense and Tax Basis.

Every template you added to your money lacks an expiry time which is yours eternally. So, if you would like down load or printing one more copy, just proceed to the My Forms area and click on around the kind you will need.

Gain access to the Massachusetts Option to Renew that Updates the Tenant Operating Expense and Tax Basis with US Legal Forms, the most considerable collection of legal file web templates. Use a huge number of specialist and condition-certain web templates that satisfy your organization or personal requires and demands.

Form popularity

FAQ

Suppose that a tenant signs a lease in an office building for 5,000 square feet of space. The base rental amount is $10 per square foot. In year one of the lease, the landlord pays for all of the building operating expenses and the total comes out to $10,000. This is the base year expense stop amount.

An option to renew or extend the lease means that upon the tenant's exercise of the option (choice), the provisions of the agreed-upon option are adopted for another defined term. The terms of the option can include the length of the new term, a change in rent, and other modifications.

A gross lease rate consists of a base rent per square foot and additional operating expenses per square foot set during the base year. The base year is typically the year the lease is signed. As such, a gross lease rental rate is inclusive of rent and the first year's operating expenses.

The Base Year is a year that is tied to the actual amount of expenses for property taxes, insurance and operating expenses (sometimes called CAM) to run the property in a specified year. In a new lease, the Base Year is most often the year the lease is executed or the year in which the lease commences.

A base year refers to a type of expense stop in which the landlord pays for all operating expenses in the first year. After that first year, Phelps explained, the tenant is responsible for all operating expenses over and above the first year's established base year expenses.

'Base year' is the first calendar year of a tenant's commercial rental period. It is especially important as all future rent payments are calculated using base year. It's additionally important to note that base year is crafted to favor landlords.

There are two options for how to renew a lease in Massachusetts. You can sign a completely new lease with the tenants, or you can agree in writing to modify or continue the existing lease.

up business may, for example, rent an office space for three years. A renewal option would allow the business to renew or extend the lease to remain in the office space beyond the threeyear lease term.